Just Markets Nigeria Review

Is Just Markets A Regulated Forex Broker?

!! Regulator Warning !!

CFD trading involves complex financial instruments unsuitable for all investors. Before trading gold CFDs, carefully assess your financial situation, knowledge level, and risk tolerance. Never trade with funds you cannot afford to lose

Very honest broker and they do their best to make sure you win. When I first heard of Just Markets I was skeptical but after trying them I think I have finally found my permanent broker. Low spreads, fast execution, 24/7 support and the list goes on.

Multiple withdrawals in one day and they reflect in seconds. Well done Just Markets !

A promising broker but they are not yet in the bug league. They need to add more trading tools because the 1:3000 leverage they offer carries high risk.

I absolutely love their low spreads and fast withdrawals. Lots of people are sleeping on this broker but for me they are the best for anyone in Nigeria. I think they should increase their physical presence in Nigeria with ground troops and personal account managers because the brand is not popular in Nigeria yet.

I was drawn to Just Markets by the high leverage of 3000x and I was also attracted by the naira account they offer. I have placed a few trades with them and I cant complain- they are worth the trouble.

Initially I was skeptical about this broker because their spreads seemed too good to be true but they are for real ! I love them for their low spreads especially on Gold and I also cherish their 24/7 support because i trade crypto on weekends.

Just Markets is an FSA Regulated Forex Broker with a $10 Minimum Deposit, NGN Base Currency & Raw Spread Pricing

| 👨 Broker | Just Markets |

| 👨 Accepts Nigerian Traders? | Yes |

| 📅 Year Founded | 2012 |

| ⚖ Regulators | FSC Mauritius |

| 💰 Minimum Deposit | $10 (around 17,000 NGN) |

| 💰 Minimum Withdrawal | $10 (around 17,000 NGN) |

| 📈 CFD Instruments | Forex, Indices, Commodities, Shares, Crypto |

| 🚀Leverage | 1:3000 |

| 🔎Auditors | |

| 💻 Platforms | MT4, MT5, JM App |

| 📋Account Types | Cent Account, Standard Account, Pro Account, Raw Spread Account |

| 💱Account Currency | Naira, USD |

| 📞Live Support | 24/7 |

| 🏖️ Inactivity Fee | $5 |

| 😭CFD Traders Who Lose Money | - |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

