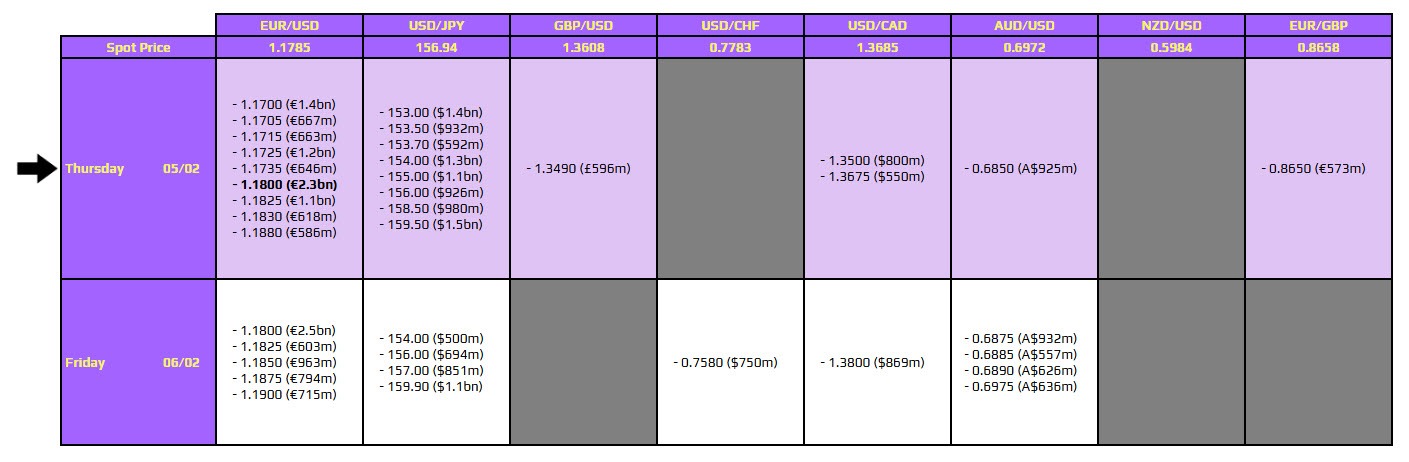

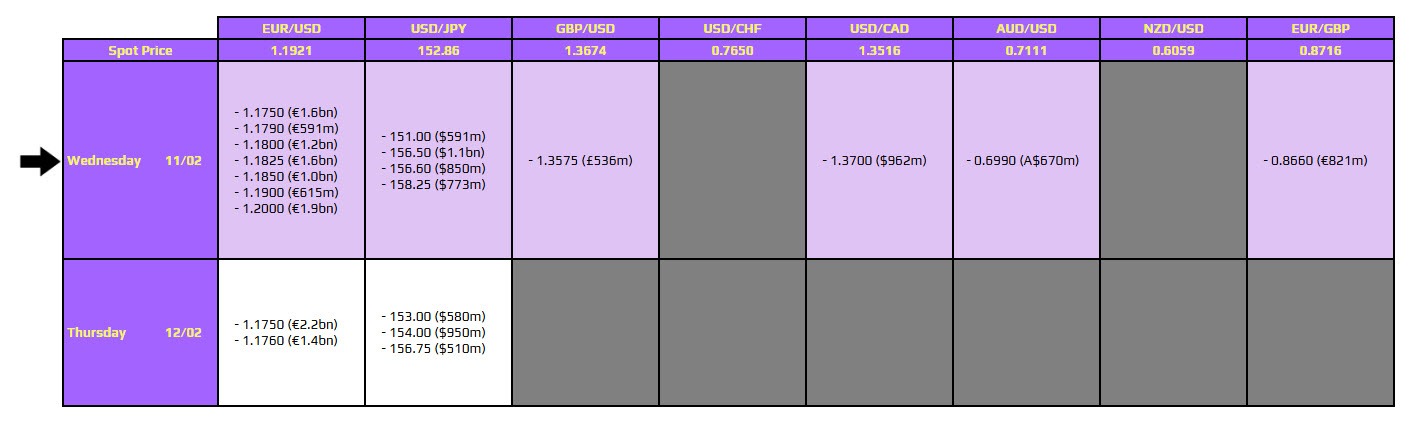

Daily FX Options Expiring by 10 AM New York Cut

EURUSD 1.1800 - 2.3 Billion Euros

Pls what does this really means?

