XTB Review

Is XTB Legit?

Had to leave XTB when they discontinued API support for private clients.

the stocks for investment should be displayed in other currencies instead of just usd/eur. This will reduce the need for currency conversion which xtb charges a fee for.

Beginners should avoid this broker, their spreads are so high and customer support is bad. Experienced traders will love thm though because of the advanced tools and research

They do not have MetaTrader and then sometimes they are performing maintenance on their xStation trading app so i get locked out from trading. Their customer support is also nonchallant in their response to issues.

Excellent broker for investing in shares. There's also lots of education on investment

XTB doers not offer API services to private clients and I hope they could change this.

XTB is an internationally regulated forex broker that accepts Nigerian traders with no minimum deposit requirement

| 👨 Broker | XTB International |

| 👨 Trading Name | XTB |

| 👨 Accepts Nigerian Traders | Yes |

| 📅 Year Founded | 2002 |

| ⚖ Regulators | FSC Belize |

| ⚖ Firm Ref. No. | 000302/11 |

| 📈 CFDs | Forex , Indices, Commodities, Stocks, ETFs |

| 🚀Max. Leverage | 1:500 |

| 🔎Auditors | |

| 💻 Platforms | xStation |

| 📋Account Types | Standard Account |

| 💰 Minimum Deposit | $0 |

| 💰 Minimum Withdrawal | $0 |

| 💰 Base Currency | USD only (No Naira Account) |

| 📞Live Support | 24/5 |

| 🏖️ Inactivity Fee | 10 EURO |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

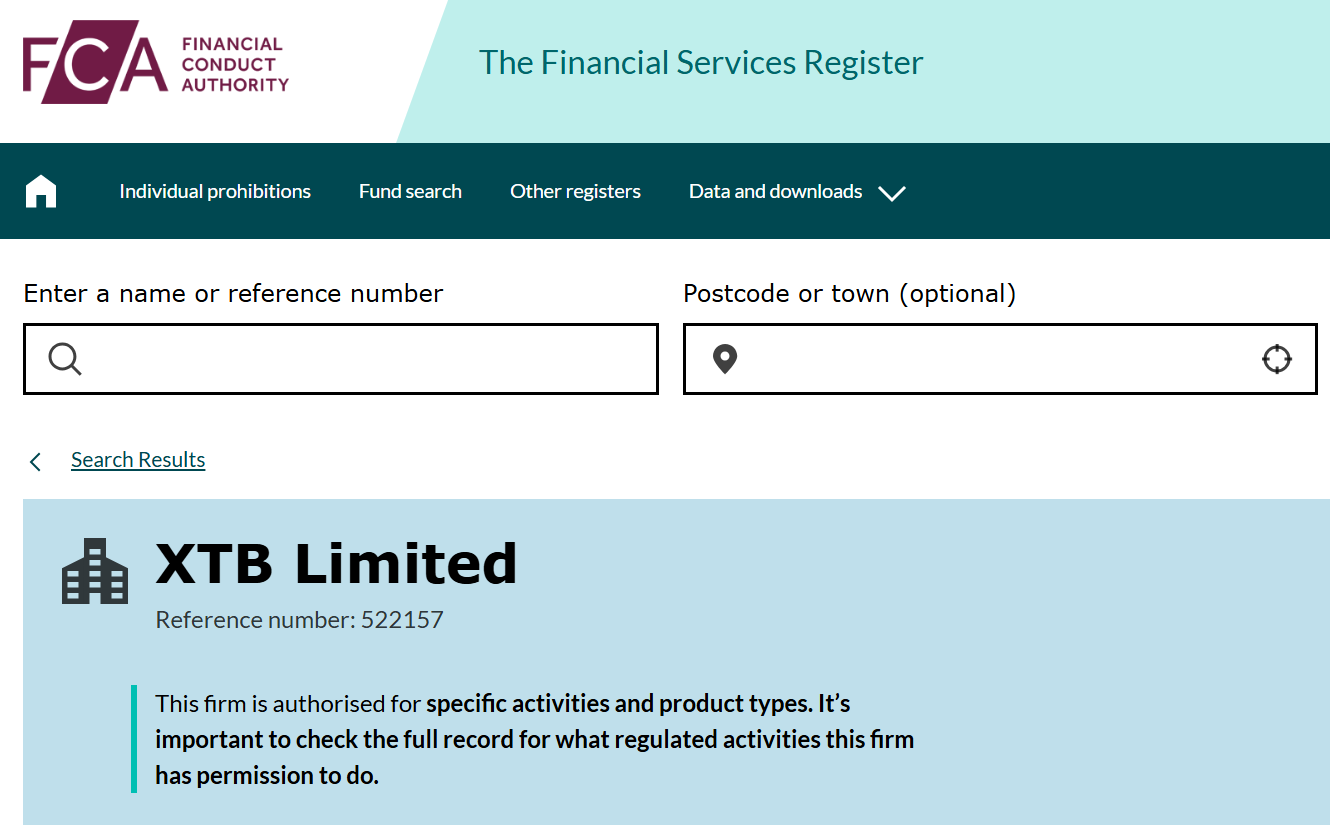

Regulation - 10/10

FSC Belize

XTB activities in Nigeria are regulated by the Financial Services Commission (FSC) in Belize.

