Anzo Capital Review

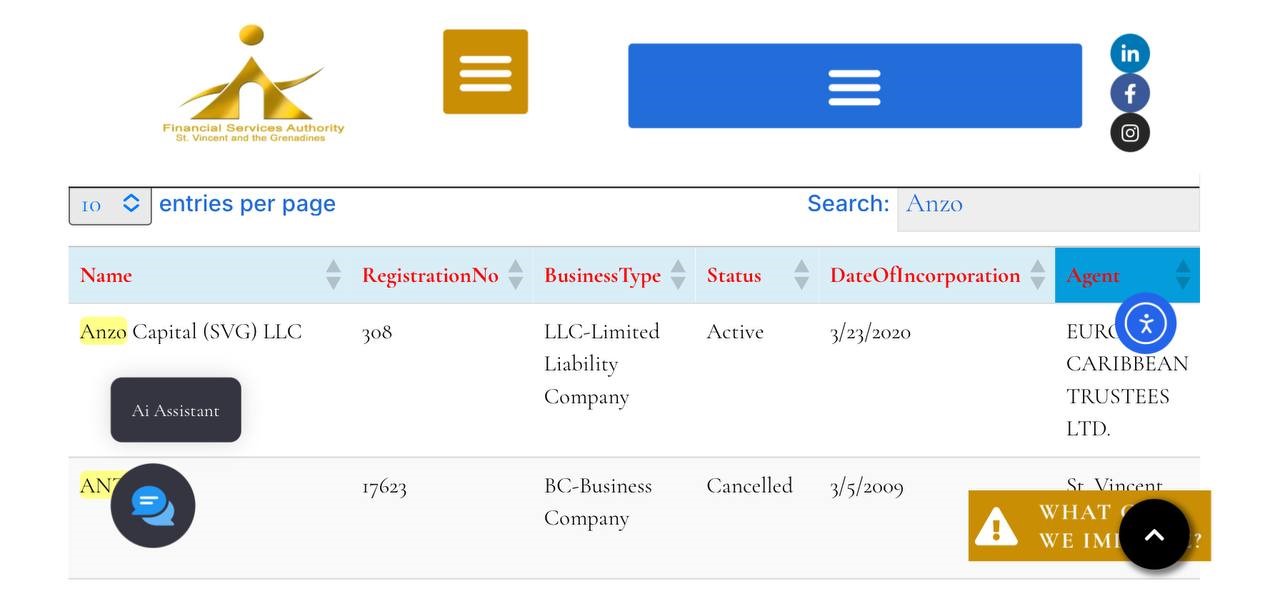

Is Anzo Capital Regulated?

!! Regulator Warning !!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Anzo Capital is regulated by the SVG FSA with $10 minimum deposit for Nigerian traders

| 👨 Broker | Anzo Capital SVG LLC |

| 👨 Trading Name | Anzo Capital |

| 👨 Accepts Nigerian Traders? | Yes |

| 📅 Year Founded | 2015 |

| ⚖ Regulators | FSA Saint Vincent & Grenadines |

| ⚖ License No. | 308 |

| ⚖ Investor Protection | No |

| 💰 Minimum Deposit | $10 |

| 💰 Minimum Withdrawal | $10 |

| 📈 Ways to Trade | CFD |

| 📈 CFD Instruments | Forex, Stocks, Indices, Commodities, Bonds |

| 🚀Leverage | 1:1000 |

| 🔎Auditors | |

| 💻 Platforms | MT4, MT5, Anzo Mobile App |

| 📋Account Types | STP, ECN |

| 💱Account Currency | USD |

| 📞Live Support | 24/7 |

| 🏖️ Inactivity Fee | $30 after 3 months of inactivity |

| 😭CFD Traders Who Lose Money | |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

Regulation - 5/10

Is Anzo Capital Regulated?

Yes, Anzo Capital activities in Nigeria are regulated by the Financial Services Authority (FSA) of Saint Vincent & The Grenadines.

This regulatory body (FSA) is weak and is not ranked among the top-tier forex market regulators in the world.

Funding & Withdrawal - 5/10

Anzo Capital Minimum Deposit

Anzo Capital minimum deposit stands at $10 for all their account types, and you can deposit in Naira currency.

