Trading GBP/USD

Hi everyone, my name is Samuel. Here I will be sharing my trade ideas, setups and results on GBPusd using my strategy called SLK. SLK means structure, liquidity and key levels. It’s a very simple strategy. Stick with me on this thread as we explore it together.

Vital information about GBP/USD:

1 . GBP/USD is a major forex currency pair that shows the value of the British Pound(GBP) against the US Dollar(USD).

When the price goes up, the Pound is strengthening.

When it goes down, the Dollar is strengthening.

2. GBP/USD is one of the most traded pairs in the forex market because it offers:

-High liquidity

-Tight spreads

-Strong and clear price movements

- Plenty of learning resources and analysis.

It is suitable for beginners who want to learn proper market structure.

3. Average Volatility

GBP/USD typically moves:

80 – 120 pips per day

This makes it:

More volatile than EUR/USD

Less wild than pairs like GBP/JPY

Good for traders who like clear movement but manageable risk.

4. Pip Value (Very Important)

For GBP/USD:

1 pip = 0.0001

Example:

1.2700 → 1.2701 = 1 pip

Lot size example:

0.01 lot ≈ $0.10 per pip

0.10 lot ≈ $1 per pip

1.00 lot ≈ $10 per pip

Finally, walk with me on this thread as we explore this amazing pair together.

Yes, I have subscribed to your thread.

Thank you, let’s embark on this journey together

What’s SLK ?

SLK means the combination of market structure, liquidity and key levels. An understanding of this three concept is vital in trading the SLK strategy.