FCA UK

XTB also operates in the United Kingdom where they are overseen by tier-1 market regulator - Financial Conduct Authority (FCA)

Funding & Withdrawal - 8/10

XTB Minimum Deposit

XTB minimum deposit is $0, so you can deposit any amount you have into your XTB Standard Account.

However, if you want to invest in real Stocks & ETFs the minimum investment is 10 USD.

XTB Minimum Withdrawal

XTB minimum withdrawal is $0, so you can withdraw any little profits you make. XTB will require you scan a photo of your bank statement before making your first withdrawal.

Accepted Funding Methods at XTB

1. Nigerian Bank Transfer

You can fund your XTB account by transferring funds from your Nigerian Bank, into an account number XTB will generate for you. There are no fees for this.

2. Cards

XTB also accepts funding via Visa, Maestro & MasterCard.

3. eWallets

Skrill & Neteller is also accepted by XTB as a means of funding your trading account.

Range of Markets - 5/10

1. Forex CFDs

You can trade all major and minor FX pairs at XTB.

2. Indices CFDs

Nas100 and other popular indices are available at XTB.

3. Commodity CFDs

Up to 28 Commodities including Gold, Nat Gas & Oil CFDs are available for trading at XTB.

4. Real Stocks & ETFs

At XTB you can open an Invest Account to buy and hold over 3,000 real Shares of U.S. & EU companies as well as ETFs.

XTB Fees - 6/10

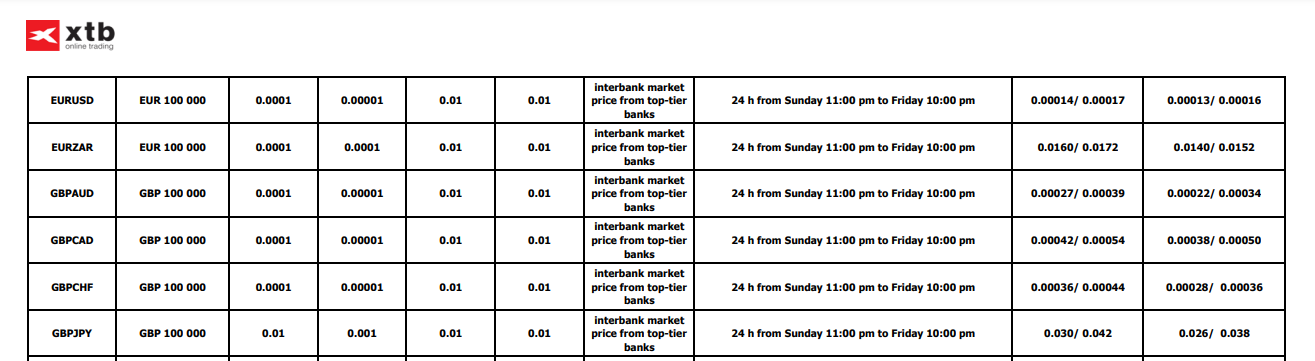

1.Spread

XTB spreads on the CFD Trading Account starts from 0.5 pips.

EUR/USD average spread is 1.4 pips .

However, if your account is configured to swap-free, the spread will start from 1.6 pips & EUR/USD average spread will be 1.7 pips.

2. Commission

When trading CFDs you don't pay commissions because everything is built into the spread but when buying stocks & ETFs you pay a 0.2% commission not exceeding 10 EUR.

3. Withdrawal Fees

Yes, XTB charges withdrawal fees on bank withdrawals below $50. Skrill withdrawals attract a 2% fee and Neteller withdrawals attract a 1% fee.

4. Inactivity Fees

Yes, XTB charges an inactivity fee of 10 EUR.

5. Currency Conversion Fee

XTB does not offer Naira accounts so a 0.5% currency conversion fee will apply for changing your Naira deposits into USD.

Range of Accounts - 5/10

1. CFD Trading Account

This account is for CFD trading and it is a spread-only account with no minimum deposit required.

