Threads

Trending News

Brokers

University

Market Hours (UTC +1)

Legality of Forex Trading in Nigeria (is it banned?)

According to a public notice we found on the Securities & Exchange Commission (SEC) Nigeria website, forex trading is not banned but the Nigerian government do not monitor what the forex brokers do. This means that you are free to trade forex in Nigeria, but if you are duped or suffer pecuniary losses to any forex broker, the Nigerian government will not compensate you or help you recover your funds rom the forex broker.

How Forex Trading Works in Nigeria

Forex trading is when traders try to make money from the fluctuation in the exchange rate of a currency.

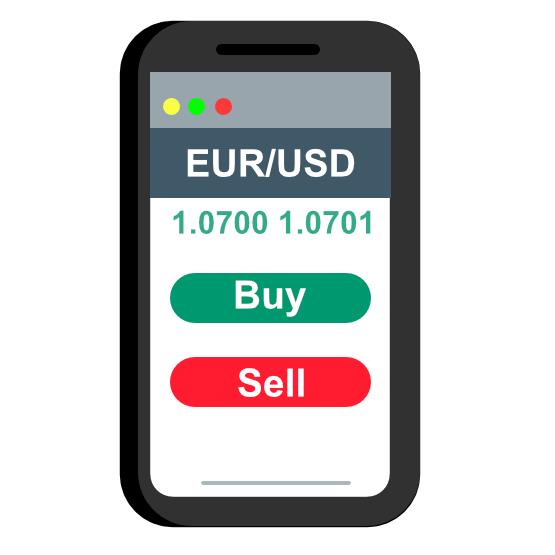

Every currency when paired with another, has an exchange rate so the euro paired with us dollar (EUR/USD) can have an exchange rate of say 1.0700. A forex trader will try to make money when this exchange rate rises or falls.

When the exchange rate is rising, the trader will click on the buy button to make profits from the rise.

When the exchange rate is falling, the trader will click on the sell button to make profits as the rate falls.

So, in online forex trading traders can make money from both rising and falling exchange rates, this is what makes it so popular.

Is forex Trading Gambling?

The similarity between forex trading and gambling is that if you are wrong, you lose your initial investment/stake. forex trading is much different from investing because when you invest you the chances that the price of the stock/asset will fall to zero is not unrealistic.

However, there are also some differences between forex trading and gambling.

In gambling its a zero sum game, so if you stake $100 you stand to lose it all if your prediction is wrong. However, in forex trading, you can control the amount of loss you sustain by exiting a losing trade before the losses wipe out your investment.

Is Forex Trading Halal in Nigeria?

Nigeria has a large population of muslims living in the northern part of the country. The Islamic religion is opposed to receiving interest on financial transactions, and interest payment is a part of forex trading when you leave a trade open overnight.

Islamic faithfuls always ask if forex trading is halal or haram. The answer depends on the kind of forex trading account type a muslim opens.

If a muslim who wants to trade forex opens an "Islamic Account" then forex trading will be halal because he will not pay or receive any overnight interest which islam frowns upon.

How to Start Forex Trading in Nigeria

1. Open A Forex Trading Account With A Broker

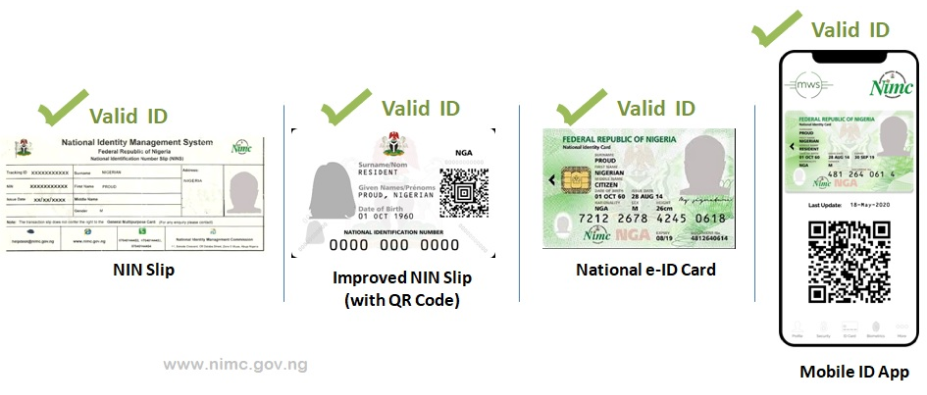

To open a forex trading account in Nigeria, you will need a government issued means of identification such as NIN slip, BVN number or drivers license. You will also need a proof of residence document and for this you can use your electricity bill or still use your drivers license since it carrier your residential address.

Choose any regulated forex broker and then go through the account opening process with them, snap/upload your means of identification and wait for them to approve your account opening application.