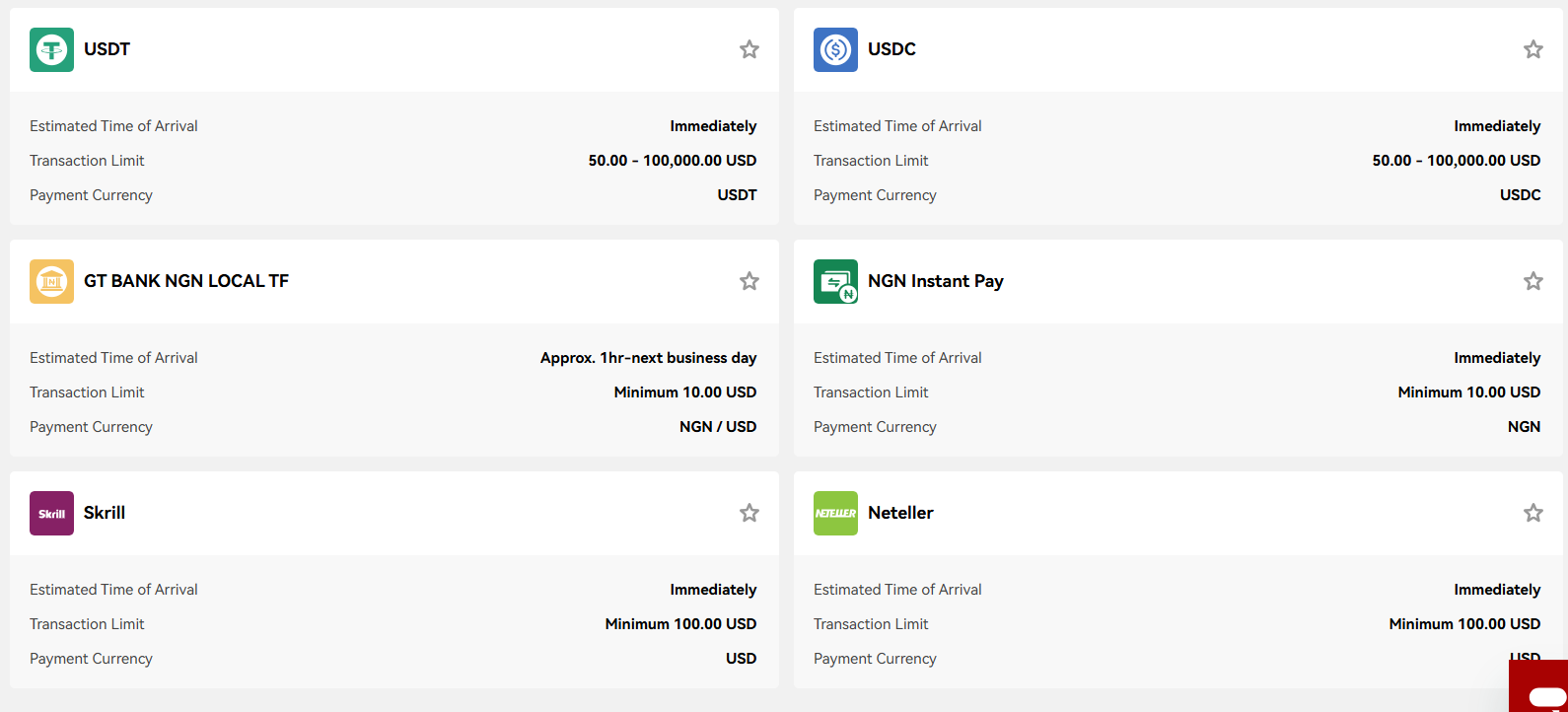

Anzo Capital Funding Methods

1. Nigerian Bank Transfer

Anzo Capital supports Nigerian bank transfer; so you can fund your Anzo account by transferring funds (in naira), from your bank to an account number that Anzo will generate for you.

2. Neteller & Skrill

You can also fund your Anzo account (in USD) using Skrill & Neteller payment methods.

2. Crypto

TRC20 is the only digital currency you can use to fund your Anzo account.

Anzo Capital Minimum Withdrawal

Anzo Capital minimum withdrawal is also $10 and you can withdraw several times in a day without any restriction.

Anzo Capital Minimum Withdrawal Time

For Nigerian banks, Anzo Capital withdrawal time is instant but for other withdrawal methods it can take up to 2 working days.

