Markets.com Review

For SA Traders

I traded with them for some months, and they are a good broker just that their minimum deposit is not encouraging

An FSCA Regulated Forex Broker with ZAR Accounts and Competitive Spreads

| 👨 Broker | Finalto SA PTY LTD |

| 👨 Trading Name | Markets.com |

| 👨 Accepts South African Traders? | Yes |

| 📅 Year Founded | 2008 |

| ⚖ Regulators | FSCA South Africa |

| ⚖ FSP No. | 46860 |

| ⚖ Authorized ODP | Yes |

| 💰 Minimum Deposit | 1,000 ZAR |

| 💰 Minimum Withdrawal | 100 ZAR |

| 📈 CFD Instruments | Forex, Shares, Commodities, Indices, Crypto, ETFs, Bonds |

| 🚀Leverage | 1:500 |

| 🔎Auditors | |

| 💻 Platforms | MT4, MT5, Markets.com App |

| 📋Account Types | Micro Account, Classic Account, Raw Account |

| 💱Account Currency | ZAR, USD |

| 📞Live Support | 24/7 |

| 🏖️ Inactivity Fee | $10 |

| 😭CFD Traders Who Lose Money | - |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

Regulation - 10/10

Is Markets.com Legit?

Yes, Markets.com is regulated in South Africa by the Financial Sector Conduct Authority (FSCA) who have also authorized them to act as an Over-the-counter Derivative Provider (ODP).

Markets.com being an authorized ODP means they can issue derivatives directly and act as market makers or counterparties to your trade; resulting in better transparency and pricing.

Deposit & Withdrawal - 9/10

Markets.com Minimum Deposit

The Markets.com minimum deposit in South Africa is 1,000 ZAR.

You can fund your Markets.com account using the following methods:

- AO PAY (Local Bank Transfer)

- Bank Cards

- OZOW

- Skrill

- Wire Transfer

Minimum Withdrawal

The minimum withdrawal at Markets.com is $5 via eWallet, $20 via Bank Cards, $100 via Bank Wire & $0 via AO Pay Local Bank Transfer.

Markets.com Welcome Bonus

On your first deposit only, Markets.com South Africa will credit you with a 50% welcome bonus. To qualify you have to deposit at least $100 or around 1,800 ZAR.

However, Markets.com does not offer the bonus to existing clients as only new clients can qualify.

