Tickmill South Africa Review

Our unbiased review of Tickmill trading conditions & operations in South Africa

!! Regulator Warning !!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The new mobile app is so user friendly. Tickmill should allow standard account users also access TradingView because right now only raw spread accounts users are allowed to connect to TradingView. The deposit time is fast but the withdrawal time is around 2 days which is not great.

This broker is always improving, execution speed is fast and customer support is the best. I hear they pay interest on deposits but I have never received any. They should also work on their deposit bonus the way it is now you must deposit at least $100 to qualify for bonus which is too high. Lastly the withdrawal time is not good, it takes too long.

The new Tickmill mobile app is excellent, and the addition of TradingView is great. Customer support is also topnotch, the only down side is the deposit/withdrawal methods are not many and instant withdrawal is absent

They like to delay withdrawal for days. Forget instant withdrawal, you will never get it with them. You will be lucy to get your withdrawals after 2 working days.

I like that you can cancel a withdrawal after initiating it. I also love the Tickmill Trader mobile app, its the most sophisticated I have seen so far.

A very very good broker, I recommend Tickmill because their MT5 is perfect, no lagging, no glitches etc. They also keep evolving and improving which is the sign of a serious broker, recently they have added TradingView.

If you trade with Tickmill and are always unprofitable then maybe the problem is you, because tickmill provides you all the tools you need especially the acuity trading tools are excellent. Keep it up tickmill

top class broker with world class regulation. however i cannot say ther customer support is the best, it needs improvement.

Very transparent with their spreads and they are highly regulated. They dont play the games these small brokers play (i mean stop luss hunting etc). I have traded with them for 2 years now using a raw spread account and they are great. They should work on this their new mobile app called tickmill trader, to make it more easy to setup

Hard time opening an account with Tickmill. They keep rejecting my means of ID even when this is the same ID I used to open an account with other brokers. Their customer support sucks

I had issues trying to connect my Tickmill account to TradingView. I know this is a new feature but they should perfect it soon enough.

Tickmill your minimum withdrawal is too high at 25 USD. Why not keep it low like other brokers do? Other than that i enjoyed trading with Tickmill using their Raw Account which has very transparent spreads. Tickmill also has a lot of high-end tools which i found very helpful when I was starting out.

The spreads on their Standard (Classic) Account is too high, if they don't want people to use the standard account they should cancel it and only offer Raw Account. How can one pay up to 1.6 pips on EUR/USD? The only account they have that makes sense is the Raw Account but not everybody is used to trading with commissions.

Tickmill does not have Naira account & that's the only thing i don't like about them. But their platforms are top notch & execution speed is high. Their spreads are also stable with no unnecessary widening of spread like some brokers do

Tickmill is an international forex broker under strong regulation from the FCA UK, & also accepts clients from Africa

| 👨 Broker | Tickmill South Africa |

| 👨 Accepts South African Traders? | Yes |

| 📅 Year Founded | 2014 |

| ⚖ Regulators | FSCA |

| ⚖ License Type | FSP & ODP |

| 📈 CFD Markets | Forex, Stock Indices, Commodities, Bonds, Crypto, Stocks |

| 📈 Futures & Option Markets | Forex, Stock Indices, Commodities, Bonds, Stocks |

| 🚀Leverage | 1:1000 |

| 💻 Platforms | MT4, MT5, Tickmill Mobile App, Tickmill Web Terminal, TradingView. |

| 📋Account Types | Classic, Raw, Tickmill Trader Raw |

| 💰 Minimum Deposit | 100 ZAR |

| 💰 Minimum Withdrawal | 25 ZAR |

| 📞Live Support | 24/5 |

| 🏖️ Inactivity Fee | $0 |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

Regulation - 10/10

Is Tickmill in South Africa?

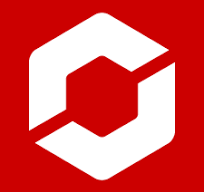

Yes, Tickmill is in South Africa & is regulated by the Financial Sector Conduct Authority (FSCA) which is the watchdog for the financial markets in SA.

The FSCA has also authorized Tickmill to operate as a market maker by issuing it an ODP license.

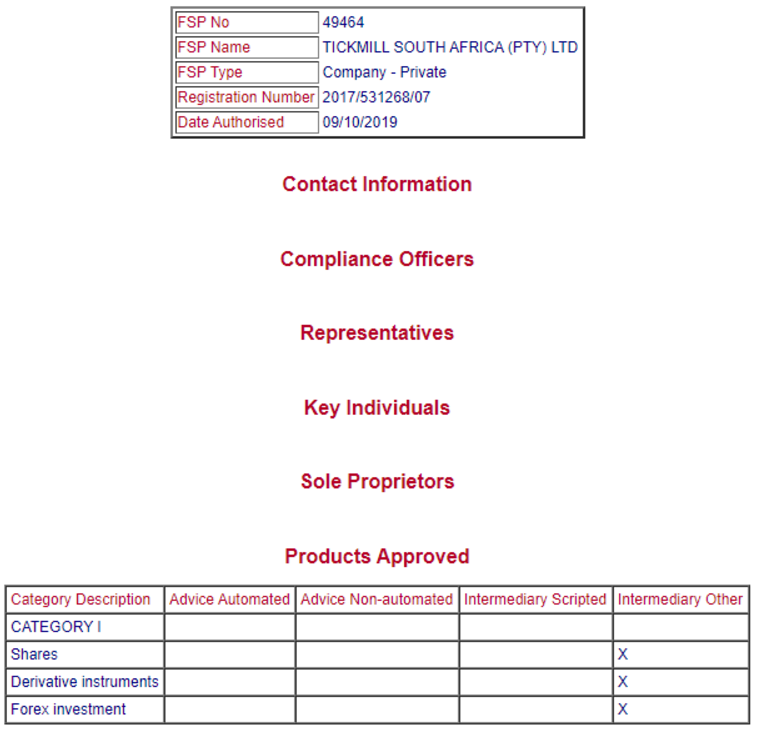

Tickmill is also regulated in Seychelles by the Financial Services Authority (FSA).