Regulation - 6/10

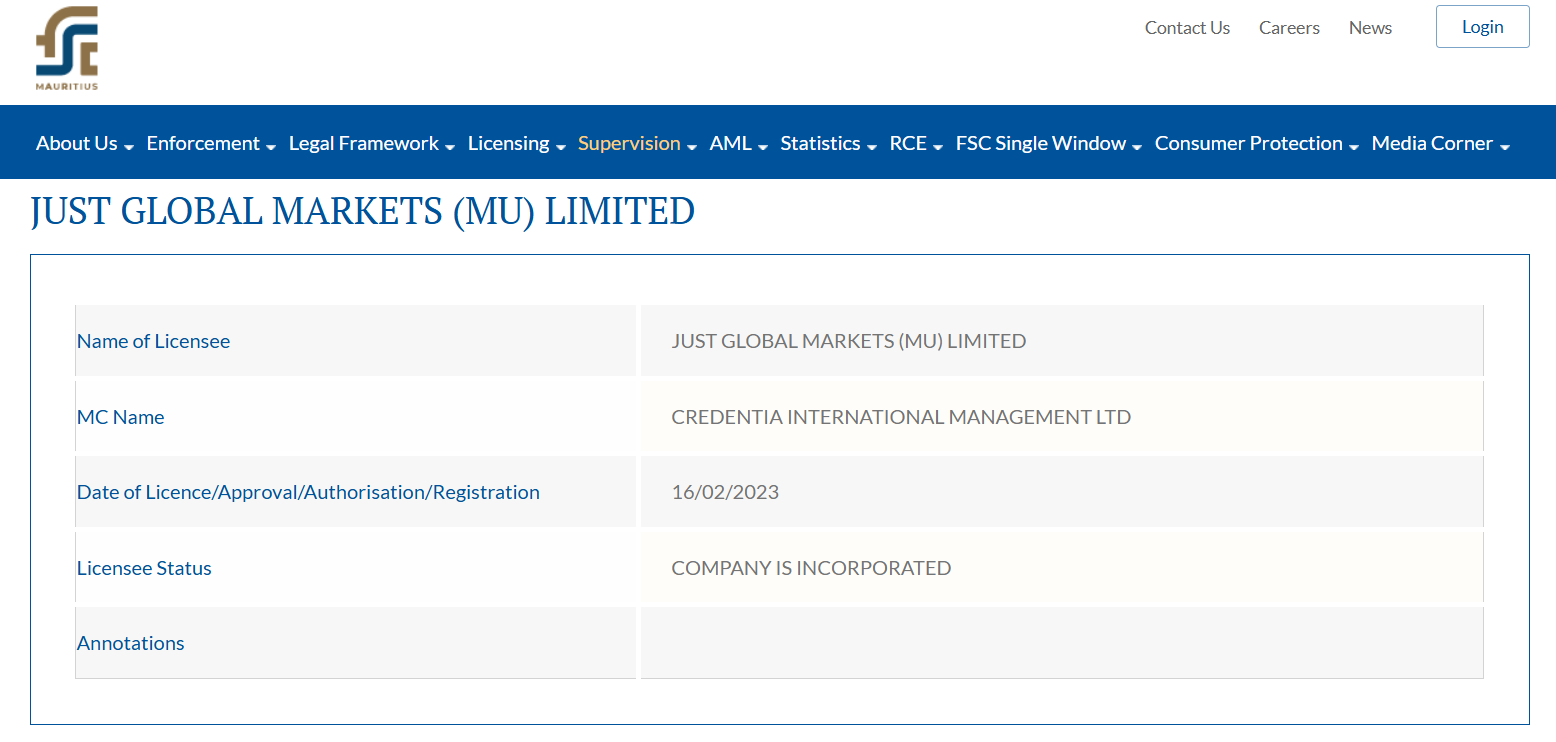

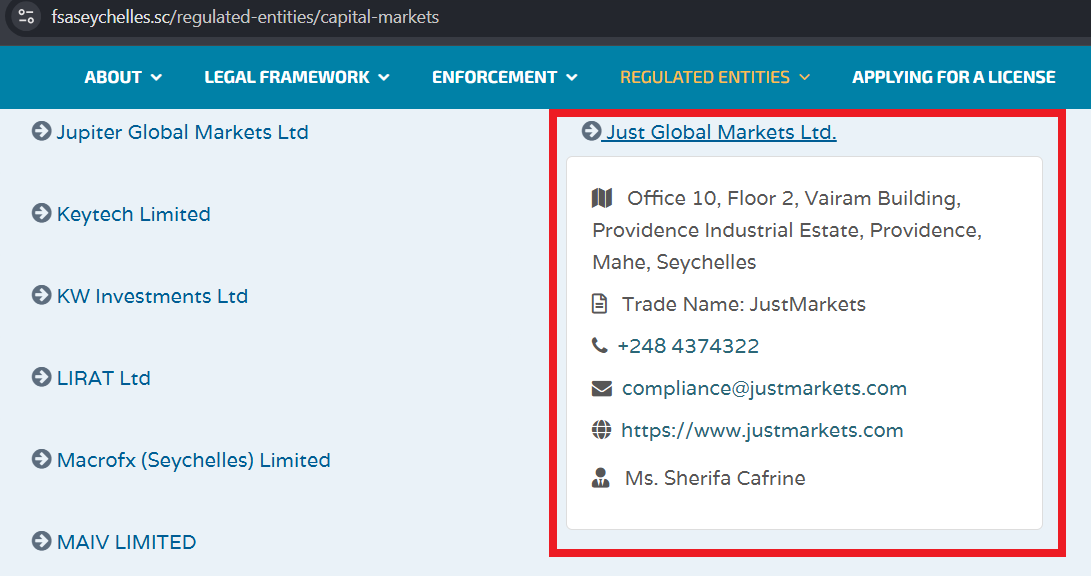

Is Just Markets Legit?

