SLK STRATEGY

UNDERSTANDING KEY LEVELS: Part 1

I’ll be showing you the types of key levels we have, as well as what to expect from every one of them.

UNDERSTANDING KEY LEVELS: Part 1

I’ll be showing you the types of key levels we have, as well as what to expect from every one of them.

Key levels are decision points. We basically have three types of key levels.

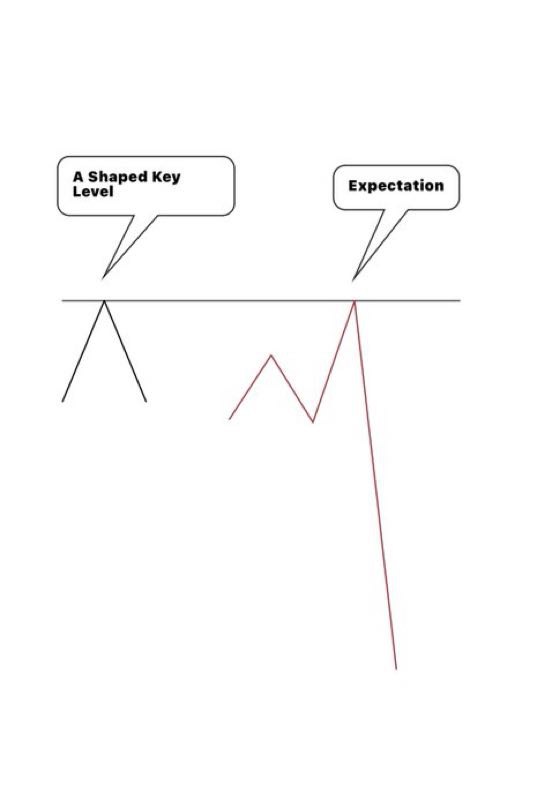

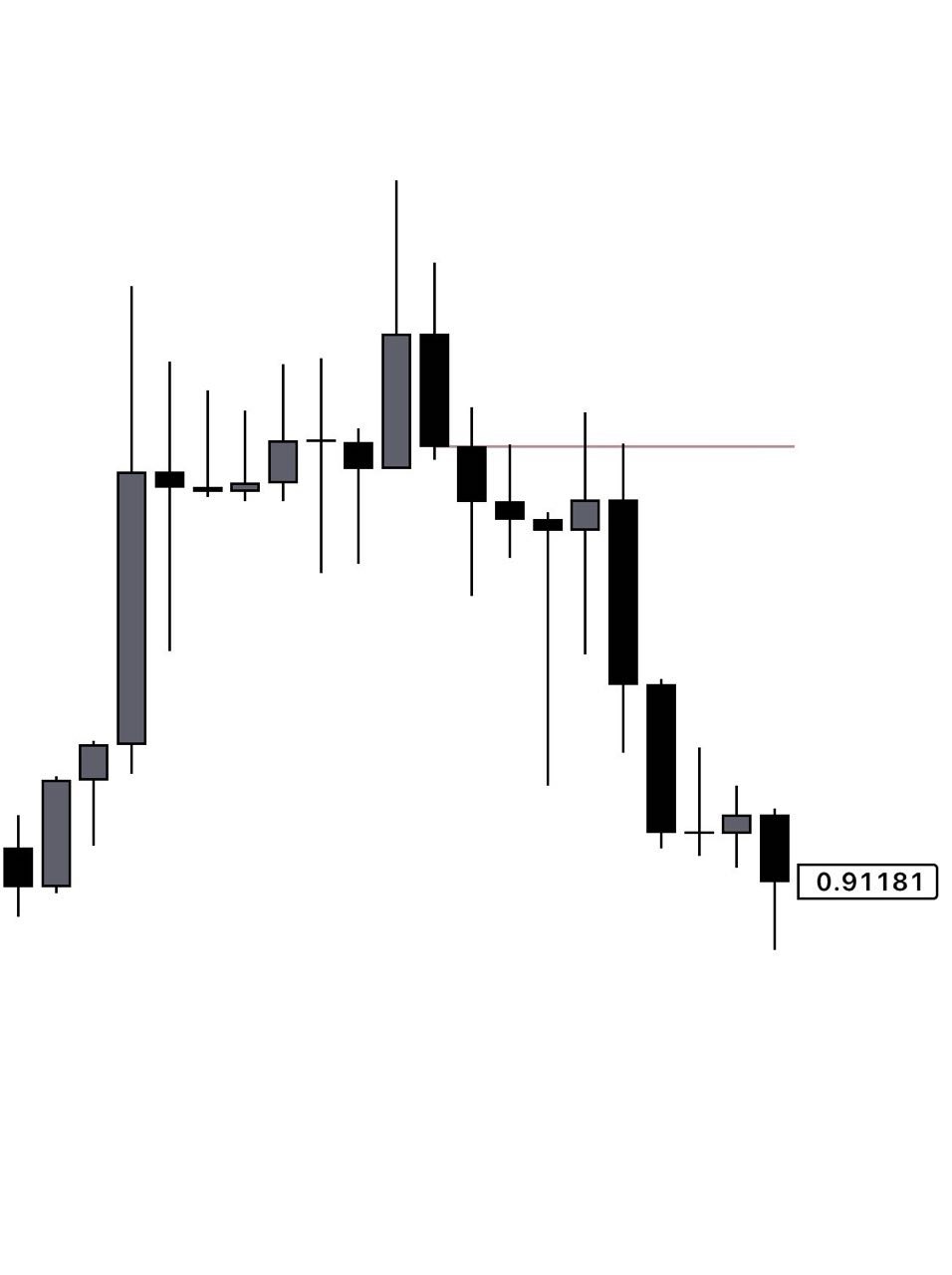

First is the A shaped key level which is where you’re expected to sell from.