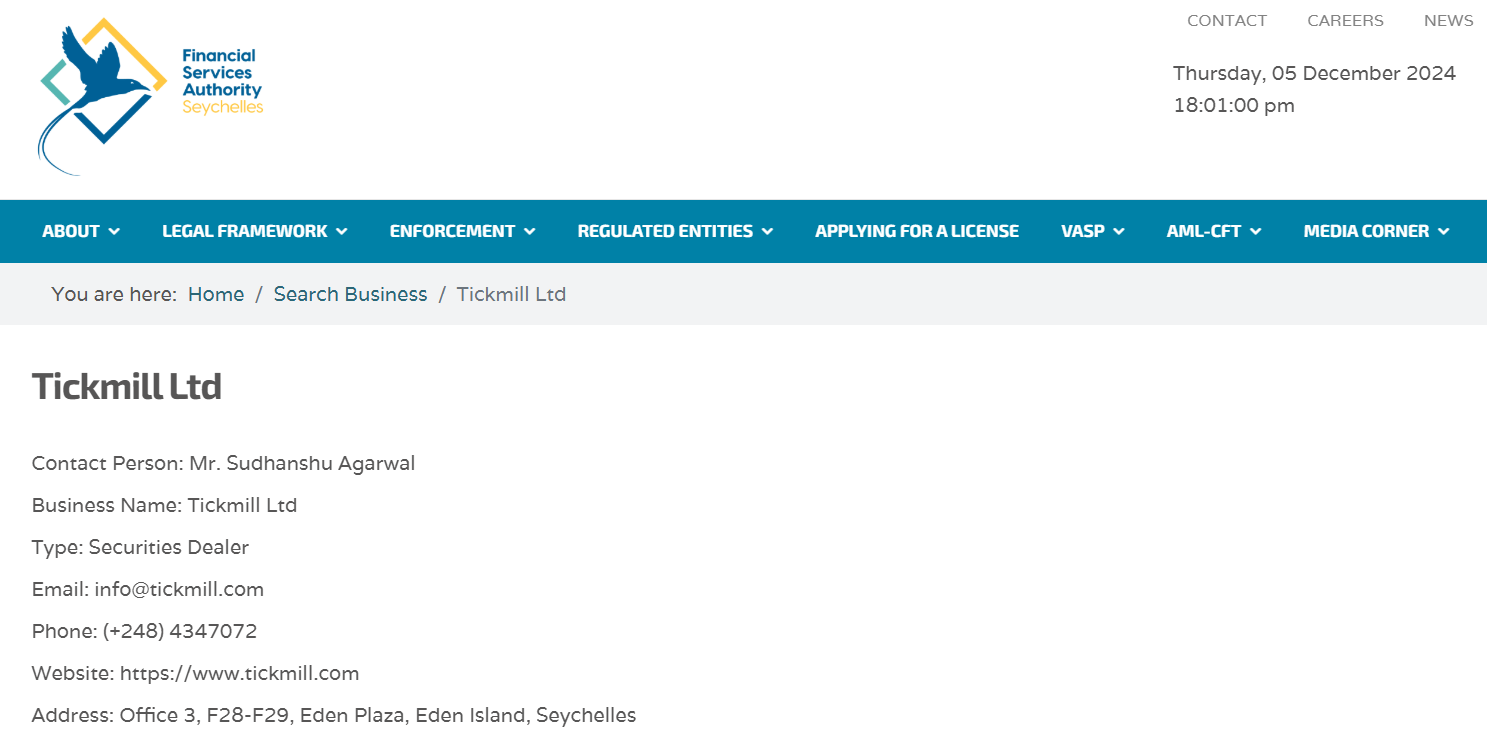

In the United Kingdom, Tickmill UK LTD is regualated by the Financial Conduct Authority (FCA), & a member of the Financial Services Compensation Scheme (FSCS) for UK traders.

