Connect with Broker

Get in touch with Broker and connect

Not a very high tech broker, they are only good for beginners. The lack a variety of platforms such as cTrader and TradingView, their mobile app is also not too sophisticated

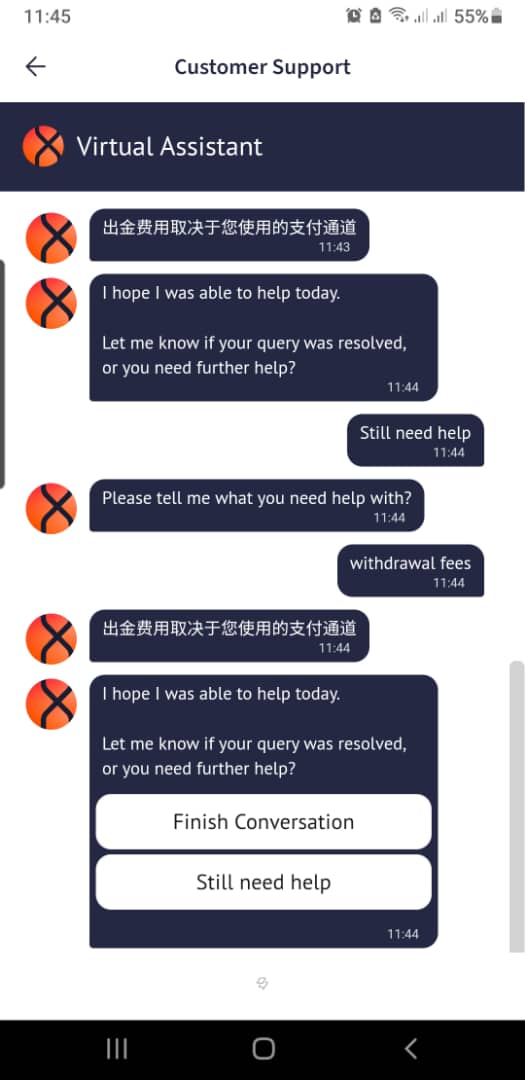

Very nonsense customer support. I tried to chat with a customer agent via FXTM mobile app to ask about withdrawal fees but the agent was an AI bot and it responded in Chinese language instead

I wish they had TradingView so i give them 3 starts but they are good broker for starters

Excellent customer support, FXTM is very beginner friendly but they should re-introduce the micro account

I just started trading with FXTM 5 months ago and its all good with affordable minimum deposit and fast MT5 platform, my only worry is that the spreads are a bit high

I see some comments here saying FXTM minimum deposit is high, that has now changed. I just opened an account with FXTM and their minimum deposit in Nigeria is NGN 7,000 which is around $5. FXTM low minimum deposit and easy account opening (under 5 minutes) is what attracted me to them.

I used to trade with fxtm 3 years ago but after the Nigerian government blocked their website I had to move on to another broker. FXTM also stopped offering the micro account which was loved by beginners, they have grown more and more distant from their consumer base

This broker is for rich people, if you dont have money dont near them. But their services are good, if you want to trade with them better open ECN Advantage account where the spread is more transparent.

Their fees are too high, whats going on FXTM? Dont you see what other brokers are doing, why are you being so ridiculous? I would have coped with the high spreads exceeding 2 pips but when I want to withdraw its just fee after fee after fee. The withdrawal fees are not even uniform

A very expensive broker to trade with, FXTM is definitely not meant for beginners, I can see why they discontinued the micro accounts. Their fees are simply too high; fees on deposits, fees on withdrawals, high spreads etc. With all the money they are charging one would expect better service and at least they should be on TradingView platform

Its difficult opening an account as the wait time is long, every step of the pricess they tell you to wait 24 hours liike really? I had to move to another broker