Yes, Just Markets activities in Nigeria are regulated by the Financial Services Commission (FSC) in Mauritius.

Just Markets is also regulated by the Financial Services Authority (FSA) Seychelles

Just Markets is regulated in Cyprus by the Cyprus Securities & Exchange Commission (CySEC)

| 📍Country | ⚖️Regulator | #️⃣License No. | 📅Date License Issued |

| Mauritius | FSC | GB22200881 | 2023 |

| Seychelles | FSA | 8427198-1 | xx |

| South Africa | FSCA | 51114 | |

| Cyprus | CySEC | 401/21 | 2021 |

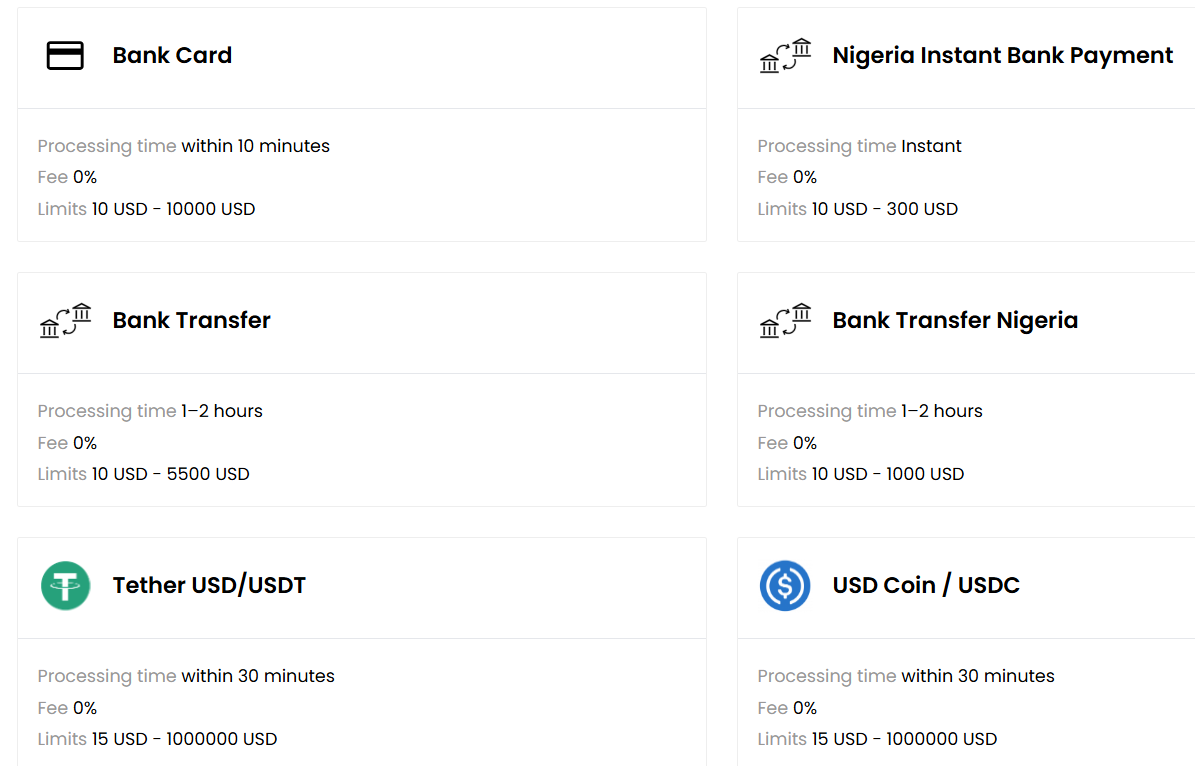

Deposit & Withdrawals - 9/10

What is the Minimum Deposit for Just Markets?

