FXCM Review

Is FXCM A Good Broker?

!! Regulator Warning !!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The FXCM android app does not update the live pricing as it should. I complained about this and they promised to fix it in the next update so for now i give them 3 stars

Began trading with fxcm on demo account but when i switched to live account i noticed the spreads were higher. secondly their mobile app always freezes and TradingView connection is unstable

No slippage, No lag, their pricing is always on point !!!

I trade frequently so I have been able to get lower spreads using the fxcm active trader account. I think anyone trading actively should try this account. However, I think fxcm need to lower their non-trading fees and subscriptions

I must confess i started using FXCM demo account for chart analysis only but with time I had to abandon my old broker and switch to them because they are so organized and keep everything professional.

Their TradingView integration is very good and their trade execution speed is fast. The problem I have with FXCM is sometimes when I deposit, they start asking for proof of deposit. Another issue is that FXCM customer support is slow and this should be fixed.

FXCM has some of the best customer support you can ask for from any broker. They are also very transparent with their spreads.

FXCM is an FSCA Regulated Broker with a $50 Minimum Deposit

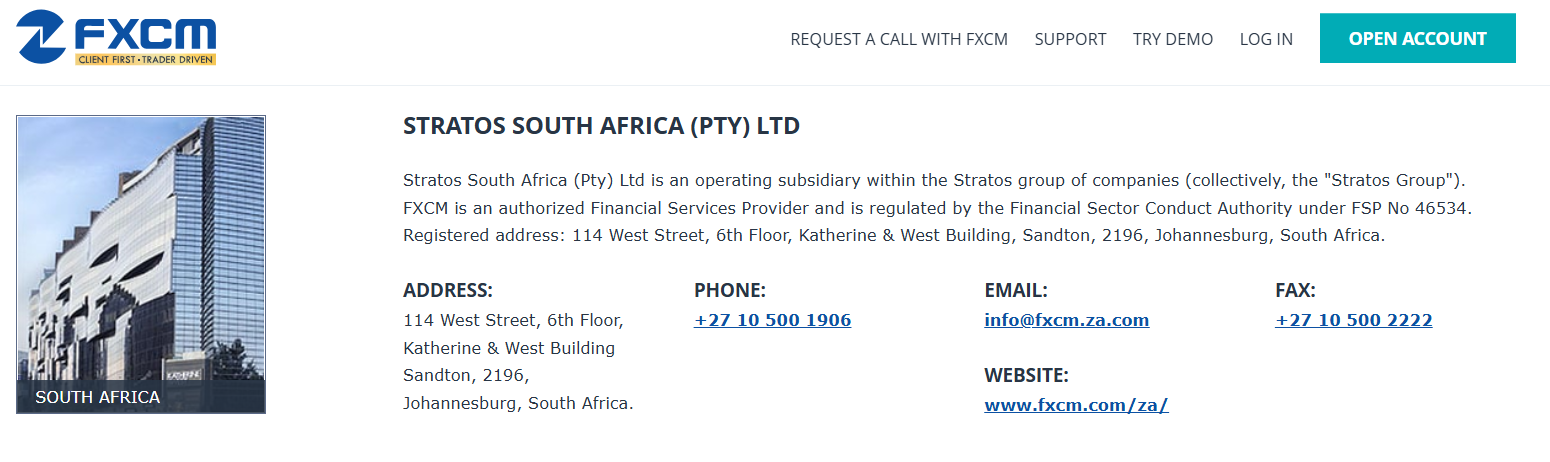

| 👨 Broker | Stratos South Africa (Pty) Ltd |

| 👨 Trading Name | FXCM |

| ⭐ Overall Score | 8/10 |

| 👨 Accepts South African Traders? | Yes |

| 📅 Year Founded | 1999 |

| ⚖ Regulators | FSCA South Africa |

| ⚖ FSP No. | 46534 |

| ⚖ Authorized ODP | No |

| 💰 Minimum Deposit | $50 |

| 💰 Minimum Withdrawal | $0 |

| 📈 CFD Instruments | Forex, Shares, Indices, Commodities, Forex Baskets, Share Baskets |

| 🚀Leverage | 1:400 |

| 🔎Auditors | |

| 💻 Platforms | MT4, TradingView PRO, Trading Station |

| 📋Account Types | CFD Account, Active Trader Account |

| 💱Account Currency | USD |

| 📞Live Support | 24/5 |

| 🏖️ Inactivity Fee | $10 |

| 😭CFD Traders Who Lose Money | 64% |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

Regulation - 9/10

Is FXCM Regulated in South Africa?

