City Index UK Review

For UK Traders

Their withdrawal process is designed to annoy you. Easy to deposit funds, buttakes almost 1 week to withdraw

They should add more payment methods, if not they are a good broker with fast execution

First of all the CI mobile app is great and doesn't delay when I am in a hurry to open it. However, when trading stocks, it takes a while to see the stock active on the mobile app, even after the market is active. This causes me to delay my trades because I have to wait for the stock trade button to be active before i engage. Please fix this.

I was locked out of my account and they said it was some global issue caused by a third party provider but City Index should have a Business Continuity Plan so when there is downtime we are not locked out of our trades. On the bright side, City Index has good customer support and fast withdrawals.

City Index is an ASIC & FCA regulated trading platform

| 👨 Broker | StoneX Financial Ltd |

| 👨 Trading Name | City Index |

| ⭐ Overall Score | 7/10 |

| 👨 Accepts UK Traders? | Yes |

| 📅 Year Founded | 1983 |

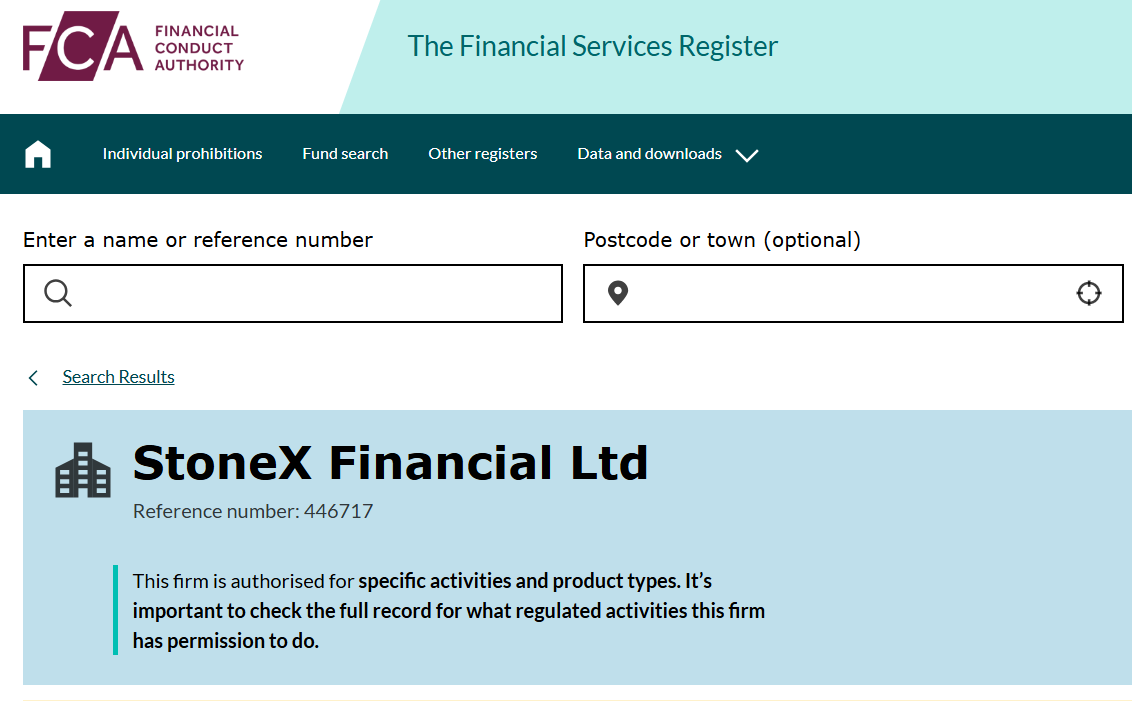

| ⚖ Regulators | FCA UK |

| ⚖ Firm Reference No. | 446717 |

| ⚖ Investor Protection | FSCS |

| 💰 Minimum Deposit | 0 |

| 💰 Minimum Withdrawal | 0 |

| 📈 Wats to Trade | CFDs & Spread Bets |

| 📈 Instruments | Indices, Shares, Forex, Metals, Commodities |

| 🚀Leverage | 1:30 |

| 🔎Auditors | KPMG |

| 💻 Platforms | TradingView, MT4, City Index Mobile App, City Index Web Trader |

| 📋Account Types | Standard Account, MT4 Account |

| 💱Account Currency | GBP, EUR, USD |

| 📞Live Support | 24/5 |

| 🏖️ Inactivity Fee | $15 |

| 😭CFD Traders Who Lose Money | 69% |

| ✅Reason To Trade | Range of Markets, Trading View Access, Guaranteed Stops |

| ❌Reason To Avoid | No MT5, Inactivity Fee, |

Regulation & Reputation - 5/5

Is City Index a Good Broker?