Just Markets minimum deposit is $10 for their entry-level Standard Account & Cent Account.

However, if you seek the more advanced Professional & Raw Accounts, the minimum deposit is $100.

How Does Just Markets Welcome Bonus Work?

Just Markets gives a welcome bonus of 50% on any deposits from $10 & above. However, the welcome bonus is not available on the Raw Spread Account.

Every time you make a deposit above $10, you are qualified for a Just Markets welcome bonus so there's no limit on the number of bonuses you can get.

To get the Just Markets welcome bonus, you must tick the get deposit bonus box while you are making any deposit above $10.

Yes, you can withdraw the Just Markets welcome bonus but on condition that you trade a certain number of standard lots.

The formula for determining the number of standard lots you must trade before you can withdraw the Just Markets welcome bonus is No. of Lots = (Bonus Received/2).

So, if you received a $50 bonus then you must trade 25 standard lots, before you can withdraw the bonus.

What is the Minimum Withdrawal Amount at Just Markets?

Just Markets minimum withdrawal amount is $10 for local Nigerian withdrawal methods.

However, for international withdrawal methods, the minimum withdrawal varies. Please see below:

- Nigerian Banks: $10

- Skrill: 5 USD

- Bitcoin: 100 USD

- USD Coin: 15 USD

- Tether: 15 USD

- Ethereum: 55 USD

- Tron: 80 USD

- Lite Coin 35 USD

- Doge Coin: 190 USD

- Bitcoin cash: 55 USD

- Ripple: 150 USD

- Wire Transfer: 100 USD

- Payment Agent: 10 USD

To initiate a Just Markets withdrawal, go to your personal area, click on accounts, click on withdrawal, select withdrawal method, input amount, wait for security PIN to be sent to your email, input the PIN & submit.

How Long Does Just Markets Withdrawal Take?