2. Investment Account

This account is for buying and holding real shares & ETFs.

Account Management - 6/10

XTB Leverage

When trading CFDs, XTB allows you up to 1:500 leverage.

Account Currency

XTB broker does not have Naira accounts instead your trading account comes in USD account currency by default.

Margin Call & Stop Out

When trading with XTB, you will get a margin call when your margin level falls to 100% and you will be stopped out when your margin level falls to 50%.

Maximum Number of Accounts Allowable

At XTB you can open up to 4 trading accounts at a time.

How to Open an XTB Account

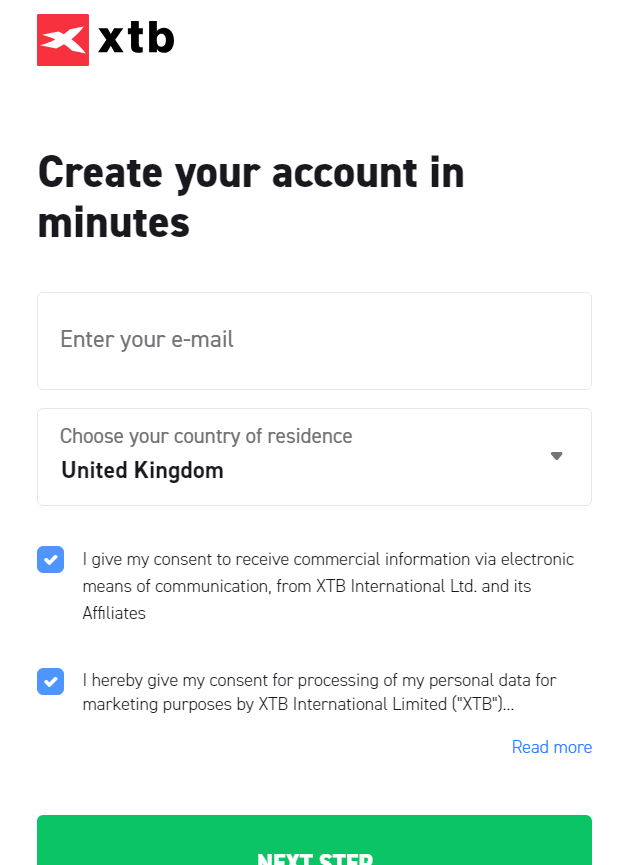

Step 1: Register

Start by registering with your email address, choose your country of residence & create a password.

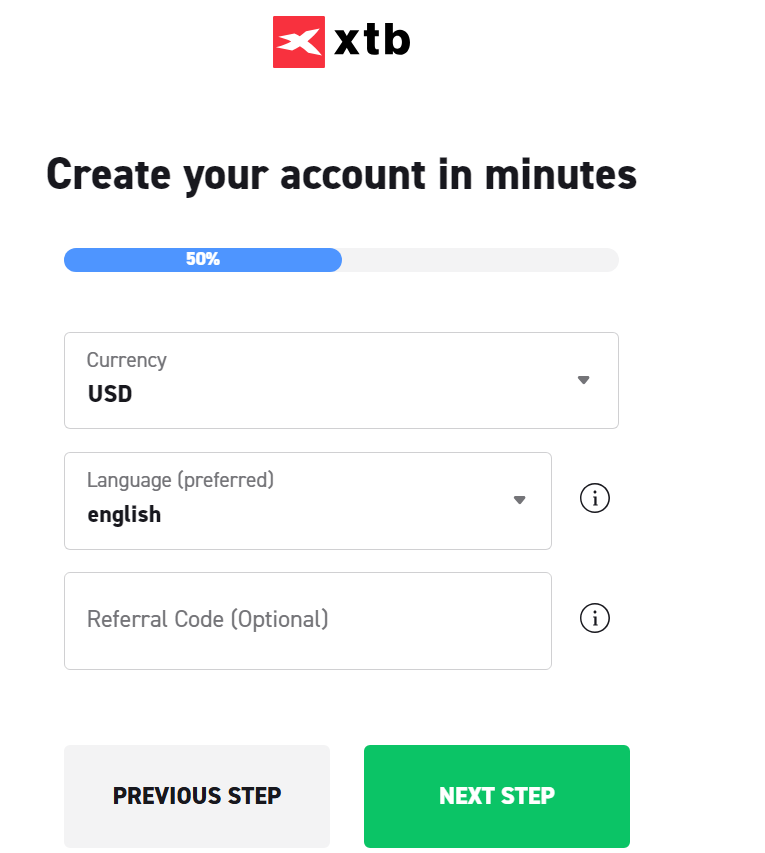

You will need to select your account currency & USD is the only account currency offered by XTB.