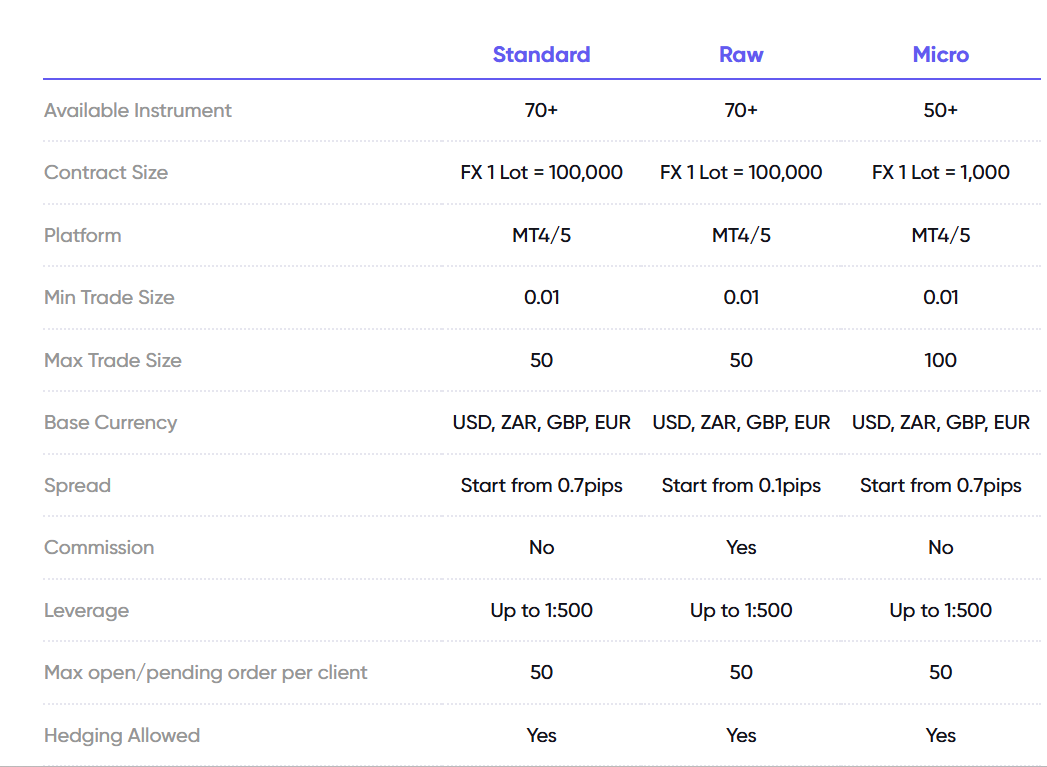

Range of Accounts - 9/10

1. Micro Account

With this spread-only account, you can only trade small volumes and your lot size cannot exceed a micro lot. it is ideal for beginners and those who want to test new strategies while risking little losses.

2. Classic Account

On this spread-only account, there is no lot size restriction hence you can trade standard lots.

3. Raw Spread Account

Spreads on this account are lower than on the other accounts but in addition to the low spread, you must pay a fixed commission every time you trade.

Account Management - 8/10

Account Currency

Markets.com allows you to open your trading account in the ZAR Account Currency.

With ZAR Accounts at Markets.com, your transactions are displayed in ZAR & you skip paying currency conversion fees, every time you deposit/withdraw in ZAR.

Markets.com also has USD, GBP & EUR account currencies.

Negative Balance Protection

Markets.com ensures that your account balance cannot fall below zero even in the event of extreme price movement and slippage.

Margin Call & Stop Out

When your margin level falls to 100%, you will receive a margin call and when it falls to 50% you will be stopped out of your trades (starting from the least profitable ones).

Maximum Number of Trading Accounts

markets.com allows you open as many trading accounts as you wish. You can manage these trading accounts from your client area.

