FXTM (Exinity) Kenya Review

Everything you need to know about FXTM operations in Kenya

Not a very high tech broker, they are only good for beginners. The lack a variety of platforms such as cTrader and TradingView, their mobile app is also not too sophisticated

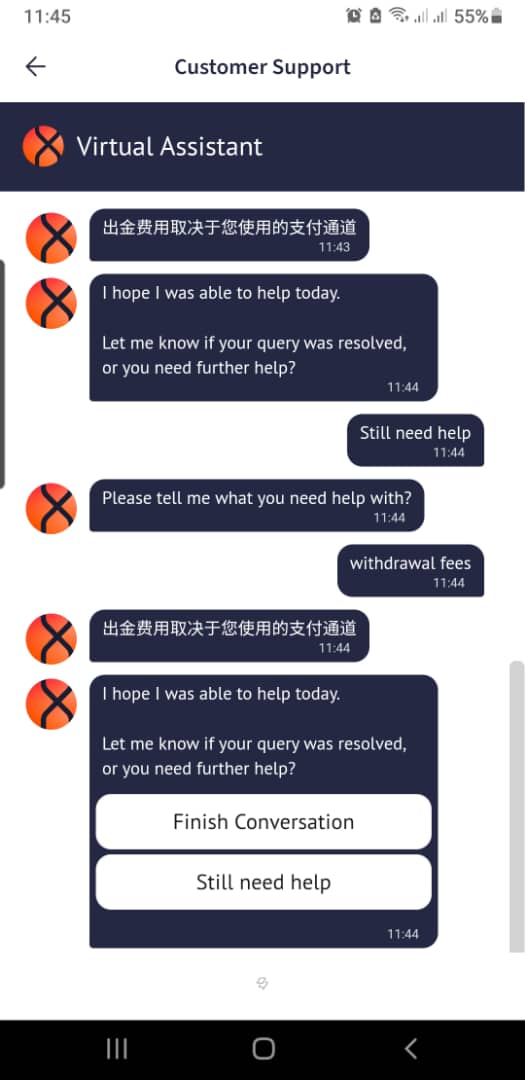

Very nonsense customer support. I tried to chat with a customer agent via FXTM mobile app to ask about withdrawal fees but the agent was an AI bot and it responded in Chinese language instead

I wish they had TradingView so i give them 3 starts but they are good broker for starters

Excellent customer support, FXTM is very beginner friendly but they should re-introduce the micro account

I just started trading with FXTM 5 months ago and its all good with affordable minimum deposit and fast MT5 platform, my only worry is that the spreads are a bit high

I see some comments here saying FXTM minimum deposit is high, that has now changed. I just opened an account with FXTM and their minimum deposit in Nigeria is NGN 7,000 which is around $5. FXTM low minimum deposit and easy account opening (under 5 minutes) is what attracted me to them.

I used to trade with fxtm 3 years ago but after the Nigerian government blocked their website I had to move on to another broker. FXTM also stopped offering the micro account which was loved by beginners, they have grown more and more distant from their consumer base

This broker is for rich people, if you dont have money dont near them. But their services are good, if you want to trade with them better open ECN Advantage account where the spread is more transparent.

Their fees are too high, whats going on FXTM? Dont you see what other brokers are doing, why are you being so ridiculous? I would have coped with the high spreads exceeding 2 pips but when I want to withdraw its just fee after fee after fee. The withdrawal fees are not even uniform

A very expensive broker to trade with, FXTM is definitely not meant for beginners, I can see why they discontinued the micro accounts. Their fees are simply too high; fees on deposits, fees on withdrawals, high spreads etc. With all the money they are charging one would expect better service and at least they should be on TradingView platform

Its difficult opening an account as the wait time is long, every step of the pricess they tell you to wait 24 hours liike really? I had to move to another broker

FXTM Kenya is a CMA Regulated Forex Broker that offers ECN Pricing on its MT4/5 Platforms

| 👨 Broker | Exinity |

| 👨 Trading Name | FXTM |

| 👨 Accepts Kenyan Traders | Yes |

| 📅 Year Founded | 2011 |

| ⚖ Regulators | CMA kenya |

| 📈 CFD Instruments | Forex, Commodities, Indices, Shares, ETFs, Crypto, Futures, Crosses |

| 🚀Leverage | 1:400 |

| 💻 Platforms | MT4, MT5, FXTM Trader |

| 📋Account Types | Advantage, Advantage Plus |

| 💰 Minimum Deposit | $5 |

| 💰 Minimum Withrawal | $0 |

| 💱Base Currency | KES, USD |

| 📞Live Support | 24/5 |

| 🏖️ Inactivity Fee | $10 |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

FXTM Regulation - 6/10

Exinity LTD trading as FXTM, is availabe in Kenya where they are regulated by the Capital Markets Authority (CMA) in Kenya. their CMA license number is 135 and we verified this from the CMA website.

