City Index Australia Review

For Australian Traders

Their withdrawal process is designed to annoy you. Easy to deposit funds, buttakes almost 1 week to withdraw

They should add more payment methods, if not they are a good broker with fast execution

First of all the CI mobile app is great and doesn't delay when I am in a hurry to open it. However, when trading stocks, it takes a while to see the stock active on the mobile app, even after the market is active. This causes me to delay my trades because I have to wait for the stock trade button to be active before i engage. Please fix this.

I was locked out of my account and they said it was some global issue caused by a third party provider but City Index should have a Business Continuity Plan so when there is downtime we are not locked out of our trades. On the bright side, City Index has good customer support and fast withdrawals.

City Index is an ASIC regulated trading platform with a $150 minimum deposit & spread-only accounts

| 👨 Broker | StoneX Financial Pty Ltd |

| 👨 Trading Name | City Index (formerly Forex.com) |

| ⭐ Overall Score | |

| 👨 Accepts Australian Traders? | Yes |

| 📅 Year Founded | 1983 |

| ⚖ Regulators | ASIC |

| ⚖ AFSL No. | 345646 |

| ⚖ Dispute Resolution | AFCA |

| 💰 Minimum Deposit | $150 |

| 💰 Minimum Withdrawal | 0 |

| 📈 CFD Instruments | Indices, Shares, Forex, Metals, Commodities, Crypto |

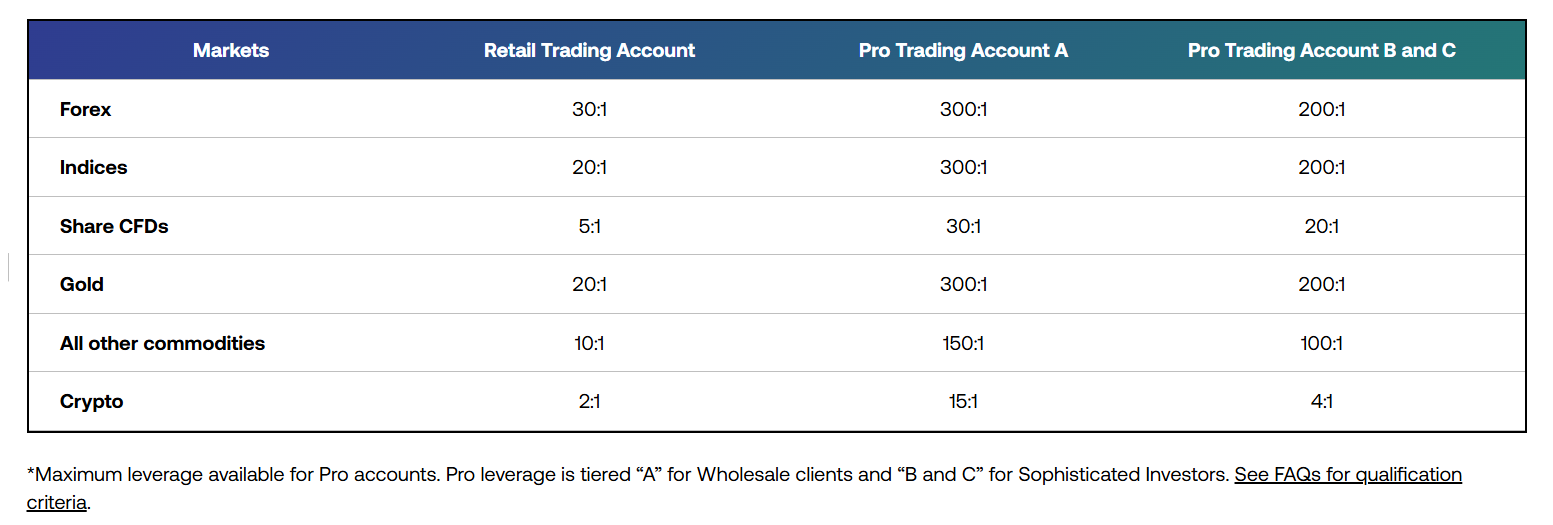

| 🚀Leverage | 1:30 |

| 🔎Auditors | KPMG |

| 💻 Platforms | TradingView, MT4, City Index Mobile App, City Index Web Trader |

| 📋Account Types | Standard Account, MT4 Account |

| 💱Account Currency | AUD, USD |

| 📞Live Support | 24/5 |

| 🏖️ Inactivity Fee | $15 |

| 😭CFD Traders Who Lose Money | |

| ✅Reason To Trade | Trading View Access, Guaranteed Stops, Low Spread, Range of Markets, Great Trading Platforms |

