Connect with Broker

Get in touch with Broker and connect

!! Regulator Warning !!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

I ativated autoinvest but it is still not working, also the Trading212 app doesnt work well on tablets but its okay on smartphones. I complained and was told to update to latest version and clear cache but still didnt improve.

I had a good experience with them, they offer full-service brokerage at a low cost

The inetrest rate i receive on my unused deposits have been reduced. I think they should have at least sent a mail to inform on why it is so, instead of keeping mute.

The Annualized Average Return (AAR) should not be capped at 20% because after that it doesn't show on the pies.

I love their ISA Account and they also give a debit card which I use to shop and there are no fees attached. Trading212 is simply the best broker for a complete experience of CFD trading and Investing all on one stop shop

I enjoyed investing in Shares through this broker but they should reduce their minimum withdrawal. Trading212 is a true full-service broker

Trading 212 is an FCA UK regulated CFD & Investment Broker with 1 USD Minimum Deposit & Multi Base Currency Accounts

| 👨 Broker | Trading 212 AU PTY Ltd |

| 👨 Trading Name | Trading 212 |

| 👨 Accepts Australian Traders? | Yes |

| 📅 Year Founded | 2014 |

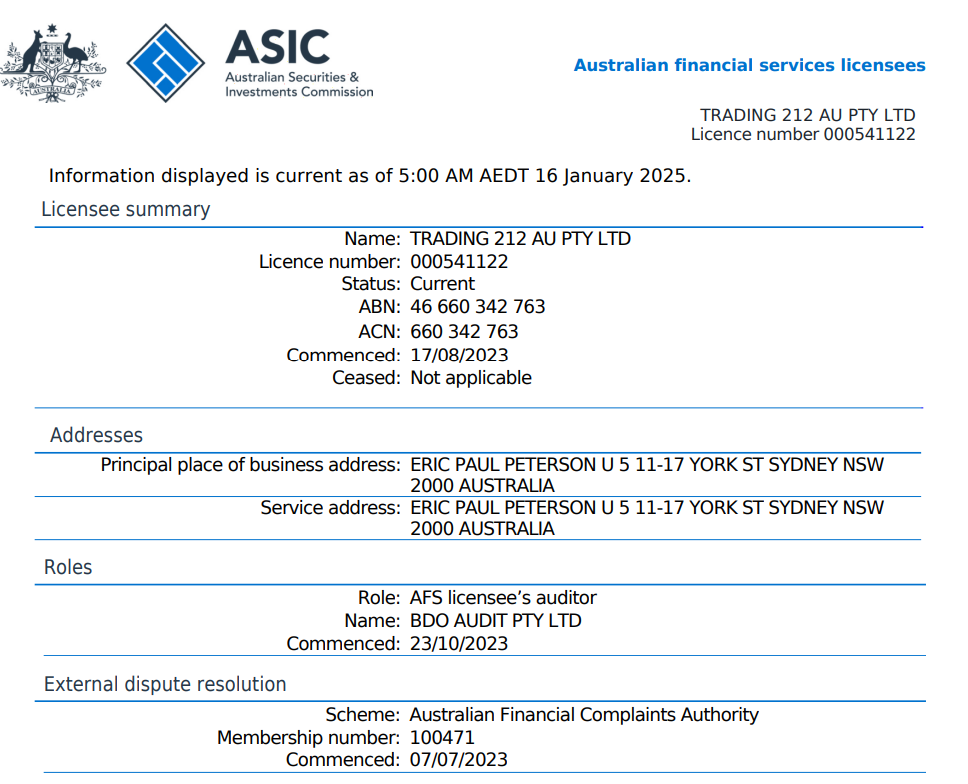

| ⚖ Regulators | ASIC |

| ⚖ AFSL No. | 541122 |

| ⚖ Dispure Resolution | AFCA |

| 💰 Minimum Deposit | 10 USD |

| 💰 Minimum Withdrawal | 10 USD |

| 📈 CFD Instruments | Forex, Indices, Commodities, Shares, ETFs, Bonds |

| 📈 Investment Instruments | Shares, ETFs, Bonds |

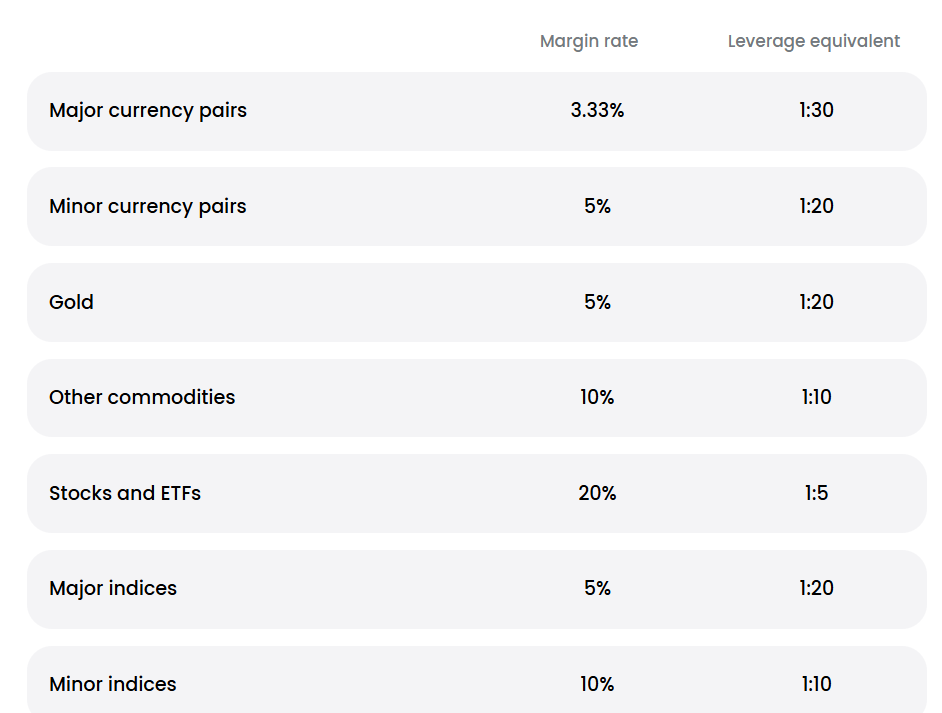

| 🚀Leverage | 1:30 |

| 🔎Auditors | Buzzacott Auditors |

| 💻 Platforms | Trading 212 Mobile App, Trading 212 Web Terminal (No MT4 or MT5) |

| 📋Account Types | CFD Account, Investment Account, Stocks ISA Account |

| 💱Account Currency | AUD, GBP,USD, EUR |

| 📞Live Support | 24/7 |

| 🏖️ Inactivity Fee | $0 |

| 😭CFD Traders Who Lose Money | 77% |