2. Deposit Funds Into Your Trading Account

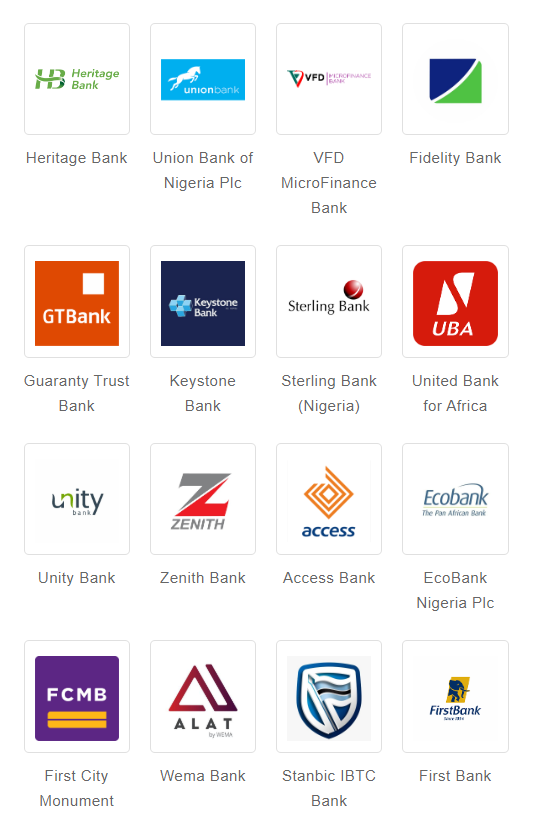

You can deposit naira currency into your trading account, because forex brokers operating in Nigeria accept it. The broker will then convert the naira into your selected account currency at a small fee called a currency conversion fee.

Some forex brokers in Nigeria offer naira trading accounts so when you deposit naira, there will be no need to convert it to another currency; however most brokers offer USD as the default account currency.

Forex broker allow you to simply transfer money from your Nigerian bank account, into a receivable account that will be generated for you by the broker.

Brokers also allow you deposit funds using your visa/mastercard, ussd, crypto wallet etc..

Forex brokers always have a minimum amount they will permit you to deposit into your account. For most brokers in Nigeria, the smallest amount you can depisit and start trading with is around $5 (Five US Dollars).

Once you perform the transfer, the money will reflect in your trading account.

3. Connect Your Account To Trading Software

Most forex brokers offer the MetaTrader trading software platform to their clients. Once you open your trading account, you can connect your account to MetaTrader following these steps:

- Open a MetaTrader4 or MetaTrader5 account, then check your email for the account number/password and server name.

- Download MetaTrader4 or MetaTrader5 from your brokers website.

- Login to MetaTrader by inserting your tradng account number in the "login" box, inserting your MetaTrader password in the "password' box and selecting the server name to match the one sent to your email.

4. Trade By Yourself or Copy Trades of Others

To trade forex by yourself on your phone or desktop, you simply click buy if you think price will rise or sell if you think price will fall.

Alternatively, you can use copy trading which is a way of linking your account to another traders account to replicate his trades.

Copy trading forex works in Nigeria and several forex brokers offer this service. Copy trading is mostly used by those who are too busy to learn how to trade. It however comes with it's risks as if the if the person you are copying sustains a loss, it will also reflect in your account in the same proportion.

Frequenty Asked Questions on Forex Trading

What is the Daily Trading Volume in the Forex Market?

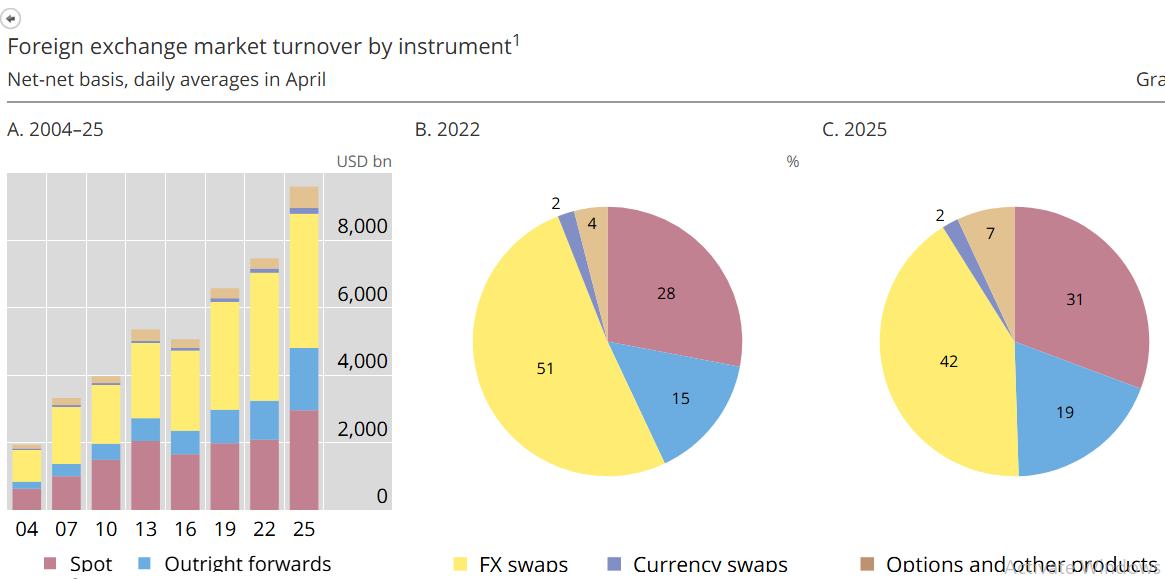

According to the Bank of International Settlements (BIS) 2025 triennial survey, 9.6 Trillion USD worth of currency pairs is traded everyday on the forex market.