| ❌Reason To Avoid | No MT5, Inactivity Fee, No ECN pricing |

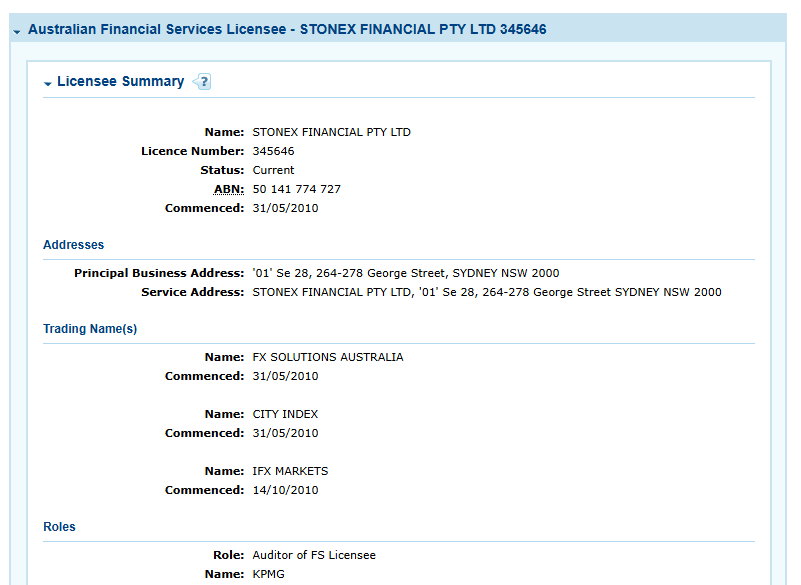

Regulation & Reputation – 5/5

City Index operates in Australia under StoneX Financial Pty Ltd, regulated by the Australian Securities and Investments Commission (ASIC) with ACN 141 774 727 and AFSL 345646.

StoneX is a global, public-traded company with over 1 million active accounts. StoneX’s adherence to regulatory standards, including segregated client funds and transparent reporting, boosts its credibility and trustworthiness.

With over 40 years in the industry, City Index has a strong reputation for innovation, providing clients access to a wide range of financial instruments, including CFDs, forex, and crypto assets.

City Index is a member of the Australian Financial Complaints Authority (AFCA). This membership offers added security for Australian clients, as it allows them access to an independent dispute resolution service.

AFCA handles complaints from retail clients in Australia regarding financial services, ensuring a fair process for resolving issues.

Customer Support & Education - 4/5

City Index offers responsive 24/5 support, providing quick assistance on queries through all channels.

The FAQs page provides help and support on common queries. When you need some more information, you can reach out through email, a dedicated phone line, a request form, live chat, and WhatsApp.

City Index assigns Personal Account Managers (PAMs), mostly for high-net-worth or premium account holders. PAMs provide a more tailored experience, helping clients with trading strategies, account management, and support.

PAMs may not be assigned to all account holders, meaning those with standard accounts may miss out on this level of personalized service.

City Index provides comprehensive educational resources like videos, guides, webinars, practical examples, and articles. These courses, lessons, webinars/seminars, and glossary cover trading topics, technical analysis, risk management, and more.

For beginners, their introductory courses provide a solid foundation, while advanced tutorials help experienced traders improve their strategies.

City Index offers a demo account, allowing new users to get hands-on practice without financial risk. This demo is beneficial for testing the platform and exploring trading strategies.