Range of Markets - 9/10

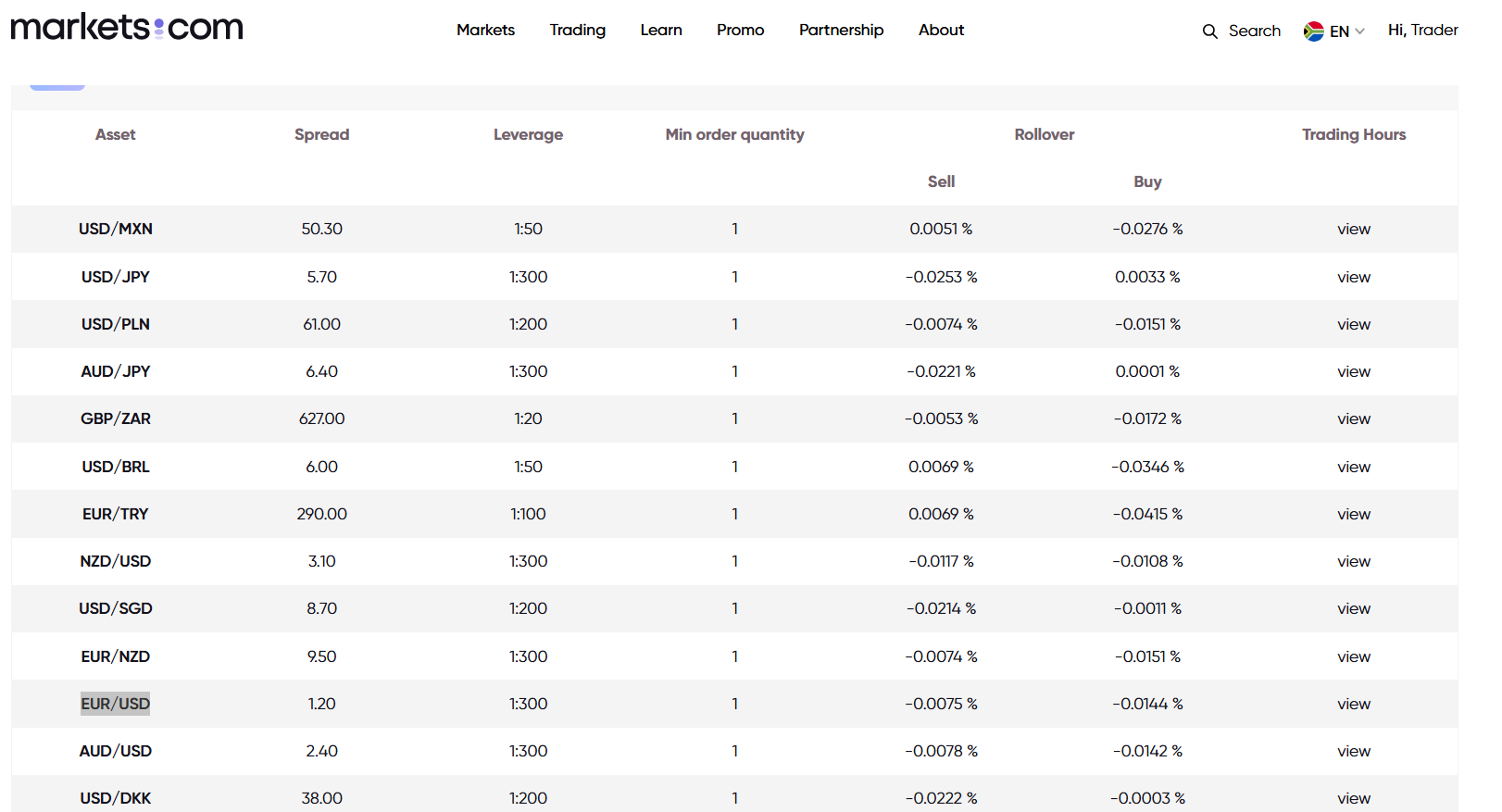

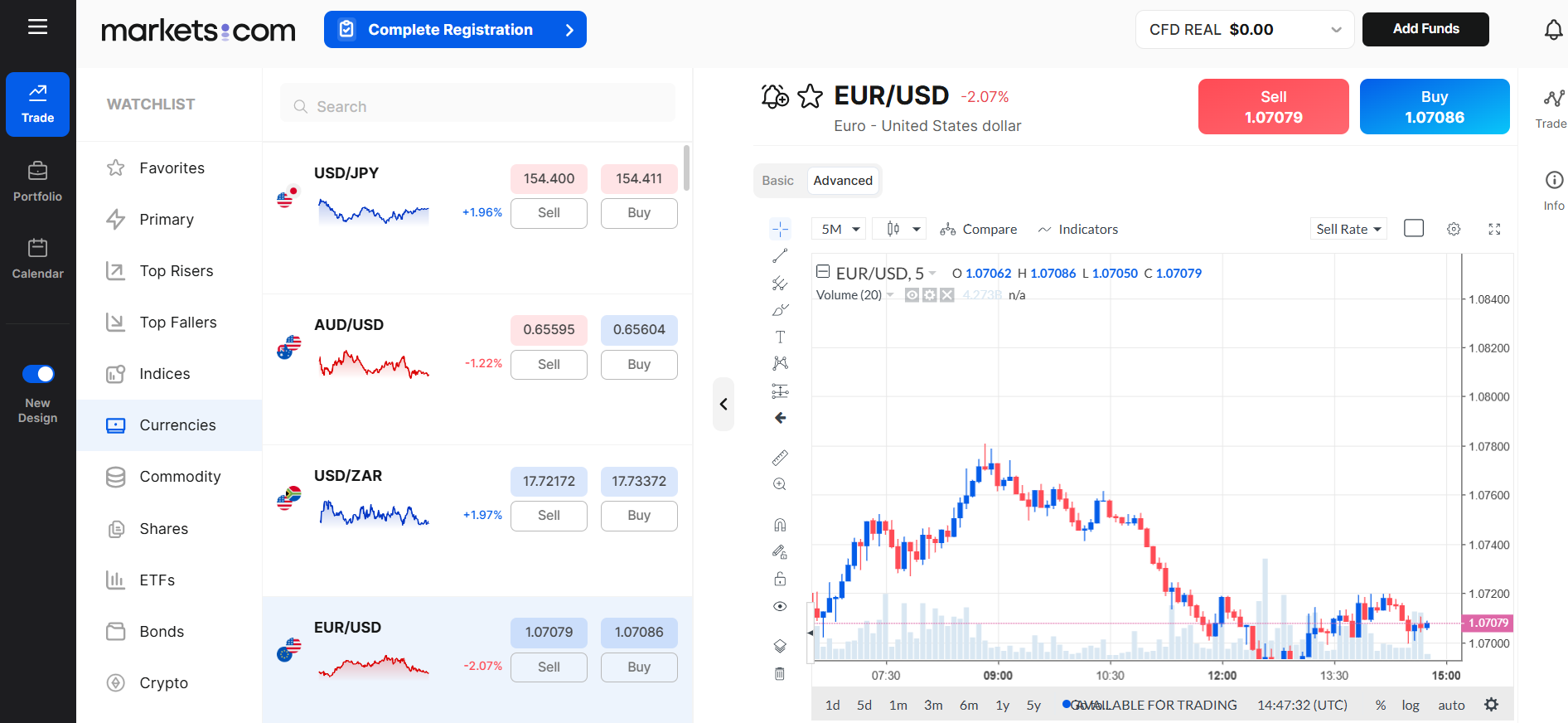

Forex CFDs

We are talking over 50 currency pairs which include the EUR/USD. You can also speculate on the South African Rand with pairs like the USD/ZAR, EUR/ZAR & GBP/ZAR.