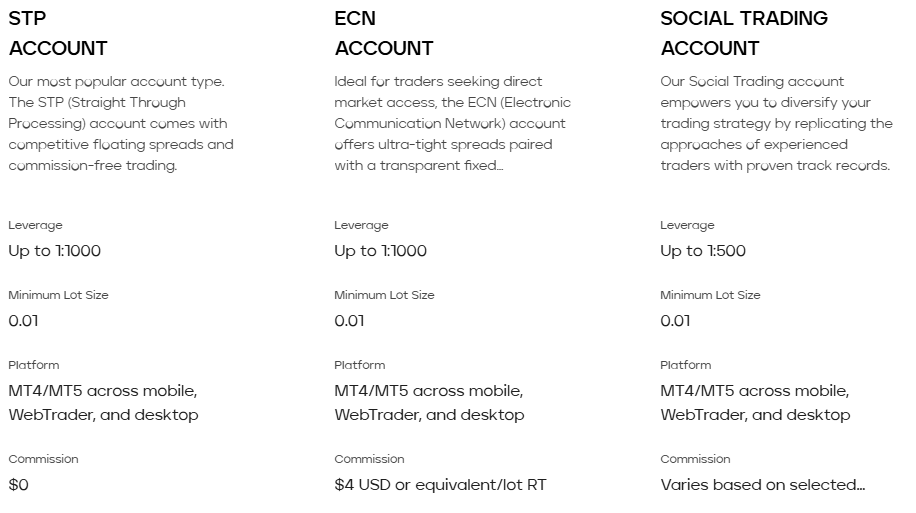

Account Types - 5/10

1. STP Account (1:1000 leverage)

The STP Account is the entry-level standard account for beginners. Spread is the only trading fee here & you do not pay commissions per trade.

2. ECN Account (1:1000 leverage)

The ECN Account is for experienced traders. Although this account charges a lower spread than the STP Account, you must pay a flat commission on every trade you take.

3. Social Trading Account (1:500 leverage)

This account is specifically meant for copying the trades of other more experienced traders. You can also opt to have other less experienced traders copy from you, using this account.

Account Management - 7/10

Account Currency

In Nigeria, Anzo Capital does not offer the Naira account currency. Instead, they offer USD & EUR as account currencies.

Max. Number of Trading Accounts

Each user can create up to 10 live accounts, 10 accounts for MT4 (Meta Trader 4) and 10 for MT5 (Meta Trader 5) plus 5 demo accounts.

Negative Balance Protection

Anzo Capital provides Negative Balance Protection, capping losses at the initial deposit amount, in any market condition, even in volatile markets. In others words, or simpler terms rather, traders cannot lose more than their initial investment.

Margin Call & Stop Out

You will get a margin call when your margin-level falls to 80% and you will be stopped out of your trades when it falls to 50%.

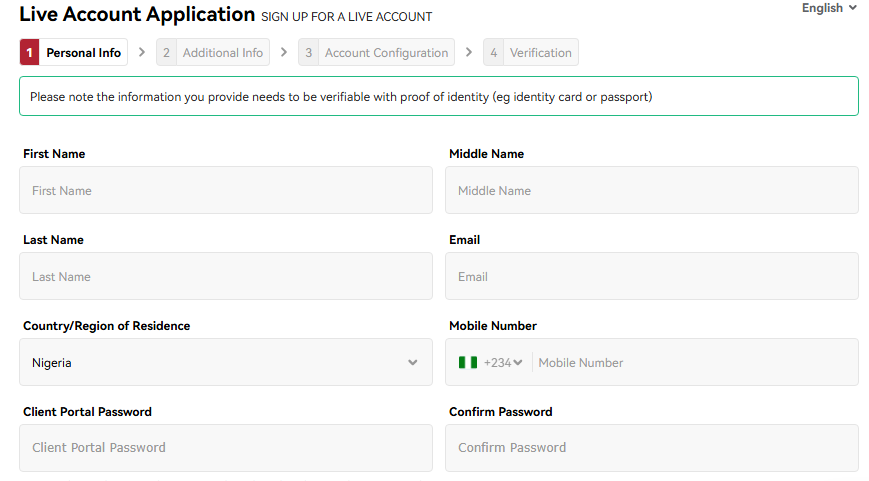

Account Opening Procedure

Step 1: Personal Info

Visit the AnzoCapital website or their app to sign up. You will then get a prompt to enter in your first name, middle name, last name, email, country/region of residence, mobile number, and a password.