Range of Markets - 5/5

City Index offers access to over 6,300 global markets. These include:

1. Indices

You can trade over 30 indices, including the US Tech 100, Australia 200, Germany 40, and Wall Street.

City Index offers over 30 indices which comprises a variety of popular indices for trading including US Tech 100, Australia 200, Germany 40, and Wall Street, covering major global markets with a leverage up to 1:20.

2. Shares

You can access over 6000 shares with a margin of 20%. You can trade shares like Commonwealth Bank of Australia (CBA), Woolworths, Amazon, and Tesla with leverage up to 1:5.

3. Forex

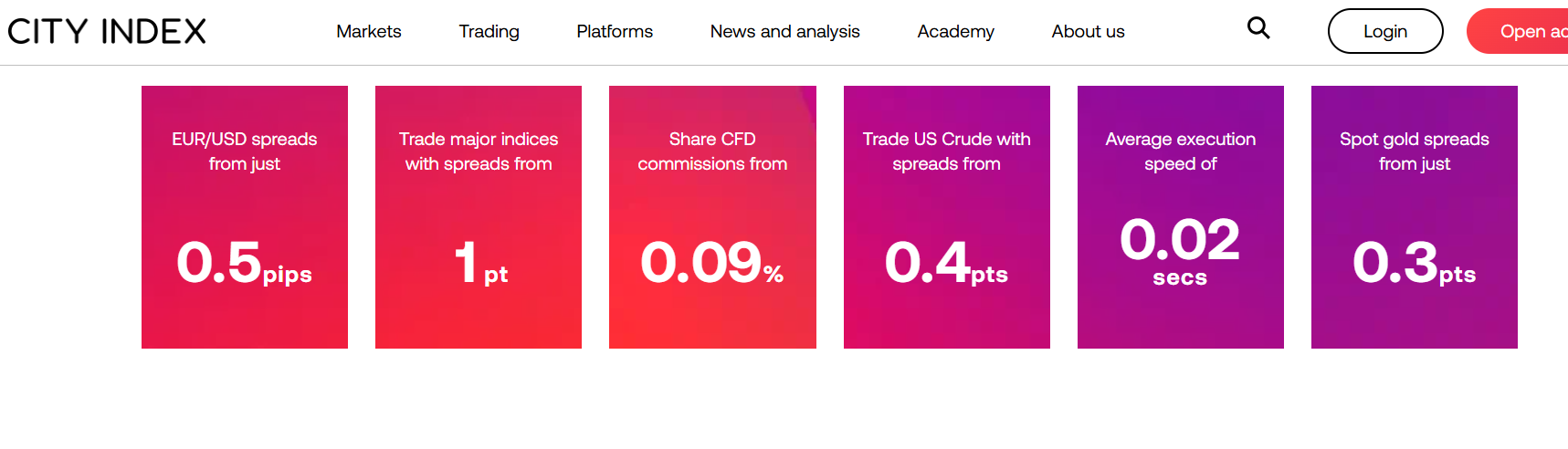

City Index offers over 84 exotic, minor, and major FX pairs. You can access pairs like AUD/USD, EUR/USD, AUD/CAD, AUD/JPY, and USD/JPY with a leverage up to 1:30.

4. Commodities

City Index offers a variety of commodities with a leverage up to 1:20. You can trade the following commodities:

- Oil – US Crude Oil and UK Crude Oil.

- Soft commodities – Coffee, corn, cotton, orange juice, soybean oil, and wheat.

- Precious metals – Gold and Silver

- Base metals – Copper, Palladium, Platinum, and other metals.

5. Cryptocurrencies

City Index offers a variety of cryptos including Bitcoin, Ethereum, Litecoin, Cardano, Dogecoin, Solana, and Ripple with a leverage up to 1:2.

6. Thematic Indices

City Index allows you to trade thematic indices like Cannabis, AI, FAANG+, Remote Economy, ESG, and Green giants at a 10% margin.

7. Bonds

With City Index, you can trade a variety of bond markets including UK Long Gilt, US T-note, and Euro Bund markets with a margin of 20%.

8. Interest Rates

You can trade and make profits from both rising and falling interest rates with City Index, speculating on Eurodollar and Euribor rates.