- Nigerian Banks: Instant withdrawal time

- Bank Card: up to 7 working days withdrawal time

- eWallets: Instant withdrawal time

- Crypto: 1 day withdrawal time

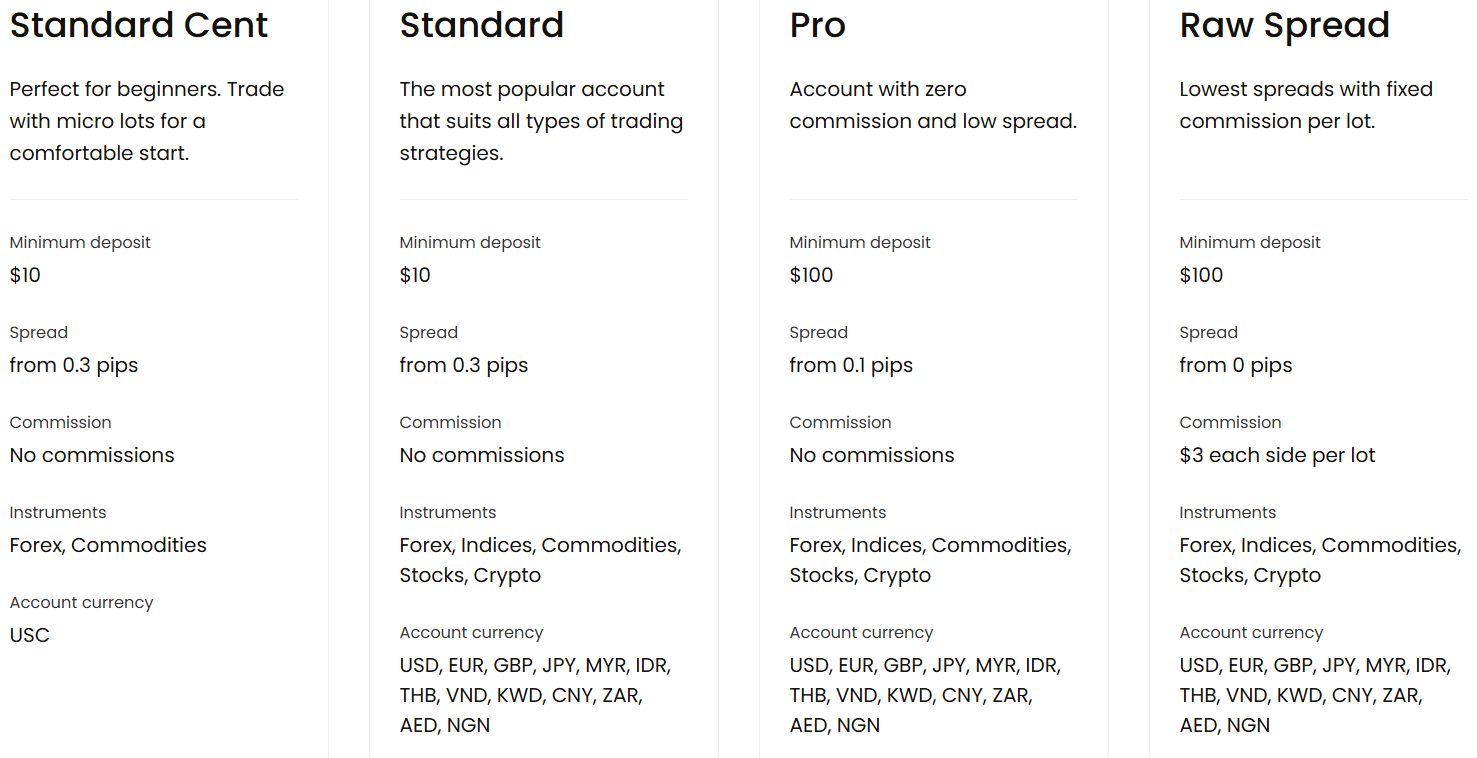

Account Types - 10/10

1. Just Markets MT4 Cent Account

Beginners who want to experience live trading while limiting their losses/profits can open the Just Markets Cent. Here, you can only open small trades & hence you cannot make big losses.

2. Just Markets MT4/5 Standard Account

This is an full-fledged account and this is for normal trading with no restrictions. Its a spread-only account meaning you don't pay commissions.

3. Just Markets MT4/5 Raw Spread Account

Another full-fledged account but this time you pay commissions on every trade you make but in exchange, you get razor-thin spreads..

4. Just Markets MT4/5 Pro Account

This is a hybrid cross between the Standard & Raw Spread Accounts. On the Pro Account, you save about half the spread you would have paid on the Standard Account & you still don't pay any commissions per trade

Account Management - 7/10

Available Account Currencies

Just Markets offers Naira as an account currency, so you can avoid paying conversion fees every time you deposit/withdraw in the local Naira currency.

USD, GBP & EUR Accounts are also available at Just Markets & you can open several trading accounts with different base currencies.

Negative Balance Protection

At Just Markets even if your account balance goes into negative for any reason, Just Markets will refund the negative balance & restore your account balance back to zero.

Number of Trading Accounts Allowed

At Just Markets, you can open an unlimited number of trading accounts but you can only register for one Personal Area.

Dynamic Leverage

Just Markets has dynamic leverage so once your account balance is up to 1,000 USD, you can no longer access up to 1:3000 leverage.

For an account balance of 1,000 to 4,999 USD, the leverage you can access is automatically reduced to 1:2000.

For an account balance of 5,000 to 29,999 USD the leverage you can access is automatically reduced to 1:1000.