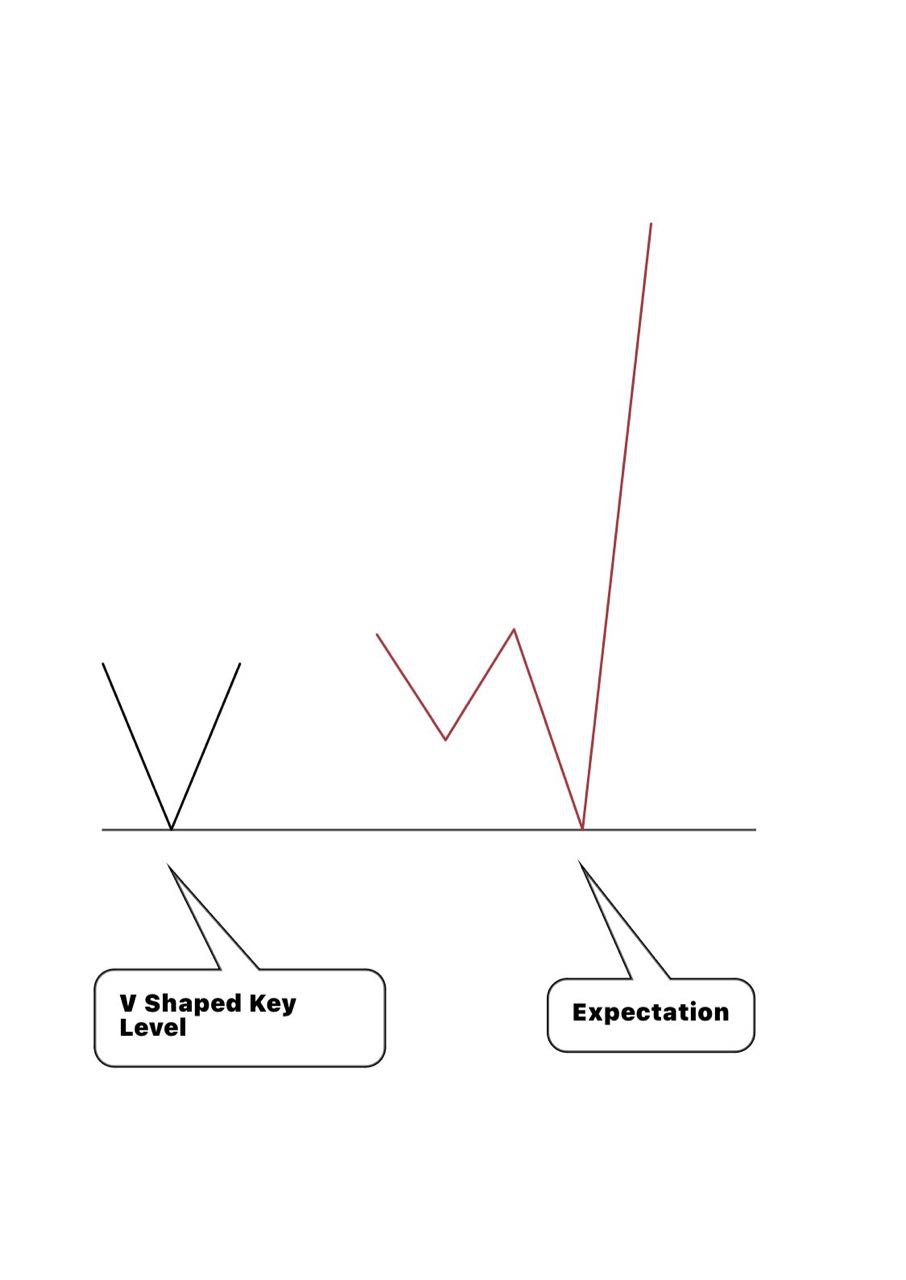

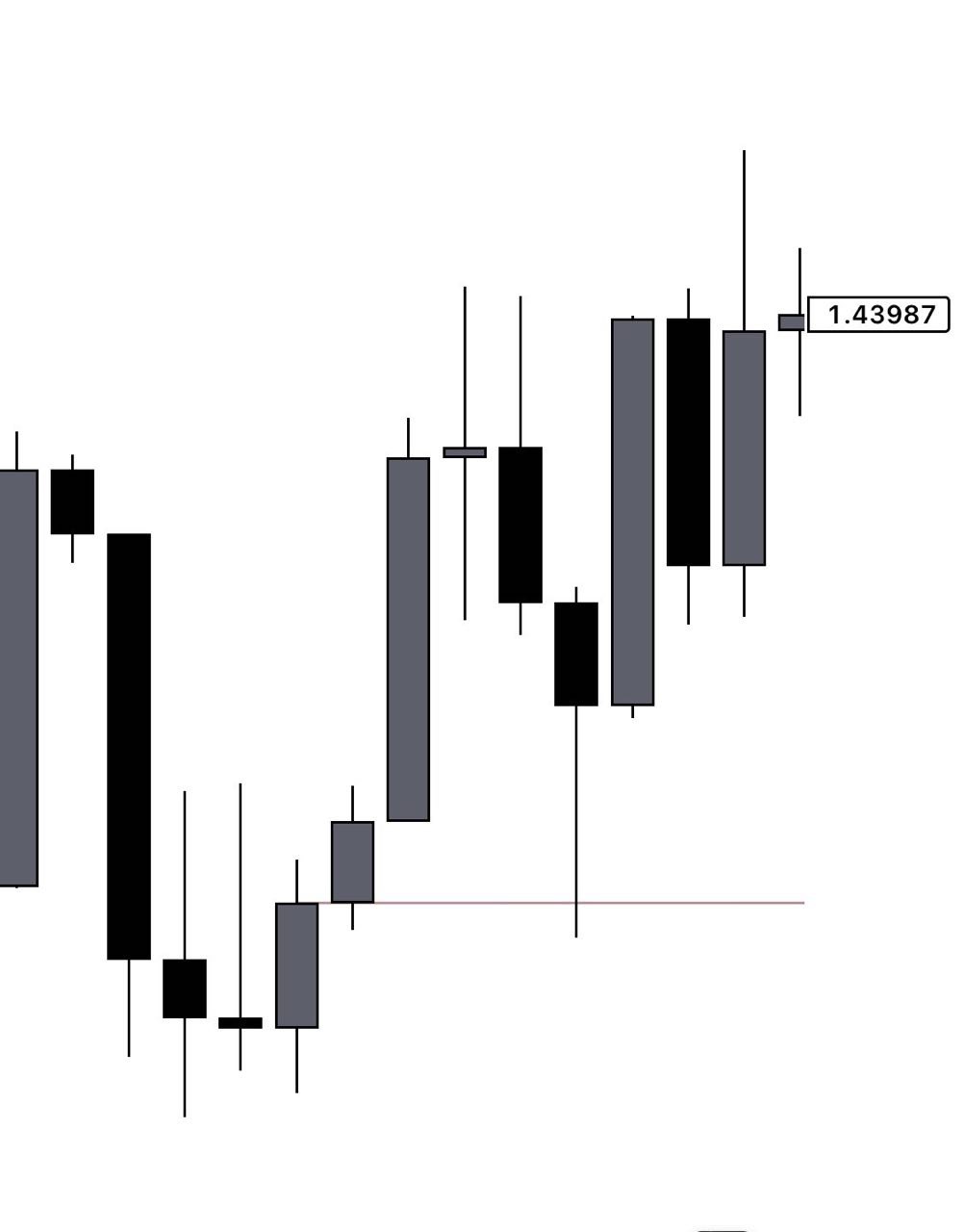

Second is the V shaped key level which is where you’re expected to buy from.

Third is the Open-Close Key level.

