Deriv Review

Is Deriv in Kenya?

!! Regulator Warning !!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Many users find it convenient to deposit with the same method on Deriv, but being required to use the same method for withdrawals can be limiting and cause delays. Allowing users to choose different withdrawal options like bank transfers, e-wallets, or cryptocurrencies would improve flexibility, user experience, and trust in the platform.

I like the peer 2 peer deposit method, it simply ahead of its time. I also like the low low minimum deposit/withdrawal. Another thing I like is the different account types you can opn for any strategy.

Deriv is not as good as people say they are. I opened an account with them but their trading consitions are just average. I only recommend them for beginners who want to learn trading.

Before you chat with a deriv live agent they will send a verification code to your email which you must input to start the chat. This is a waste of time because even after entering the code they could tell you there is no live agent available

Currently USDT transactions are limited to ERC & TRC20 which is not good enough, it should be expanded.Another thing I noticed is that they increase their spread unnecessarily causing stop loss to be hit in a trade

I came to deriv to try their TradingView but I was disappointed because they are not eally TradingView brokers, they only built something that looks like TradingView and it does not work well, it sometimes doesnt allow you save your chart settings. I have left them for Trade Nation that offers a better TradingView experience.

They have a very slow mobile app, before the charts load it takes ages. When you save a setting, it doesn't save and returns you to default after a while.

They ask for Tax Identification Number from everyone, and I dont have it so i had to abandon trading with them. Makes no sense because other brokers dont ask for TIN

They dont allow you to open more than one trading account which is very bad in my opinion. It means every money you deposit will always constitute part of your free margin and can be wiped away is you forget to use stop loss

they are not accepting deposits from mastercard in Nigeria, such things make me nervous

Love their 24/7 customer support which is open even on saturdays and sundays. Even if i am trading crypto during weekends i have someone to talk to when i need help. Deriv should improve on their accoun topening process to make it seamless and faster

When registering i submitted by National Identity Card number and it got approved immediately but when i uploaded my proof of address they said it will take 3 days to verify !!! this is too long didnt expect such analogue services from deriv

At Deriv, my stop loss keeps getting hit without price getting to it. I also trade with FxPro and this rarely happens

I enjoy the weekend trading of Volatility Index and the fact that you can choose how volatile you want the market to be. However, I noticed customer support is not as good during weekends and deriv could fix this.

Too many account types on offer and it can get confusing with this broker. They need to reorganize their account types and I also had issues depositing with my Visa Card. The broker is trying but they should not try to do too much. They should focus on one thing and do it properly instead of trying to do everything at once and having issues.

I trade synthetics with Deriv and except for a few delays in receiving my deposit in my trading account, I have not had any major issues.

I have not had any issues with deriv since I started using them but here is what I think: as a broker with weak regulation, they offer too many advanced instruments and I fear it could backfire one day. So for me, I make sure i don't put in too much money and I make my withdrawals everyday

Deriv is not a CMA regulated broker so you should proceed with caution

| 📷 Name of broker | Deriv (formerly Binary.com) |

| 👨 Accepts Kenyan Traders? | Yes |

| ⚖ Deriv Regulation | Saint Vincent & The Grenadines |

| 💰 Deriv Minimum Deposit | $5 |

| 🚀Deriv Leverage | 1:1000 |

| 💸 EUR/USD average spread | 1.4 pips |

| 💳 Minimum withdrawal | $5 |

| 💱 Account currency | USD, GBP, EUR, Crypto |

| 🏖️Inactivity fee | $25 after twelve months of inactivity |

| 🎧Support | 24/7 |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

Deriv Regulation - 2/5

Does Deriv Work in Kenya?

Yes, Deriv works in Kenya but they are high risk since they are not regulated by the CMA Kenya.

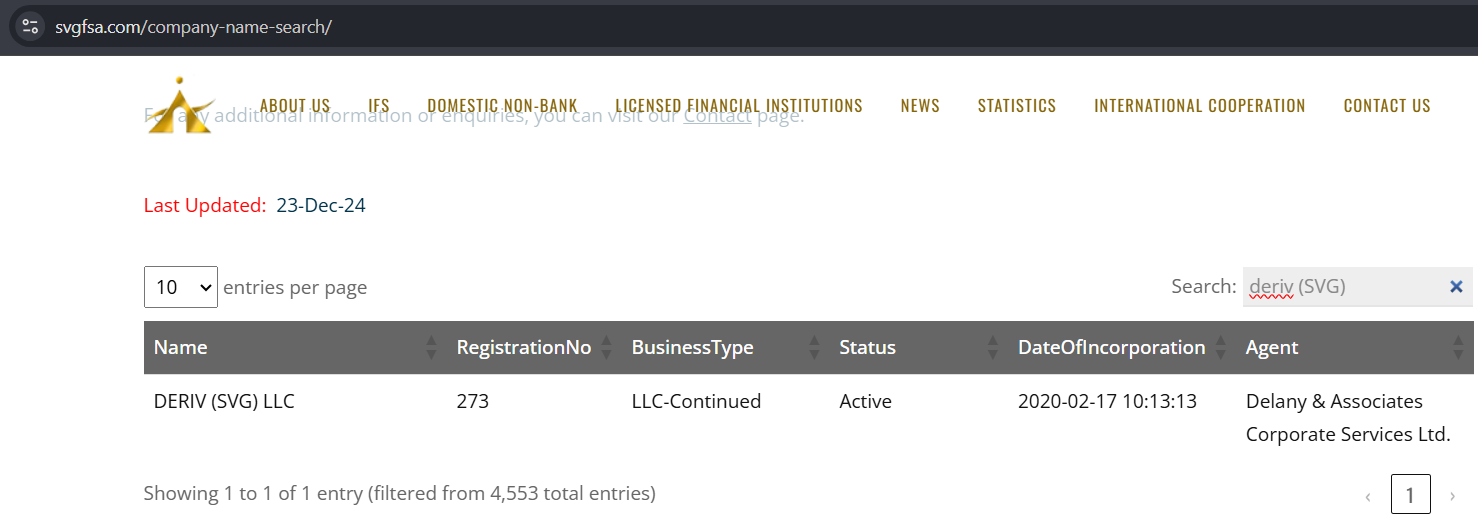

Deriv is regulated by the Saint Vincent & The Grenadines Financial Services Authority (SVGFSA) which authorizes them to operate as a forex broker in oversea jurisdictions including Kenya.

However, we consider Deriv a high risk forex broker because they have low quality regulation.