You will enter in your date of birth, and residential address in details: Area, Po box, city, province/state, postal code.

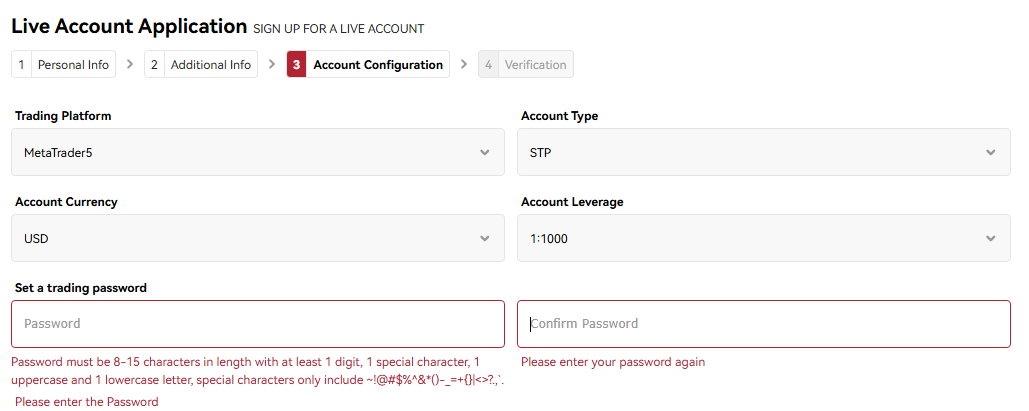

Step 2: Account Configuration

At this point, you will get the option to choose your preferred trading platform, and since AnzoCapital only offers two options, you get to choose either MetaTrader 4 or MetaTrader 5.

Then you choose your preferred account type from the two account type options they offer, STP & ECN. Choose your preferred account currency from the two option available for Nigerian users USD & EUR.

Choose leverage with options from 1:50 up to 1:1000. Lastly in account configuration, you set up a trading password.

Step 3: ID Verification

You will be asked to upload an identity verification with 3 available options for you to pick one from: Passport, National ID, Drivers License.

And lastly you will be asked to provide proof of address, which could be your utility bill(water or electricity), bank/credit card statement, landline phone/broadband bill etc..

Fees - 7.5/10

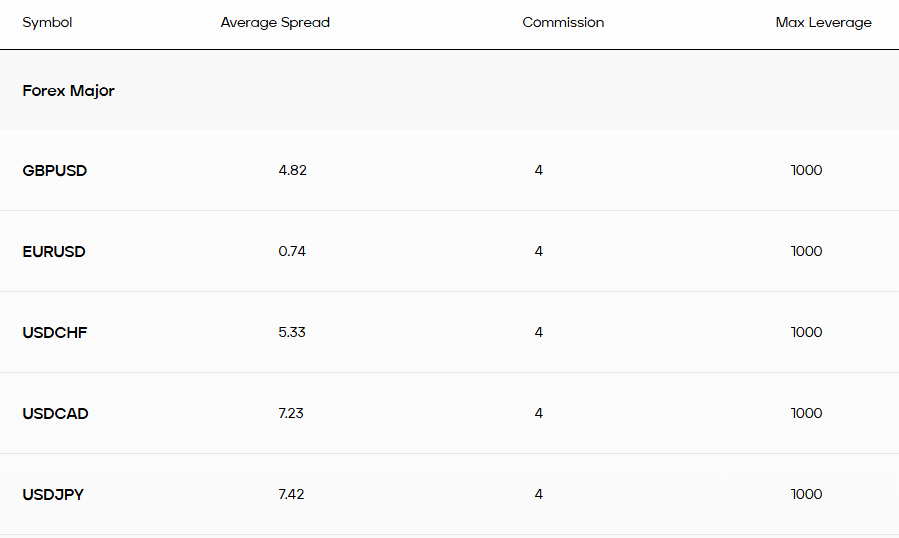

1. Spread & Commission

Anzo Capital spread starts from 0.6 pips when using the STP Standard Account.