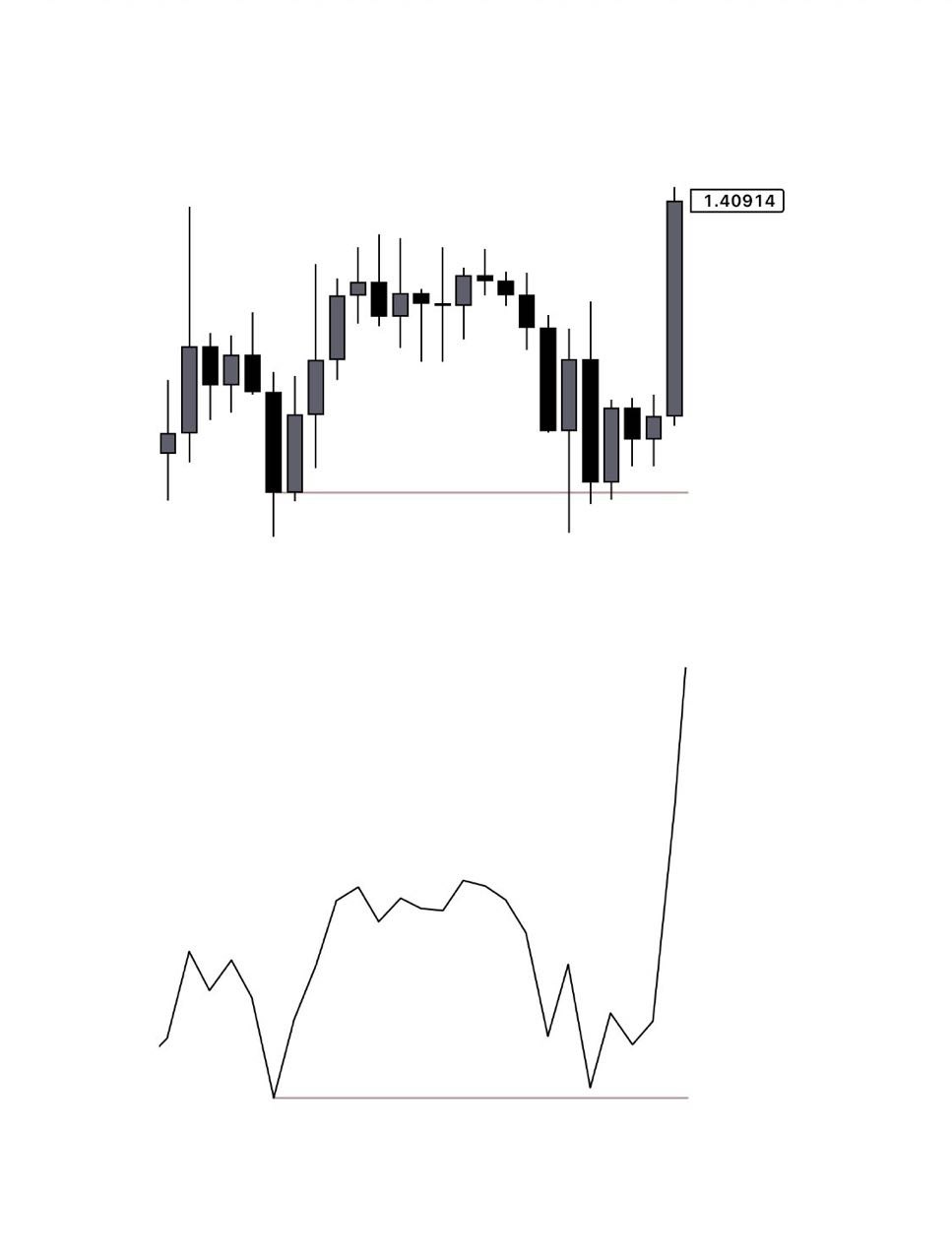

We have the bullish o/c (it consists of two bullish candles) - you’re expected to buy from a bullish o/c KL.