FXTM is a regulated broker that offers ECN Pricing on its MT4/5 Platforms

| 👨 Broker | Exinity |

| 👨 Trading Name | FXTM |

| 👨 Accepts Nigerian Traders | Yes |

| 📅 Year Founded | 2011 |

| ⚖ Regulators | FSC Mauritius |

| 📈 CFD Instruments | Forex, Commodities, Indices, Shares, ETFs, Crypto, Futures, Crosses |

| 🚀Leverage | 1:3000 |

| 🔎Auditors | - |

| 💻 Platforms | MT4, MT5, FXTM Trader |

| 📋Account Types | Advantage, Advantage Plus |

| 💰 Minimum Deposit | First Deposit N550,000, Subsequent Deposits N50,000 |

| 💰 Minimum Withrawal | N50,000 (without fees), N1,000 (with fees) |

| 💱Base Currency | NGN, USD |

| 📞Live Support | 24/5 |

| 🏖️ Inactivity Fee | $10 |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

FXTM Regulation - 6/10

Exinity LTD trading as FXTM, is a totally legit broker that operates with license number C113012295 issued by the Financial Services Commission (FSC) in Mauritius.

Although FXTM is not regulated by the Nigerian government, their FSC Mauritius license gives them a legal standing to operate internationally.

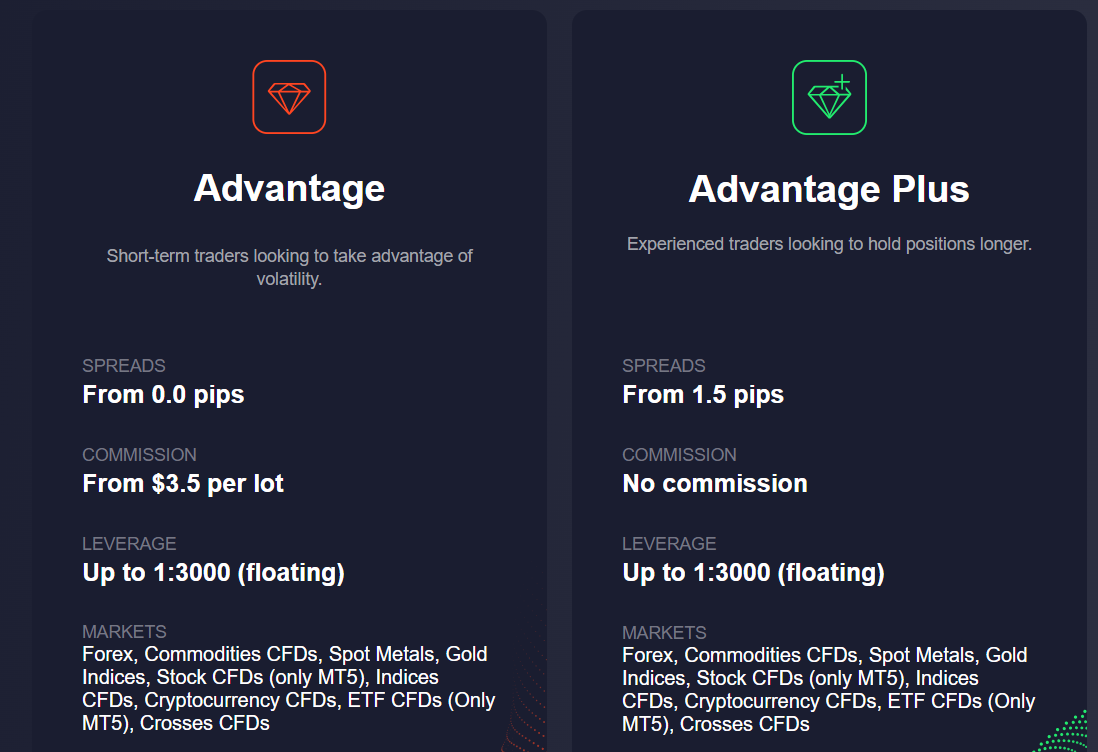

FXTM Trading Account Types - 6/10

FXTM does not have Micro Account types but they offer two Standard Accounts for CFD trading:

1. Advantage Account

This account has the lowest spreads of all FXTM account types but in return, you must pay a fixed amount of miney (commission) on every trade you take.

2. Advantage Plus Account

This account has higher spreads than the Advantage Account we just discussd above, but you dont pay any commission on trades.