Yes, Stratos South Africa (Pty) Ltd. (trading as FXCM) is in South Africa and is regulated by the Financial Sector Conduct Authority (FSCA); their FSP number is 46534.

FXCM is authorized by the FSCA to carry out brokerage services, but they cannot act as market makers since they don't have an ODP license.

Deposit & Withdrawal - 8/10

FXCM Minimum Deposit in ZAR

The FXCM minimum deposit in South Africa is $50 (around 900 ZAR) & there are no deposit fees.

Available Deposit Methods at FXCM

- Local SA Banks (instant)

- Credit/Debit Card

- Skrill (instant)

- Neteller (instant)

- International Bank Wire (3-5 days)

FXCM Minimum Withdrawal

FXCM minimum withdrawal amount is $0, so you can withdraw any profits you make no matter how little they may be.

Withdrawal Time

Withdrawals via local South African banks are instant, while international bank wire withdrawals can take between 3 and 5 days to reach your account.

Range of Accounts - 7/10

1. CFD Trading Account

This is basically an entry level account with spread-only pricing. The minimum deposit for opening this account is $50. You will experience spreads from 1.2 pips on this account, because the commission is built into the spread.

2. Active Trader Account

This is for regular traders who have more trading experience. The minimum deposit for this account is also $50.

This account features raw spreads which are thin and close to zero but in return you pay commissions on every trade.

On the FXCM Active Trader Account, you get rebates on spread when you trade a certain volume of instruments & this helps lower trading cost.

Account Management - 6/10

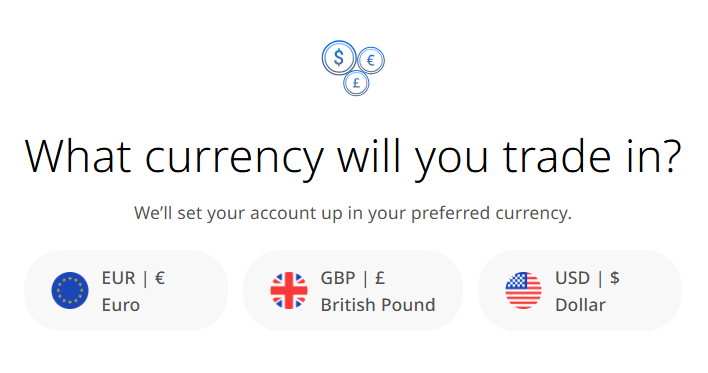

Account Currency

FXCM South Africa does not offer ZAR Accounts, instead South African traders will have to open USD Accounts. This means that ZAR deposits will be converted into USD & you face a currency conversion fee.

Leverage

FXCM traders in South Africa can access up to 1:400 in leverage & you can adjust this leverage from your FXCM personal area.