If you want lower spread, then open the ECN Account to get spreads from 0.0 pips but you must pay a commission of $2 per side for every standard lot you trade.Anzo Capital Withdrawal Fees

Anzo Capital withdrawals are charged at $0 except you attempt to withdraw without placing a trade, then a $6 withdrawal fee will apply.

Inactivity Fees

Anzo Capital will charge you an monthly inactivity fee of $30 if your account has been inactive for more than three months.

Overnight Fees

When trading with leverage, AnzoCapital charges an overnight fee for trade positions that exceed the very day the trade was executed.

Range of Markets - 5/10

1. Forex CFDs

Anzo Capital offers an extensive selection of forex CFDs, covering major, minor, and exotic currencies with 40+ currency pairs.

2. Indices CFDs

So far, I found that they offer only 5 indices like the popular NAS100, UK100, USIDX, US30, HSCHKD. You can trade all these with low spreads starting from 0.0 on AnzoCapital’s STP & ECN account types.

3. Precious Metals CFDs

The number of precious metals they offer are quite few, these includes XAGUSD & XAUUSD. Too few in my opinion

4. Commodity CFDs

Just like the number of metals they offer, the commodities on the list are just as few, including: XTIUSD & XBRUSD. Maybe the low spreads could make up for it in your point of view.

5. Stock CFDs

The stocks they offer includes: MSFT, TSLA, AAPL, AMZN, NVDA. These are popular stocks by the way.

Platforms - 6.5/10

MT4/MT5

The dual-combo of the older MetaTrader 4 & the newer MetaTrader 5 are available for you to use on desktop, web & mobile.

Anzo Capital Mobile App

Anzo Capital has a mobile app for on-the-go trading; you can download the app from google & apple online stores.

Tools - 5/10

1. MAM (Multi-Account Manager)

Multi Account Manager is a platform that enables a single trader to manage multiple number of client accounts, all from one master account. It would be a good tool for fund managers looking to optimize their trading process.

2. Social/Copy Trading

You can trade by mirroring the strategies of other traders, or offer your strategies to be copied by other traders.

Support - 6/10

Live Chat

Anzo Capital has a 24/7 customer support through live chat, with a wait time that is below 1 minute. I tried it severally and personally like the quick response.

Telephone & Email Support

They is an email address and a phone number available on their website, on the contact us option that is on their website.

Beginner Education

AnzoCapital has educational resources available on their website, stated as “Academy” click on it to get free trading resources.

Final Verdict - 6/10

Anzo Capital is one of the best forex brokers in Nigeria for beginners because of the low spreads & quick support. However, it remains a high-risk broker because of its weak regulation and low popularity.

| 🏛️ Broker | ⚖️ Regulation | 💰Deposit & Withdrawals | 💱Account Types | 🧹Account Management | 🛒Range of Markets | ✂️Fees | 💻Platforms | 🛠️Tools | 🚑Support | 🏆Score |

| HFM | 10 | 10 | 10 | 10 | 8 | 7 | 5 | 8 | 9 | 8.4 |

| Trade Nation | 10 | 8 | 8.5 | 8 | 7 | 9.6 | 8 | 5.5 | 9 | 8.2 |

| Tickmill | 10 | 7 | 7 | 9 | 9 | 8 | 7.5 | 10 | 6 | 8.2 |

| Pepperstone | 10 | 10 | 6 | 6 | 9 | 6 | 10 | 9 | 7 | 8.1 |

| Exness | 10 | 10 | 10 | 6 | 5 | 7 | 8 | 5 | 8 | 7.8 |

| FxPro | 10 | 10 | 6 | 10 | 9 | 6 | 8 | 5 | 7 | 7.8 |

| Just Markets | 6 | 9 | 10 | 7 | 7.5 | 9 | 7 | 4 | 8 | 7.5 | XM | 10 | 10 | 6 | 6 | 8 | 8 | 6 | 6 | 6 | 7 |

| XTB | 10 | 8 | 5 | 6 | 5 | 6 | 5 | 5 | 7 | 6 |

| AvaTrade | 10 | 5 | 4 | 5 | 10 | 4 | 7 | 8 | 9 | 6 |

| FBS | 8 | 10 | 5 | 6 | 6 | 5 | 6 | 6 | 10 | 6 |

| Anzo Capital | 5 | 5 | 5 | 7.5 | 5 | 7.5 | 6.5 | 5 | 6 | 6 |