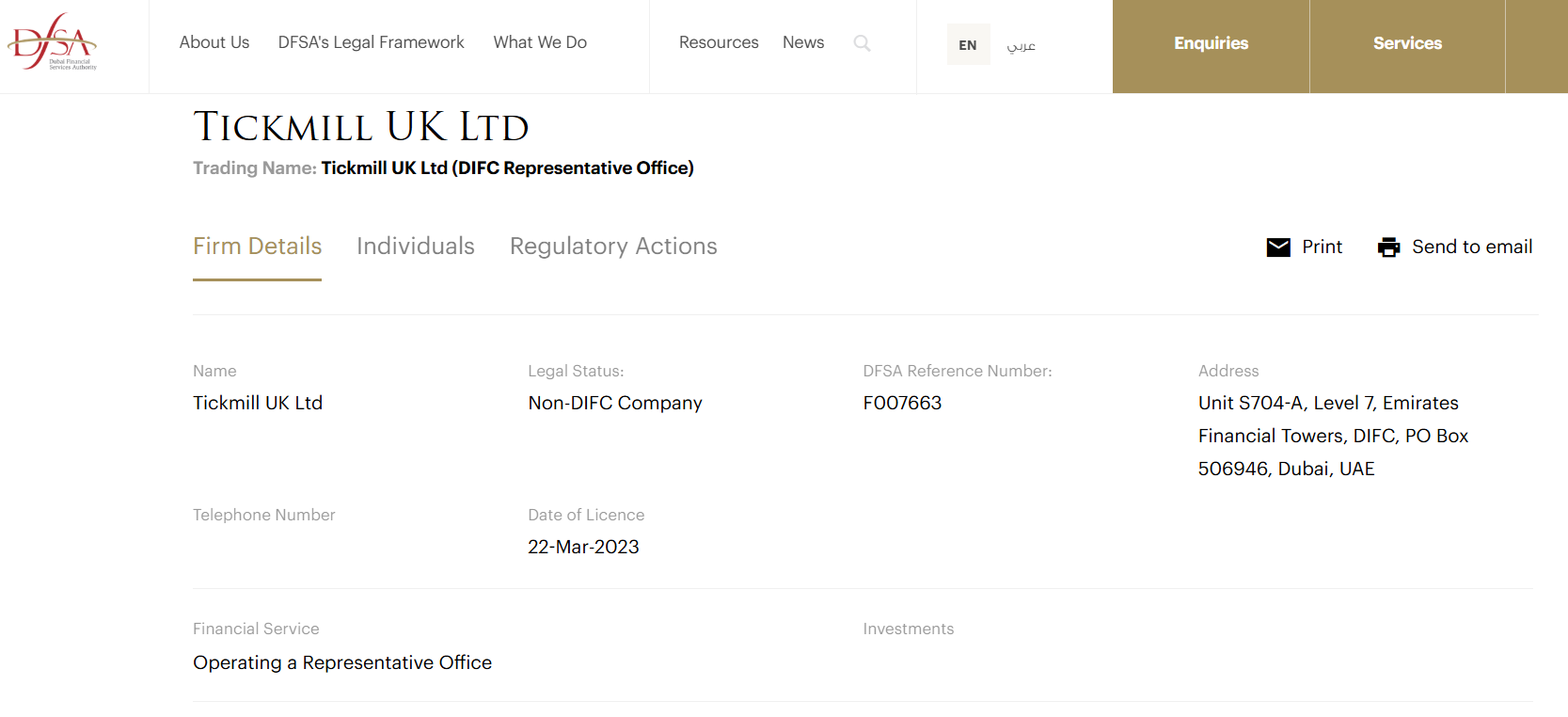

Tickmill UK LTD is also regulated in Dubai by the Dubai Financial Services Authority (DFSA).

Tickmill Regulation Summary

| 📍Country | ⚖️Regulator | #️⃣License No. | 📅Date License Issued | 🔒Trust |

| South Africa | FSCA | FSP 49464 | 2019 | High |

| FSA | Seychelles | SD 008 | Low | |

| FCA | UK | 801701 | 2016 | High |

| Dubai | DFSA | F007663 | High | |

| CySEC | Cyprus | 278/15 | 2015 | Medium |

Range of Markets - 9/10

Tickmill traders in South Africa can trade using CFDs or they can trade Futures/Options.

When trading CFDs, South African traders can access up to 1:1000 leverage but when trading Futures/Options, leverage cannot exceed 1:30.

1. Forex CFDs

Tickmill allows you trade all the major currency pairs such as EUR/USD, USD/JPY, USD/CAD etc. as well as minor & exotic pairs.

2. Index CFDs

Popular indices such as Nasdaq & US Dollar Index are part of the menu & you get to trade over 20 indices at Tickmill. You can also trade the Africa40 index CFD which exposes you to the African market.

3. Commodity CFDs

Both soft & hard commodities are on the menu. You can trade Gold/USD pair, Silver/USD pair, Coffee, Sugar, Crude Oil & Natural Gas CFDs etc.

4. Bond CFDs

At Tickmill you can trade CFDs on German Bonds & this gives you exposure to the fixed income market.

5. Crypto CFDs

Tickmill also allows you trade CFDs on several popular cryptocurrencies including Bitcoin, Ethereum, Litecoin, Cardano, Ripple, Stellar, Chainlink, Solana and EOS.

5. Stock & ETF CFDs

You can trade stock & ETF CFDs on popular leading companies from USA, Europe etc. Tickmill also pays proportional dividends when these companies are paying out dividends.

Tickmill also provides an Earnings Calendar so you know when the companies are publishing their earning reports.

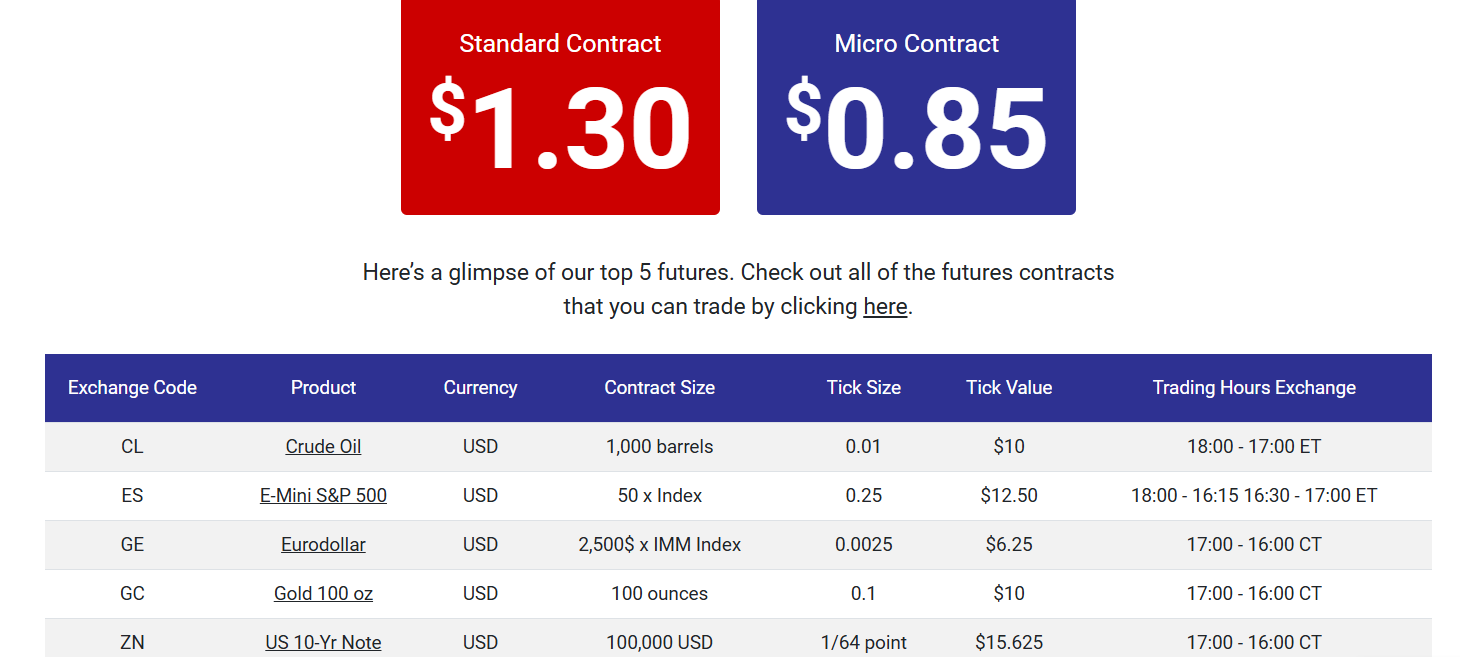

6. Futures & Options Trading

You can trade over 100+ Standard & Mini Futures & Options Contracts with Tickmill UK entity.