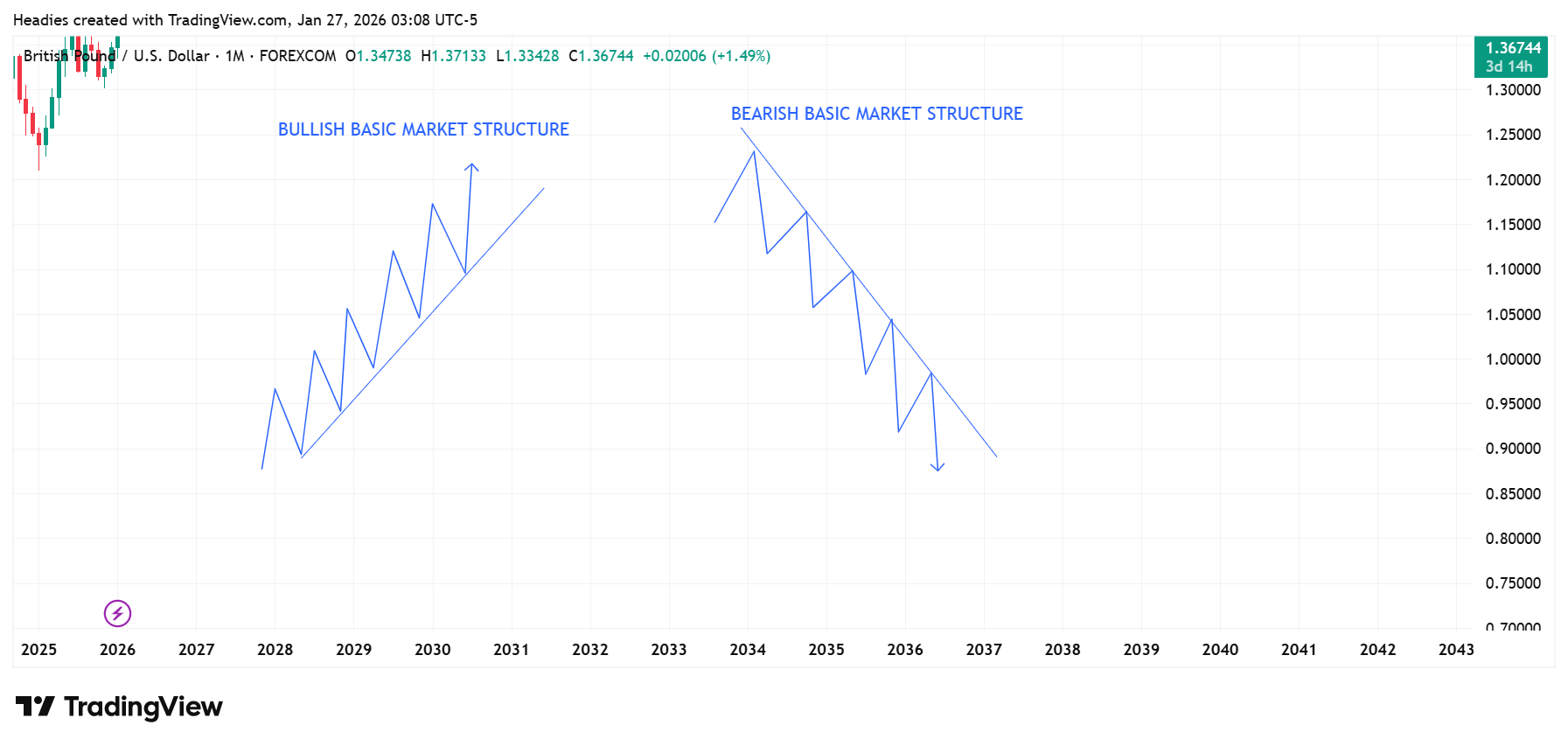

Market Structure:

- Basic Market Structure

- Advanced Market Structure.

This two are vital to trading the SLK strategy.

LIQUIDITY.

The concept of liquidity is also very important in trading this strategy.

What’s Liquidity?

liquidity is how easily money flows in and out a particular currency pair without disturbing the price.

There are two forms of liquidity that are considered when trading the SLK strategy. They are;

- Single Candle formation liquidity

- Engineered Liquidity.

Liquidity is what fuels the market. Price will always target liquidity before moving in the direction it wants to move. This is essentially why the liquidity concept is so vital.

Keylevel

Keylevels are simply POIs I.e Point of interest. There are basically three types of keylevels:

- A-shaped key levels

- V-shaped Key levels

- Open close Key levels.

Keylevel

Keylevels are simply POIs I.e Point of interest. There are basically three types of keylevels:

- A-shaped key levels

- V-shaped Key levels

- Open close Key levels.

Can you show us examples of A shape V Shape and Open and close liquidity levels on the chart?

I will be buying GBPUSD until that high marked with a horizontal red line is taken out. I am also still waiting for my setup to show up .

Can you show us examples of A shape V Shape and Open and close liquidity levels on the chart?

