iFX Brokers Review

is ifx a good broker?

Been trading with ifx brokers for a few months now and so far I can say they are not as bad as I had thought. Their customer support is responsive and their spreads are moderate.

ifx brokers impressed me with their customer support especially the live chat. I had read so many negative reviews about them but I think they are taking corrections and have actually improved.

Manipulation of spreads and system glitches are common with ifx. They should also allow their bonus to constitute free margin

Terrible customer support. They don't even send you email confirmation once an action is completed except you check from your personal area. At least if something is wrong they should call or email and their live chat is not working i doubt they even have one. They should also improve the speed of account verification.

iFX is a native South African forex broker with ZAR accounts & support for multiple local ZAR funding methods

| 👨 Broker | iFX Brokers |

| 👨 Accepts South African Traders | Yes |

| 📅 Year Founded | 2017 |

| ⚖ Regulators | FSCA South Africa |

| ⚖ FSP No. | 48021 |

| ⚖ Authorized ODP | Yes |

| 📈 Trading Instruments | Forex, Commodities, Indices, Crypto, Shares |

| 🚀Max. Leverage | 1:1000 |

| 🔎Auditors | |

| 💻 Platforms | MT4, MT5 |

| 📋Account Types | Cent, Raw, Premium, Standard, VIP |

| 💱Account Currency | ZAR, USD |

| 💰 Minimum Deposit | $0 |

| 📞Live Support | 24/5 |

| 🏖️Inactivity Fee | $0 |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

Regulation - 10/10

iFX brokers is a trusted forex broker that is native to South Africa.

iFX Brokers is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa.

iFX brokers is also an FSCA authorized Over-the-counter Derivative Provider(ODP).

Funding & Withdrawal - 8/10

iFX Minimum Deposit in ZAR

iFX Brokers minimum deposit is 0 ZAR for their Standard & Cent Accounts

Other IFX Accounts such as the Premium Account, Raw Spread Account & Standard Account; require a $250 minimum deposit.

The iFX Flagship VIP Account requires a $1,000 minimum deposit.

iFX Deposit Methods

Start by logging into your secure client area, then click on ''wallet''.

Various deposit methods will be displayed then you choose the one you desire, choose your currency, enter the amount & submit.

- Mastercard

- Visa Card

- OZOW

- PayFast

- Crypto

- Skrill

- Neteller

- Wire Transfer

iFX Brokers Minimum Withdrawal

iFX brokers does not have a minimum withdrawal and you can only make two withdrawals per day.

iFX Brokers Withdrawal Time

iFX brokers withdrawals take 24 hours minimum and 48 hours maximum to reach your account.

1. Cent Account

iFX Cent Account has no minimum deposit and has a lot size restriction so you can not trade more than 1,000 units of any instrument.

There is also a restriction on what you can trade as you can only trade major forex pairs on the cent account.

The Cent Account is meant for beginners who want to risk less losses by restricting the lot size they can trade.

2. Standard Account

The iFX Standard Account has no minimum deposit and there is no lot size restriction as you can trade standard lots of 100,000 units.

3. Premium Account

The Premium Account has a 250 USD minimum deposit and there is no lot size restriction as you can trade standard lots of 100,000 units.