Notice how price pushed towards the 1.1800 option this morning? Usually, option expiries with big monetary values act as price magnets. In todays case, the option barrier in bold at 1.1800 was worth 2.3 billion euros whis is fairly large so it attracted price towards itself.

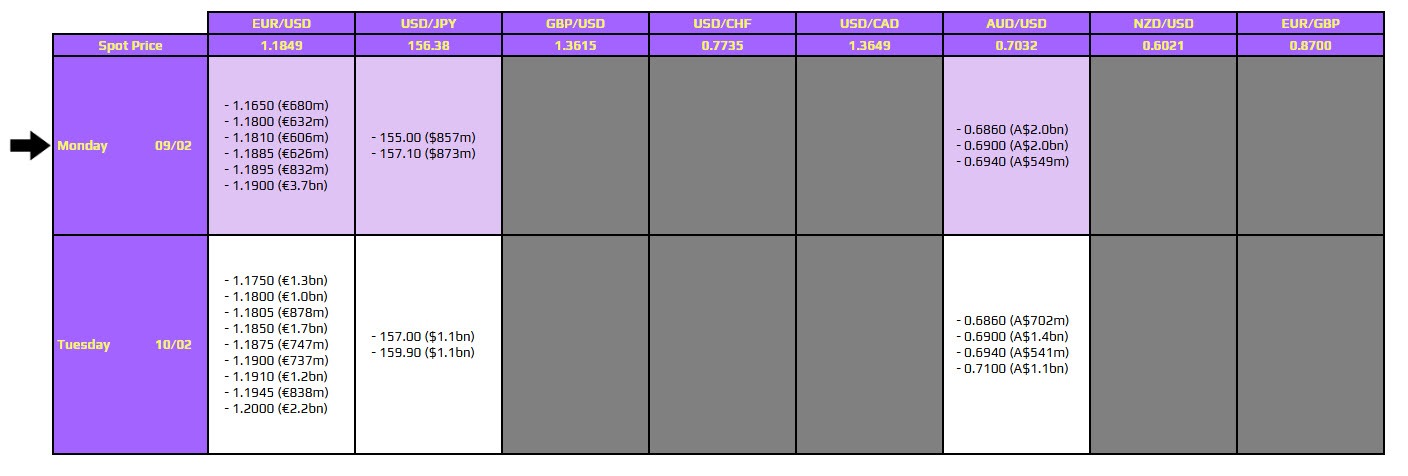

For EUR/USD the star expiry for today is at 1.1910 so price could keep attracting to this point. There are other expiry clusters between 1.1875 and 1.1850 but because the us dollar is weak we may nit see much of a downward movement during the European session.

EUR/USD option clusters between 850 to 790 could push price downward during the London session