Index CFDs

Markets.com offers the NASDAQ Index CFD which it calls USTECH100, as well as CFDs on other popular indices like the UK 100.

Markets.com also offers the South Africa 40 (SA40) index CFDs for speculation so you can get exposure to the local South African Market using CFDs.

Stock CFDs

Markets.com lets you speculate on international stock CFDS such as Facebook CFDs PayPal CFDs, FedEx CFDs, Airbus CFDs, Chevron CFDs & Nasdaq CFDs etc. However, local stocks like MTN & ABSA are missing from the menu.

ETF CFDs

Markets.com offers CFDs on over 50 popular ETFs such as S & P 500, Vanguard, MSCI, etc.

Commodity CFDs

Markets.com offers CFDs on both soft & hard commodities. The menu includes Oil, Natural Gas, Gold, Palladium, Cocoa, Coffee, Sugar etc.

Bond CFDs

Markets.com gives you exposure to the fixed income market via U.S., EU & UK Bond CFDs.

Cryptocurrency CFDs

Markets.com offers a limited list of Crypto CFDs & we are talking Lite Coin, Ethereum, Ripple & Bitcoin/USD.

Fees - 7/10

1. Spread

Markets.com spreads start from 0.7 pips on the Standard and Micro Accounts and from 0.1 pips on the Raw Account.

2. Commission

Markets.com commissions vary according to the instrument you are trading and are charged on the Raw Account only.

3. Rollover Fees

Markets.com South Africa will charge you an overnight fee to roll your trade over to the next day.

4. Funding Fees

There are no fees for deposits/withdrawal at Markets.com except you are transacting through International Bank Wire then your bank will charge you fees.

Trading Platforms - 9/10

1. MT4/5

Markets.com offers MT4 & MT5 & these are the best forex trading apps in the world. However, the Markets.com MT4/5 only come as a desktop version without any mobile/web MetaTrader versions

Markets.com does not offer MetaTrader support & upgrade tools such as downloadable trading & non-trading EAs.

2. Markets.com Web Trader

The Markets.com Web Trader platform is a lightweight trading platform that requires no download/installation because it is hosted markets.com servers.

To access the Web Trader, simply go to Markets.com website, click on the trading tab & then click on Web Platform.

The Web Trader loads very fast and does not freeze or suffer glitches like we have seen with Web Platforms from some competing brokers.

4. Markets.com Mobile Apps

Markets.com offers a CFD Trading App & Copy Trading App. These are separate mobile apps and can be downloaded on the google & apple online stores.

These apps are also lightweight making them load fast and execute trades without freezing or glitches.