Yes, City Index is a good broker. They are a part of the NASDAQ-listed StoneX Group with over 40 years of market experience, is a forex and CFD broker highly regarded for its financial stability.

In the UK, City Index is regulated by the Financial Conduct Authority (FCA), a top-tier body known for strict oversight, ensuring City Index is a low-risk choice for traders.

City Index UK is a member of the

Customer Support & Education – 4/5

City Index offers solid customer support, available 24/5 through various channels. Their live chat system is efficient, often with minimal wait times and prompt, relevant responses.

Phone support is listed clearly under the ‘Contact Us’ section with an additional toll-free number.

City Index assigns Personal Account Managers, adding a personalized touch to client support.

The City Index Academy offers courses for beginner, intermediate, and advanced levels; each with multiple lessons that are short and text-based, complete with a progress tracker.

Quick lessons cover various topics and a glossary offers fast, easy term look-ups. They also provide a City Index demo account, which, while useful, expires after 30 days and must be reactivated with a reset, limiting long-term utility.

Webinars add depth, and users can access past sessions or check popular topics via filters. Additionally, City Index news section helps traders stay updated on economic events, but some improvements, like maintaining ongoing demo account settings, could enhance the overall experience.

Range of Markets - 4/5

City Index offers dual ways to trade the financial markets using either CFDs or Spread Bets.

Traders can access indices, shares, forex, oil, commodities, metals, and bonds through both CFDs and spread betting.

The latter allows traders to stake on price movements without commission fees, though equities have wider spreads. Gains from spread betting are also tax-free, adding appeal for UK-based traders.

Leverage options at City Index cater to both retail and professional traders. For retail traders, leverage on forex is capped at 30:1, while professional traders enjoy leverage up to 400:1.

However, traders should heed the risks of high leverage, as 69% of retail accounts incur losses.

Range of Accounts - 4/5

1. Standard Account

Features variable spreads as low as 0.5 pips, access to over 6300 markets, and advanced trading tools. No extra commission is charged except for share CFDs.

2. MT4 Account

This account offers variable spreads as low as 0.8 pips and includes expert advisors (EAs). There are no extra commissions for CFDs.

3. Spread Betting Account

Traders can bet on price movements without paying commissions, though spreads on equities may be wider. This account type offers tax-free gains.

How to Open an Account with City Index

- Visit www.cityindex.co.uk and click on the ‘Start Trading’ button.

- Complete your personal details, choose your account type, and set a login password.

- Fill in your address and personal details, including place of birth.

- Provide employment details, trading experience, and annual income.

- Answer questions about your understanding of risks in trading CFDs and Spread Betting, and select your communication preferences.

- Review the terms and conditions, then click ‘submit application’. Your application is typically approved within a day.

Deposit & Withdrawals - 4/5

What is City Index Minimum Deposit?

City Index minimum deposit is 0 GBP for Bank Transfer deposit method, 50 GBP for PayPal deposit method & 100 GBP for Card deposits .

What is City Index Minimum Withdrawal?

The City Index minimum withdrawal is $0 but if your account balance is above 100 GBP, then the minimum withdrawal becomes 100 GBP.

For online withdrawals to credit cards, the maximum withdrawal amount is limited to £20,000 per transaction within a 24-hour period. Withdrawals exceeding this amount require direct contact with the client management team.

An additional feature is the new Interest Payment Scheme, offering 2.5% interest on tradable funds for clients maintaining an average balance of £20,000 or more each month.

How Long Does City Index Withdrawal Take?

City Index Card withdrawals take up to 5 days, while Local UK Bank withdrawals take 1 to 2 days. PayPal withdrawals are instant.