After that, you will need to accept some legal terms by ticking the boxes & your are done with the registration step. You can then go to your account to continue the next step.

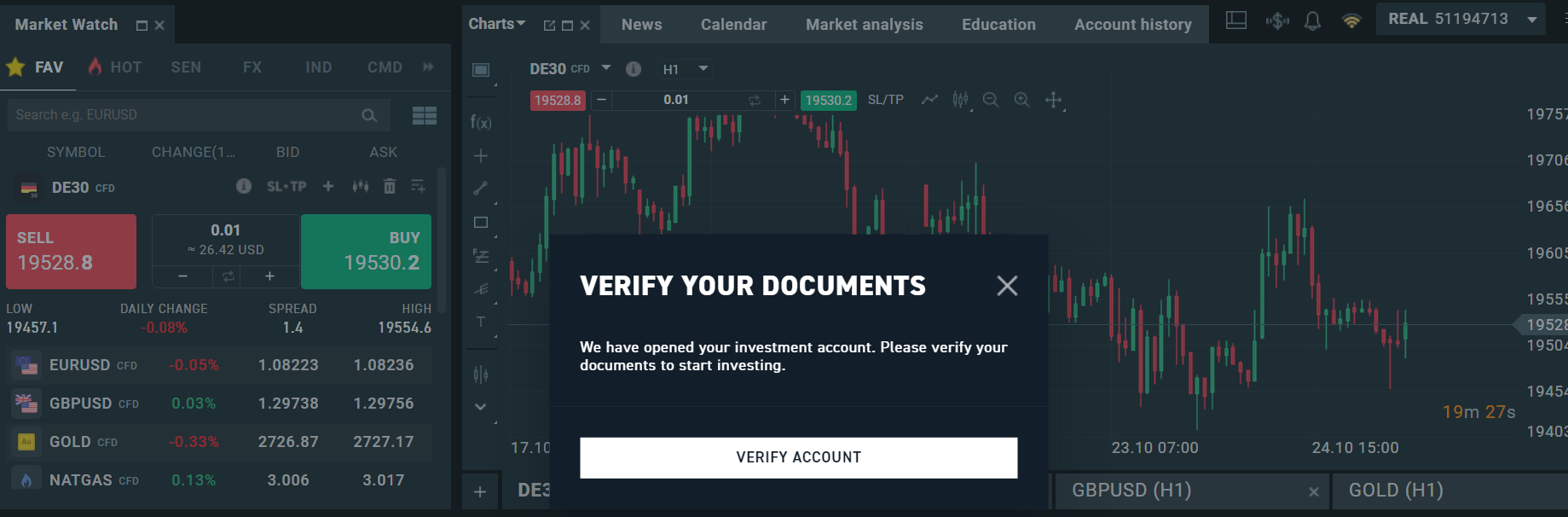

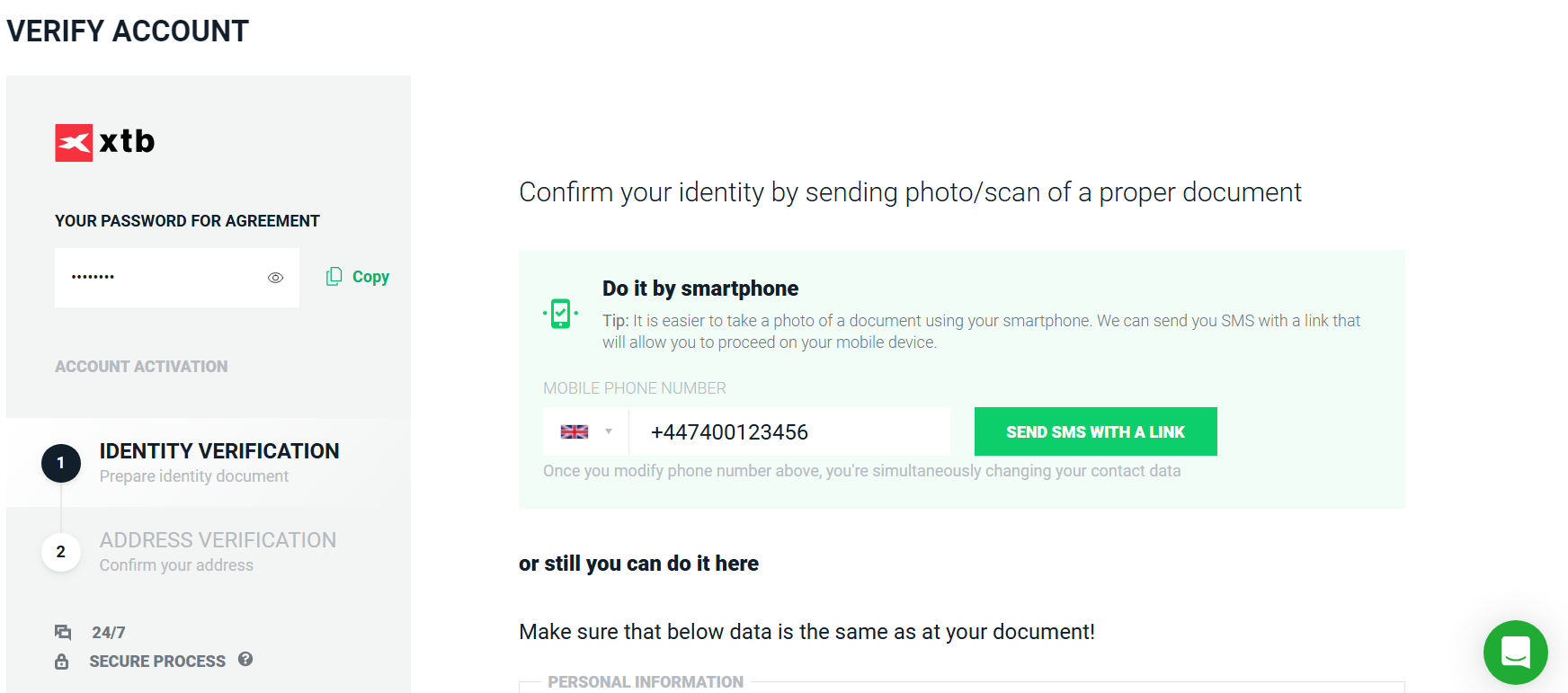

Step 2: Verify Your Documents

At this point, you simply snap & upload your Nigerian government issued ID & after XTB verifies they are genuine you will get a message that your account has been opened. You can then proceed to make your first deposit.

How To Close XTB Account

To close your XTB account, send an email to XTB support containing the account number to be closed. You can also engage the live chat and send the closure request to the agent who will respond to you.

Platforms -5/10

XTB only offers its xStation Proprietary trading platform as a mobile app & web trader.

XTB does not have MetaTrader, cTrader or TradingView.

Tools - 5/10

1. Market Sentiment

This tool shows you the percentage of XTB traders that are long or short on a particular instrument.

2. Investment Calculator

You can use the XTB investment calculator to estimate the size and risk profile of your investment.

3. Economic Calendar

The economic calendar can be accessed from the xStation platform and it shows you the dates when important economic data (such as NFP, CPI etc.) will be released.

Customer Support - 7/10