These are real Exchange Traded Derivatives (and not CFDs) so they carry more risk. The minimum amount for trading Futures & Options at Tickmill is 1,000 USD.

The Futures & Options contracts are derived from global stock exchanges like CME, COMEX, CBOT, NYMEX and EUREX.

Tickmill Futures & Options span several asset classes but some of the most popular Futures are: Gold Futures, Eurodollar Futures, S&P 500 Mini-Futures, Crude Oil Futures & US 10 Year Note Futures.

| 🛒Product | #️⃣Number | 🚀Leverage | 🌙Swap Free Trading | |

| Forex CFD | 60+ | 1:1000 | No | |

| Stocks CFD | 480 | 1:20 | No | |

| Index CFD | 20 | 1:100 | No | |

| ETF CFD | 20 | 1:20 | No | |

| Bond CFD | 3 | 1:100 | No | |

| Commodity CFD | 10 | 1:100 | No | |

| Crypto CFD | 9 | 1:200 | No | |

| Futures & Options Contracts | 100+ | 1:20 | No |

Funding & Withdrawal - 5/10

What is Tickmill Minimum Deposit in ZAR?

The Tickmill minimum deposit is 100 ZAR when you are trading CFDs. However if you intend to trade Futures & Options at Tickmill, the minimum deposit is higher at 1,000 USD.

100 ZAR is the least amount CFD traders must deposit into their Tickmill trading account at all times. If you attempt to deposit below the minimum deposit, the submit button will be deactivated.

Tickmill Minimum Withdrawal

The Tickmill minimum withdrawal is $25 or 25 ZAR for all withdrawal methods.

Tickmill Withdrawal Time

Tickmill does not have instant withdrawal, their withdrawals take up to 7 days to reach your account.

If you are withdrawing via bank transfer, you need to withdraw to the exact bank account you used to deposit if not your withdrawal request will be declined.

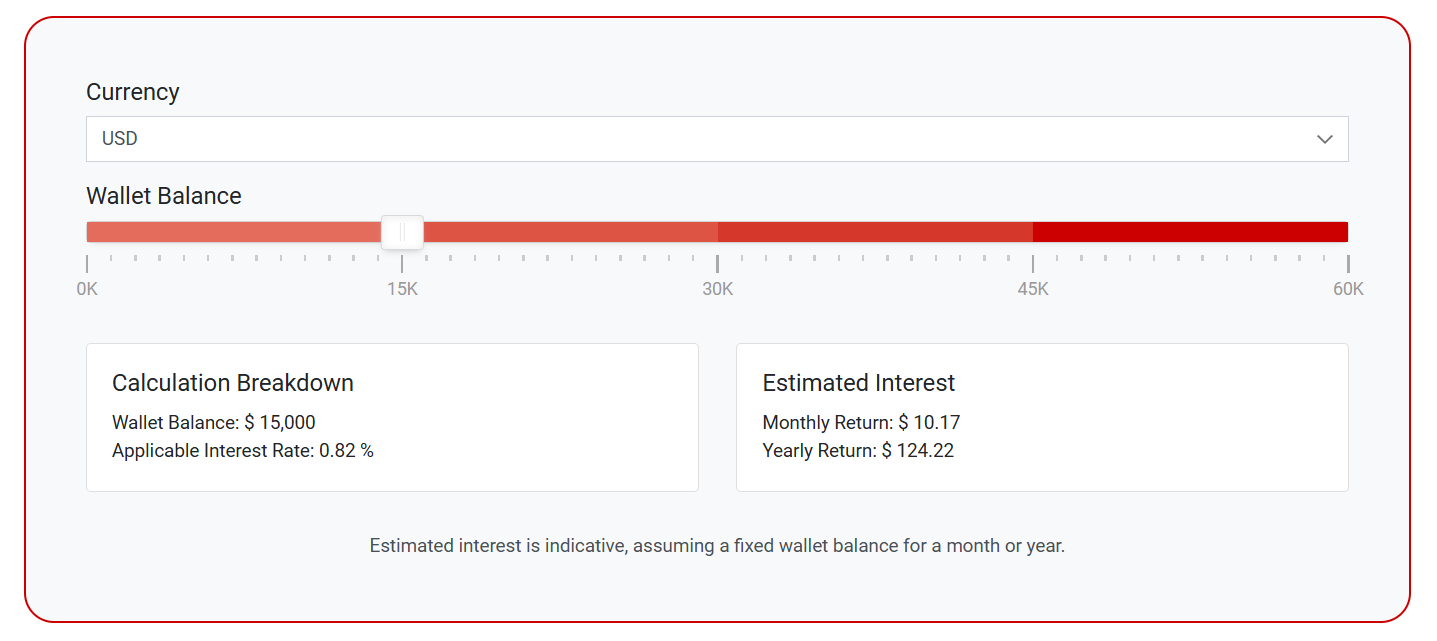

Interest on Deposits

Tickmill pays up to 2.75% interest on funds kept in your Tickmill Wallet as far as your wallet balance is above $100, & you execute at least one trade per month.

Tickmill also has an interest rate calculator tool under its client services section which helps you estimate the interest you will be paid as per your wallet balance.

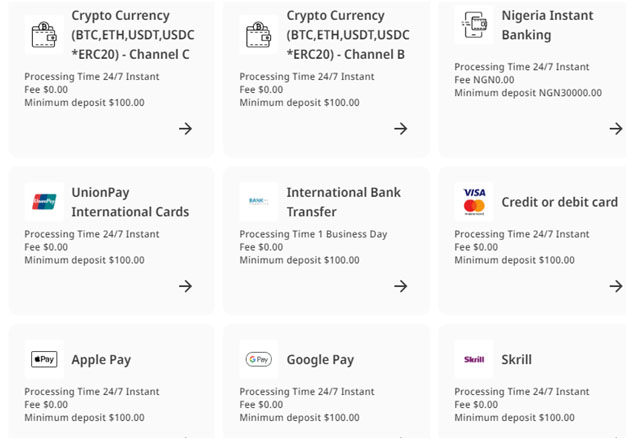

Withdrawal & Deposit Methods

1. South African EFT

Tickmill accepts transactions via Electronic Fund Transfer (EFT) of any South African bank. The EFT deposits/withdrawals are processed 24/7 including on weekends & they reflect instantly.