City Index Fees - 4.5/5

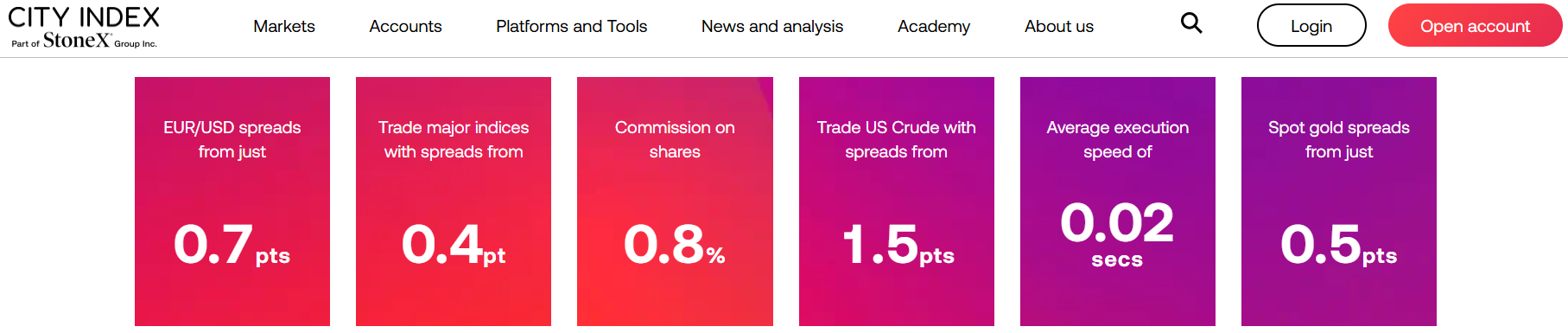

1. Spread

Spread on the City Index Standard Account starts from 0.8 pips, while on the MT4 Account the spread starts from 0.5 pips.

2. Commission

City Index does not charge commissions except you are trading share CFDs.

City Index commission on EU & UK shares is 0.08% or 10 GBP (which ever is lower), while for US Shares it is 1.8 cents per share or 10 GBP (which ever is lower).

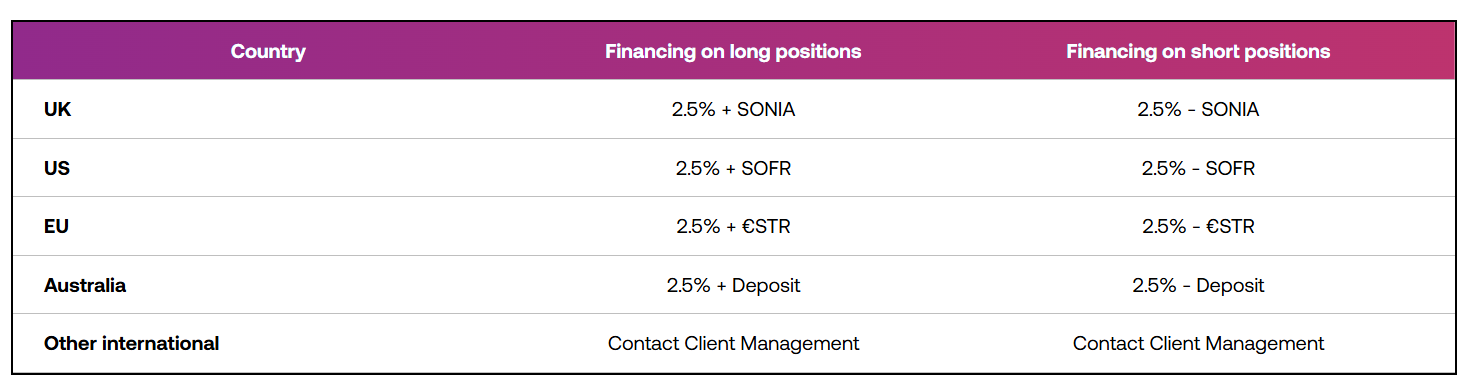

3. Overnight Swap Fees

Swaps are calculated based on the United Kingdom's SONIA rate ±2.5%. This means the cost or credit applied to positions held overnight depends on this rate.

4. Inactivity Fees

City Index imposes a monthly inactivity fee of $15 on accounts that have been inactive for 12 months or more.

Is City Index a Market Maker?

Yes, City Index is a market maker because they don't charge commissions (except shares) & only depend on the spread as their source of income.

Spread-only pricing policy is a hallmark of market maker forex brokers, because they determine the buy/sell prices of any instrument.