Deriv Regulation - British Virgin Islands

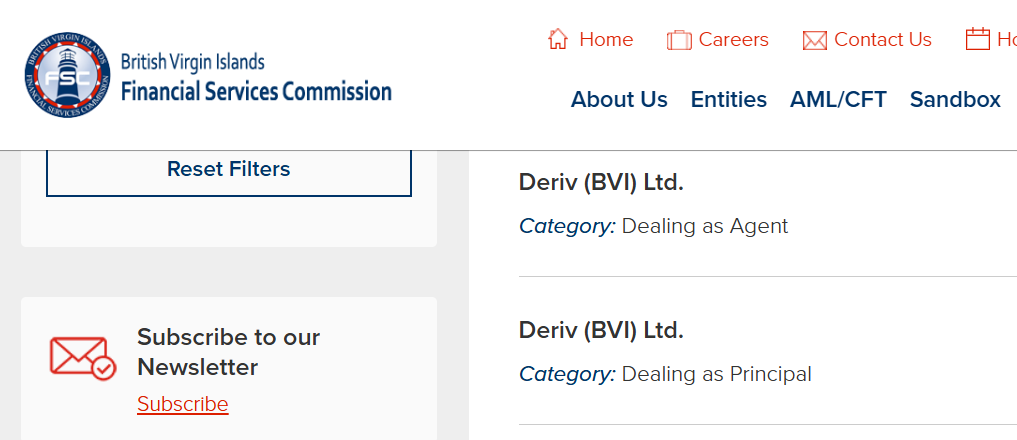

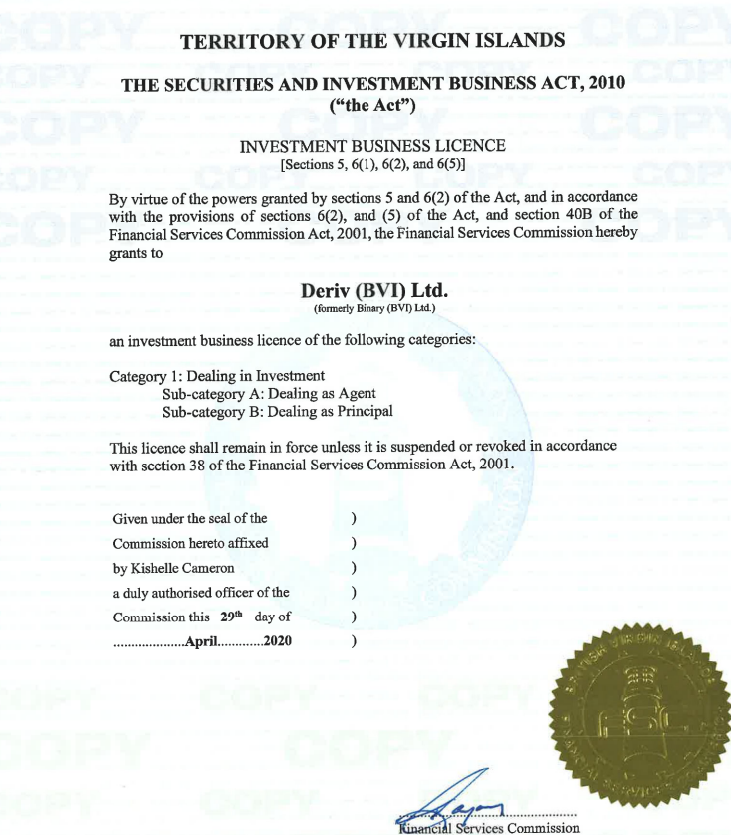

Deriv is also regulated by the British Virgin Islands Financial Services Commission (BVIFSC) located in the

Deriv Regulation - Malta

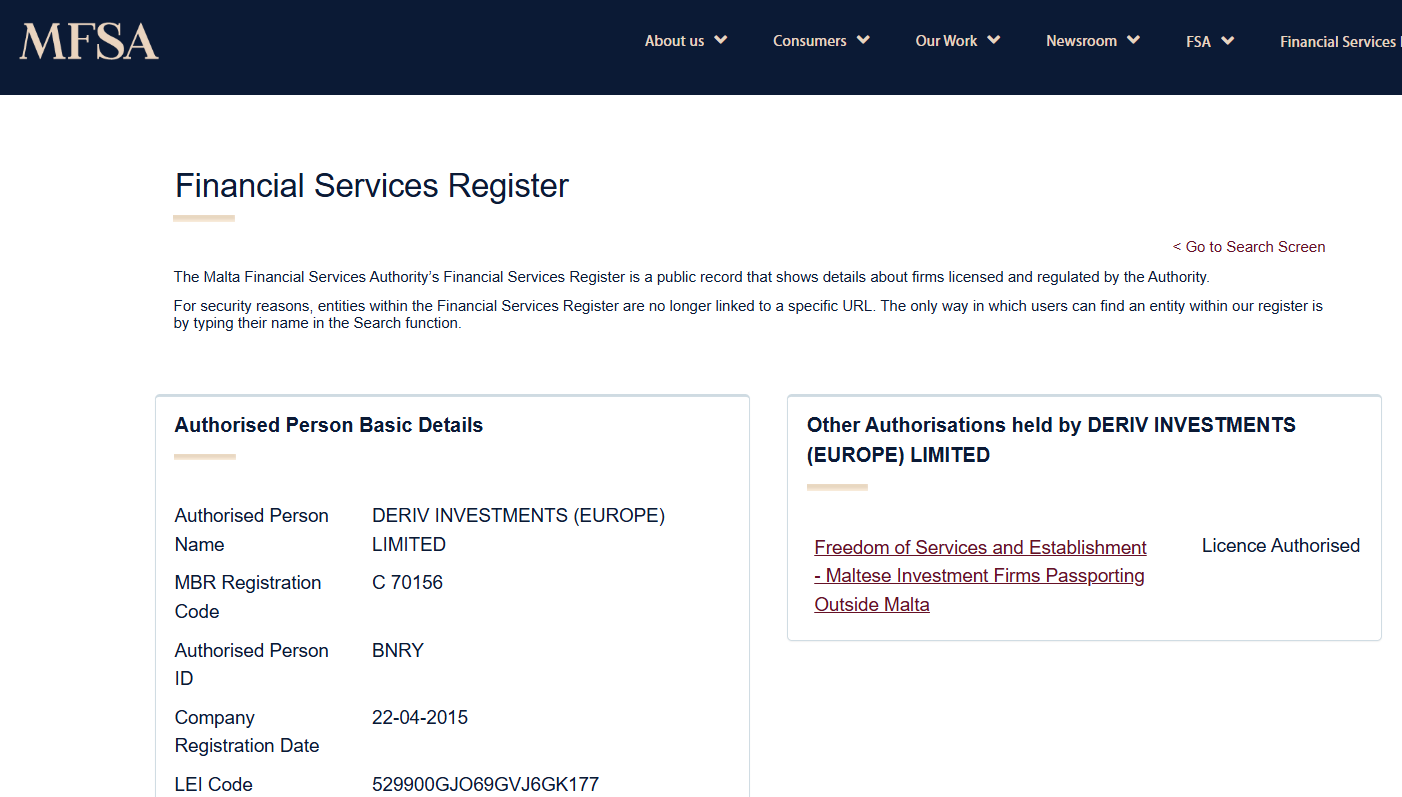

Deriv in Europe is also regulated by the Financial Services Authority (FSA) in Malta and traders from Europe are registered under this entity.