2. Visa & MasterCard

Tickmill South Africa accepts withdrawals & deposits from Visa and Master Debit/Credit Cards issued by any South African bank. The deposits/withdrawals are processed 24/7 including on weekends & they reflect instantly.

3. Cryptocurrency

Tickmill South Africa accepts withdrawals & deposits using Bitcoin, Ethereum, Tether & USDC.

The crypto deposits/withdrawals at Tickmill are processed 24/7 including on weekends & they reflect instantly.

4. Apple Pay & Google Pay

Tickmill South Africa accepts withdrawals & deposits using Apple Pay & Google Pay.

Apple Pay & Google Pay deposits/withdrawals at Tickmill are processed 24/7 including on weekends & they reflect instantly.

5. Skrill

Tickmill South Africa accepts withdrawals & deposits using Skrill.

Skrill deposits/withdrawals at Tickmill are processed 24/7 including on weekends & they reflect instantly.

6. International Bank Wire

Tickmill South Africa accepts withdrawals & deposits using International Bank WIre.

International Bank Wire deposits/withdrawals at Tickmill are processed in 1 working day but it may take up to 3 days for the funds to reach you.

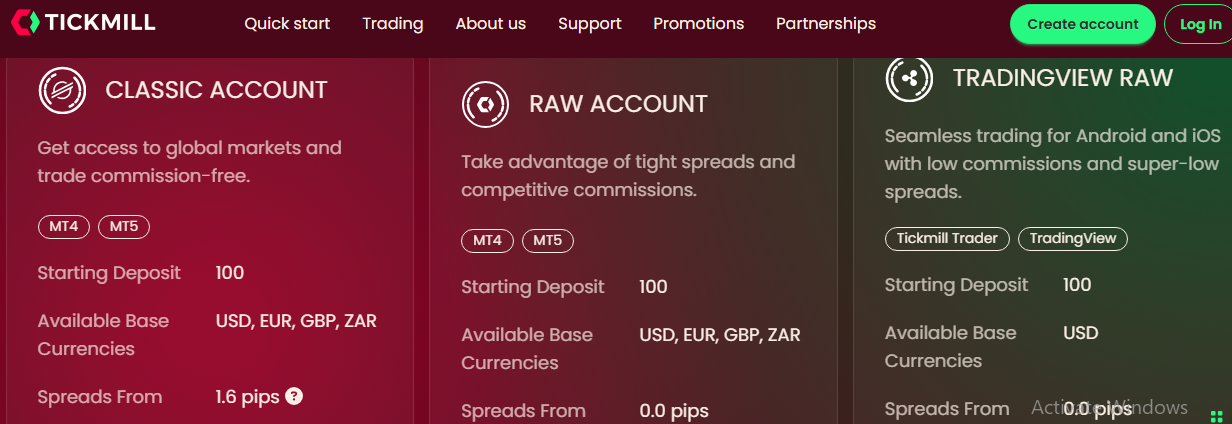

Tickmill Account Types - 7/10

1. The Classic Account

An entry-level account with a one-dimensional pricing system where you only pay spreads when you trade.

This pricing structure can be understood by beginners as it is less ambiguous. However the Classic Account has higher spreads than other accounts in the Tickmill lineup.

Tickmill Margin Call & Stop Out level for the Classic Account is 100 & 30% respectively.

2. Raw Account

The Tickmill Raw Account charges commissions plus raw spread.

This pricing style is more complicated but some traders would rather pay a commission so they can get lower spreads.

Tickmill Margin Call & Stop Out level for the Raw Account is 100 & 30% respectively.

3. Tickmill TradingView Account

This new account class was created by Tickmill for those who want to trade on TradingView.

Tickmill Margin Call & Stop Out level for the Tickmill TradingView Account is 100% & 30% respectively.

4. Demo Account

The demo account is for demonstration so you can experience what it feels like to trade with Tickmill while using virtual cash.

If you want to add virtual funds to your Tickmill demo account to replenish it, simply send an email containing the demo account number & amount you want to reflect in the demo account.

| 👨 Account Type | #️ Quantity |

| Spread-Only Account | 1 |

| Spread Plus Commission Account | 2 |

| Demo Account | 1 |

Account Management - 9.5/10

Tickmill Wallet

Yes, when you register & create a profile with Tickmill, an online wallet is created for you to warehouse your deposits.

The Tickmill wallet is not a trading account; when you want to trade you must perform an internal transfer from your wallet to your Mt4/5 trading account.

Does Tickmill Have ZAR Account?

Yes, Tickmill allows South African traders to select ZAR as their preferred trading account currency.

Changing Leverage on Tickmill Accounts

From your client area, you can change the leverage on your Tickmill trading account as may times as you wish. There is no restriction on how many times you can change leverge at Tickmill.

Number of Tickmill Accounts You Can Open

Tickmill allows you open 3 MT4, 3 MT5 and 1 TradingView account type.

Tickmill Negative Balance Protection

Tickmill South Africa offers Negative Balance Protection to traders so that even if your account slips into negative due to excessive use of leverage & high volatility, Tickmill will bring your balance back to zero.

Margin Call & Stop Out

Tickmill Margin Call will come when your Margin Level falls to 100% and you will be Stopped Out of all your trades when your Margin Level falls to 30%.