9. Options

City Index allows you to take advantage and profit from any market condition whether trending, range bound, or inactive.

10. Hong Kong Stocks

You can trade over 2,500 popular Hong Kong stocks, from big tech to major indices, these include Alibaba, BYD, Bank of China, Xiaomi, etc between 7 October – 31 December 2024.

Range of Accounts – 3/5

City Index offers different account types designed to cater to various needs, experience levels, and investment strategies.

1. Demo Account

City Index offers a demo account that’s ideal for new and experienced traders to practice and refine their strategies in a risk-free environment.

The demo account mirrors real market prices, allowing you to gain realistic experience without risking actual funds.

The demo account grants access to most of the tools and features available on the live account, such as Trading Central, TradingView charts, Market Buzz, and the Economic Calendar.

You can practice trades on indices and shares with spreads as low as 0.5 points and a 3.33% margin. City Index’s demo accounts have a 90 days expiry period.

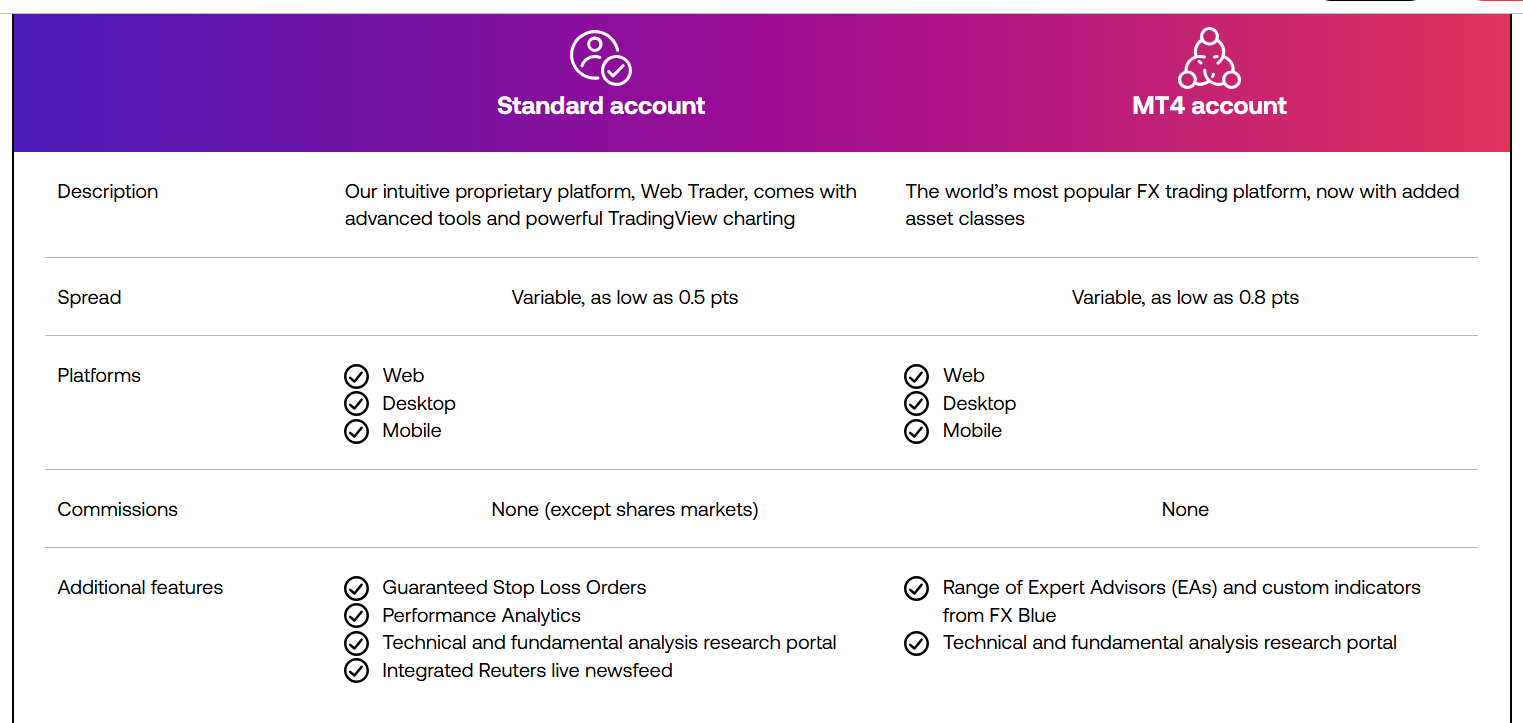

2. Standard Account

The Standard account has access to over 6300 markets with advanced TradingView charts and 80+ indicators.

You get standard spreads and competitive pricing, with leverage that aligns with Australian regulations (e.g., up to 1:30 on forex, 1:20 on indices).

3. MT4 Account

The MT4 account offers ultra-tight spreads and you can analyze market with a variety of custom indicators, charts, and timeframes. You can download trading strategies for Expert Advisors (EAs).

How To Open an Account

Visit the City Index Website and click on “Open an Account. This will lead you to a registration form to begin the application.

Fill in your personal details in the form including your country of residence, name, email, username, password, and date of birth. City Index will also ask what type of account you’d like to open.

Fill in your current address and phone number. You’ll have to verify your identity by providing a driver’s license or passport.

City Index will ask about your employment status, financial details, and trading experience. Here you’ll also choose your base currency – AU$ (AUD) or $ (USD).