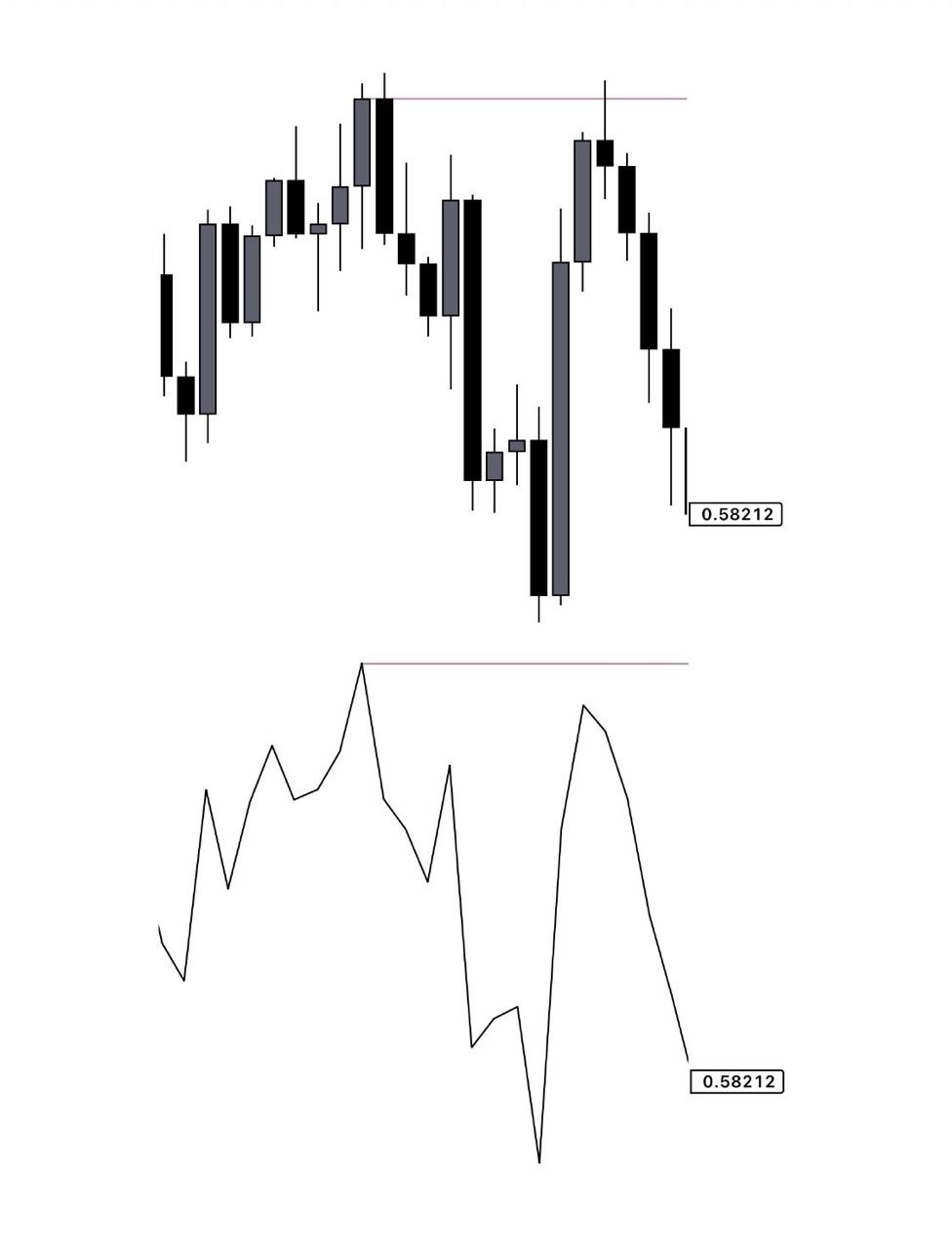

And we have the bearish o/c (it consists of two bearish candles) - you’re expected to sell from a bearish o/c KL.

My understanding of key levels is that they are basically support and resistance levels. Some traders call them point of interest, etc. but to me they are all the same thing- support and resistance.

For instance look at the levels marked with the green box, price reacted at that level on different days. To me they are just support levels. Someone else mght want to call them POI or Key levels.

For instance look at the levels marked with the green box, price reacted at that level on different days. To me they are just support levels. Someone else mght want to call them POI or Key levels.

Yes, key levels can be support or resistance

So can you discuss the Liquidity part of the SLK?

Yes, i will do that also. Liquidity is next and structure will follow.

UNDERSTANDING MARKET STRUCTURE

What is market structure?

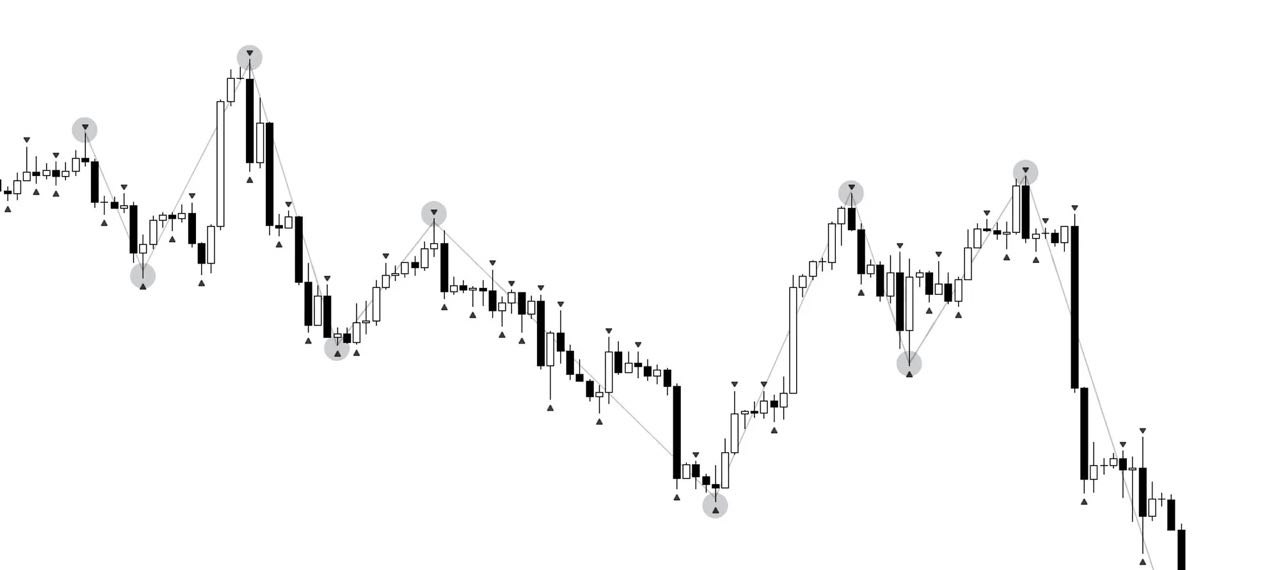

Understanding Market Structure will help you as a trader to spot bullish or bearish trends.