Sure, i will post about it any moment from now. Thank you

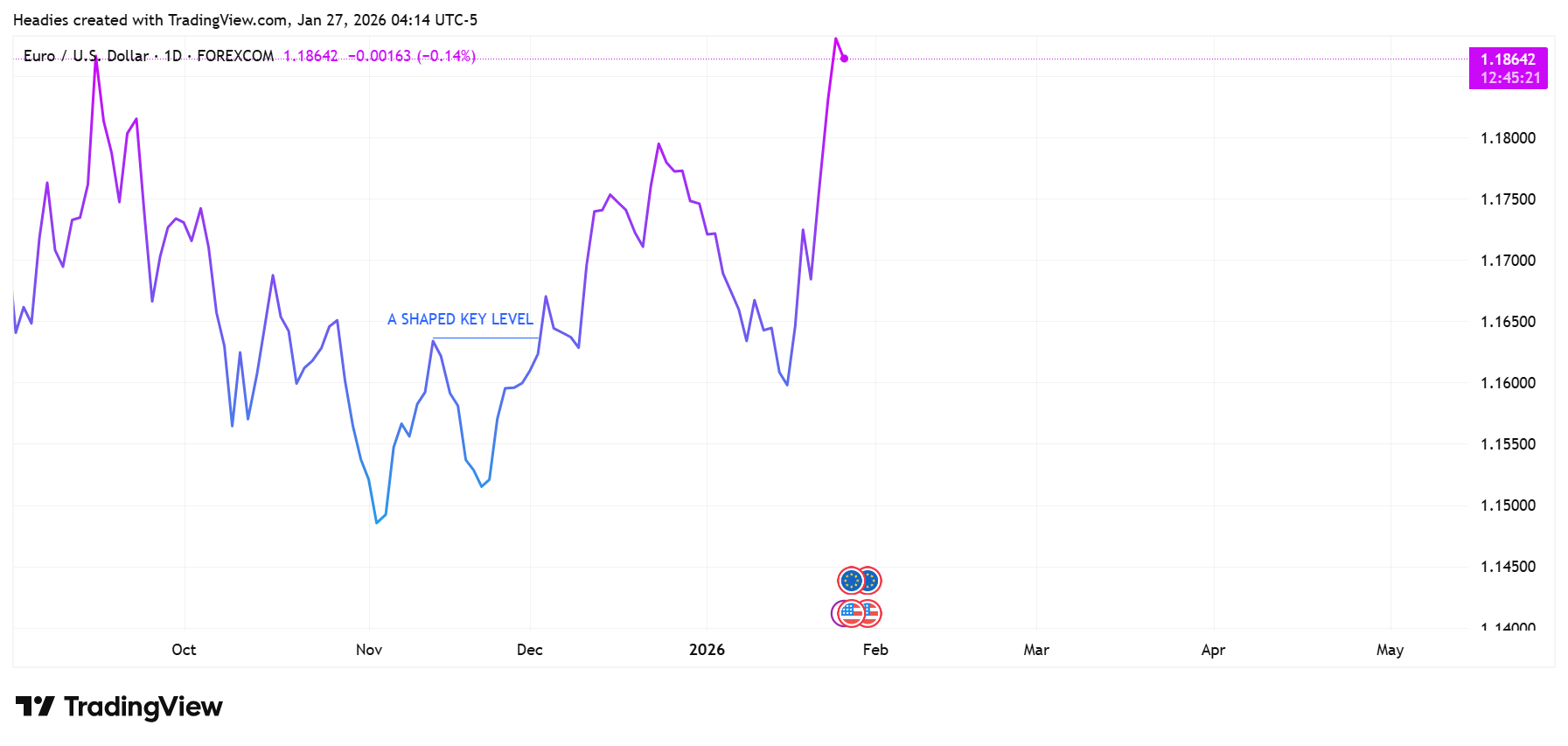

FURTHER EXPLANATION ON KEY LEVELS.

1. A shaped key level: This particular key level looks like the alphabet letter A. it is only seen on the line chart not the candlestick chart. This key level is used for selling. it is also called the resistance zone.

2. V shaped key level: This also looks like the alphabet letter V and it's also seen on the line chart. This key level is used for buying. it can also be called the support zone.

FURTHER EXPLANATION ON KEY LEVELS.

1. A shaped key level: This particular key level looks like the alphabet letter A. it is only seen on the line chart not the candlestick chart. This key level is used for selling. it is also called the resistance zone.

2. V shaped key level: This also looks like the alphabet letter V and it's also seen on the line chart. This key level is used for buying. it can also be called the support zone.

When you say you will be Buying GBP?USd till the daily chart high is taken out, wont it cost you money to hold the position? Cos you dont know how long price will take to get there.

When you say you will be Buying GBP?USd till the daily chart high is taken out, wont it cost you money to hold the position? Cos you dont know how long price will take to get there.

Ohhh, I meant i will keep looking for buy position till the high is gone. I’m a day trader, I don’t hold my trades for more than a day.

I will be entering a buy position at the marked area where I have my decision tool. Trade execution will be posted here later.

I will be entering a buy position at the marked area where I have my decision tool. Trade execution will be posted here later.

I will be canceling my position for this setup cos price has moved. Price didn’t retrace enough to tap me in for this trade.

I will be canceling my position for this setup cos price has moved. Price didn’t retrace enough to tap me in for this trade.

Let me take a look at GBP/USD chart and see how I would have traded in hindsight

If I were trading GBP/USD today, I would have waited for price to breakout of the Asian range then time my entry and buy when price is reversing upwards.

I will be canceling my position for this setup cos price has moved. Price didn’t retrace enough to tap me in for this trade.

But price passed through your desired target level of 1.3678, didnt you set a pending order there? If I were the one trading I wold have bought at 1.3685 as per the image I posted above.

Or were you waiting for price to go up then retrace back to the 1.3678 level before you buy?

Or were you waiting for price to go up then retrace back to the 1.3678 level before you buy?

Exactly, I was waiting for a retracement