| ✅Why Trading 212 is Good | |

| ❌Why Trading 212 is Bad |

Regulation - 10/10

Is Trading 212 Safe?

Trading 212 is safe because they are regulated by the Australian Securities & Investment Commission (ASIC) with AFSL number 541122.

Trading 212 has two tier-1 regulatory licenses so this makes them trustworthy and safe. Trading 212 is also regulated by CySEC in Cyprus & BaFIn in Germany.

Trading 212 Regulation Summary

| 📍Country | ⚖️Regulator | #️⃣License No. | 📅Date License Issued | 🔒Safety |

| United Kingdom | FCA | 609146 | 2014 | High |

| Australia | ASIC | 541122 | 2023 | High |

| Cyprus | CySEC | 398/21 | 2021 | Medium |

Funding & Withdrawals - 8/10

Trading 212 Minimum Deposit

The Trading 212 minimum deposit is 10 USD for CFD Trading Accounts. However, if you want to buy & hold real stocks, the minimum deposit is 1 USD for the Trading 212 Investing Account

Interest on Unused Funds

Trading 212 pays you a daily interest on any unused funds held in your trading account.

The amount of interest you will earn depends on your account currency. For example if you operate a USD Account, the daily interest is around 4.1% Annual Equivalent Rate (AER).

Trading 212 Minimum Withdrawal

Trading 212 minimum withdrawal is 10 USD for CFD Trading Accounts. However, if you want to buy & hold real stocks, the minimum withdrawal is 1 USD for the Trading 212 Investing Account

How To Deposit & Withdraw at Trading 212

1. Cards

You can fund your trading account using Visa Card, MasterCard, or Maestro Card; & deposit are free.

2. Local Bank Transfer

Trading 212 allows you fund your account by transferring funds from your local UK Bank, to Trading 212.

3. Apple Pay & Google Pay

Trading 212 accepts deposits via Apple pay & Google Pay and there is no deposit fee.

3. Open Banking

Trading 212 accepts payment via Open Banking which means you can fund your account with any fintech app.

4. Bank Wire

you can fund your trading account using international bank wire but funding fees may be charged from your bank.