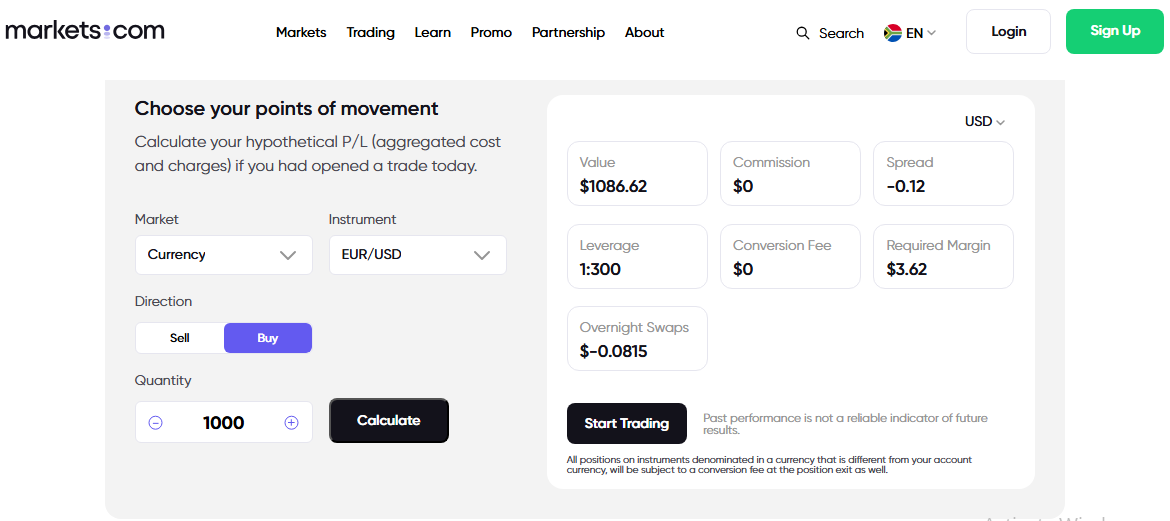

Markets.com Tools - 9/10

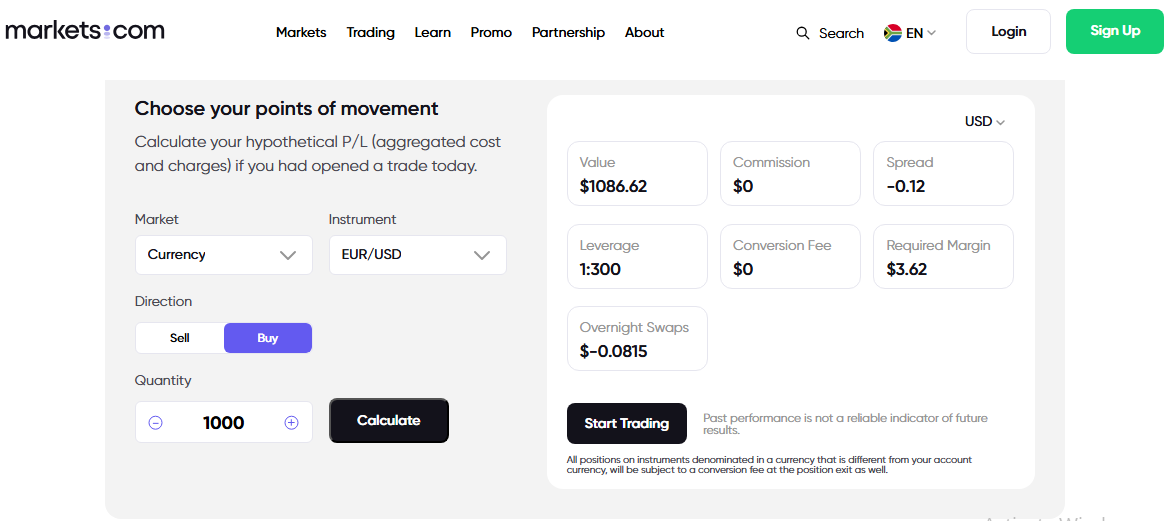

1. CFD Calculator

To use the Markets.com CFD trading calculator, go to their website, open the trading tab & select CFD trading calculator.

Select the instrument you want to trade, choose the direction (buy or sell), and enter the number/quantity of CFDs you want to trade.

If you want to trade a standard lot enter 100,000 as quantity, if you want to trade a micro lot enter 1,000 as quantity etc.

Click on calculate to display the results. The CFD calculator will show you results including the spread you will be charged in USD, the margin you must deposit, the currency conversion fees, overnight fees etc.

2. Forex Profit Calculator

Simply enter the instrument you want to trade & the quantity of CFDs contained in the lot size you want to trade.

Choose the price you intend to close the trade at (your exit price). You can also input the date you intend to close the trade (for overnight fees to be calculated properly).

When you are done, click on calculate. The forex profit calculator will show you the profit/loss you will make, the exact spread you will be charged in USD & the overnight fees.