For an account balance of 30,000 USD & above the leverage you can access is automatically reduced to 1:500.

Margin Call & Stop Out

Margin Call will come when your Margin Level falls to 40% and you will be Stopped Out of all your trades when your Margin Level falls to 20%.

Range of CFD Markets - 7.5/10

Forex (1:3000 Leverage)

You get access to all major forex pairs including exotics such as USD/NGN pair, so you can speculate on the naira.

Indices (1:500 Leverage)

You get access to popular indices like NASDAQ, S&P 500, UK 100; but you don't get access to any local South African indices.

Stocks (1:20 Leverage)

You get access to lots of international stock across multiple sectors such as oil/gas, automobile, skin care etc. but you don't get access to local South African stocks like MTN.

Commodities (1:3000 Leverage)

You get access to Precious metals such as Gold, Palladium etc. & you also get access to oil.

However, we noticed Gold is not crossed with the ZAR (there is not XAU/ZAR pair). We also noticed there are no soft commodities such as agriculture & livestock etc.

Crypto (1:20 Leverage)

Just Markets has a pretty diverse Crypto portfolio with coins like Bitcoin, TRON, DOGECOIN, ETHEREUM, etc.

However, we noticed these crypto assets are not paired against the ZAR currency. This exposes ZAR account currency users to more currency conversion fees.

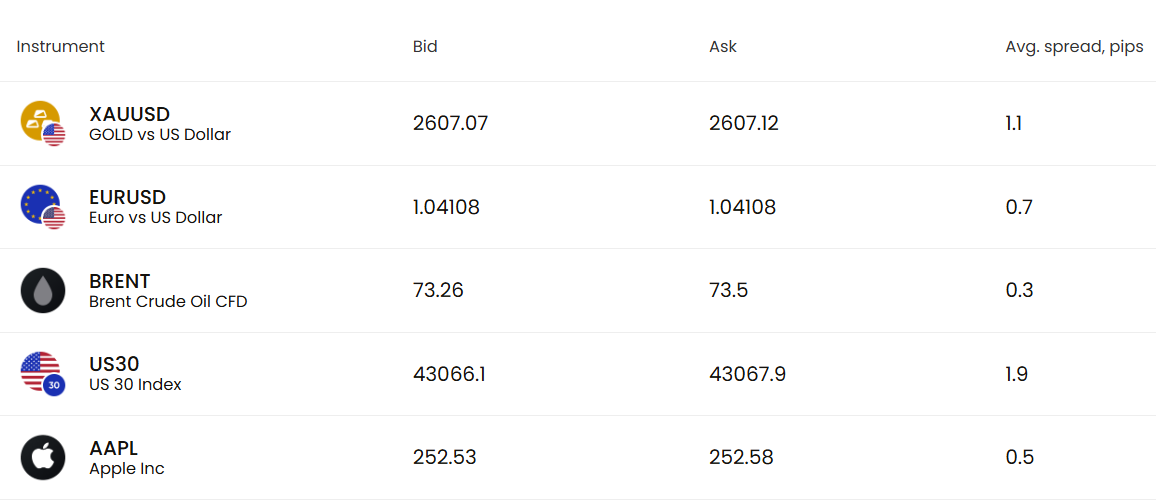

Fees - 9/10

1. Spread

Just Markets spreads are very competitive. On the Standard Account spreads start from 0.3 pips & when trading the EUR/USD pair you get an average spread of 0.7 pips.

On the Pro Account spreads start from 0.1 pips & on the Raw Account spreads are almost zero when trading major pairs.

2. Commissions

When trading forex with the Raw Spread Account, you pay a flat commission of $3 per side on every standard lot traded. In return you get near-zero spreads.

Trading Stock, Indices, Crypto & Commodity CFDs is commission-free at Just Markets.

3. Overnight Swaps

Just Markets offers extended swap-free trading on most instruments so you can hold your position open overnight at zero cost.