FXTM Trading Account Types - 6/10

FXTM does not have Micro Account types but they offer two Standard Accounts for CFD trading:

1. Advantage Account

This account has the lowest spreads of all FXTM account types but in return, you must pay a fixed amount of money (commission) on every trade you take.

2. Advantage Plus Account

This account has higher spreads than the Advantage Account we just discussd above, but you dont pay any commission on trades.

Deposit & Withdrawal - 8/10

FXTM Minimum Deposit in Nigerian Naira

FXTM minimum deposit is $5 USD for all deposit methods and account types .

FXTM Minimum Withdrawal

FXTM minimum withdrawal in Nigeria is $0 so you can withdraw any amount you wish to

FXTM Fees - 5/10

1. Spread & Commission

FXTM spread is from 1.5 pips on the Advantage Plus Account, and this account doesnt charge commissions per trde.

The spread on the Advantage Account is from 0.0 pips but in return for this low spread you must pay a commission of $3.5 per side per standard lot traded.

2. Deposit & Withdrawal Fees

FXTM does not charge any fees on deposts and withdrawals.

3. Inactivity Fees

FXTM inactivity fees is $10 and it is charged to trading accounts that have been inactive for more than 3 months.

Account Management - 8/10

Account Opening

Account opening at FXTM is fast, and it takes under 10 minutes to complete. FXTM allows non-document verification meaning you dont need to snap and upload your ID document, you just enter the document number (such as drivers license number etc.).

At FXTM you dont need to upload a separate proof of address document, as long as you enter your kenyan national ID number which already has your address registered to it.

Number of Trading Accounts

At FXTM you can open an unlimited number of trading accounts, and manage them from your personal area.

Account Currency

FXTM has KES account currency, so your trade transactions can be displayed in KES. The USD account currency is also available at FXTM.

Leverage

FXTM leverage is up to 1:400 and you can edit your account leverage from your client area.

Margin Call & Stop Out

At FXTM, you will get a margin call when your margin level drops to 100% and you will be stopped out of your trades when your margin level falls to 50%.

Platforms - 5/10

FXTM does not have TradingView charting platform and does not have their own web trader. However, they have desktop and mobile versions of MT4 & MT5 as well as an FXTM mobile app for android & apple devices.

Trading Tools - 8/10

1. Margin Calculator

The FXTM margin calculator is designed to help beginners estimate how much they need to have in their account before they can trade a specified lot size of any instrument.

2. Pip Calculator

The FXTM pip calculator helps beginners estimate how much they will profit or lose on a particular lot size, every time price changes by one pip.

3. FXTM Currency Converter

The currency converter helps you find out how much one currency is worth in another currency.

4. Economic Calendar

The economic calendar tool notifies you in advance of important news events that can affect the markets 9such as NFP, CPI, PCE, Interest rate Decision, etc.).

5. Dividend Calendar

The dividend calendar notifies you on advance of when companies are going to pay dividends on their stocks, so you can know if you will receive or be debited for dividend depending on the position you are holding (whether buy or sell).

Range of Markets - 6/10

1. Forex

You can trade 45 forex pairs using CFD contracts and leverage reaching 1:400.

2. Spot Metals

FXTM has 9 spot metal pairs which you can trade with CFD contracts.For example FXTM has XAU/USD with 1:400 leverage and spread of 9 pips.

3. Other Commodities

You can trade soft commodities such as cotton, coffee; as well as energies such as Nat Gas, Oil, etc. using CFD contracts . Leverage is up to 1:400 when trading commodities.

4. Indices

FXTM has a limited number of Indices CFDS which are: US30, NAS100, S&P 500 and GER40. These indices can be traded with up to 1:400 leverage.

5. ETFs

You can trade 43 ETFs using CFD contracts and leverage up to 1:10.

6. Crypto

You can trade 31 Cryptocurrency pairs using CFD contracts and leverage up to 1:200.

7. Stocks

You can trade 600 U.S. Stocks using CFD contracts and leverage up to 1:1.

Customer Support - 7/10

FXTM customer support is open 24/5 on week days and you can reach them through live chat where they respond immediately. FXTM also has email and telephone support teams for Kenya.

For beginners, FXTM offers basic beginner education, account managers and a demo account for practice.,/p>

Final Verdict - 8 /10

FXTM is one of the best forex brokers in Kenya for beginners.