How to Withdraw from Trading 212

The first step is to ensure 2 Factor Authentication (2FA) is enabled on your trading account because you will need it

The second step is to login to your client area, click menu & select withdraw. Proceed to re-enter your password, then select the withdrawal method, input the amount & submit.

At Trading 212, you can only open one CFD Trading Account so if you want to withdraw in a different currency, you simply select the desired currency & Trading 212 will convert it at a 0.5% conversion fee.

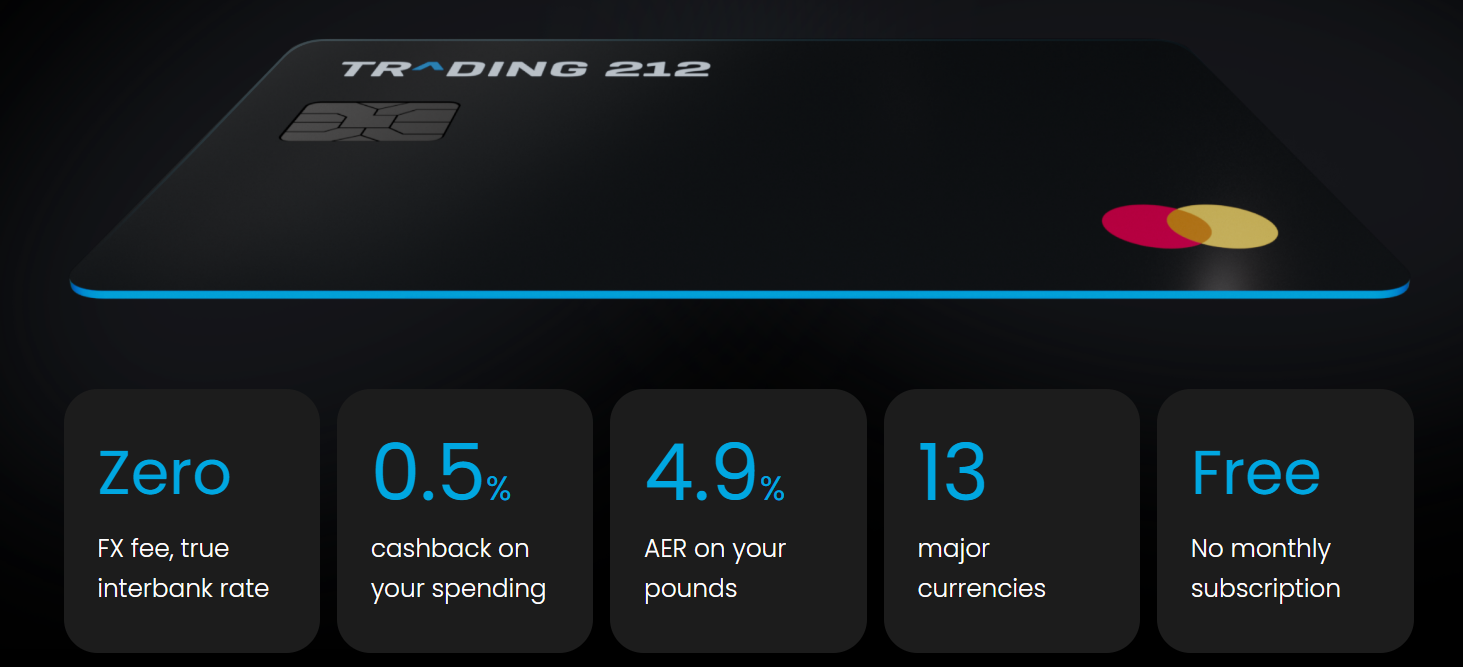

If you opened a Trading 212 Invest Account, you can apply for the Trading 212 Debit Card and use it to withdraw funds in 13 major currencies, without paying any currency conversion fees.

How Long Does Trading 212 Withdrawal Take?

Trading 212 withdrawals take 3 working days to process. if you don't see the withdrawal after 3 days, contact Trading 212 to send you a proof of payment which you should take to your bank to track the transaction.

Trading 212 Account Types - 6/10

1. CFD Trading Account

The CFD Trading Account has a $10 minimum deposit & is used for trading CFD instruments without owning the underlying asset.

Leaving a CFD trade open till the next day will attract overnight fees when using the CFD Trading Account.

2. Invest Account

The Invest Account is meant for buying & holding real Stocks & ETFS and this account has its own Debit Card for withdrawals. The Invest Account minimum deposit is 1 USD.