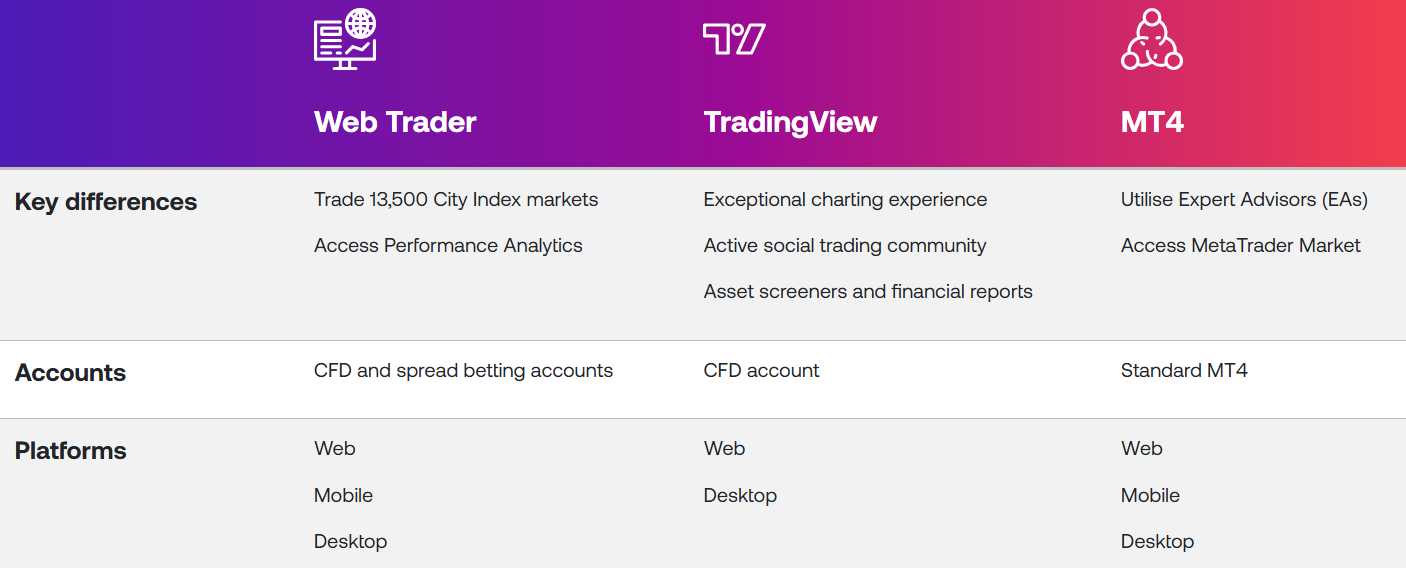

Trading Platforms - 4/5

1. City Index MT4

MT4 is available as a web trader, desktop, and mobile app (iOS and Android), allowing traders to access its robust charting and automated trading capabilities.

2. TradingView

City Index Uk is a TradingView broker. TradingView, known for its advanced drawing tools, integrates seamlessly with City Index, providing another option for traders who value charting precision.

3. City Index Apps

For users who prefer proprietary platforms, City Index offers a web trader and a mobile app.

The web trader features 14 timeframes and a set of advanced drawing tools, including SMART signals and performance analytics, to enhance trading strategies.

The mobile app is available on both iOS and Android devices, ensuring that traders can manage their positions on the go.

However, one notable missing platform is MetaTrader 5 (MT5), which is not offered by City Index. While MT5 is known for its enhanced features over MT4, the absence of this platform may be a limitation for traders who prefer it.

Trading Tools - 4.5/5

1. Performance Analytics

City Index offers an array of tools, including Performance Analytics, which guides traders through planning, executing, and reviewing their trades.

The Trading Plan helps set clear goals, while PlayMaker gives real-time feedback to keep traders on track. The GamePlan feature uncovers valuable insights into trading strengths and weaknesses, providing a strategic edge.

2. Market360

For market analysis, City Index offers Market 360, which covers over 13,500 markets, providing advanced charts, news, trading hours, and margin requirements.

Trading Central is another key feature, delivering in-depth technical and fundamental analysis, including real-time trade ideas based on historical data.

Additionally, traders can access live market news through Reuters Insider, keeping them updated with real-time market-moving events.

3. City Index Economic Calendar

The platform also includes an economic calendar to track significant announcements such as unemployment figures and company earnings reports.

For charting, City Index provides the Advanced TradingView charting tool, which allows users to view markets across multiple timeframes and utilize over 80 custom indicators and drawing tools.

Final Verdict - 7/10

City Index is a reliable market maker regulated by the FCA and ASIC, offering low-risk trading conditions. With over 12,000 CFD markets, they provide competitive spreads and a wide range of instruments without extra commissions for currency pairs. Risk management tools like negative balance protection and guaranteed stop-loss orders offer additional security for traders.

However, the broker’s average pricing and limited MetaTrader offerings, particularly the absence of MetaTrader 5, slightly hinder its standing among top-tier brokers. Despite this, City Index remains a solid option for UK traders looking for a regulated platform with ample research tools and low-risk trading options.