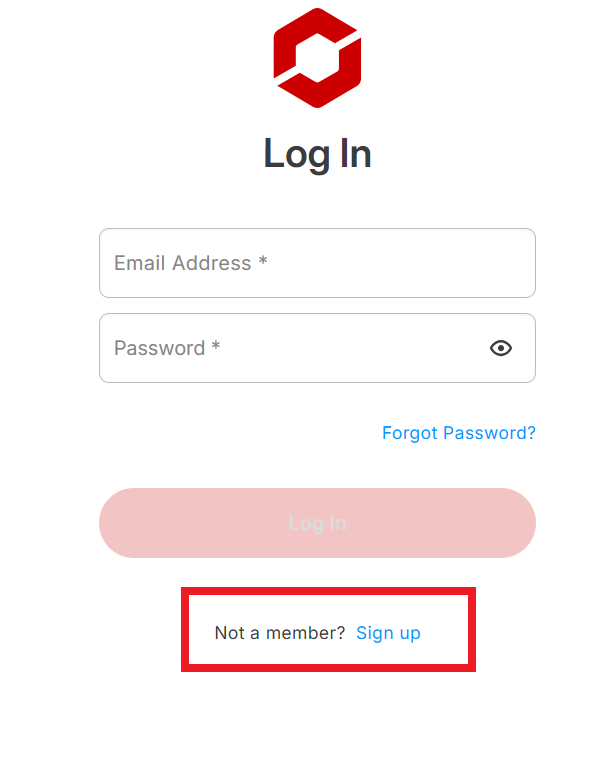

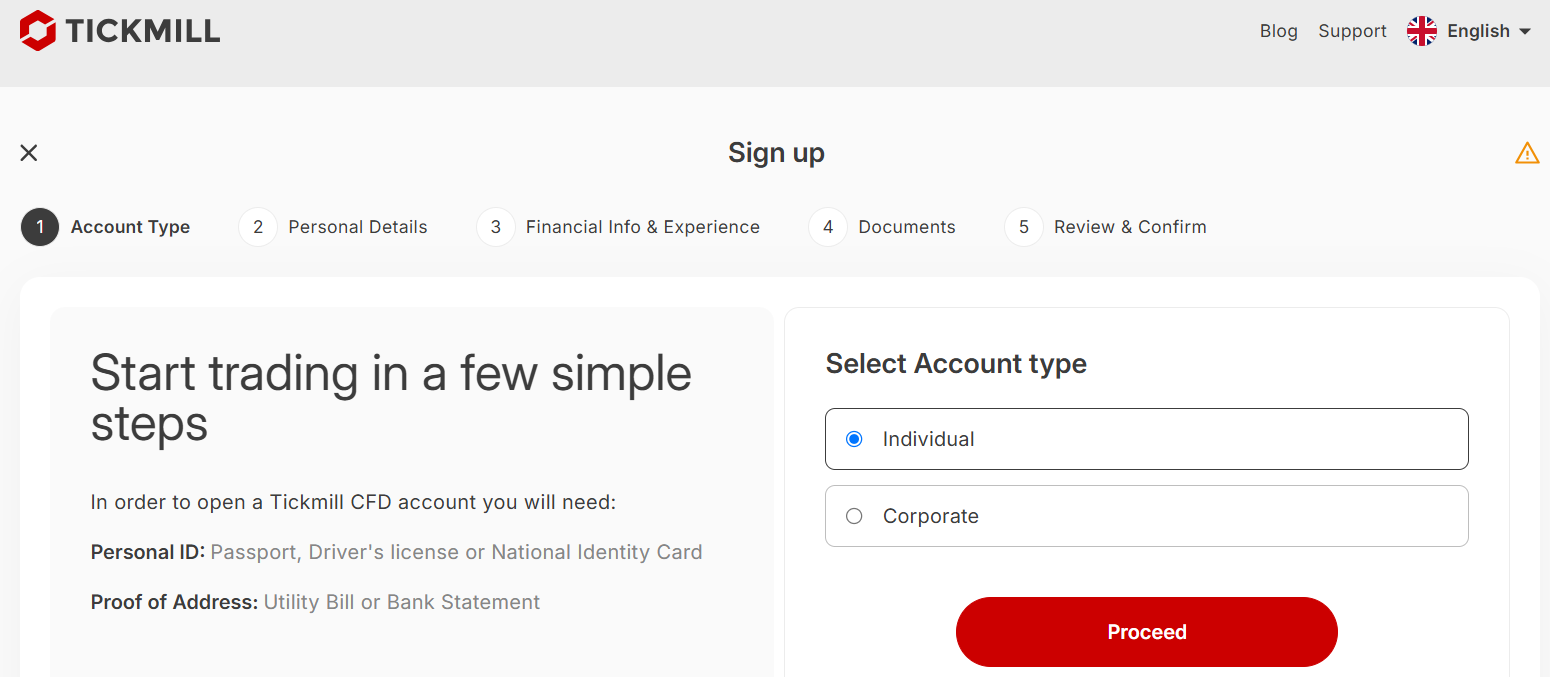

How Do I Open a Tickmill Account?

Step 1: Account Type

Go to the Tickmill website and click on Create Account, then click on signup.

Select the class of account you want to open; Tickmill allows you open Individual & Corporate Account Classes.

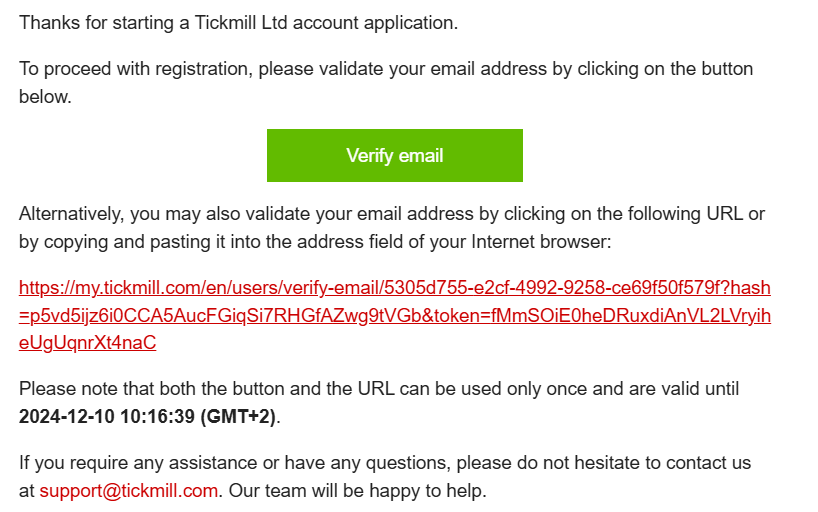

Step 2: Personal Details

Proceed to enter your personal details such as name and date of birth as it appears on your government issued ID.