The Invest Account is also a multi-Currency Account meaning you can change the account currency any time without the need to open an additional account.

3. Stock & Cash ISA Account

ISA means Individual Savings Account & is a tax-free account with a 1 GBP minimum deposit.

Money you place in a Stock ISA will be invested in Stocks which you can sell without paying any Capital Gains Tax etc.

On the Stocks ISA Account, you earn interest on deposits into the account.

Money in a Cash ISA will be saved for you and you earn interest without paying any tax.

On an ISA Account, you can save a maximum of 20,000 GBP every year.

The disadvantage of an ISA Account is that you if you withdraw part of the funds prematurely, your yearly deposit limit is reduced by the amount you withdrew.

So, if you have a 15,000 GBP ISA Account balance and you withdraw 5,000 GBP, then you cannot put in any more money because your 20,000 GBP yearly limit would have been reached.

Account Management - 5/10

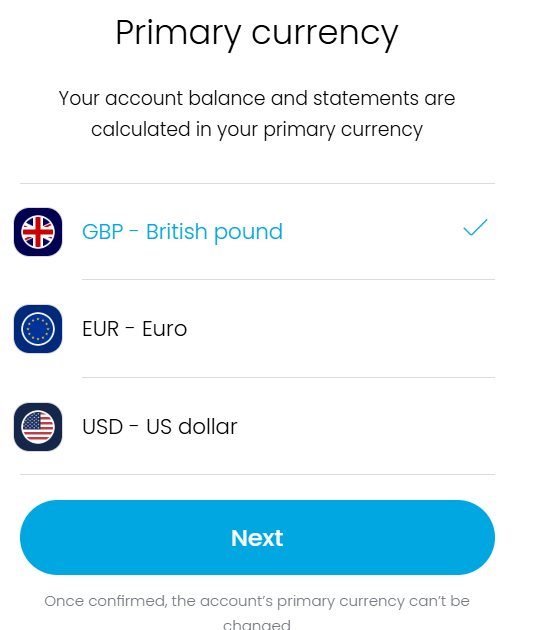

Account Currencies

Account Currencies

Trading 212 offers 3 Account Currencies which are: GBP,USD, EUR.

On the Invest Account, there is a Multi-Currency feature that allows you to edit your account currency and switch to another currency. However, this feature applies to the Invest Account only.

Maximum Number of Trading 212 Accounts Allowed

At Trading 212, you can only open one account type, so you can have One CFD Account, One Invest Account & One ISA Account.

Negative Balance Protection

Trading 212 offers to refund any negative balance in your trading account so that you don't lose more than you deposited.

Margin Call & Stop Out Level (100%/25%)

When your Margin Level falls to 100%, you will get a margin call from Trading 212 requesting you deposit more funds into your account.

If your Margin Level should fall to 25% then Trading 212 will stop you out and close all your open trades.

How To Open Trading 212 Account

Step 1: Choose Account Type

Go to the Trading 212 website, click on "Open Account", select your country of residence, then choose your desired account type (CFD, Invest or Stocks ISA Account).

Step 2: Register

Proceed to enter your email address & create a strong password & then click om "Create Account".

A verification email will be sent to you so open the mail & click on the "Verify email" link and you will get redirected to the Trading 212 Web Trader Platform where you can set up and tweak your new trading account.

Step 3: Set Up Your Account

At this point you will need to enter your name, address, phone number, nationality, Tax ID & UK National Insurance Number.

you will be required to answer questions on your financial situation and source of income.

You will also need to choose your account currency (primary currency) as this will be the transaction display currency on your account.

Step 4: CFD Knowledge Test

in this step, you will be required to take a short test to prove you understand the risks of CFD trading.

Step 5: Identity Verification

This is the final step where you will need to upload your UK government issued ID Card & Utility Bill for authentication.

If Trading 212 verifies your documents are okay, you will receive a notification saying your account has been verified and you can proceed to deposit funds.