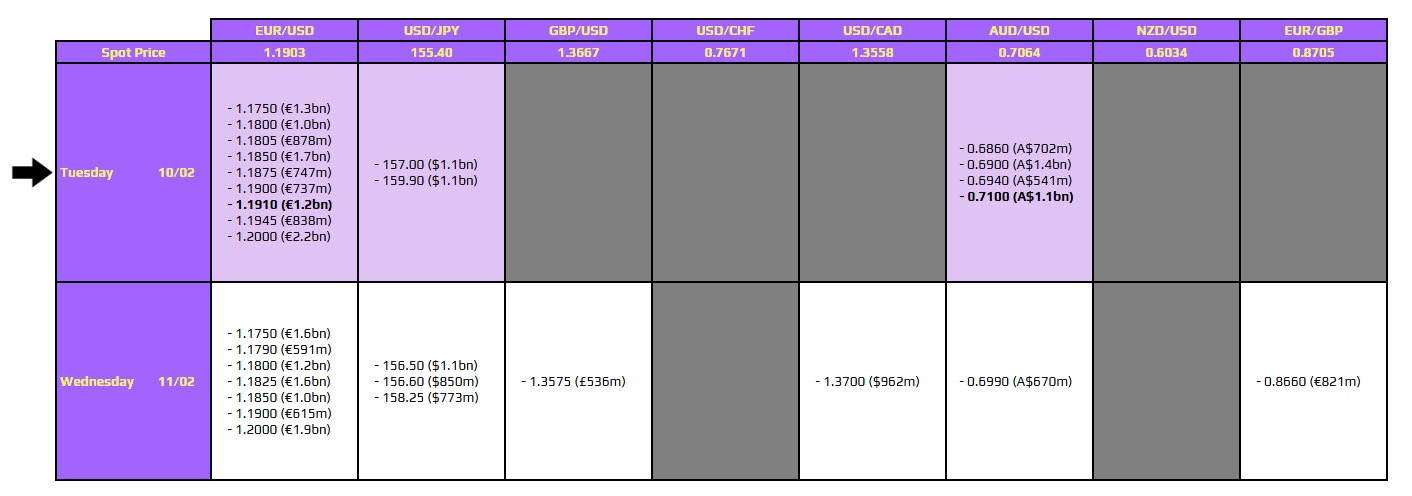

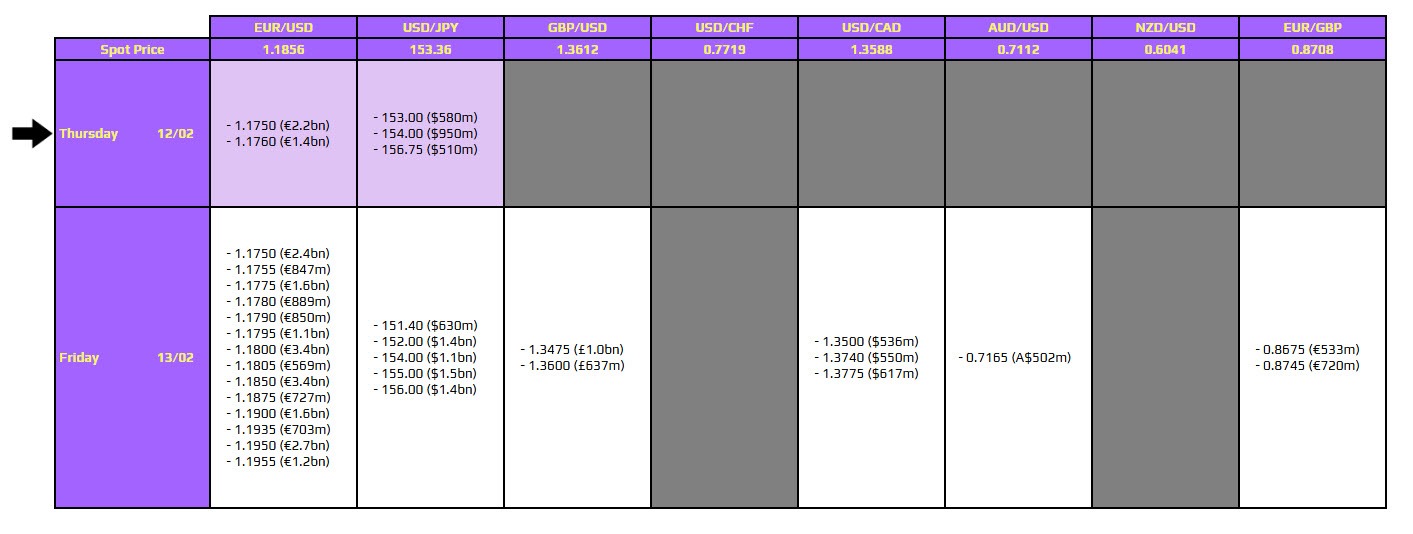

EURUSD option clusters between 1.1750 and 1.1760 will likely attract price towards them

EURUSD option clusters between 1.1750 and 1.1760 will likely attract price towards them

What’s the implication of this information?

What’s the implication of this information?

The implication is, if EUR/USD price should start falling today, it will likely fall until it reaches the 1.1750 level. Option barriers always act like price magnets. This is because these Options are usually traded by hedge funds and other big market players. So, as price begins to fall, the market regulators have ruled that to maintain a neutral theta, the market players must also sell. This selling in huge volume by the market players/hedge funds causes the price to drop even further. Mind you if price is falling, it is forbidden by regulators for hedge funds to buy or trade the opposite direction because it will be deemed manipulation. So, when price falls, hedge funds must also sell and vice versa. This effect is what causes option barriers to act as price magnets.