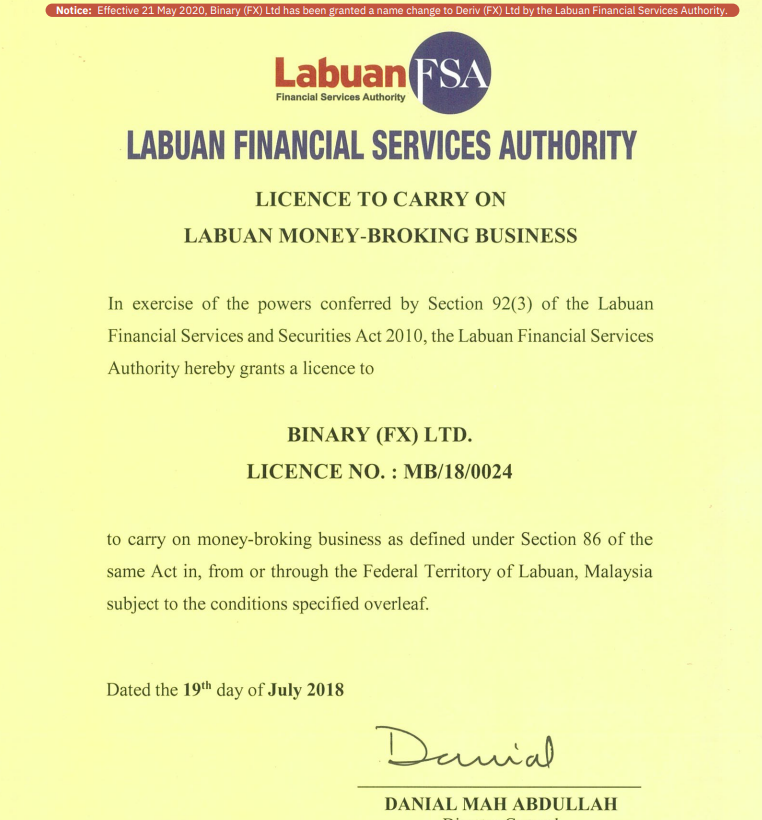

Deriv Regulation - Labuan Malaysia

Deriv is also regulated by the Labuan Financial Services Authority but the name on their license is "Binary FX" but they have since changed their name from Binary FX to Deriv.

Deriv Regulation Summary

| 📍Country | ⚖️Regulator | #️⃣License No. | 📅Date License Issued | 🔒Quality |

| CMA Kenya | Not Regulated | Not Regulated | Not Regulated | Not Regulated |

| Saint Vincent & The Grenadines | FSA | 273 | 2020 | Low |

| British Virgin Islands | FSC | SIBA/L/18/1114 | 2020 | Low |

| Malta | FSA | 529900GJO69GVJ6GK177 | 2015 | Low |

| Labuan | FSA | MB/18/0024 | 2018 | Low |

| Vanuatu | FSC | License is not for forex brokerage | License is not for forex brokerage | Low |

| Mauritius | FSC | License not found | License not found |

Account Management - 3/5

Negative Balance Protection

Deriv offers Negative Balance Protection so that even if your trading account should slip into negative, Deriv will absorb the negative balance and return your account balance to zero.

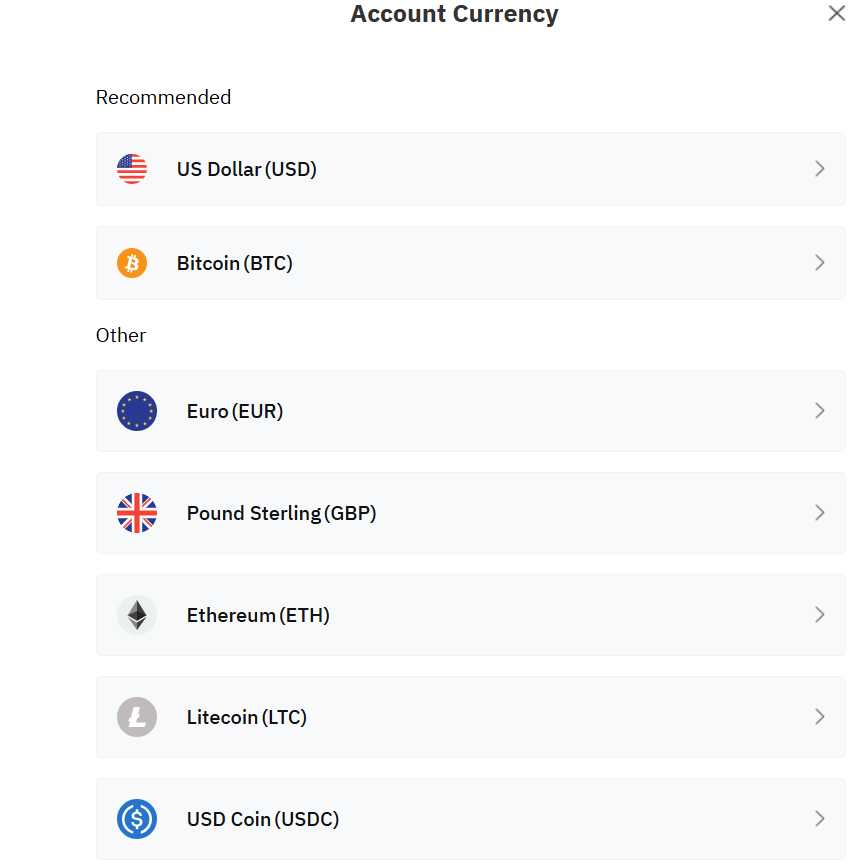

Deriv Account Currencies

Deriv does not have KES Account Currency but USD, EUR, GBP & Crypto are available as account currencies.

Because Deriv does not offer KES Accounts, you must pay currency conversion fees if you deposit/withdraw in Naira.

Margin Call & Stop Out

Deriv Margin Call will come when your Margin Level falls to 100% and you will be Stopped Out of all your trades when your Margin Level falls to 50%.

How To Create Deriv MT5 Account

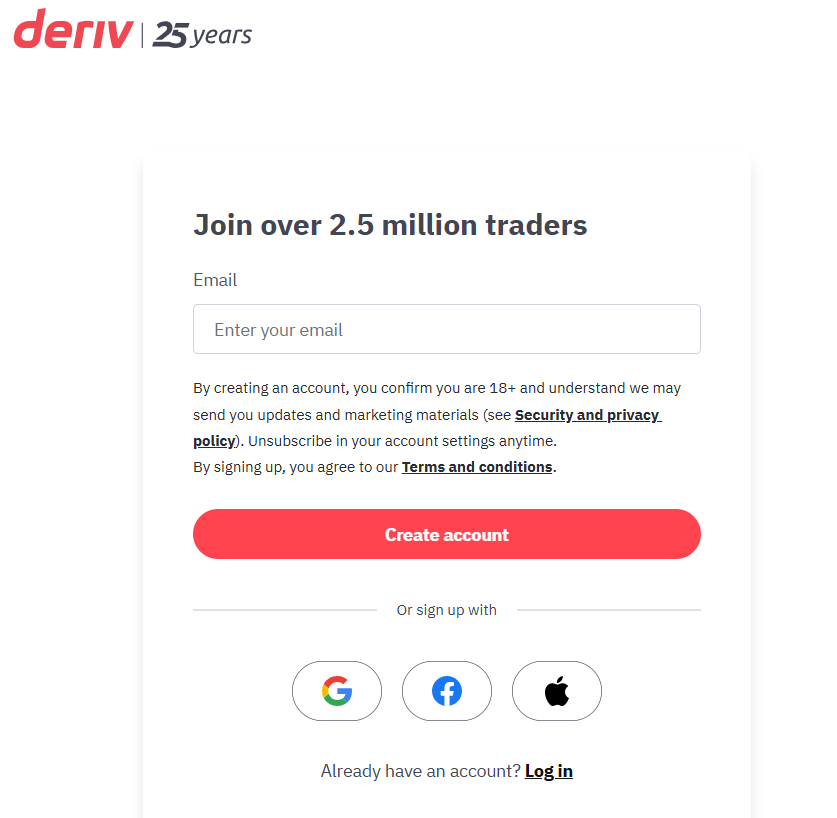

Step 1: Register

Visit the deriv website, click on "open account", enter your email address & click on "create account".

A verification email will be sent to you so click on the link in the email to continue.

After you verify your email, Deriv will redirect you back to the account opening page to enter your country of residence & create a password.