How Does Daylight Savings Affects Forex Sessions in Nigeria?

For the London session, Daylight Savings Time (DST) starts on the last Sunday of March and ends on the last Sunday of October every year.

For the New York session, DST starts on the last Sunday of March and ends on the first Sunday of November every year.

During DST, the London session will open at 8 AM instead of 9 AM; and the New York session will open at 1 PM instead of 2 PM. In other words, the London session will open one hour later, while the New York session will open one hour early during daylight savings.

However, after DST the London session will open at 9 AM and the New York session will open at 2 PM.

What is the Most Traded Currency Pair in London & NY Sessions?

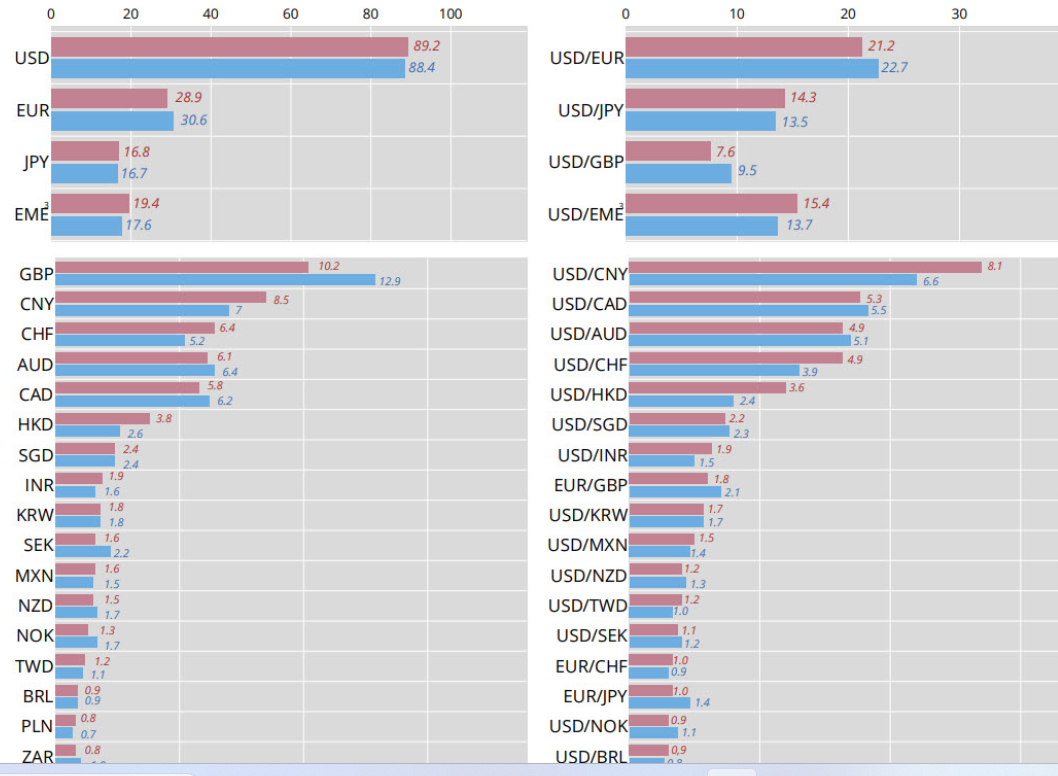

The US Dollar is the most traded currency in the forex market, accounting for 89.2% of all trades that took place in 2025 according to the BIS report.

If you want to trade any pair that contans the USD, you should consider doing so during the London or New York sessions.

The EUR/USD is the most traded currency pair in the forex market, accounting for 21.2% of all the forex transactions that took place in 2025. EUR/USD is also the most traded currency pair during the London & New York sessions.

The runner up is the USD/JPY currency pair which is the second most traded currencyy pair in the forex market. USD/JPY accounts for 14.3% of all forex transactions that took place in 2025.

See our list of most traded currencyy pairs in the forex market for 2025:

- EUR/USD - 21.2%

- USD/JPY - 14.3%

- USD/GBP - 7.6%

- USD/Emerging Market Economy Currencies - 15.4%

Which Country Had the Most Forex Trading Activity in 2025?

According to the 2025 Bank of International Settlement triennial survey, the United Kingdom (London) had the highest number of forex transactions in 2025 with $4.7 trillion USD, making UK/London the worlds leading fx financial hub.

- United Kingdom - $4.7 trillion USD

- United States - $2.3 trillion USD

- Singapore - $1.48 triillion USD

- Hong kong - $883 billion USD

The combination of the UK, US, Singapore & Hong kong, accounted for 75% of all forex transactions in the market in 2025.