Range of Markets - 8/10

1. CFDs

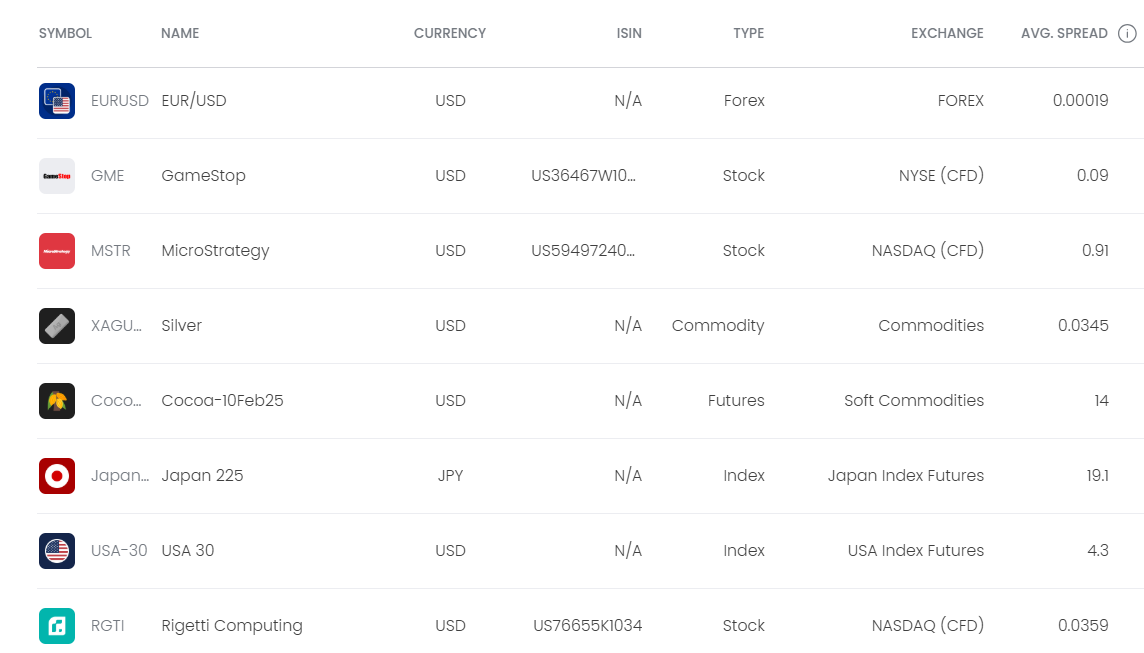

At Trading 212, you can trade CFDs on 180 FX Pairs, Hard & Soft Commodities (including Gold), Indices (Including Nasdaq) and over 8,000 Stocks (including GameStop).

2. Real Shares

At Trading 212, you can buy & own as many as 13,000 Real Shares when you open the Invest Account. You can also buy & own Fractional Shares with as little as 1 USD.

Trading 212 also allows you lend out your shares so you can earn income via lenders fees.

Trading212 pays dividend on stocks & ETFs, and Dividend Reinvestments Plans (DRIPs) are available.

Trading 212 Fees - 7/10

How Does Trading 212 Make Money?

1. Spread

Trading 212 makes most of its money through spread because it is a zero-commission broker.

Trading 212 spread FX spreads are higher than industry averages. EUR/USD spread always fluctuates around 1.9 pips and GBP/USD spread is around 2.8 pips.

However, when trading non-forex instruments the spread is lower. Nasdaq (US 100) is around 1.43 pips and Gold spread is around 0.78 pips.

2. Currency Conversion Fees

Trading 212 currency conversion fee is 0.5% on the CFD Trading Account.

For the Invest Account, currency conversions are charged at a lower rate of 0.15%.

3. Overnight Fees

Trading 212 charges you an overnight fee if you leave a CFD trade open till the next day.

4. Deposit Fees

Trading 212 does not charge deposit fees to CFD Trading Accounts but when depositing into an Invest or ISA Account, any card deposits above 2,000 GBP will attract a 0.7% fee.

Trading Platforms - 4/10

Does Trading 212 Have MetaTrader?

No, Trading 212 does not have MT4 and MT5, instead you must trade the Trading 212 Mobile App or Web Trader platforms.

Trading 212 Mobile App is available on Google & Apple online stores while the Web Trader can be launched by logging into your client area from the Trading 212 website.

Tools - 4/10

Trading 212 Economic Calendar is available to shows you the dates when important market moving economic data such as NFP, CPI, PCE etc. will be released.

Trading 212 lack more sophisticated tools needed for technical analysis of currencies.

Customer Support - 7/10

1. Live Chat

trading 212 offers 24/7 live chat but you can only access it by logging into your client area. The live agent responds in about 1 minute.

2. Email

Trading 212 does not offer telephone support instead you can reach them through email.

3. Education

Trading 212 has a learning module for beginners but the content is only about learning to invest. there are no courses on learning to trade forex.

Final Verdict - 8/10

Trading 212 is a great platform for investing in Australia especially for those seeking a full-service broker