Account Management - 8/10

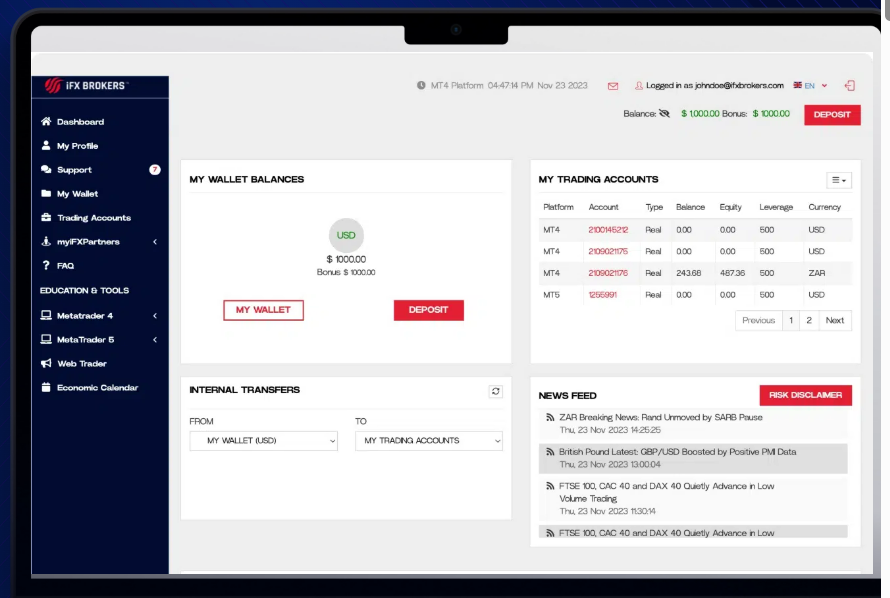

Online Wallet

When create a profile at iFX Brokers, an online wallet is automatically created for you. You can fund the wallet then when it is time to trade, you transfer funds from the wallet to your trading account.

iFX Leverage

iFX Brokers South Africa allows you use a maximum leverage of 1:1000 on the Cent Account & 1:500 on the other accounts.

To change leverage, simply login to your client area, select the account, edit it, input the new leverage & submit.

iFX Account Currency

iFX Brokers accounts can be opened in the local South African Rand (ZAR) account currency.

Margin Call & Stop Out

On the iFX brokers Standard & Cent Accounts, you will get a margin call the moment your margin level falls to 50% and you will be stopped out when your margin level falls to 30%.

On the Premium & VIP Accounts, Margin Call comes at 60% and Stop Out comes at 20%.

