Trading 212 Minimum Deposit

How To Avoid Trading 212 Deposit Fee

| Trading 212 Minimum Deposit | USD 10 |

|---|---|

| Deposit Methods | Local Bank Transfer,Credit/Debit Card |

| Account Types | Pro Account |

| Deposit Fees | No fees |

| Account Base Currencies | USD, GBP, EUR, CAD, CHF |

| Withdrawal Fees | No fees |

| 💰 Minimum Deposit | $10 |

| 🏧 Minimum Withdrawal | $10 |

| 💱Base currency | EUR, GBP, USD |

| 💨Fastest Deposit Method | Bank Transfer |

| 🏦Deposit Fees | 0.7% on Card Deposits above 2,000 GBP |

| 🎁Deposit Bonus | No |

| 🐷Online Wallet System | No, deposits go straight into your trading account |

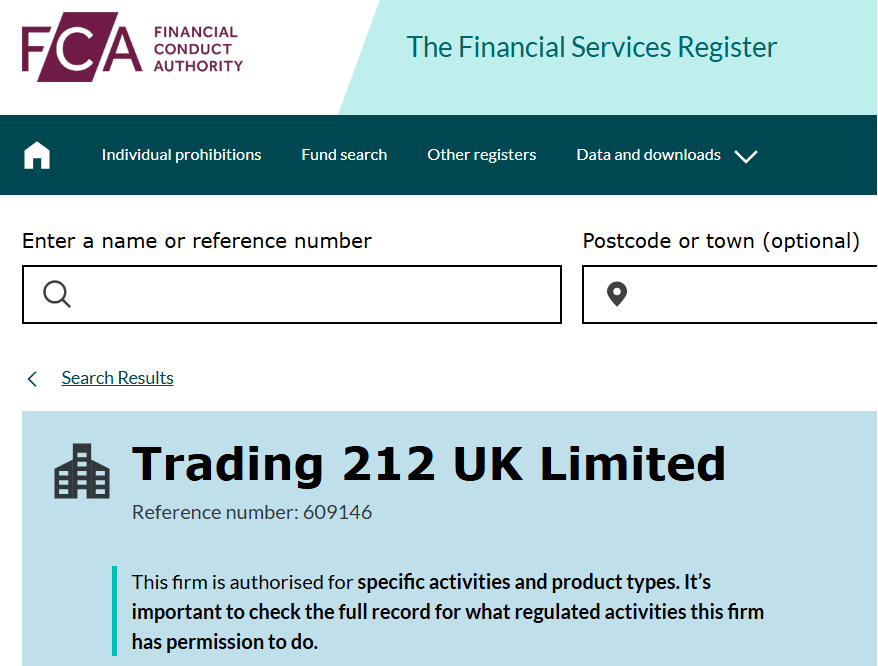

Can I Trust Trading 212 With My Money?

Yes, Trading 212 is trustworthy and authorized to receive customer deposits because Trading 212 is regulated by the FCA in the UK.

Because Trading 212 is also a member of the Financial Services Compensation Scheme (FSCS), your funds are protected up to 85,000 GBP, in the event you suffer pecuniary losses.

Trading 212 Minimum Deposit for CFD Trading Account

You need a minimum deposit of 10 USD to be able to fund your Trading 212 CFD Account.

Trading 212 Minimum Deposit for Invest Account

You need a minimum deposit of 1 USD to be able to fund your Trading 212 Invest Account from where you can buy and hold Real Stocks & ETFs.

The Invest Account is specially designed to be a Multi-Currency Account which means you can switch the account base currency to any of the 13 international currencies provided.

Trading 212 Minimum Deposit for ISA Account

You need a minimum deposit of 1 USD to be able to fund your Trading 212 Stock or Cash ISA Account.

With the ISA Account, you can deposit a maximum of 20,000 GBP per year & this funds will be used to invest in stocks of your choice tax-free.

How To Avoid Trading 212 Deposit Fees

Trading 212 only charges deposit fees on card deposits above 2,000 GBP & the fee is 0.7% of the deposited amount.

To avoid paying this fee, you can explore depositing through other Trading 212 funding methods such as Local UK Bank Transfer, Apple Pay, Google Pay or Open Bank.

Another way to avoid paying Trading 212 deposit fees, is to make daily deposits of around 1,000 GBP per day.

Trading 212 Currency Conversion Fees

1. Currency Conversion for CFD Traders

Trading 212 charges a currency conversion fee of 0.5% when you are trading with the CFD Account.

The CFD Trading Account type can only be opened in GBP, USD or EUR account currencies. If you deposit/withdraw in a currency outside your account currency, the conversion fee will be applied.

2. Currency Conversion for Investors

Investors at Trading 212 will operate an Invest or ISA Account and the currency conversion fee is 0.15%.

Because the Invest Account is multi-currency, you can switch between 13 account currencies without needing to open another account (by the way you can only open one account at Trading 212).

Earn Interest on Deposits

You can earn daily interest on any unused funds in any of your Trading 212 Accounts (ISA, CFD or Invest Accounts).

To Enable Interest Earning on your account, you must agree that your funds will be held in Qualifying Money Market Funds and tap on the "Enable Interest on Cash" button in your client area.