Proceed to choose your deriv account currency. Unfortunately, deriv does not offer KES account currency but you can choose from USD, EUR, GBP & Crypto account currencies.

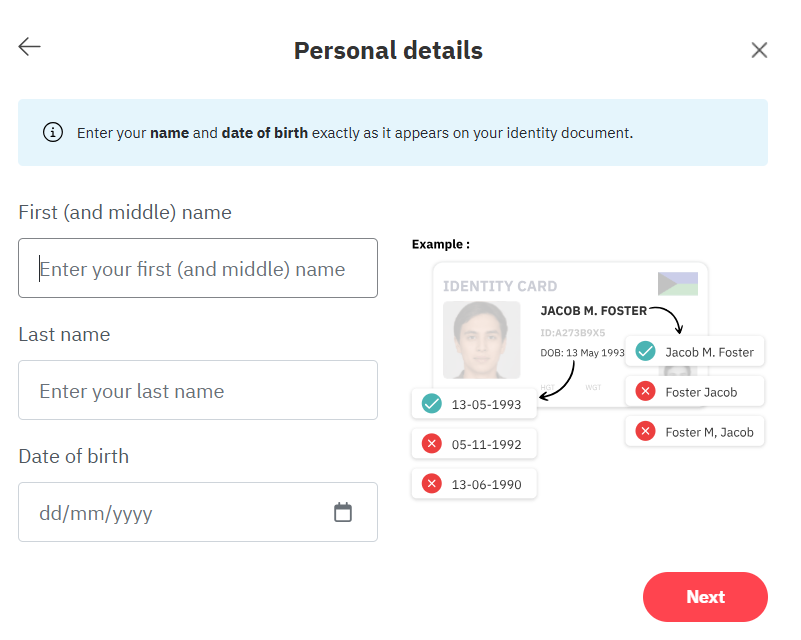

Step 2: Enter Personal Details

Proceed to enter your bio data as it appears on your government issued ID.

Enter your phone number & choose your account opening purpose (speculation, hedging or income earning).

Step 3: Employment Details

Proceed to state whether you are employed or not, and you will be asked to enter your Tax Identification Number (TIN) but this is not compulsory so you can leave it blank.

Enter your address, town, state & postal code to continue

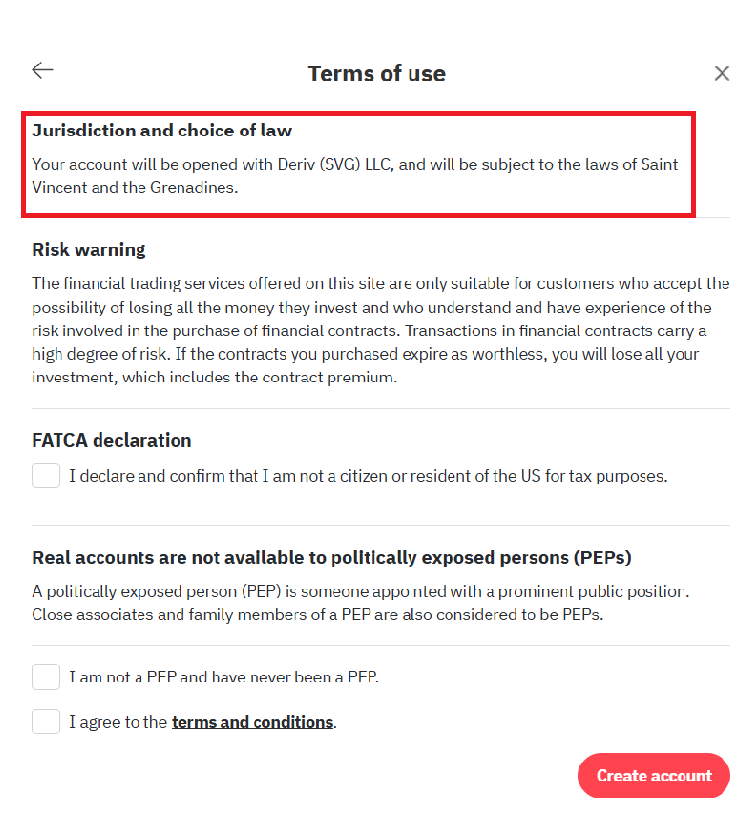

Step 4: Accept Terms & Conditions

Proceed to read through the terms & conditions (take note of the entity & country laws under which your account is registered), then click on "create account"

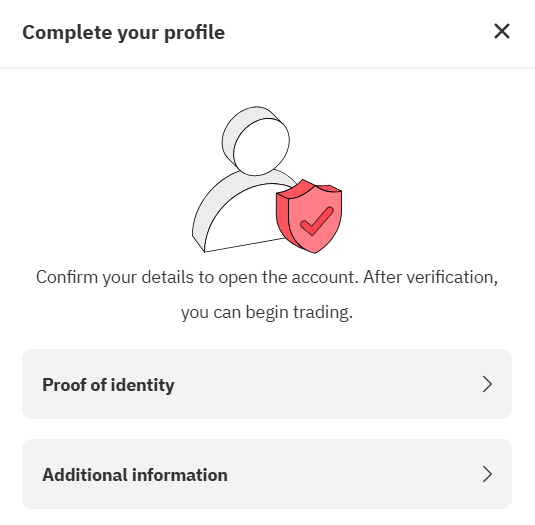

Step 5: Choose Trading Account Type & Upload Your ID Card

After clicking on create account, you will be redirected to your Traders Hub where you will be asked to choose the type of Deriv Account you want to open.

The supported Deriv Account types include an Options Trading Account, MT5 Account & cTrader Account.

When you select your preferred trading account type, Deriv will ask you to upload your means of identification & utility bill (to act as proof of residence).

After your means of ID is authenticated as being genuine and not expired, your Deriv account will be activated for live trading.