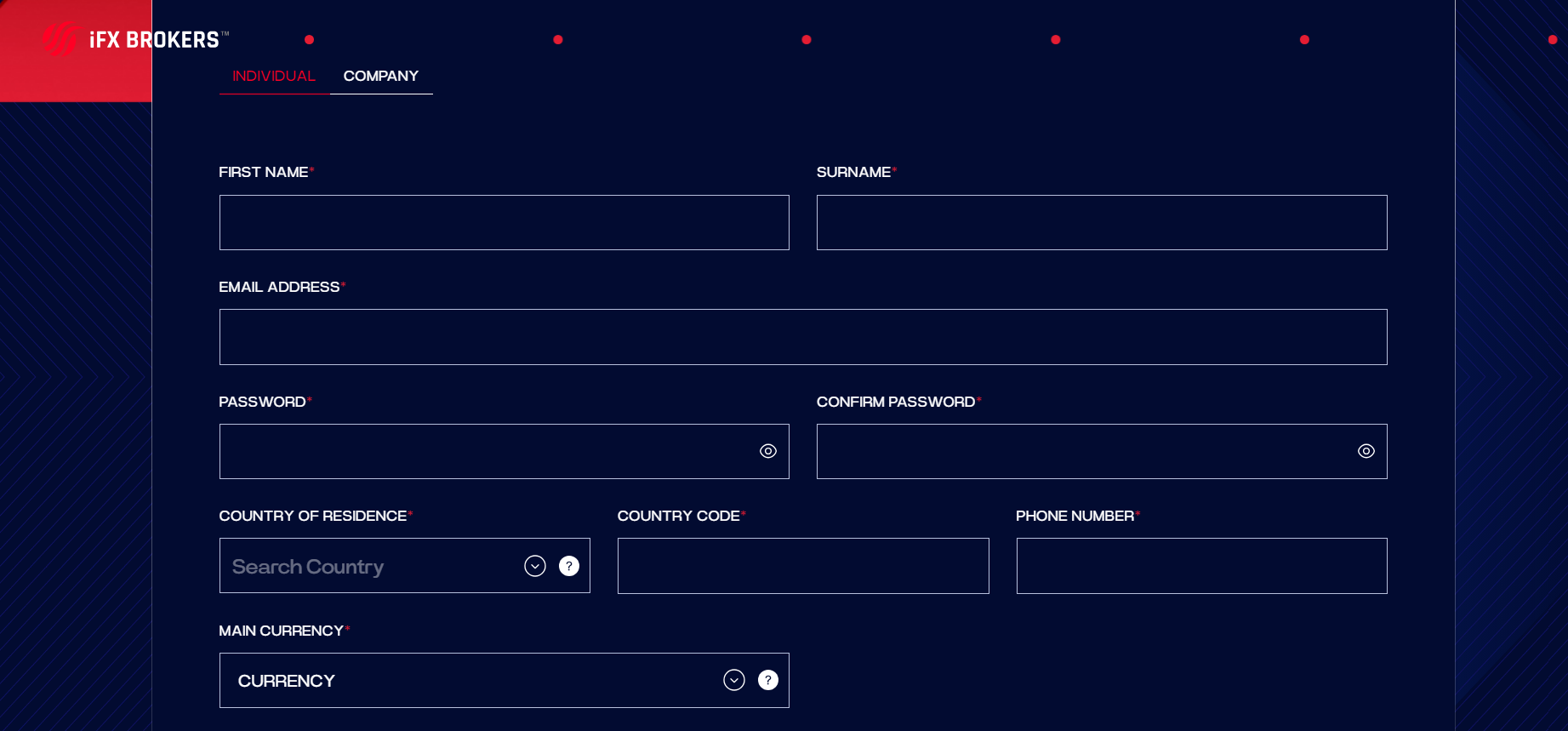

Account Opening Steps

Start by registering & creating a profile. Visit the iFX Brokers website & clicking on ''open account''.

Fill in your personal details, create a password, select a base currency, then click on ''register''.

Check your email address for a confirmation message, then click on the link in the message to validate your email & finalize the registration step.

When you click on the link in the confirmation email, you will be redirected to your iFX Client Area Dashboard.

At this point an MT4 demo account has already been created for you automatically. This demo account is for practice only.

From your client area dashboard, click on ''start the live account opening process''