Once you’re done filling out the application, submit it and your information will be reviewed.

When your account has been approved, you can start trading once you’ve funded the account.

City Index also allows you to open a joint account. You can’t add a second person to an existing single trading account as the joint account goes through a different application process.

Deposit & Withdrawals – 3/5

Deposits

City Index offers AUD base currency.

The minimum deposit amount is $150, although City Index recommends an initial deposit of $2,000 for FX/Indices and $2,500 for Equities, Metals, Commodities, and other markets.

You can fund your account using credit or debit cards, EFT, BPAY, PayID, or PayPal. City Index does not accept cash payments paid directly into their bank account. The method of deposit is also the method of withdrawal.You can add a maximum of three cards to your account at any time.

City Index Withdrawal

The minimum amount for withdrawal is $0 but if you have above $150 in your account, the minimum withdrawal automatically jumps up to $150.There are no deposit or withdrawal fees charged by City Index Australia.

How Long Does City Index Withdrawal Take?

City Index withdrawals typically take 2 days but if you are withdrawing to a bank card it will take up to 10 working days.

City Index does not offer deposit bonus and online wallet. If your payment method, like a card, is no longer available (e.g., if it’s been canceled), City Index might be able to remove it from your trading account after a few security checks.

In some cases, you may need to provide proof that the payment method is inactive.

If the bank account linked to the payment method is still open, City Index will process withdrawals to that account. But if both the bank account and payment method are closed, you’ll need to provide a closure letter or bank statement to confirm this before City Index can remove it.

City Index Fees – 3/5

1. Currency Conversion Fee

City Index charges a 0.5% conversion fee if the funds being deposited is not the same as your account base currency.

2. Inactivity Fee

You may be charged an inactivity fee of $15 a month when your account becomes dormant after 24 months.

3. Commission

City Index does not charge commissions on FX markets or CFDs but charges a commission of 0.09% ($5 minimum) on Australian equities.