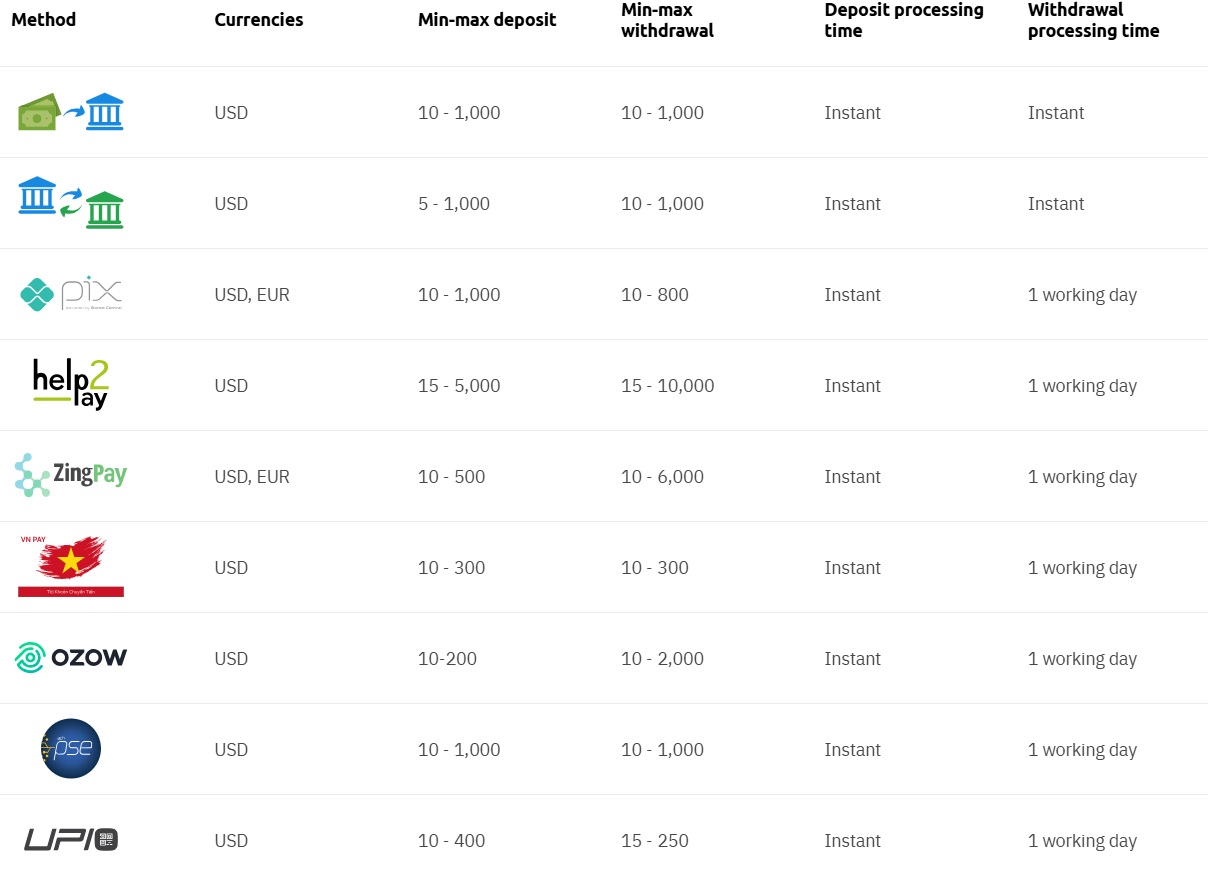

Deriv Withdrawal & Deposits - 4/5

What is The Minimum Deposit For Deriv?

The Deriv minimum deposit is $5 and this is the smallest amount you can fund your Deriv account with at any point in time.

How To Deposit Funds Into Deriv

1. MPESA

Deriv accepts MPESA funding & withdrawals from Kenyan traders. The Deriv minimum deposit with MPESA is $5 or KES equivalent.

You can download the Deriv MPESA mobile app from your google playstore or apple store.

2. Online Bank

Deriv minimum deposit via online banking is $10; you can transfer the KES equivalent from your Kenyan bank to the account number Deriv will give you.

The processing time for online bank deposits at Deriv is instant and there are no deposit fees.

3. Debit/Credit Cards

The minimum deposit for card deposits at Deriv is $10 & we are talking Visa, Maestro, Discover & Diner Club cards.

Deriv does not accept Mastercard deposits and this is a minus for them.

The processing time for card deposits at Deriv is instant& there are no deposit fees.

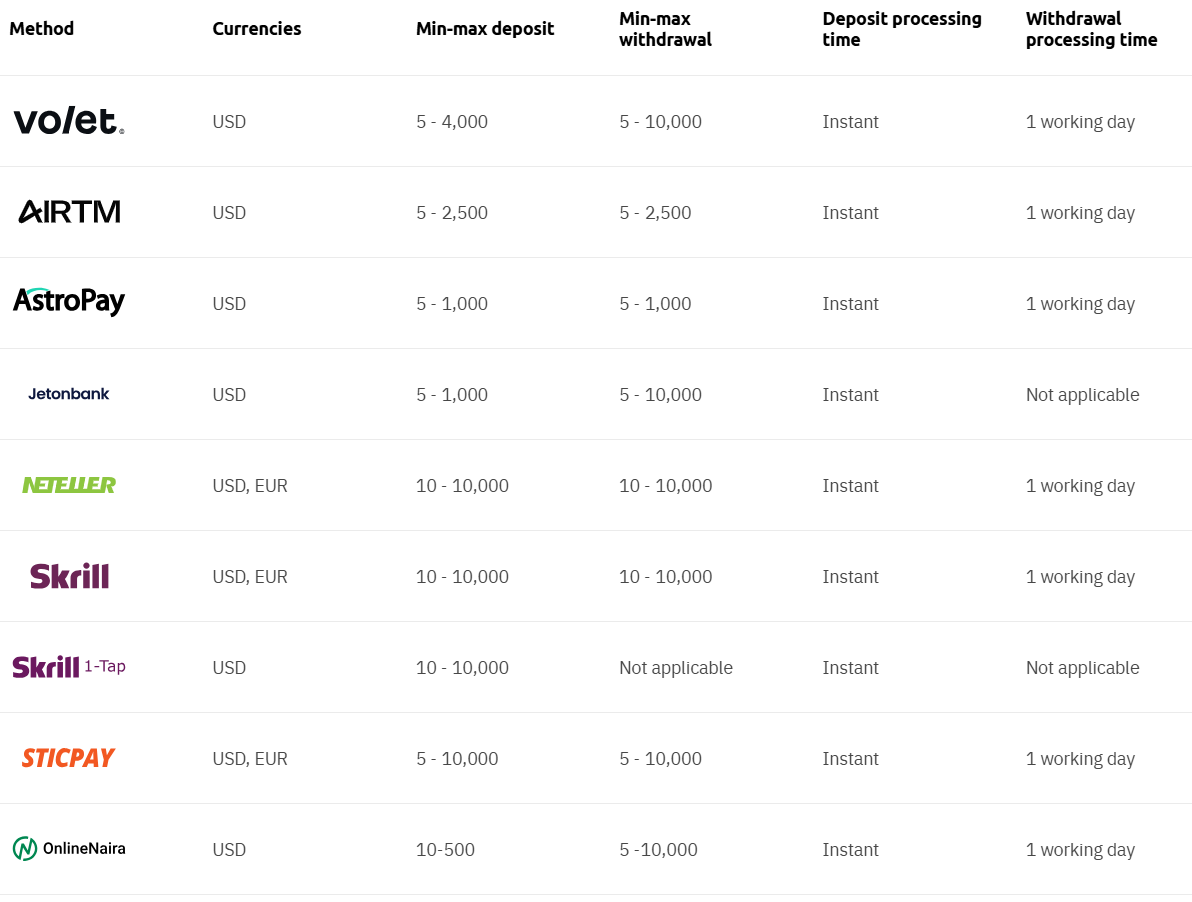

4. EWallets

The Deriv minimum deposit for eWallets is $10 & processing time is instant at zero fees.

Deriv accepts eWallet funding methods such as Online Naira, Skrill, Neteller, SticPay, etc.