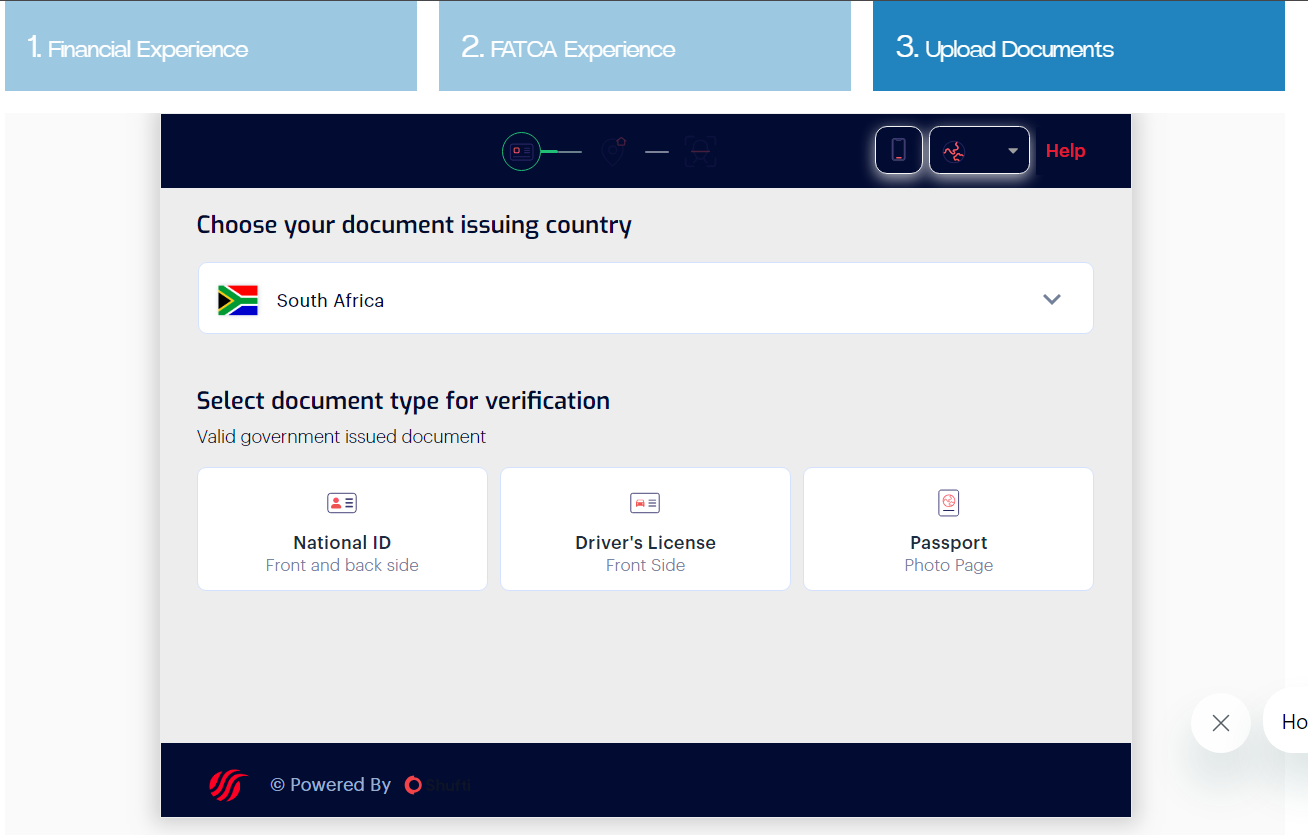

Fill in some more info & select your account base currency (again).

Choose the method you will be using to fund your account (bank transfer or cards), then submit your bank details.

The last step is to upload your South African government issued means of identification. After this, your account will be activated & you can make your first deposit.

iFX Fees - 6.6/10

1. Spread & Commission

iFX brokers spread is higher than most major competition & the spread widens even more during news releases & other volatile periods

Its also important to note than unlike most brokers, iFX has no average spread.

The Cent Account spread starts from 1.6 pips upwards with no commission.

The Raw Account spread starts from 0.0 pips but you pay commission of $3 per side 100,000 units traded.

The Premium Account spread starts from 1.0 pips with no commission, while the Standard Account spread starts from 1.3 pips with no commission..

The VIP Account spread starts from 0.6 pips with zero commission.

2. Inactivity Fee

iFX brokers only charges inactivity fees on dormant accounts if the account balance is below 50 ZAR. In such a case any money in your account below 50 ZAR will be deducted as inactivity fee.

3. Currency Conversion Fee

iFX charges currency conversion fees when you deposit/withdraw outside your account currency. You can reduce currency conversion fees by opening your trading account in ZAR currency.

When funding your account in ZAR you can do so with ZAR compatible payment methods like OZOW, PayFast, Bank Cards & eWallets.

4. Overnight Fees

iFX Brokers does not offer swap-free trading so leaving your CFD trade open till the next day will attract overnight swap fees.

Range of Markets - 4/10

At iFX brokers you can trade 200+ instruments across different asset classes. This number is low as most brokers offer a higher number of tradable instruments.

- 50+ forex pairs (including EUR/USD, EUR/ZAR, GBP/ZAR, USD/ZAR etc.)

- 7 Commodities (including XAU/USD, NAT GAS, Crude)

- 11 Indices (including Nas100)

- 3 Crypto Pairs (BTC/USD, XET/USD, LTC/USD)

- 100+ US & EU Shares

iFX Brokers Platforms - 6.4/10

MT4 & MT5 Only

iFX Brokers don't have their own proprietary platform but they offer the popular MT4 & MT5 platforms. Since you cannot fund your account from MetaTrader, you must do so from the iFX website/client area

Because iFX brokers does not have their own mobile app, if you somehow lose access to MetaTrader due to network glitches etc. it means you will not be able to trade or manage existing trades.

Tools - 2/10

iFX Brokers does not provide sufficient tools and the economic calendar is the only tool they provide and you can access it from your client area.

Customer Support - 5/10

1. Live Chat

You can access the iFX live chat 24/5 from your client area and you can chat with an agent during weekdays only.

2. Telephone & Email

iFX South African help lines are open 24/5 so you can call them for any issues. A dedicated email address for support issues is also displayed on their website.

Final Verdict - 6/10

iFX Brokers is good for experienced traders but not for beginners; because they lack adequate beginner tools/education.