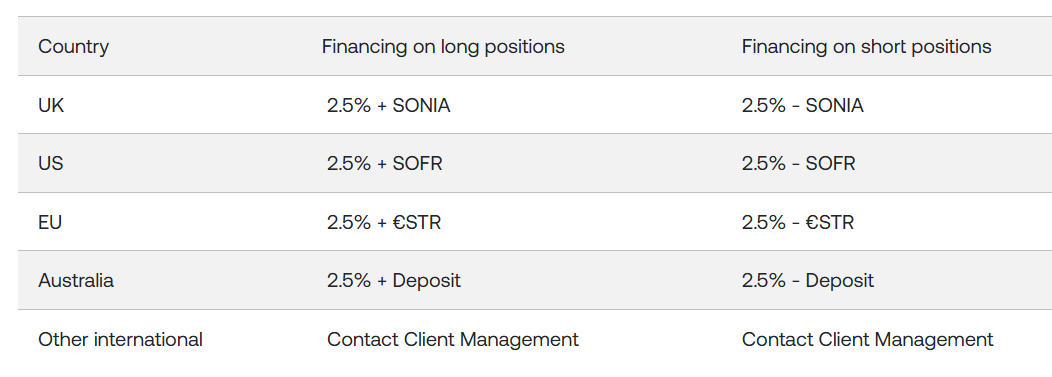

4. Overnight Fee

For long CFD positions, an overnight fee is charged at the base rate of your instrument plus 2.5%. For short positions, you’ll receive the base rate minus 2.5%.

The fee is calculated based on your trade size at the end of each day, then divided by 365 to get the daily rate.

5. Spread

City Index offers you the choice of trading with Fixed or variable Spreads. The spread on the Standard Account starts from 0.5 pips and on the MetaTrader Account, the spread starts from 0.8 pips.

6. GSLO Fee

There’s no fee for placing standard orders like stop and limit orders. However, if you use a guaranteed stop loss order (GSLO), there is a charge. This fee is only applied if the GSLO is triggered, and it isn’t refundable.

For example, the GSLO fee for the Australia 200 index is calculated as 4 times the quantity of CFDs or stake, charged in your account's base currency. So, if you’re trading 2 CFDs, the premium would be 4 x 2 = $8.