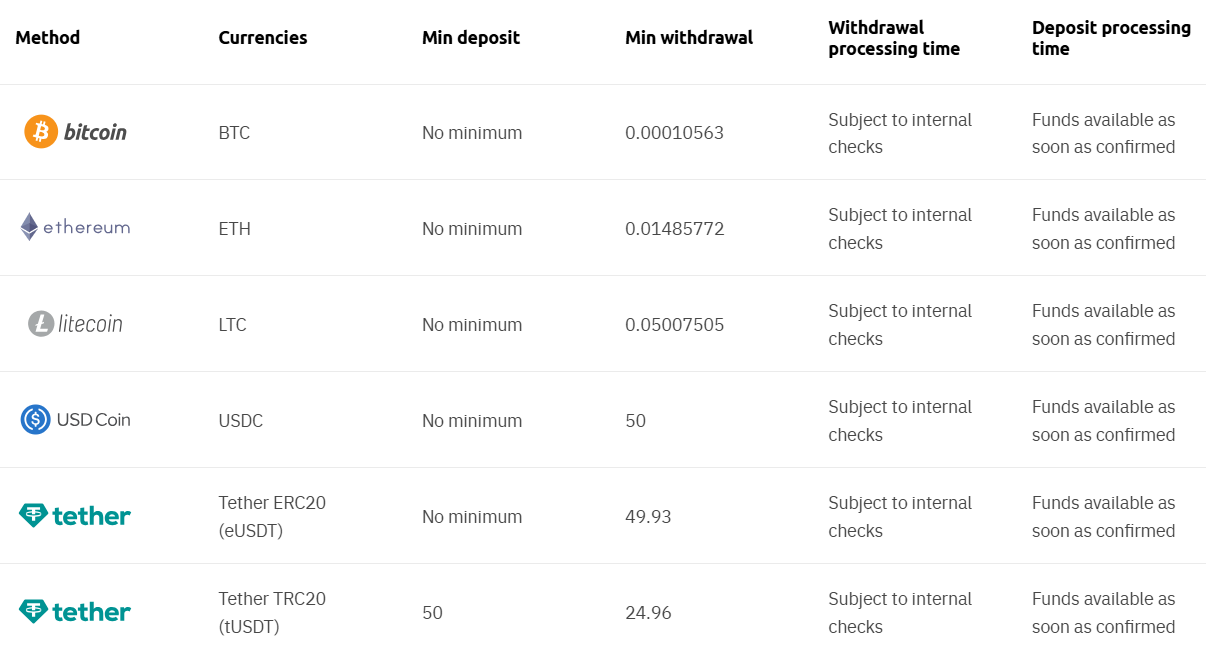

5. Crypto Funding

Deriv Kenya allows you fund your account via cryptocurrency such as Bitcoin, Ethereum, Litecoin, USD Coin & Tether.

When funding your Deriv account via crypto methods, there is no minimum deposit & the deposit processing time depends on when Deriv is able to confirm payment.

How Long Does Deriv Withdrawal Take?

Deriv withdrawal processing time is instant when you use the Online Bank withdrawal method.

Visa card withdrawals are processed within one working day but other card withdrawals don't have a definite processing time.

Ewallet withdrawals at Deriv are processed within one day, while withdrawals by crypto methods don't have a specific processing time.

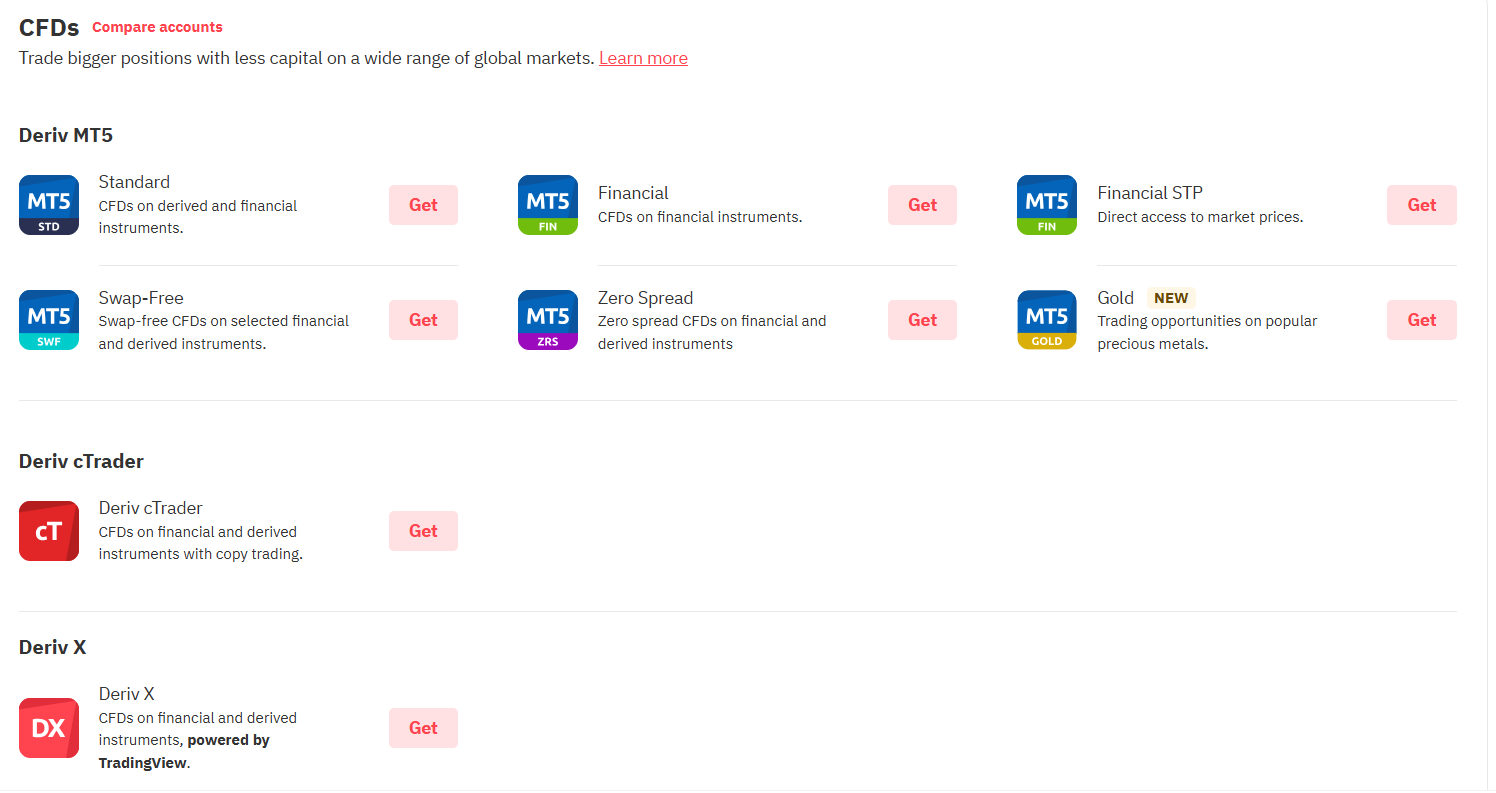

Deriv Account Types - 3.6/5

At Deriv, you can open an MT5 Account, cTrader Account & Options Trading Account.

MT5 Accounts

1. MT5 Derived Account

The Derived Account is meant for trading Synthetic Instruments only.

2. MT5 Financial Account

The Financial Account is meant for trading normal (non-synthetic) CFD instruments only.

The Financial Account includes Standard Account, Zero-Commission Account, STP Account & Gold Trading Account.

3. MT5 Swap-Free Account

The Deriv Swap-Free Account is meant for trading both Synthetic & Non-Synthetic instruments without paying any overnight fees also known as swap.

CTrader Account

1. Deriv cTrader Account

To use the cTrader platform provided by Deriv, you must open a cTrader Account.

Deriv X Account

To be able to use the Deriv X app where the charts are designed to mimic TradingView charts, you must open a Deriv X Account.