4. Inactivity Fees

Yes, Just Markets charges a $5 monthly fee on dormant accounts after 5 months of inactivity.

Platforms - 7/10

1. MetaTrader

Just Markets offers MT4 & MT5 desktop/web trading platforms.

The Cent Account only works on MT4 while other trading accounts work on both MT4/5.

We noticed that Just Markets execution speed is not as fast as some competitors when we tested their MT5. There were occasional delays when we tried to close trades.

However, Just Markets does not provide additional MetaTrader support such as free Expert Advisor tools that can upgrade the performance of MT4.

We also noticed an issue with the Just Markets MT5 desktop platform where if you set a trailing stop loss & then cancel it, it will keep coming back/resetting itself.

2.Just Markets Mobile App

The JM mobile app is compatible with android & apple devices. The app is not very sophisticated but is ideal for monitoring your ongoing trades & funding/withdrawing from your account./p>

Trading Tools - 4/10

1. Economic Calendar

Just Markets provides you an economic calendar to help you keep track of the exact dates when important market changing data such as Nonfarm Payroll, CPI & PCE; will be released.

2. Copy Trading

Just Markets offers copy trading where you can either copy other experienced investors, or let people copy your strategies.

to start copy trading at Just Markets you need to register a copy trading profile & create an investor wallet.

Next you have to perform an internal transfer from your normal trading account, to your investor wallet.

After funding your wallet, you can proceed to select an investor to copy.

Just Markets so called Investment Protection Mechanism (IPM) temporary pauses your copy trading when the market is moving against the investor you're copying from.

Customer Support - 8/10

Just Markets provides 24/7 customer support via various channels.

The Live Chat is the best support channel with instant responses and even the bot which greets you at the beginning is well configured to answer questions.

Another good support feature is the request a call back feature which meant we didn't need to spend our airtime calling Just Markets; they quickly got back to us after we requested a call back.

Emails are also responded to in about 24 hours which is good.

However, we visited the online stores and noticed that Just Markets does not respond frequently to complaints about their mobile app/services.

There is also customer support in form of a demo account for practicing with fake cash & there is free educational material.

Just Markets education is not organized into a trading academy as some brokers do & there's not much of videos to watch. However, the text-based learning materials cut straight to the chase and are updated regularly.

Final Verdict - 7.5/10

| 🏛️ Broker | ⚖️ Regulation | 💰Deposit & Withdrawals | 💱Account Types | 🧹Account Management | 🛒Range of Markets | ✂️Fees | 💻Platforms | 🛠️Tools | 🚑Support | 🏆Score |

| HFM | 10 | 10 | 10 | 10 | 8 | 7 | 5 | 8 | 9 | 8.4 |

| Tickmill | 10 | 7 | 7 | 9 | 9 | 8 | 7.5 | 10 | 6 | 8.2 |

| Exness | 10 | 10 | 10 | 6 | 5 | 7 | 8 | 5 | 8 | 7.8 |

| FxPro | 10 | 10 | 6 | 10 | 9 | 6 | 8 | 5 | 7 | 7.8 |

| Just Markets | 6 | 9 | 10 | 7 | 7.5 | 9 | 7 | 4 | 8 | 7.5 |

| Pepperstone | 10 | 8 | 6 | 6 | 9 | 6 | 10 | 9 | 7 | 7 |

| XM | 10 | 10 | 6 | 6 | 8 | 8 | 6 | 6 | 6 | 7 |

| AvaTrade | 10 | 5 | 4 | 5 | 10 | 4 | 7 | 8 | 9 | 6 |

| FBS | 8 | 7 | 5 | 6 | 6 | 7 | 6 | 7 | 10 | 6 |

Just Markets is one of the Best Forex brokers in Nigeria for experienced traders but we do not recommend them for beginners because of the high leverage, lack of trading tools & high minimum withdrawal.