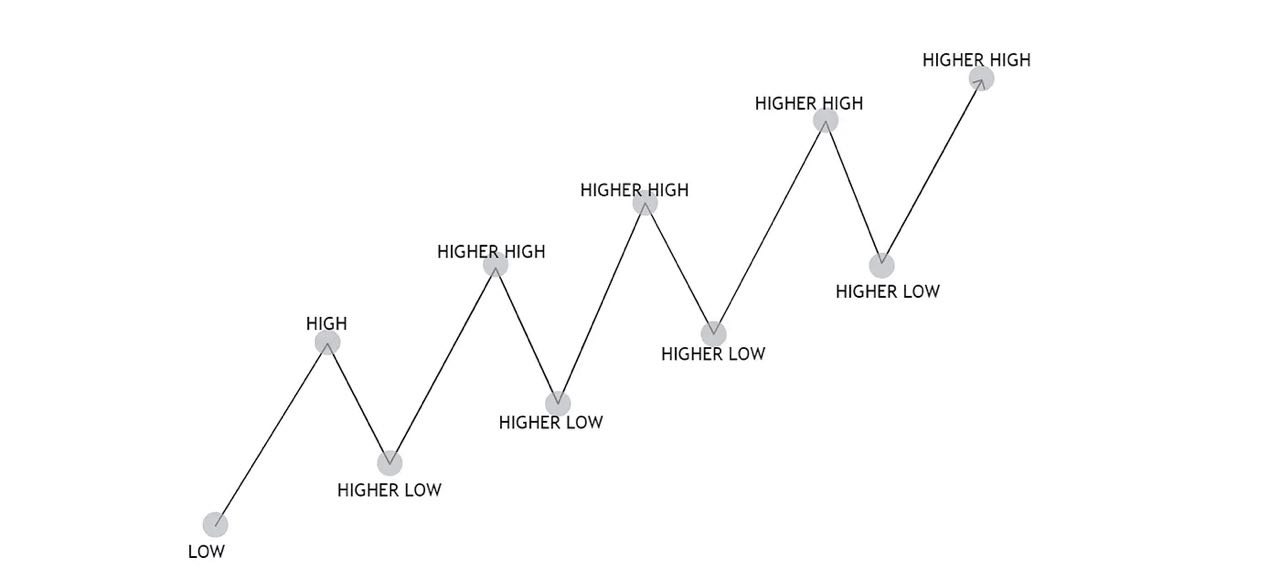

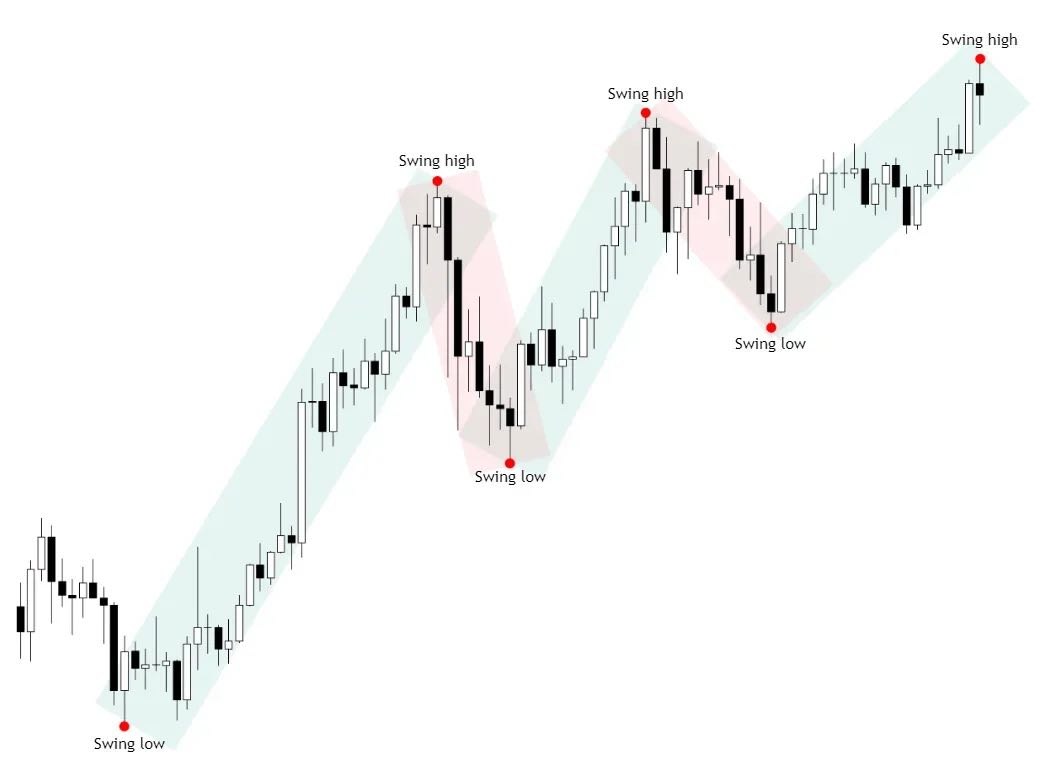

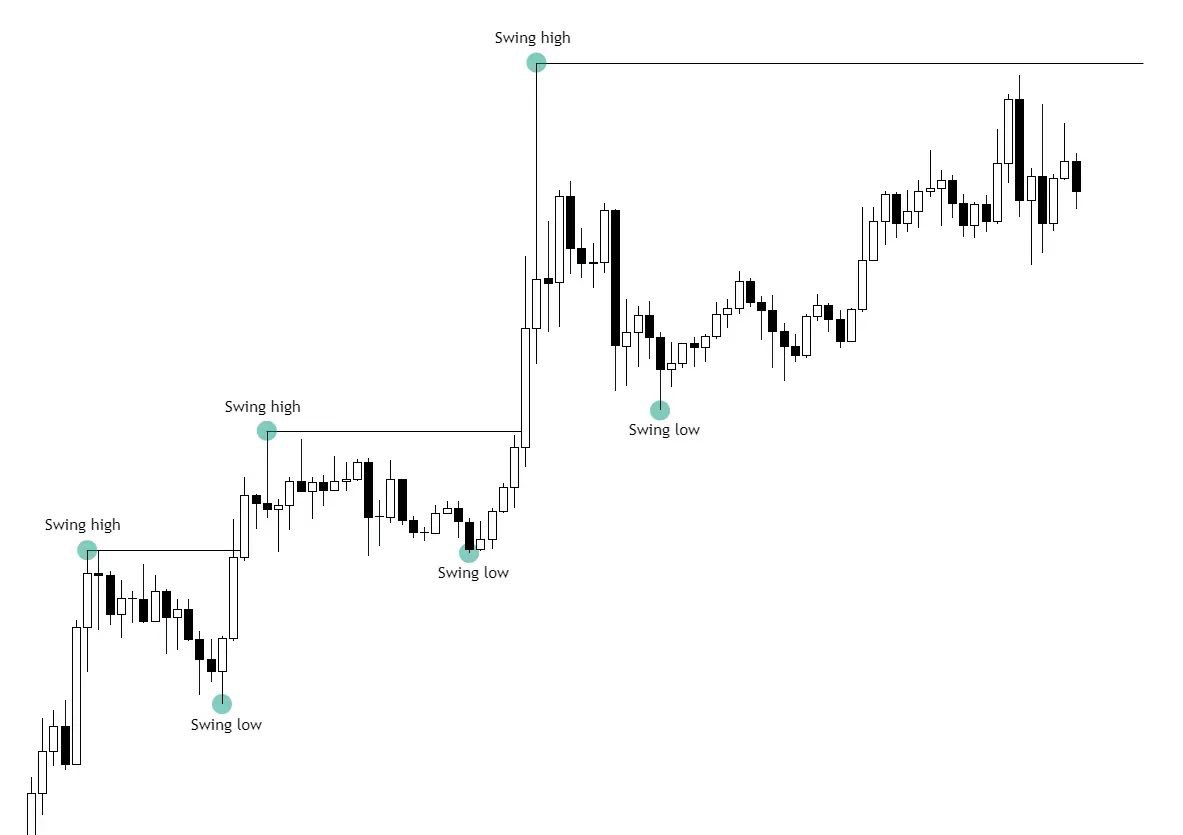

Market structure is a continuous series of HH (Higher High) and HL (Higher lows) on a Bullish Market structure.