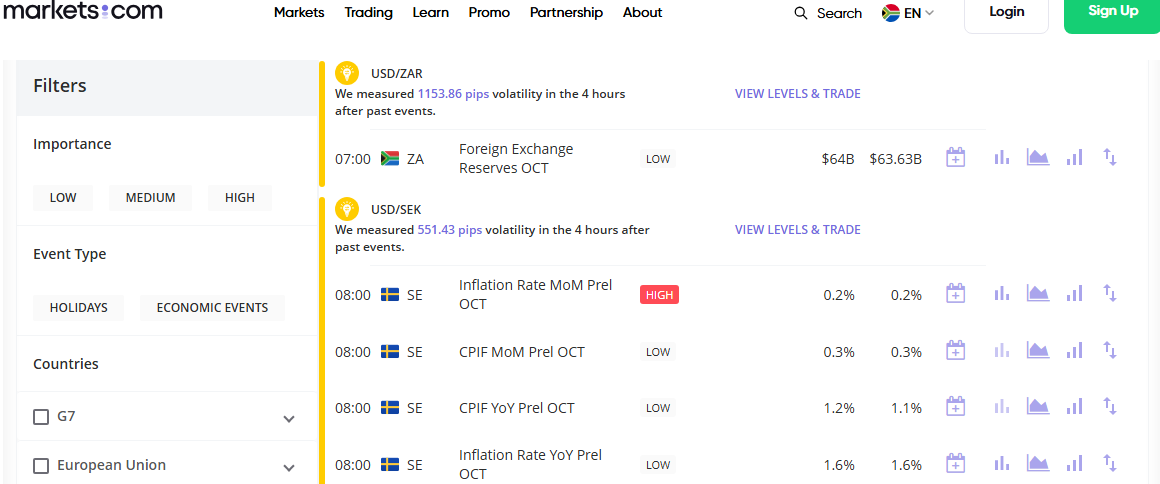

3. Economic Calendar

Markets.com offers a light weight economic calendar on their website & trading platforms. The economic calendar loads fast without any delays.

It has a filter search function that lets you sort news by importance (low, medium or high), event type (holidays or economic events), countries (G7, EU, All countries) etc.

The economic calendar also shows you when data concerning the South African financial market will be released so you can use this info to trade the USD/ZAR, GBP ZAR, & EUR/ZAR pairs.

4. Copy Trading

Markets.com offers copy trading in a social environment that lets you interact with other traders, hence the name social trading.

For this purpose, Markets.com built a special social trading app which we checked out on google play store & apple store. However, the number of app downloads is low at just over 1,000 downloads. This may mean a limited number of traders to interact with on the app.

The Markets.com social trading app is also fairly new as it was released in February 2024 so it has not been tested by many as thy were no reviews left by users on google play store.

We would have loved to see Markets.com partner with third-party copy trading platforms like DupliTrade & ZuluTrade just to give their users more options.

Customer Support - 8/10

Personal Account Manager

Personal Account Managers are assigned to every client & you can contact them at any time to help resolve issues.

Telephone Support

Local telephone help lines are displayed on their website for you to dial if you need help.

Live Chat

You can chat with a live agent using the live chat feature accessible from Markets.com website and mobile app. The agents respond in under one minute.

Education

For beginners there is a learning center with webinars and video tutorials; however the tutorials are not very comprehensive.

Beginners can also use the Markets.com Demo Account to experiment with fake cash.

Final Verdict - 8/10

Markets.com is one of the best forex brokers for beginners because of the competitive spread, easy to use platforms/tools & great customer support.

Expert traders may not find Markets.com very convenient because of the absence of raw spread pricing & the limited range of accounts.

| 🏛️ Broker | ⚖️ Regulation | 💰Deposit & Withdrawals | 💱Account Types | 🧹Account Management | 🛒Range of Markets | ✂️Fees | 💻Platforms | 🛠️Tools | 🚑Support | 🏆Score |

| HFM | 10 | 10 | 10 | 10 | 8 | 7 | 5 | 8 | 9 | 8.4 |

| Tickmill | 10 | 7 | 7 | 9 | 9 | 8 | 7.5 | 10 | 6 | 8.2 |

| Markets.com | 10 | 9 | 9 | 8 | 9 | 7 | 9 | 9 | 8 | 8 |

| Exness | 10 | 10 | 10 | 6 | 5 | 7 | 8 | 5 | 8 | 7.8 |

| FxPro | 10 | 10 | 6 | 10 | 9 | 6 | 8 | 5 | 7 | 7.8 |

| Trade Nation | 9 | 10 | 5 | 6 | 5 | 9.6 | 7.5 | 5.5 | 8 | 7.5 |

| Just Markets | 6 | 9 | 10 | 7 | 7.5 | 9 | 7 | 4 | 8 | 7.5 |

| RCG Markets | 9 | 7 | 10 | 6 | 5 | 4 | 5 | 3 | 6.5 | 7.3 |

| XM | 10 | 10 | 6 | 6 | 8 | 8 | 6 | 6 | 6 | 7 |

| AvaTrade | 10 | 5 | 4 | 7 | 10 | 4 | 7 | 8 | 9 | 6.8 |