Deriv Fees - 3/5

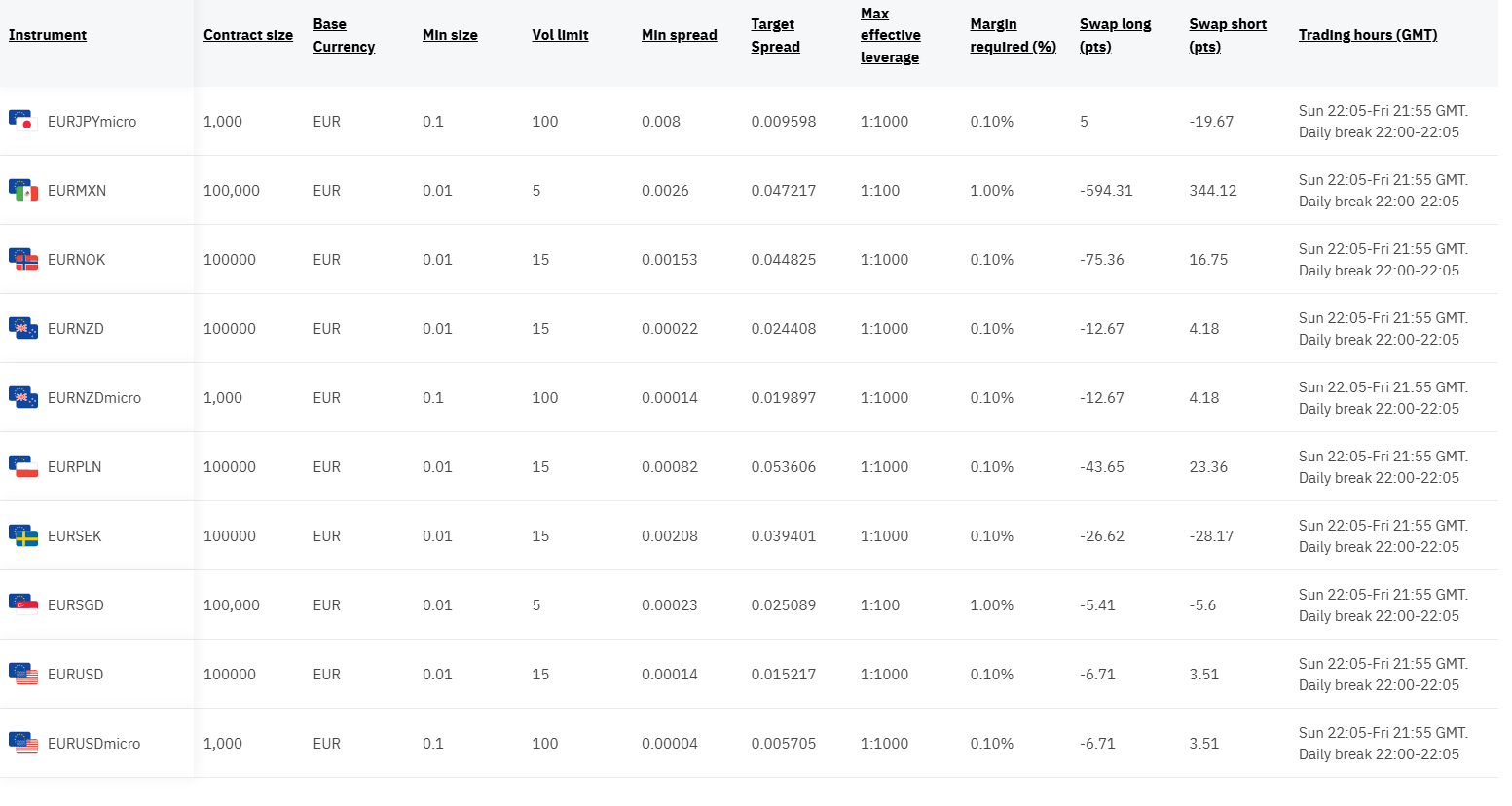

1. Spread

Deriv spreads start from 1.4 pips. Deriv has also designed Micro Lot Size Trading on specific currency pairs like EUR/USD micro, EUR/JPY micro, EUR/NZD micro, etc.

When trading micro lot sized instruments at Deriv, the spread starts from 0.4 pips.

2. Deriv Commission

Deriv does not charge commissions on their trades (except you are trading with the Zero-Spread Account) so you trade forex, stocks, crypto, gold, indices etc. with zero-commissions.

However, on the Zero Spread Account the Deriv Commission is not fixed & depends on the instrument being traded. The Deriv commission is as high as $4.5 per side when trading forex CFDs.

3.Overnight Fees (swaps)

Deriv charges overnight fees on CFD trades kept open till the next day but to avoid paying swaps you can open the Deriv MT5 Swap-Free Account.

4. Inactivity Fees

Deriv inactivity fee is $25 and it is charged every month on Deriv accounts that have been left dormant for one year.

Is Deriv A Market Maker?

Yes, Deriv is a market maker because they don't charge commissions, so they increase the Bid/Ask spread to make up for the zero-commission.

Range of Markets - 4.5/5

CFDs

The CFDs you can trade on Deriv, depend on your account type.

1. Derived Account CFDs

If you open a Deriv MT5 Derived Account type, you can trade CFDs on Synthetic Indices, Basket indices & Derived FX.

2. Financial Account CFDs

If you open a Deriv MT5 Financial Account, you can trade CFDs on Forex, Stocks, Equity Indices, Commodities, Crypto & ETFs

3. Swap-Free Account CFDs

if you open a Deriv MT5 Swap-free Account, you can trade CFDs on Forex (no exotic pairs), Stocks, Indices, Commodities, Crypto, ETFs & Synthetic Indices.

Options

Deriv allows you to trade Option Contracts on over 50 instruments including Gold Basket options, Forex Basket Options, Indices Options, Crypto Options etc.

| 🛒CFD | #️⃣Number | 🚀Leverage |

| Forex | 70+ | 1:1000 |

| Commodities (including XAU/USD) | 20+ | 1:500 |

| Equity Indices (including Nasdaq) | 20+ | 1:100 |

| Derived Indices | 60+ | 1:4000 |

| Tactical Indices | 4 | 1:500 |

| Stocks | 70+ | 1:10 |

| Crypto | 30+ | 1:100 |

| ETFs | 40+ | 1:5 |

Deriv Platforms - 3.6/5

1. Deriv MT5 (for trading CFDs)

Deriv offers MT5 as a trading platform on Desktop, Mobile Phone & Web Browser.

You can also trade on Deriv MT5 using your Demo Account.

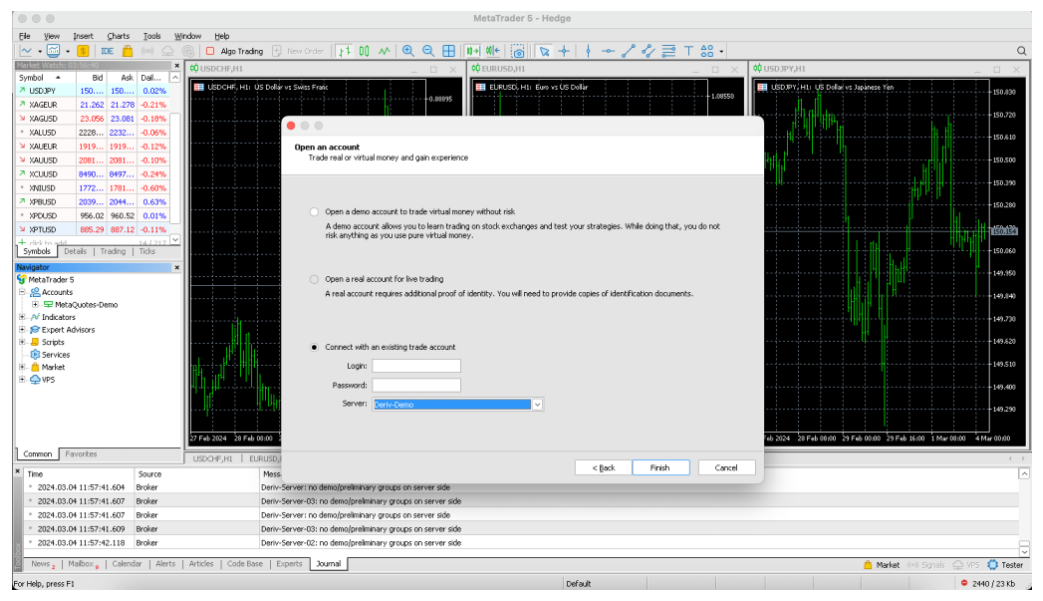

How to Connect Deriv to MT5

To logon to your MT5, check your email for the Deriv MT5 login details that were sent to you after you opened your account.