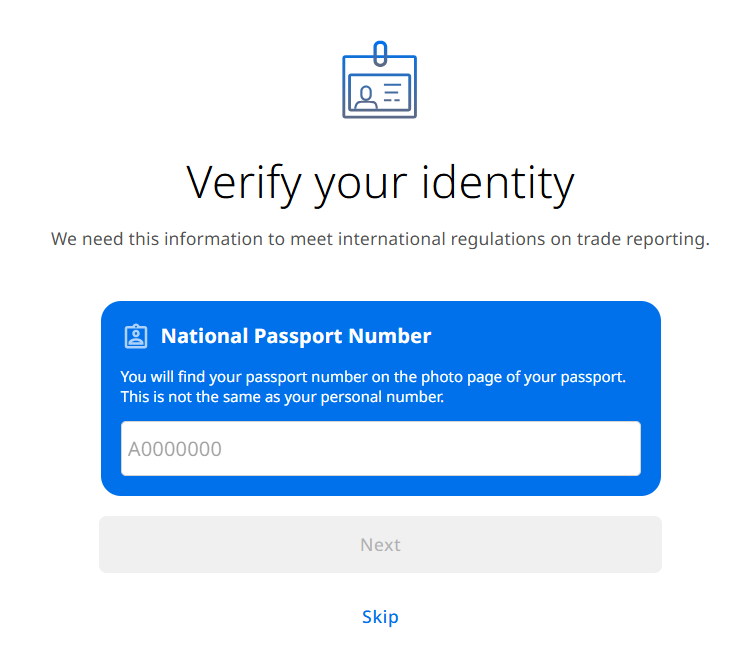

Account Opening Procedure

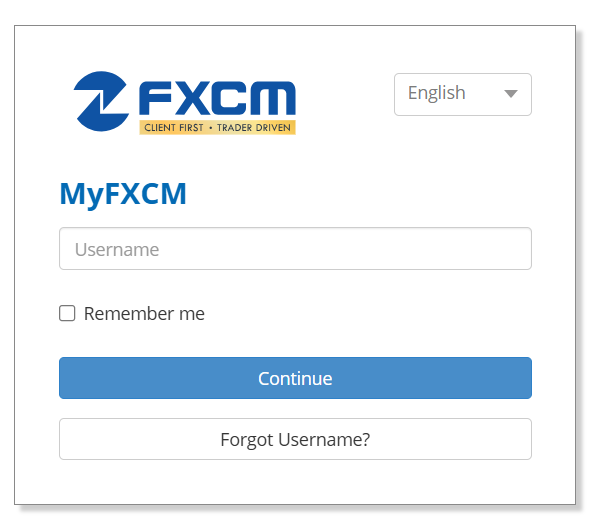

Step 1 - Register

Go to the FXCM website or mobile app and click on register then fill in your email address & create a password. FXCM does not give you the option of registering with your Google or Apple Account which could have made the registration process faster.

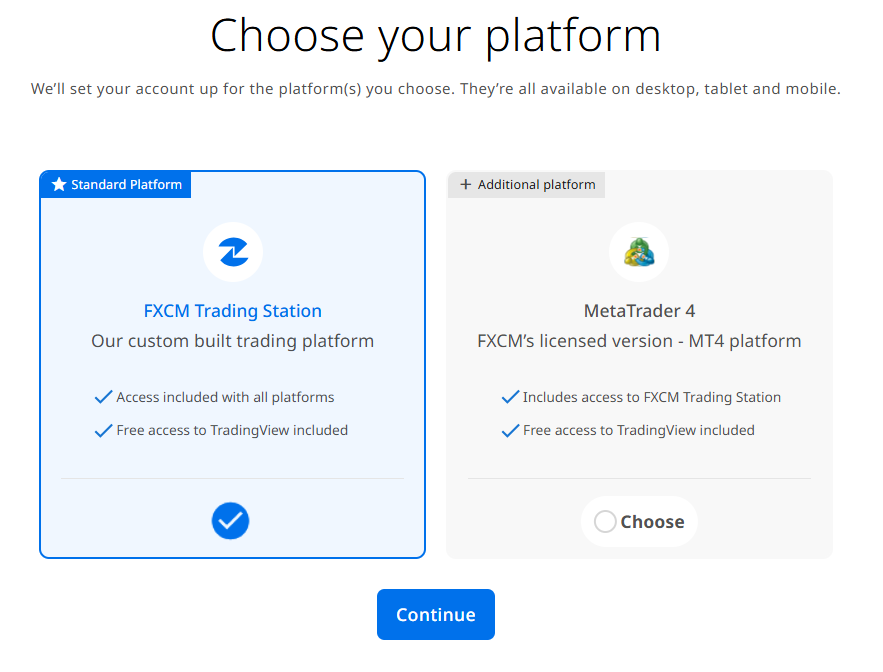

Step 2 - Choose a trading platform

Choose the FXCM Trading Station Platform, the MT4 platform or both.

Step 3 - Choose your base currency

Step 4 - Profile setup

Here, you will be required to fill in personal information and input your South African National Passport Number to verify your identity.

Next, you will be prompted to answer a few questions on your means of livelihood and trading experience then after that your FXCM profile & free demo account is created for you.

you can then login to your FXCM dashboard to open a live account and upload you South African government ID for verification.

Please note that FXCM does not accept South Africa Drivers License as a means of ID.

Once your ID is verified, your live account will be activated and you can make your first deposit for trading.

Range of Markets - 7/10

1. Forex CFDs (1:400)

At FXCM South Africa you can trade CFDs on the major currency pairs & commodity pairs as well as minors plus exotics.

Speaking of exotics, South African traders can speculate on the South African Rand via the USD/ZAR & ZAR/JPY pairs.

2. Index CFDs

FXCM has the NASDAQ CFD on their menu, along side other popular indices such as S & P 500 mini, GER30, etc. However the South Africa 40 index is unavailable.

