how do i spot volatility on charts without using indicators?

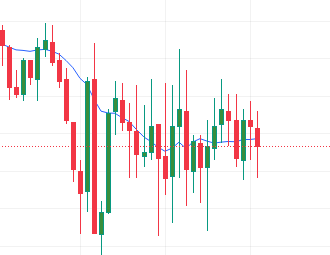

I look out for "scattered charts"; when i see a lot of wicks making the charts look like a thorn field i know theres some volatility in the market.

I look out for "scattered charts"; when i see a lot of wicks making the charts look like a thorn field i know theres some volatility in the market.

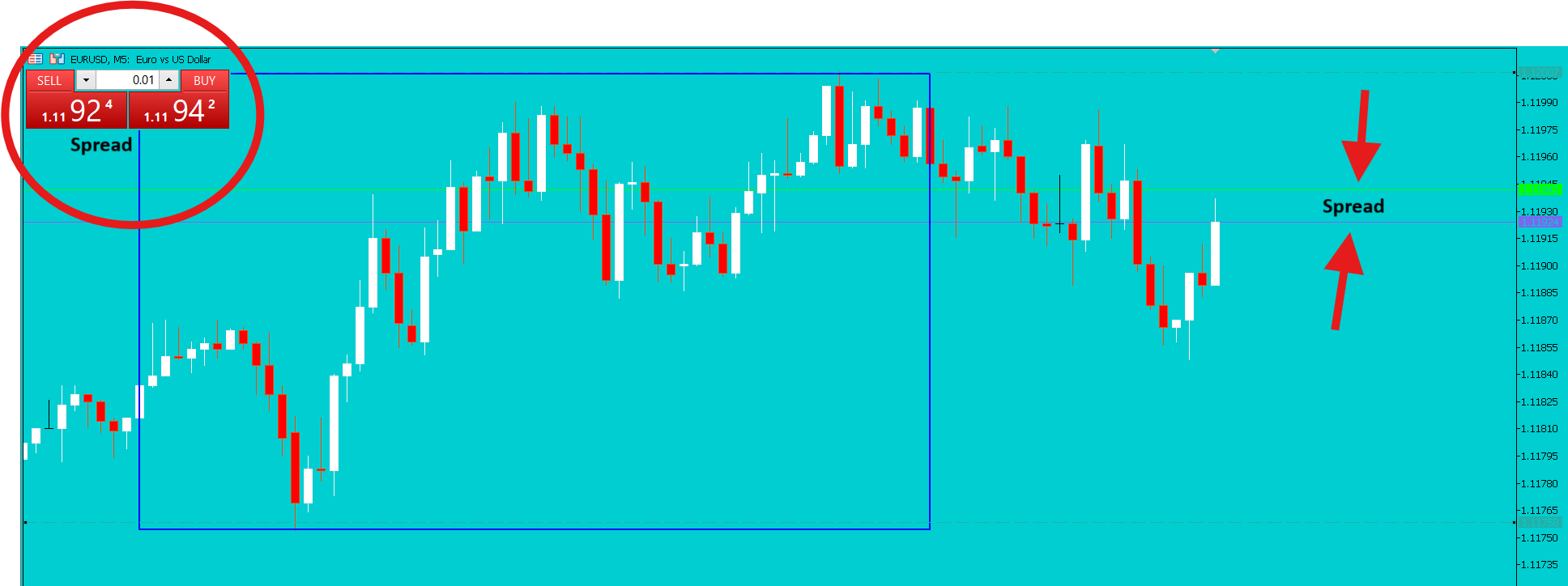

When volatility is high, forex brokers ususally increase their spread as seen on the charts. On your chart, the space between the bid and ask price lines is the spread so you will notice the space becomes unusually wider.

When volatility is high, forex brokers ususally increase their spread as seen on the charts. On your chart, the space between the bid and ask price lines is the spread so you will notice the space becomes unusually wider.

Just like @melody said, a volatile market will have a lot of wicks on candlesticks. This is an Ethereum/USD chart and cryptocurrency pairs are always very volatile so you can see that almost every candle is accompanied by a wick.

These long wicks mean you face a higher chance of your stop loss getting hit so you need to place a wide stop when trading volatile pairs

Nice one 👌

Normal Volatility

You can also use the SMA indicator as a guide. When volatility is normal, price tends to stay above or below the Simple Moving Average (SMA) line.

High/Excessive Volatility

When volatility is excessive, price tends to engulf the Simple Moving Average line

Sometimes you just need to look at the spread on the instrument you are trading, if you notice your broker has increased/widened the spread, it means they know something you dont; theres probably incoming volatiility.

When volatility is high, your broker could reduce leverage. On the charts you also see unusually tall candlesticks