Deposit & Withdrawal - 5/10

FXTM Minimum Deposit in Nigerian Naira

For your first deposit, FXTM minimum deposit is N550,000 or $200 but this only applies to the first deposit you make after opening your account.

For your second/subsequent deposits into your trading account, the FXTM minimum deposit is N50,000 but if you want to deposit below this amount, you will be charged an FXTM deposit fee of N5,000.

The FXTM minimum deposit is the same for all their account types.

FXTM Minimum Withdrawal

FXTM minimum withdrawal in Nigeria is N1,000 or $1 but these kind of small withdrawals attract an FXTM withdrawal fee which we will discuss later in this review. To avoid being charged for withdrawals, you must withdraw an amount from N50,000 and above.

FXTM Fees - 5/10

1. Spread & Commission

FXTM spread is from 1.5 pips on the Advantage Plus Account, and this account doesnt charge commissions per trde.

The spread on the Advantage Account is from 0.0 pips but in return for this low spread you must pay a commission of $3.5 per side per standard lot traded.

2. Deposit & Withdrawal Fees

FXTM withdrawal fee is N5,000 for withdrawals below N50,000. Any deposits below N50,000 will also attract a N5,000 fee.

3. Inactivity Fees

FXTM inactivity fees is $10 & it is charged to trading accounts that have been inactive for more than 3 months.

Account Management - 7/10

Number of Trading Accounts

At FXTM you can open an unlimited number of trading accounts, and manage them from your personal area.

Account Currency

FXTM has naira account currency, so your trade transactions can be displayed in naira. USD account currency is also available at FXTM.

Leverage

FXTM leverage is up to 1:3000 and you can edit your account leverage from your client area.

Margin Call & Stop Out

At FXTM, you will get a margin call when your margin level drops to 100% and you will be stopped out of your trades when your margin level falls to 50%.

Platforms - 5/10

FXTM does not have TradingView charting platform and does not have their own web trader. However, they have desktop and mobile versions of MT4 & MT5 as well as an FXTM mobile app for android & apple devices.

Trading Tools - 8/10

1. Margin Calculator

The FXTM margin calculator is designed to help beginners estimate how much they need to have in their account before they can trade a specified lot size of any instrument.

2. Pip Calculator

The FXTM pip calculator helps beginners estimate how much they will profit or lose on a particular lot size, every time price changes by one pip.

3. FXTM Currency Converter

The currency converter helps you find out how much one currency is worth in another currency.

4. Economic Calendar

The economic calendar tool notifies you in advance of important news events that can affect the markets 9such as NFP, CPI, PCE, Interest rate Decision, etc.).

5. Dividend Calendar

The dividend calendar notifies you on advance of when companies are going to pay dividends on their stocks, so you can know if you will receive or be debited for dividend depending on the position you are holding (whether buy or sell).

Range of Markets - 6/10

1. Forex

You can trade 45 corex pairs using CFD contracts and leverage reaching 1:3000.

2. Spot Metals

FXTM has 9 spot metal pairs which you can trade with CFD contracts.For example FXTM has XAU/USD with 1:3000 leverage and spread of 9 pips.

3. Other Commodities

You can trade soft commodities such as cotton, coffee; as well as energies such as NatGas, Oil, etc. using CFD contracts . Leverage is up to 1:500 when trading commodities.

4. Indices

FXTM has a limited number of Indices CFDS which are: US30, NAS100, S&P 500 and GER40. These indices can be traded with up to 1:3000 leverage.

5. ETFs

You can trade 43 ETFs using CFD contracts and leverage up to 1:10.

6. Crypto

You can trade 31 Cryptocurrency pairs using CFD contracts and leverage up to 1:1000.

7. Stocks

You can trade 600 U.S. Stocks using CFD contracts and leverage up to 1:1.

Customer Support - 7/10

FXTM customer support is open 24/5 on week days and you can reach them through live chat where they respond immediately. FXTM also has emai and telephone support teams for Nigeria.

Final Verdict - 6/10

FXTM is not a bad broker but they are very expensive to use, and may not be conducive for beginners.