3. Share CFDs

We saw a lot of Share CFDs listed of the FXCM menu ranging from the oil sector, to technology, to aerospace etc. However, we didn't see any South African Share CFDs like MTN.

4. Commodity CFDs

For Commodities we saw Gold, Silver, Oil, Natural Gas & Copper on the menu but they were no soft commodities such as Grains, Livestock etc.

Another thing we noticed was that the Gold was paired against the USD and there was no Gold paired against the South African Rand.

5. Forex Basket CFDs

At FXCM you can trade the US Dollar Basket which compares how strong the USD is against the currencies inside the basket (EUR, AUD, GBP & JPY).

You can also trade CFDs on the Emerging Markets Basket which measures how strong the USD is against the constituents of the basket (ZAR, CHN, TRY, MXN).

Then there is the JPY Basket that beasures how strong the Japanese Yen is against the members of the basket (AUD, GBP, USD, EUR & CAD).

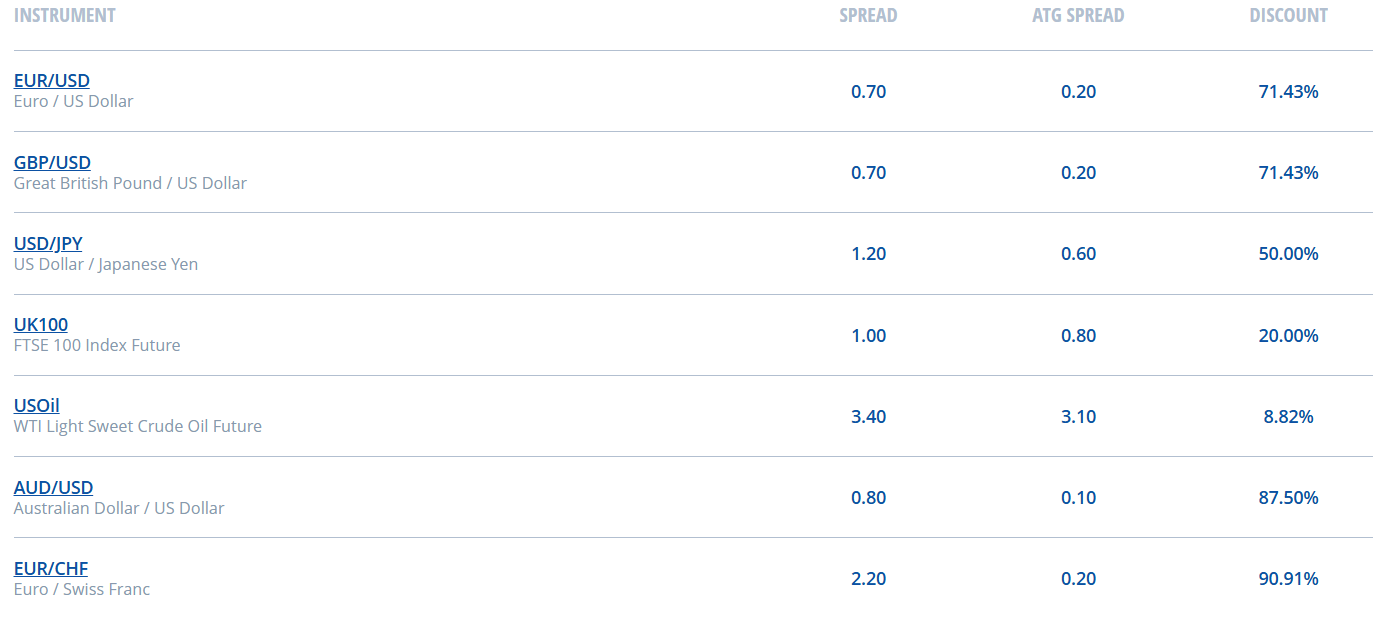

Fees - 7/10

1. Spread

FXCM spreads are variable so they fluctuate up and down as per market volatility. However on the Standard CFD Trading Account, spreads start from around 0.7 pips.

Users of the Active Trader (ATG) Account get access to lower spreads from 0.2 pips but they must pay a $2.5 per side commission per trade.

Active Trader Account users also get up to 62% rebates on spread, if they execute trades valued at up to $150 million in volume every month.

2. Commissions

At FXCM you only pay commissions of $2.5 per side when using the Active Trader Account to trade forex.