Download the Deriv MT5 platform for Desktop or Mobile then click on "File" then click on "connect to existing trade account"

Enter your MT5 account number & password (that were sent to your email) then select the server name (Kenyans should select Deriv SVG LLC server). When you are done, click on "connect" to login to your Deriv MT5

2. Deriv cTrader (for trading CFDs)

Deriv also offers cTrader in mobile & desktop versions. Simply download the cTrader platform and login with your cTrader ID.

With Deriv cTrader you can trade synthetic indices 24/7 (even on weekends) & you can also copy trades of other Deriv traders.

3. Deriv X Platform (for trading CFDs)

Deriv X is the mobile app that ws designed for CFD trading. The flagship feature of the Deriv X mobile app, is that the charts look like TradingView charts so they are very detailed.

4. Deriv Trader Web Platform (for trading Options)

Deriv Trader is a web based trading platform specifically designed for trading option contracts. To access the platform, go to the Deriv website, click on "platforms", click on "Deriv trader", then click on "trade now''.

5. Deriv Bot Platform (for trading Options)

Deriv Bot is a platform designed for you to build trading robots easily by dragging & dropping their different components onto the canvas.

With Deriv Bot, you have the option of building your robot from scratch, uploading a robot from your device or simply selecting an already made strategy & implementing it.

6. Deriv GO (for trading Options)

Deriv GO is a mobile app designed fro you to trade option contracts. Deriv GO is available on Google Playstore & Apple stores.

7. Deriv Smart Trader (for trading Binary Options)

Deriv Smart Trader is a web based platform designed for trading Binary Options. You choose an instrument, select the stake size, choose the direction you think the market will go & then your purchase the contract. If you are correct you will make a profit, but if you are wrong you will lose all your stake.

Deriv Tools - 2/5

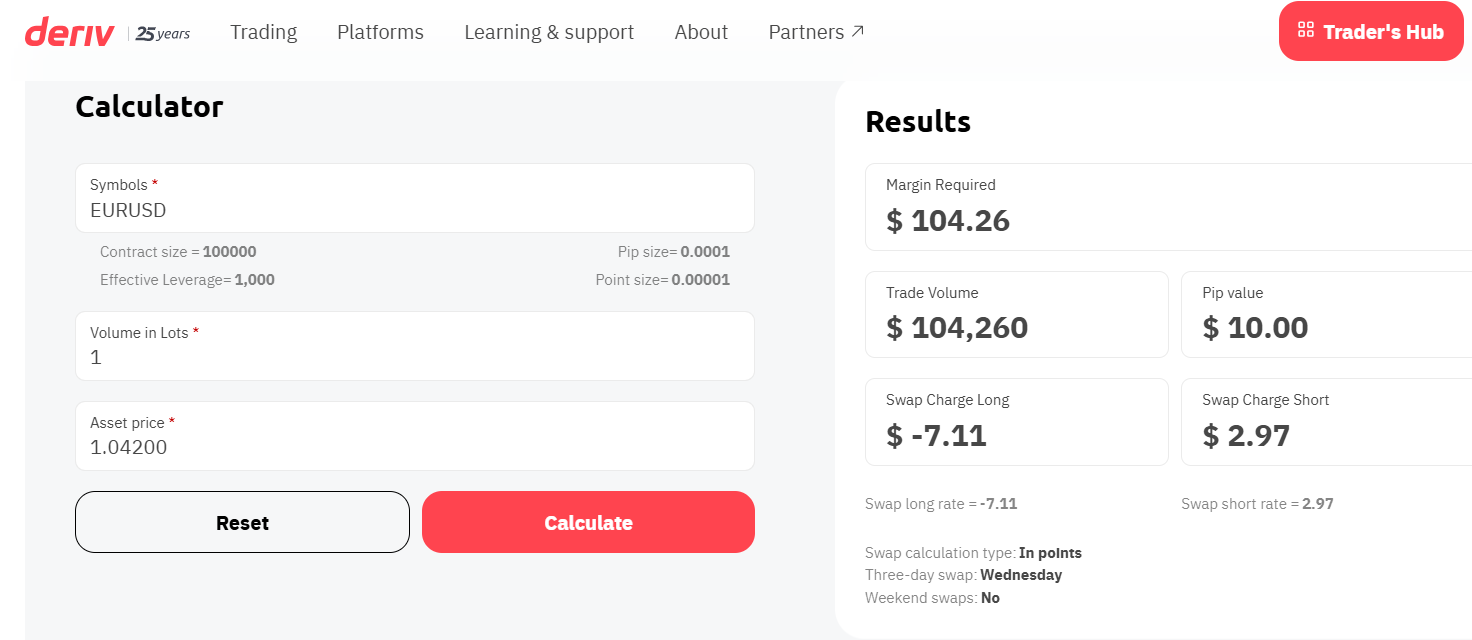

1. Trading Calculator

Deriv offers a trading calculator which has basic features and is not very advanced. It helps you calculate margin required to open a trade, pip value & swap value. Most brokers offer more advanced calculators than Deriv does.

2. Deriv Product Explorer Tool

because Deriv offers so many trading instruments, it is possible to get confused. The Deriv Product Explorer is designed to help you sort & find the instruments you want to trade.

You can apply several sorting filters like, Options, CFDs, Volatility, Trading Platforms, Asset Class, etc.

3. Deriv Economic Calendar

Deriv has an economic calendar that shows you the dates when important economic data like Nonfarm Payroll, CPI, PCE, Interest Rates, etc. are going to be released.

Deriv Customer Support - 4/5

1. Live Chat

Deriv has a 24/7 live chat communication feature where you can chat with a Deriv Agent or Bot, to resolve issues.

Getting a live agent to respond to you is always difficult as you have to wait over 15 minutes and this is a minus.

2. WhatsApp

You can also reach out to Deriv via WhatsApp to chat with a live agent 24/7. WhatsApp is the fastest way to contact Deriv and the response time is instant.

3. Email

You can send a mail to Deriv support and you will get a response in around 1 hour.

4. Deriv Community

Deriv has created a community discussion forum where you can chat with other Deriv traders in Kenya & share your experience with them. This makes for free & transparent flow of information at Deriv.

| 🎧 Live Chat Support | Yes |

| 📧 Email Support | Yes |

| 📞 Telephone Support | Yes |

| 📖 Help Center | Yes |

| 👨 Personal Account Manager | No |

| 👩🏫 Academy | Yes |

Final Verdict - 6.6/10

Deriv is not a CMA regulated forex broker so you should proceed cautiously because your accounts will not be registered under Kenyan laws.