Proceed to enter your phone number, email address & select your preferred language. You will need to verify your email via a link so ensure the email address is active.

Check your email & click on the email verification link which will redirect you to a page to fill out your National Identity Card Number (NIN) & Residential Address. You will also be required to state if you are a Politically Exposed Person (PEP)

Be careful at this stage because the address you give to Tickmill must match the one on your utility bill & drivers license/passport.

Step 3: Financial Information & Trading Experience

Proceed to fill a questionnaire about your source of income, net worth, & past trading experience.

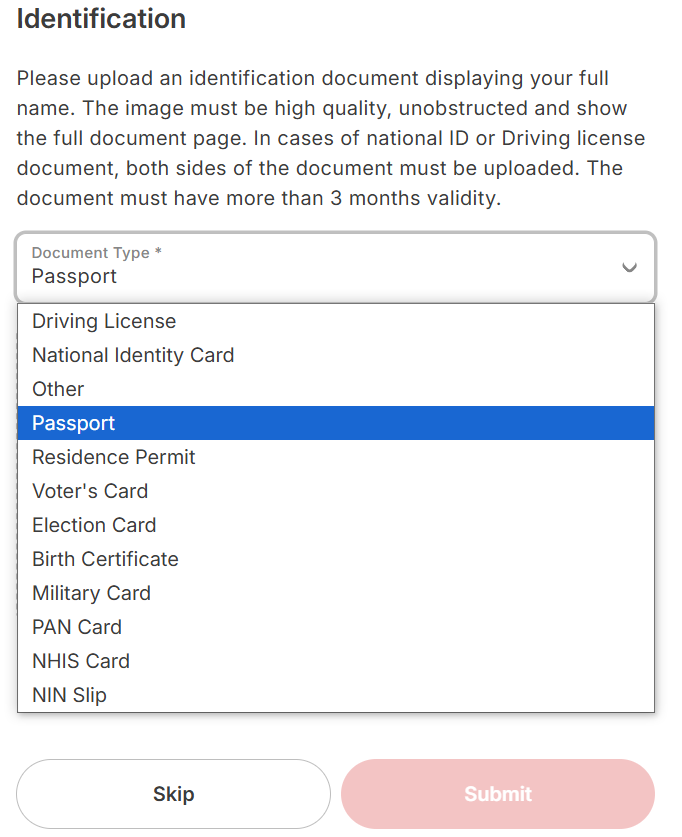

Step 4: Upload Your Means of Identification Docs

For South Africans Tickmill will require a Drivers License, National ID Card, Residence Permit, Voter's Card, ELection Card, Birth certificate, Military card, PAN card, NHIS Card, NIN Slip or international passport that contains your residential address as a means of ID.

As proof of residence, Tickmill South Africa will also require a utility bill showing your name and address.

Tickmill Fees - 9/10

Before we start, take note that the spreads displayed on the Tickmill website are for the Raw Account only. Tickmill does not display the spread for their Classic Account on their website and MT4.

1. Spread & Commission

Tickmill recommends the Raw Account where spreads start from 0.0 pips but you must pay a commission of $3 per side per standard lot.

Tickmill also has a standard account which it calls "Classic Account" but I wouldn't use this account because the spreads are too high from 1.6 pips.

2. Swap

Tickmill does not do swap-free trading, so you must pay an overnight fee for leaving your trades open till the next day/over a weekend.

3. Inactivity Fees

Tickmill does not charge an inactivity fee on dormant accounts.

If no trading activity is recorded on your Tickmill account for 60 consecutive days & your account balance is below $50, Tickmill will archive your account.

Archiving a forex trading account means deposits can no longer go into it, & the archived account disappears from your dashboard. Archived accounts will also lose their history.

Is Tickmill A Market Maker?

Yes, Tickmill acts as a Market Maker to forex & CFD trades but when you are trading Exchange Traded Derivatives like Stock Futures, Tickmill connects you directly to the source of the pricing.

Tickmill Platforms - 9/10

1. Tickmill MT4

MT4 on Tickmill comes with additional help by way of the Advanced Trading Tool Kit which when downloaded and plugged into MT4 gives added functionality and improves its performance.

All Tickmill account types also work on MT4 but spread pricing on MT4 is for the Raw Account only (and not the Classic Account).

2. TickMill MT5

Tickmill MT5 can be downloaded from their website & can be upgraded using the Tickmill Advanced Tool Kit.

If you intend to trade stock CFDs, you can only do so on Tickmill MT5. Also note that spread pricing on Tickmill MT5 reflects only the Raw Account spread.

3. Tickmill Mobile App

Tickmill has a mobile app called Tickmill Trader.

However, the app only works with the Tickmill Trader Raw Account.

4.TradingView

Tickmill South Africa allows you to connect to the TradingView charting platform, but you must open a special TradingView Raw Spread Account for this purpose.

| 💻Trading Platform | ❓Availability |

| MT4 | Yes |

| MT5 | Yes |

| Proprietary Apps | Yes |

| cTrader | No |

| TradingView | Yes |

Tickmill Tools - 10/10

1. Advanced Trading Tool Kit

The Tickmill advanced trading tool kit is for MT4 & MT5 and contains downloadable plugins which make your MetaTrader more functional.