Trading Share & Commodity CFDs is commission free as everything is included in the spread.

3. Overnight Fees

FXCM will charge you a rollover fee if you leave your CFD positions open overnight into the next day.

Inactivity Fees

FXCM South Africa charges a $50 inactivity fee after 12 months of account dormancy.

If you have more than one dormant account, each account will be charged separately for inactivity.

FXCM Trading Platforms - 9.3/10

1. Trading Station (with back testing capability)

FXCM Trading Station is a proprietary homegrown trading platform developed by FXCM for its customers.

Trading Station comes as a mobile app, desktop app & a web trader. The Trading Station platforms allow you trade from charts & use Expert Advisors (EAs).

Because FXCM does not offer MT5, the Trading Station Platform does a good job at replacing MT5 due to its advanced functionality & back-testing capability.

2. MetaTrader 4 (with free VPS)

FXCM has MT4 and it comes in mobile, web & desktop versions. You can use the free FXCM Virtual Private Server (VPS) to host your Expert Advisor & let it run 24 hours without interruption.

3. TradingView PRO

FXCM is a TradingView broker so you get access to use the TradingView platform at no cost.

On the TradingView platform you can trade from advanced charts and access modern features that are updated regularly by the TradingView team.

How To Connect FXCM To TradingView

Log in to TradingView

Visit the TradingView website, click on sign in and you get the option to sign in with your Google Account, Apple Account, LinkedIn Account, X Account, or email. elect any sign in method to proceed.