1. Online Channels

Yes, XTB customer support is open 24/5 and you can reach them through live chat (immediate response from a human) and email

2. Personal Account Manager

XTB also assigns Personal Account Manager to every client.

3. Telephone Support

XTB offers telephone support via international phone lines.

4. Education

XTB offers beginner education but it is not very comprehensive when compared to what is offered by its closest rivals.

Final Verdict - 6/10

XTB is the best forex broker for experienced traders in Nigeria.

Apart from its shortcomings like not offering a Naira Account, absence of MetaTrader, and inadequate beginner support; XTB is still competitive when it comes to overall pricing and execution speed.

| 📷 Broker | 📷 Regulation | Deposit & Withdrawals | Account Types | Account Management | Range of Markets | Fees | Platforms | Tools | Support | Score |

| HFM | 10 | 10 | 10 | 10 | 8 | 7 | 5 | 8 | 9 | 8.4 |

| Tickmill | 10 | 7 | 7 | 9 | 9 | 8 | 7.5 | 10 | 6 | 8.2 |

| Exness | 10 | 10 | 10 | 6 | 5 | 7 | 8 | 5 | 8 | 7.8 |

| FxPro | 10 | 10 | 6 | 10 | 9 | 6 | 8 | 5 | 7 | 7.8 |

| Just Markets | 6 | 9 | 10 | 7 | 7.5 | 9 | 7 | 4 | 8 | 7.5 |

| Pepperstone | 10 | 8 | 6 | 6 | 9 | 6 | 10 | 9 | 7 | 7 | XM | 10 | 10 | 6 | 6 | 8 | 8 | 6 | 6 | 6 | 7 |

| AvaTrade | 10 | 5 | 4 | 5 | 10 | 4 | 7 | 8 | 9 | 6 |

| XTB | 10 | 8 | 5 | 6 | 5 | 6 | 5 | 5 | 7 | 6 |