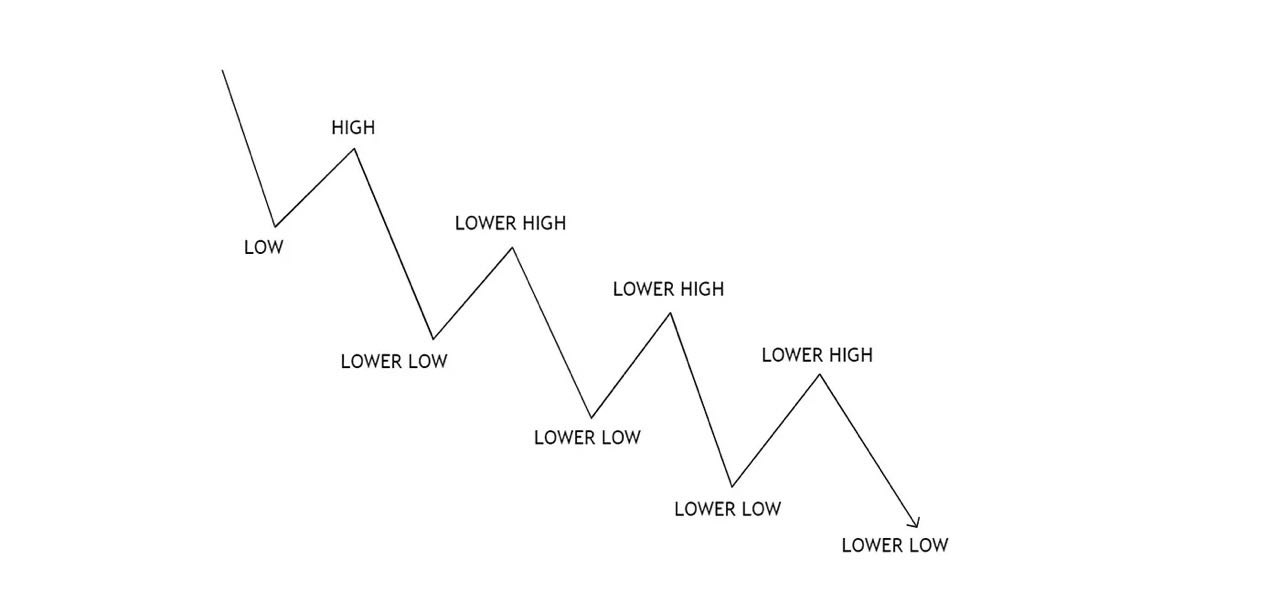

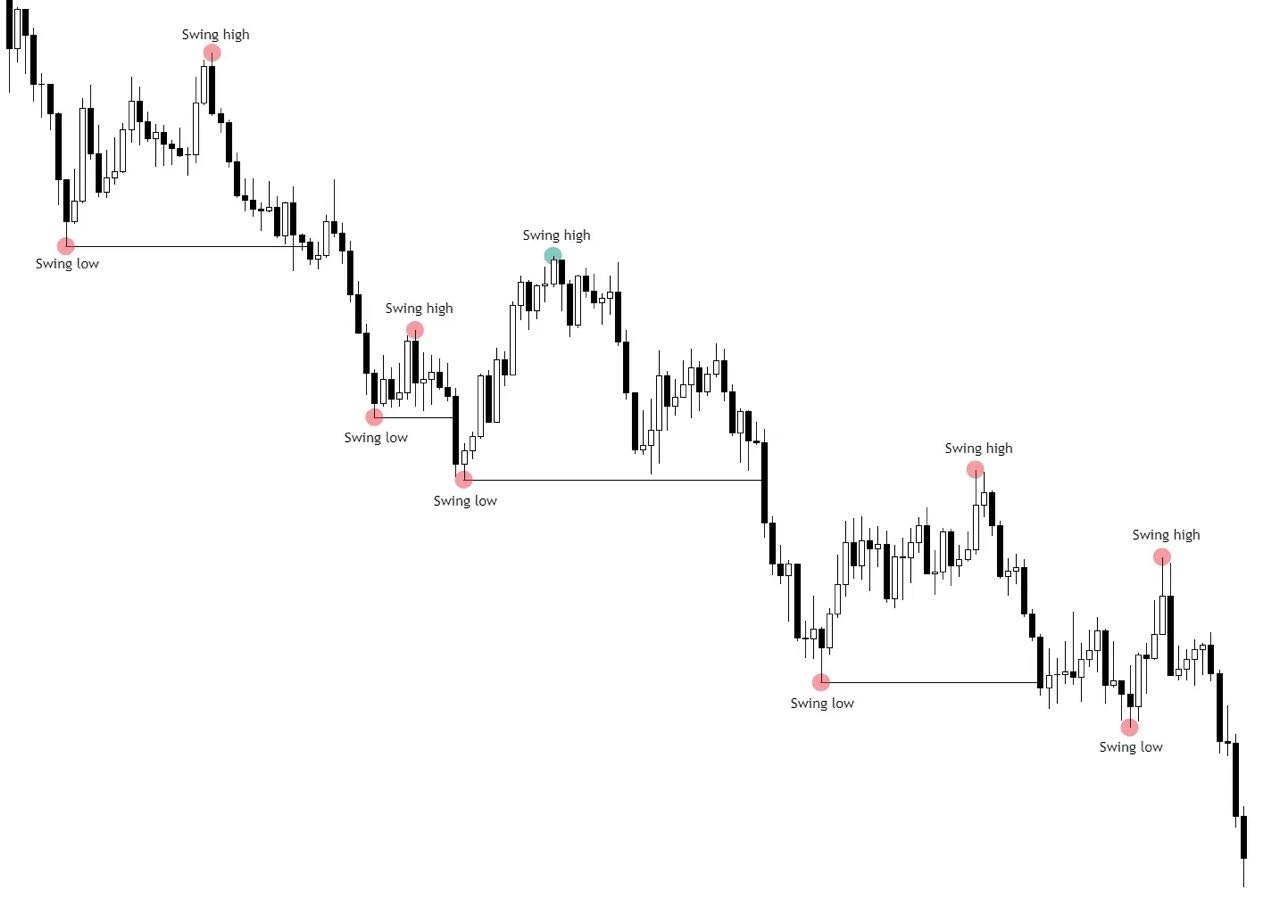

And LH (Lower high) and LL (Lower Low) on a Bearish Market structure.

TYPES OF MARKET STRUCTURE.

There are two main types of structures.

1. Bullish Market Structure: Lows and highs increase.

Each maximum and minimum is higher than the previous one.

2. Bearish market structure.

Bearish structure is defined by Lower Lows (LL) and Lower Highs (LH)

The price trend continues as long as LH are being printed.

And until a higher high (HH) is created.

TRENDS

The formation of a valid trend requires two components:

Impulse Movements: Align with the primary trend direction, strong market momentum

Correction Movements: Temporary pullbacks against the primary trend before the price continues in its original direction

How to Confirm an Uptrend:

Uptrend Confirmation: A new Swing High must surpass the previous Swing High that initiated a corrective movement.

A candle body breaking this level confirms an uptrend.

Downtrend Confirmation: A new Swing Low must break the previous Swing Low that initiated a corrective movement.

A candle body breaking this level confirms a downtrend.