The Tickmill MT4/5 downloadable plugins include:

- Sentiment Trader (shows you the market sentiment for an instrument)

- Alarm Manager (set custom alarms & actions to be executed after alarm is triggered)

- Mini Trade Terminal

- Session Map (shows you the different forex sessions in your local time & on a map)

- Figaro Trading Action

- Tick Chart Trader

- Figaro Chart

- Figaro Calculators

- Correlation Matrix

- Quick Videos on how to Install Tickmill Advanced Tools

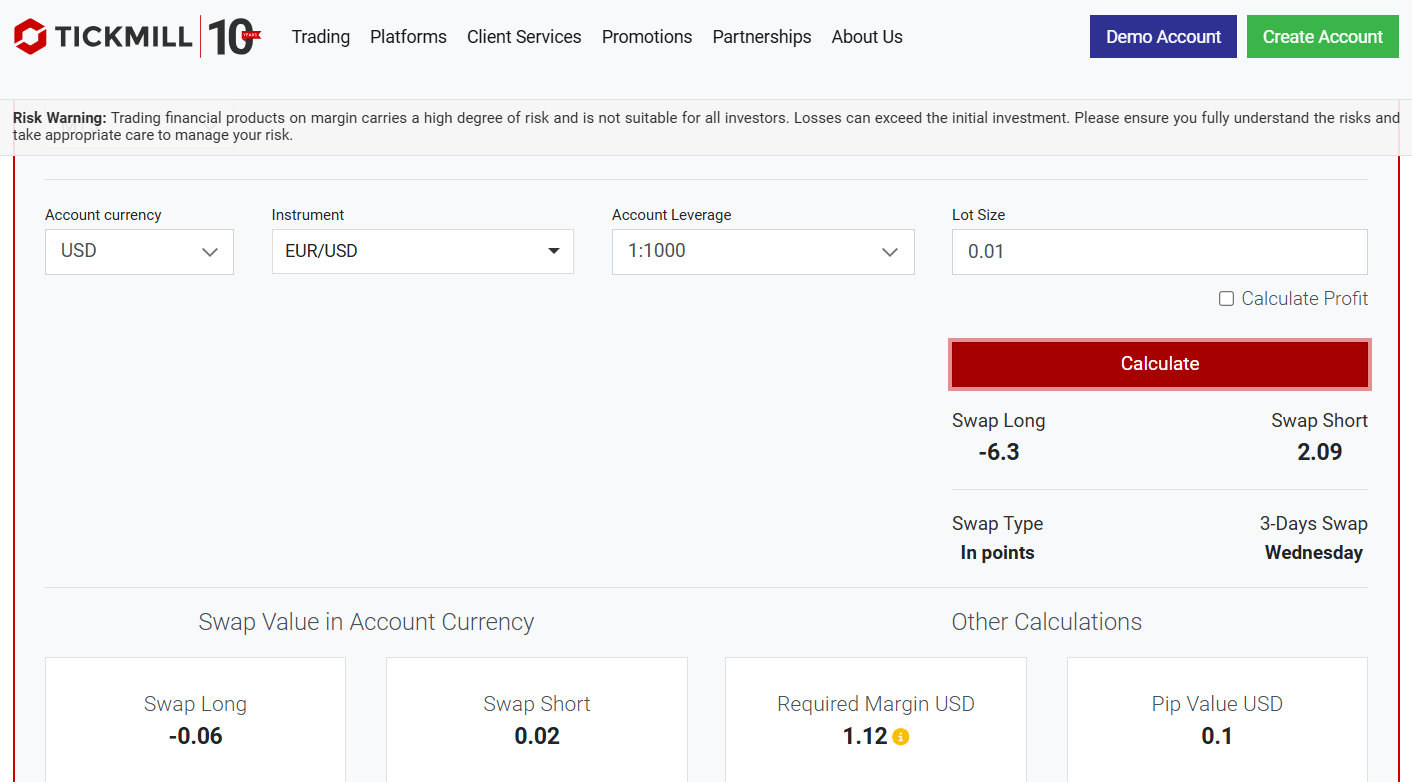

2. Tickmill Calculator

Tickmill offers a forex calculator that helps you calculate your required margin, swap value, pip value & profit.

The calculator also include a currency converter which converts one currency to another at the current Tickmill market exchange rate.

3. Tickmill Earnings Calendar & Economic Calendar

The Tickmill Economic Calendar shows you the dates when important economic data such as NFP, PCE, PMI, Interest Rates, etc. will be released.

The Tickmill EArnings Calendar shows you the dates when listed companies will release their quarterly & yearly performance/earnings reports.

The release of of company earnings data can affect the stock price, so those who trade Equity CFDs always use this information to their advantage.

4. MT4/5 Acuity Trading Tool

This consists of a set of downloadable plugins that take market sentiment analysis to a whole new level. The Tickmill Acuity Trading Tool consists of the following:

- Market Sentiment Research Terminal

- Market Sentiment Alerts

- Linear Second Market Sentiment Display

- Sentiment Complex: plots a chart of market sentiment vs price for a better understanding

- Macro Economic Calendar: a more advanced economic calendar that integrates market sentiment

5. Capitalise ai Tool

Tickmill Capitalise.ai is a platform where you can build a forex trading robot even without using complex programming language. Capitalise.ai lets you build forex robots using simple English language thus simplifying the process.

6. Copy Trading Tool

Tickmill offers copy trading and as a copier, you can connect your account to a Strategy Provider and copy their trades.

If you want to become a Strategy Provider on Tickmill, you need to open a trading account with $250 minimum balance, register & create a profile that others will see, then set your fee.

Strategy Providers on Tickmill can open multiple copy trading accounts then specify the one copiers will copy from.

Copy trading works on Tickmill MT4 & MT5 platforms but when trading stock CFDs, both copier & Strategy Provider need to be using MT5 accounts.

TickMill copy trading takes place in a social environment where you can interact with other traders hence it’s also called social trading.

Copy trading is not a guarantee of profits because SPs also make losses and their losses will reflect in the copiers account too.

Customer Support - 8/10

Tickmill customer support is 24/5 & unavailable during weekends.

Tickmill assigns Personal Account Managers to every account & this makes resolving issues faster.

Live chat is available and you get a response almost immediately.

Telephone support is available but is not toll-free.

Email response will take 24 hours but its faster to reach Tickmill through Live Chat.

Tickmill has education in both video and text format accessible from their website.

| 🎧 Live Chat Support | Yes |

| 📧 Email Support | Yes |

| 📞 Telephone Support | Yes |

| 📖 Help Center | Yes |

| 👨 Personal Account Manager | Yes |

| 👩🏫 Academy | Yes |

Final Verdict - 7/10

Tickmill is one of our Best Forex Brokers in South Africa for Beginners because they provide adequate trading tools to help any beginner learn how to trade.

However, their lengthy withdrawal time and high minimum deposit made us score them 7 out of 10.