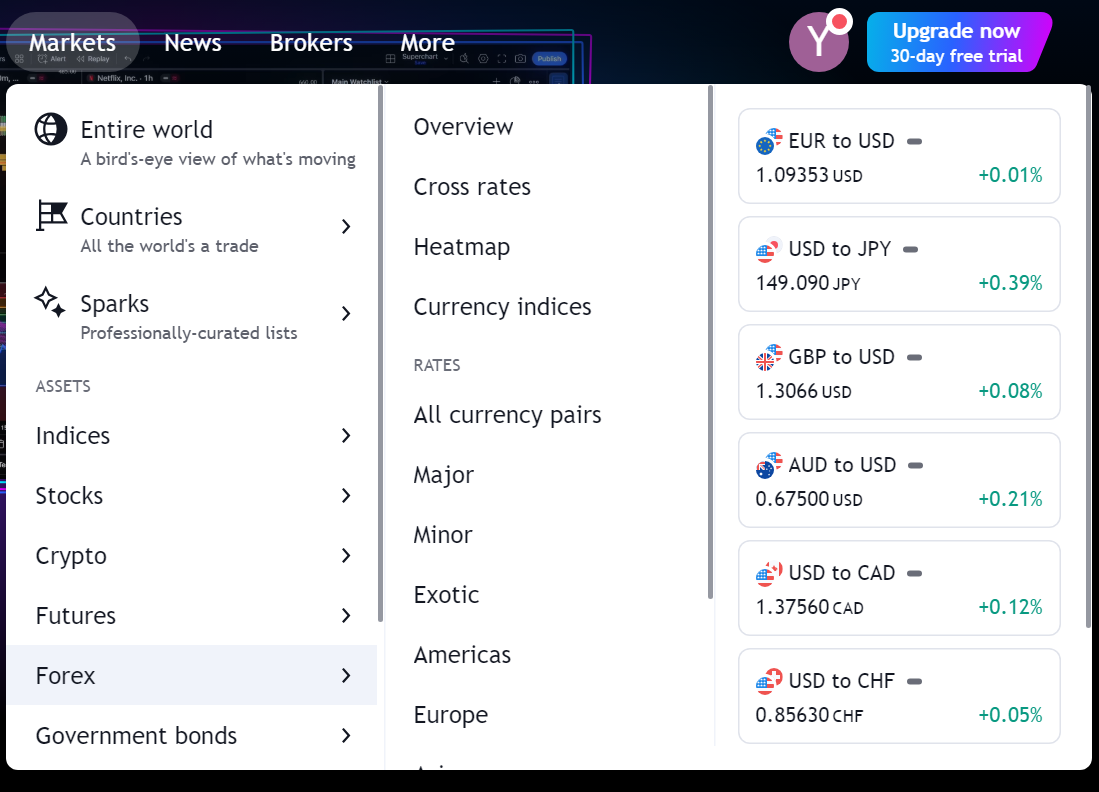

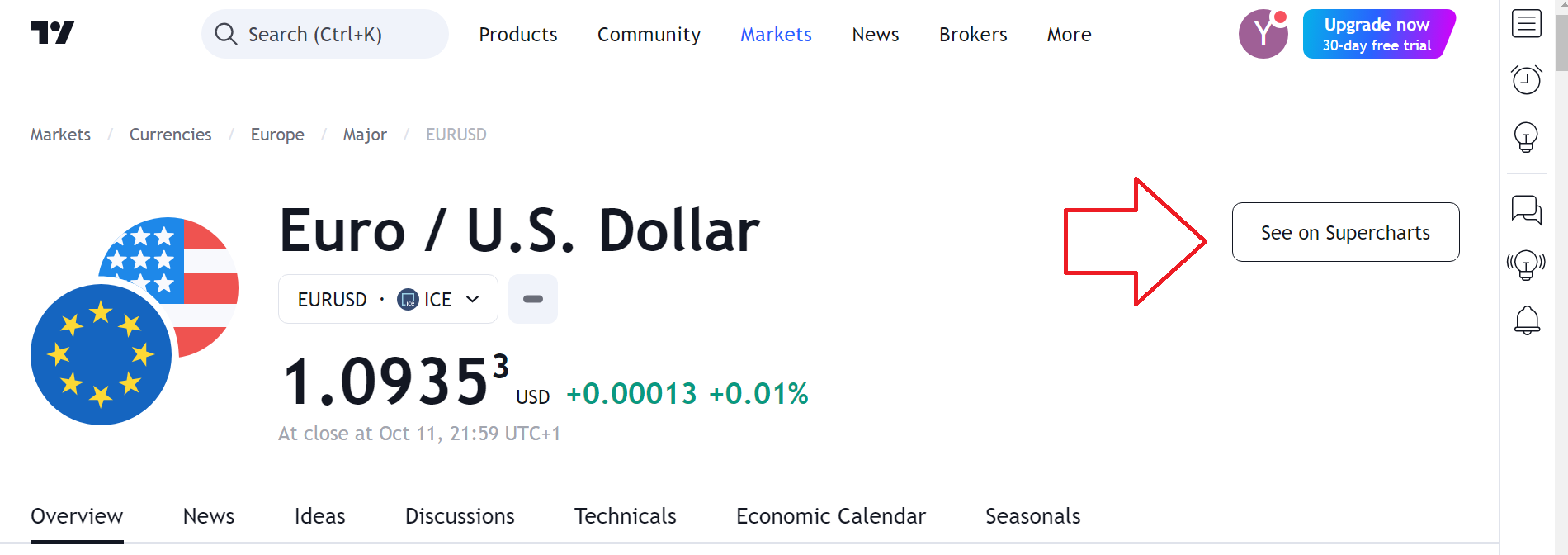

Choose an instrument to trade

To select an instrument to trade on TradingView, click on Markets and then select any instrument of choice.

Navigate To Super Charts

After choosing an instrument to trade, opt to view the instrument on Super Charts by clicking on the "see on super charts" button.