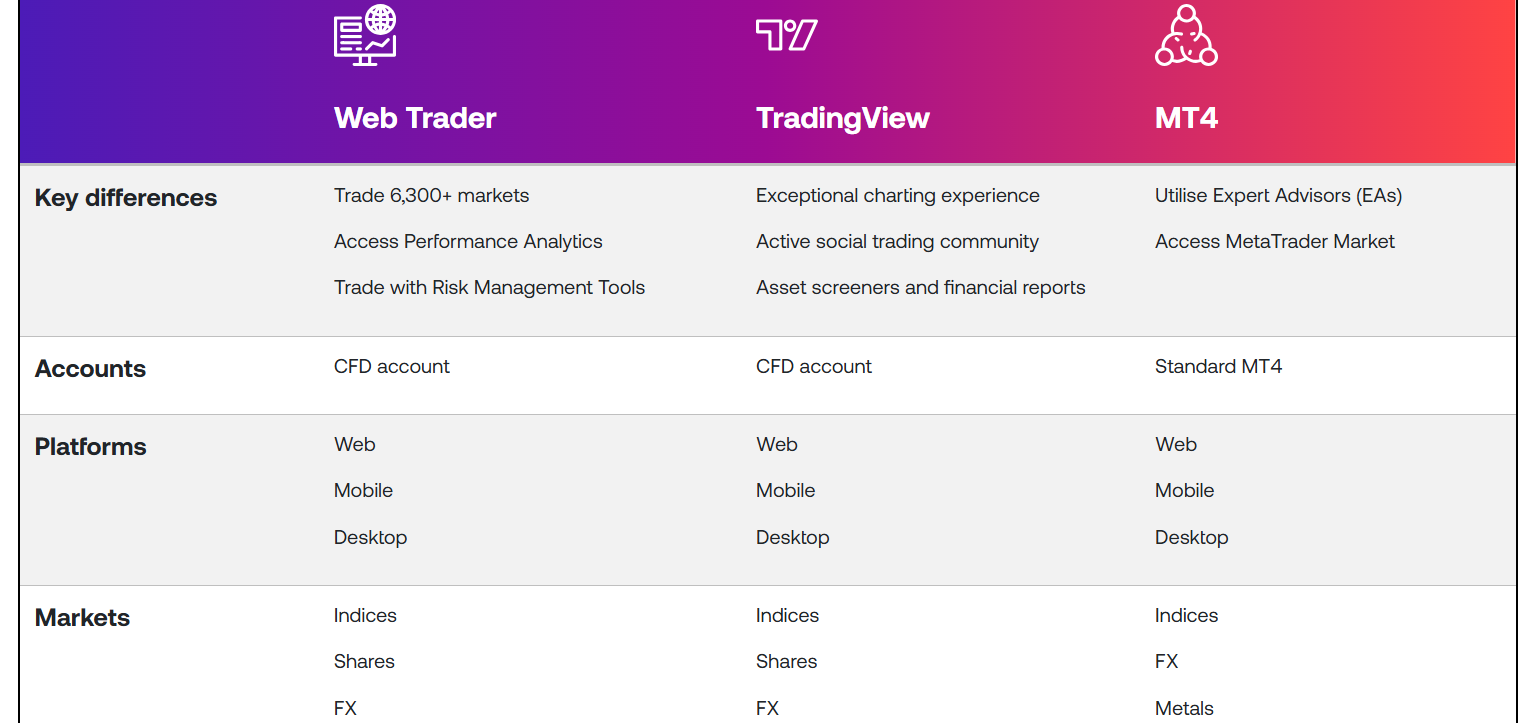

Trading Platforms - 4/5

1. City Index Web Trader

The Web Trader is a trading platform designed for both beginners and experienced traders.

It offers customizable layouts, advanced charting tools, and technical indicators.

The Web Trader makes trading easier with the exclusive one-click trading mode which is perfect for making use of opportunities in fast-moving markets without delays.

Web Trader is accessible directly from any browser, making it convenient for on-the-go trading without needing to download software.

2. City Index Mobile App

City Index’s mobile app provides access to all the core trading features, making it a solid option for traders who want to monitor and manage their trades on the move.

The mobile app simplifies trading with its one-swipe dealing, advanced charts, and smooth execution on both Android and iOS.

The mobile app provides access to TradingView charts, with 80+ indicators and drawing tools, plus the ability to trade directly from charts. You can seamlessly manage your account across desktop and mobile.

3. MetaTrader 4 (MT4)

MT4 is one of the most popular trading platforms known for its reliability and extensive range of tools.

City Index’s MT4 offering includes the standard MT4 features, such as Expert Advisors (EAs) from FX Blue for automated trading, custom indicators, and advanced charting.

The MT4 is available on both Android and iOS devices.

4. TradingView

TradingView has a customizable platform with fully synced layouts, watchlists, and settings across all devices.

You can enjoy advanced charting tools and a seamless trading experience on browser, desktop, and mobile.

TradingView gives you access to test strategies using historical data and detailed reports and tap into an active trading community with thousands of ideas and scripts to guide your decisions.

You can access standard and custom indicators, advanced screeners, and live news—all in one place with TradingView.

Trading Tools - 5/5

1. Performance Analytics

Performance Analytics offers tools to keep your trading on track and boost your results:

- Trading Plan: Set your goals and monitor your trades to see how they align with your strategy.

- PlayMaker: Get real-time feedback to help avoid costly mistakes and improve your performance.

- Review: Gain a full picture of your trading activity to understand areas for improvement.

- GamePlan: Discover key insights into your trading strengths and weaknesses to refine your approach.

2. Risk Management Tools

- Knockout Options: A straightforward way to trade major FX, indices, and commodities with unique benefits, letting you set a precise risk level.

- Guaranteed Stop Loss Orders (GSLO): Protect your trade by ensuring it closes at the exact price you choose, even if the market gaps or experiences slippage.

- Stop Loss: Set a stop loss to automatically close a trade if the market moves against you, limiting your potential losses.

- Trailing Stop: This follows the market price by a set distance to help protect gains and reduce losses.

- Limit Order: Use a limit order to close a trade at a set, more favorable price, securing a profit if the market reaches your target.

- Economic Calendar: Keep track of upcoming market events, like central bank decisions and earnings reports, so you can plan your trades around key market-moving announcements.

Final Verdict – 7/10

City Index is one of the best forex brokers for beginners in Australia because of the education, support & standard accounts.

However, more experienced traders may need raw spread pricing for algo trading using EAs & robots..