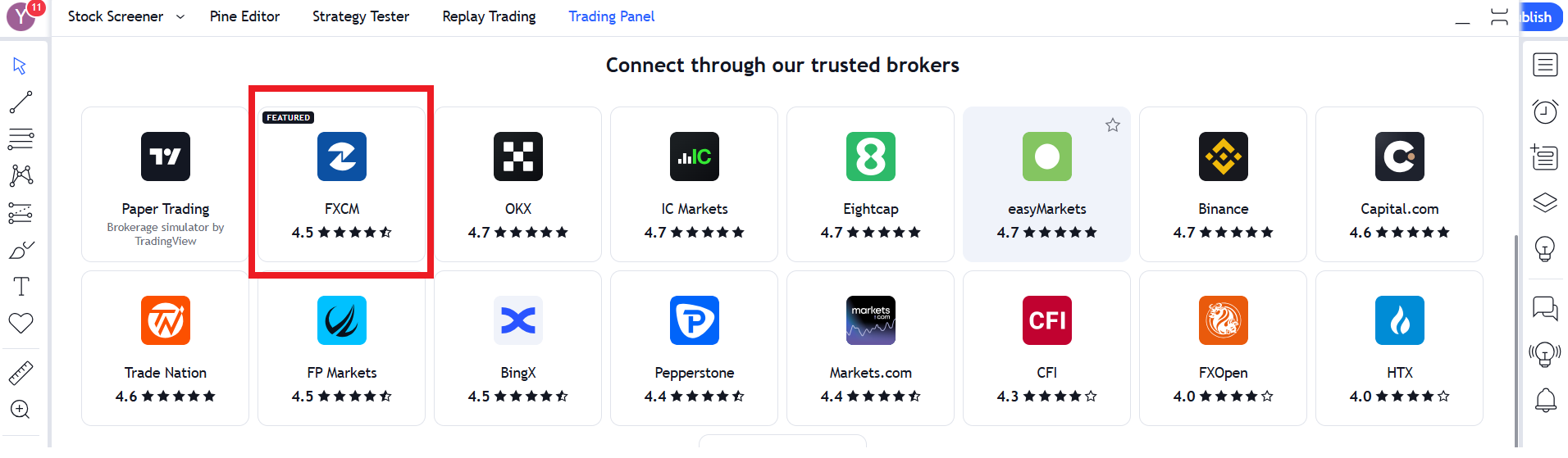

Open Trading Panel

To see a list of brokers on TradingView, click on Trading Panel.

Proceed to expand the trading panel by clicking on the expand icon by the bottom far right hand side.

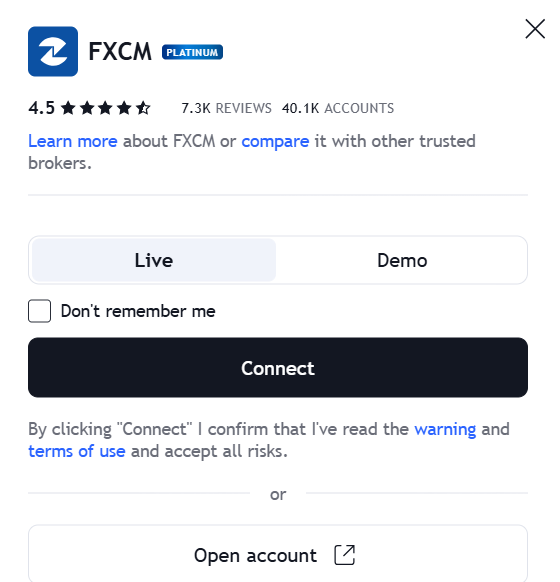

Choose Your Broker

After the trading panel opens, you will see a list of all the forex brokers on TradingView.

Locate FXCM on the list and connect with your login details.

Tools - 9/10

1. Capitalise AI

Capitalise AI is basically a tool that lets you build your trading robot using simple English language.

FXCM offers you the Capitalise AI platform at no cost so you can implement automated trading strategies with ease.

2. API Trading

An API is a set of protocols that allow to apps to talk to each other. FXCM offers 3 free APIs (FIX, Java & Forex Connect) to enable you extract data from FXCM and feed to your trading robot.

3. Specialty Apps

FXCM several specialty apps that can be downloaded to perform specialized functions. Some of the specialty apps include:

- Advanced Historical Data Downloader App

- StrongWeak Standalone App

- Tick Data Downloader App

- CFD Auto Roll App

- Speculative Sentiment Index App

4. FXCM Plus

FXCM Plus is a suite that gives you economic news from Trading Central, alerts you of support/resistance levels on charts & analyzes your trading skills/performance over time.

5. Market Scanner

This tool can be used to scan the market based on preset parameters (such as timeframe, indicators etc.) to be entered by you.

6. Economic Calendar

This tool shows you the dates when important economic news (such as NFP, PCE, CPI) will be released.

Customer Support - 6/10

1. Live Chat

You can reach FXCM via live chat, but their response is slow. They will send you a verification code (to your email) before you can chat with a live agent. All of this is time wasting.

2. Telephone & Email Support

FXCM telephone support is good as you can request a call back and an agent will get in touch with you on phone.

FXCM email support is also available but responses can take up to 1 day.

3. Personal Account Manager

Personal Account Managers are only assigned to Active Traders who trade large volumes.

4. Education

FXCM education is not in-depth but you can access it from their website. Unlike some competing brokers, FXCM does not structure their education program into a learning academy with different levels.

The FXCM demo account is also helpful for starter to learn how to trade using fake cash.

Final Verdict - 8/10

When it comes to technology & pricing, FXCM is one of the best forex brokers in South Africa.

FXCM drawbacks include their customer support for South African traders which should be improved on & their range of markets.