Tickmill Kenya Review

Everything you need to know about Tickmill in Kenya

The new mobile app is so user friendly. Tickmill should allow standard account users also access TradingView because right now only raw spread accounts users are allowed to connect to TradingView. The deposit time is fast but the withdrawal time is around 2 days which is not great.

This broker is always improving, execution speed is fast and customer support is the best. I hear they pay interest on deposits but I have never received any. They should also work on their deposit bonus the way it is now you must deposit at least $100 to qualify for bonus which is too high. Lastly the withdrawal time is not good, it takes too long.

The new Tickmill mobile app is excellent, and the addition of TradingView is great. Customer support is also topnotch, the only down side is the deposit/withdrawal methods are not many and instant withdrawal is absent

They like to delay withdrawal for days. Forget instant withdrawal, you will never get it with them. You will be lucy to get your withdrawals after 2 working days.

I like that you can cancel a withdrawal after initiating it. I also love the Tickmill Trader mobile app, its the most sophisticated I have seen so far.

A very very good broker, I recommend Tickmill because their MT5 is perfect, no lagging, no glitches etc. They also keep evolving and improving which is the sign of a serious broker, recently they have added TradingView.

If you trade with Tickmill and are always unprofitable then maybe the problem is you, because tickmill provides you all the tools you need especially the acuity trading tools are excellent. Keep it up tickmill

top class broker with world class regulation. however i cannot say ther customer support is the best, it needs improvement.

Very transparent with their spreads and they are highly regulated. They dont play the games these small brokers play (i mean stop luss hunting etc). I have traded with them for 2 years now using a raw spread account and they are great. They should work on this their new mobile app called tickmill trader, to make it more easy to setup

Hard time opening an account with Tickmill. They keep rejecting my means of ID even when this is the same ID I used to open an account with other brokers. Their customer support sucks

I had issues trying to connect my Tickmill account to TradingView. I know this is a new feature but they should perfect it soon enough.

Tickmill your minimum withdrawal is too high at 25 USD. Why not keep it low like other brokers do? Other than that i enjoyed trading with Tickmill using their Raw Account which has very transparent spreads. Tickmill also has a lot of high-end tools which i found very helpful when I was starting out.

The spreads on their Standard (Classic) Account is too high, if they don't want people to use the standard account they should cancel it and only offer Raw Account. How can one pay up to 1.6 pips on EUR/USD? The only account they have that makes sense is the Raw Account but not everybody is used to trading with commissions.

Tickmill does not have Naira account & that's the only thing i don't like about them. But their platforms are top notch & execution speed is high. Their spreads are also stable with no unnecessary widening of spread like some brokers do

Tickmill is an international forex broker under strong regulation from the FCA UK, & also accepts clients from Africa

| 👨 Broker | Tickmill |

| 👨 Accepts Kenyan Traders? | Yes |

| 📅 Year Founded | 2014 |

| ⚖ Regulators | FCA UK, FSCA South Africa, FSA Seychelles |

| 📈 CFD Instruments | Forex, Stock Indices, Commodities, Bonds, Crypto, Stocks |

| 🚀Leverage | 1:1000 |

| 💻 Platforms | TradingView, MT4, MT5, Tickmill Mobile |

| 📋Account Types | Standard & Raw Accounts |

| 💰 Minimum Deposit | $100 |

| 💰 Minimum Withdrawal | $25 |

| 📞Live Support | 24/5 |

| 🏖️ Inactivity Fee | $0 |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

Regulation - 6/10

Is Tickmill Available in Kenya?

Yes, Tickmill is currently in Kenya & accepts traders from Kenya.

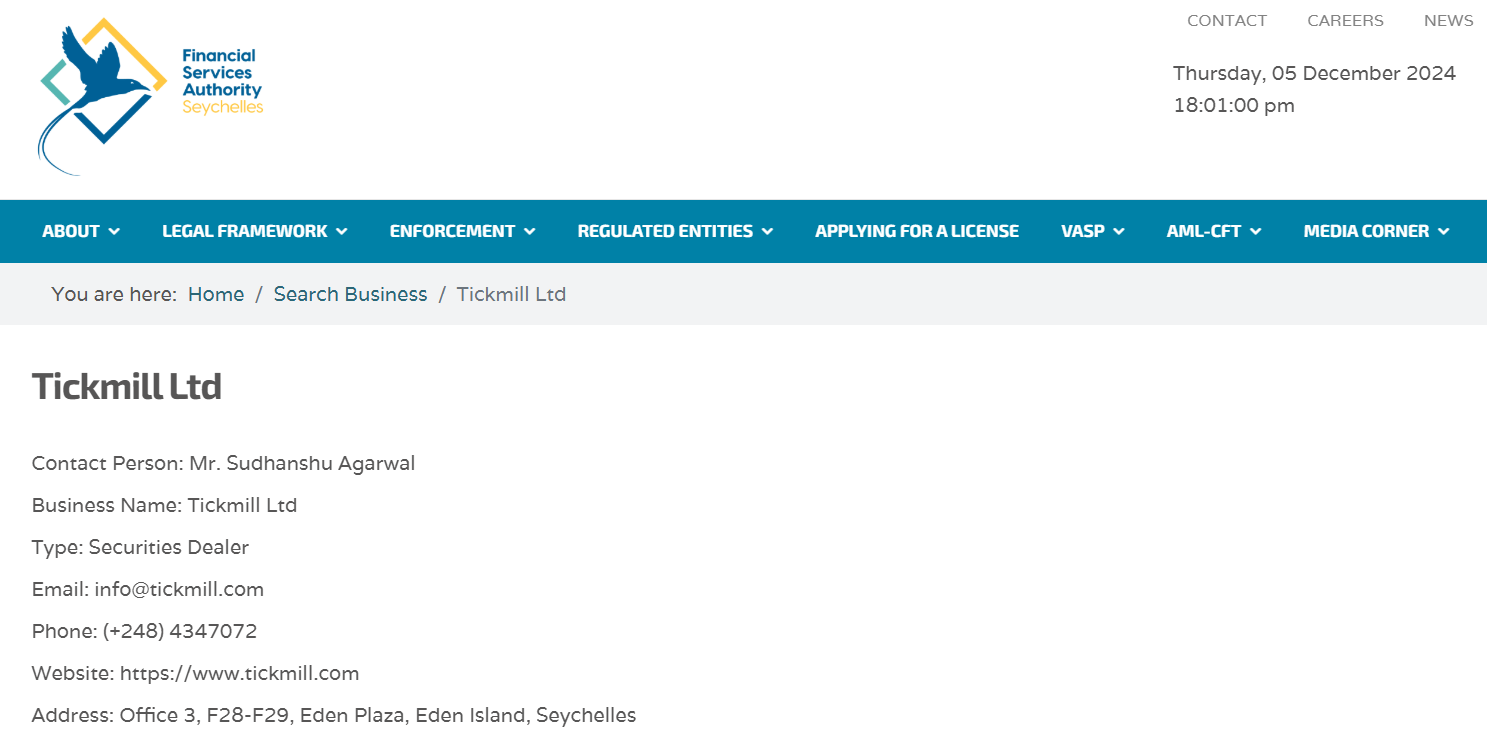

Tickmill Forex & CFD traders in Kenya will have their accounts placed under the regulation of the Financial Services Authority (FSA) Seychelles.

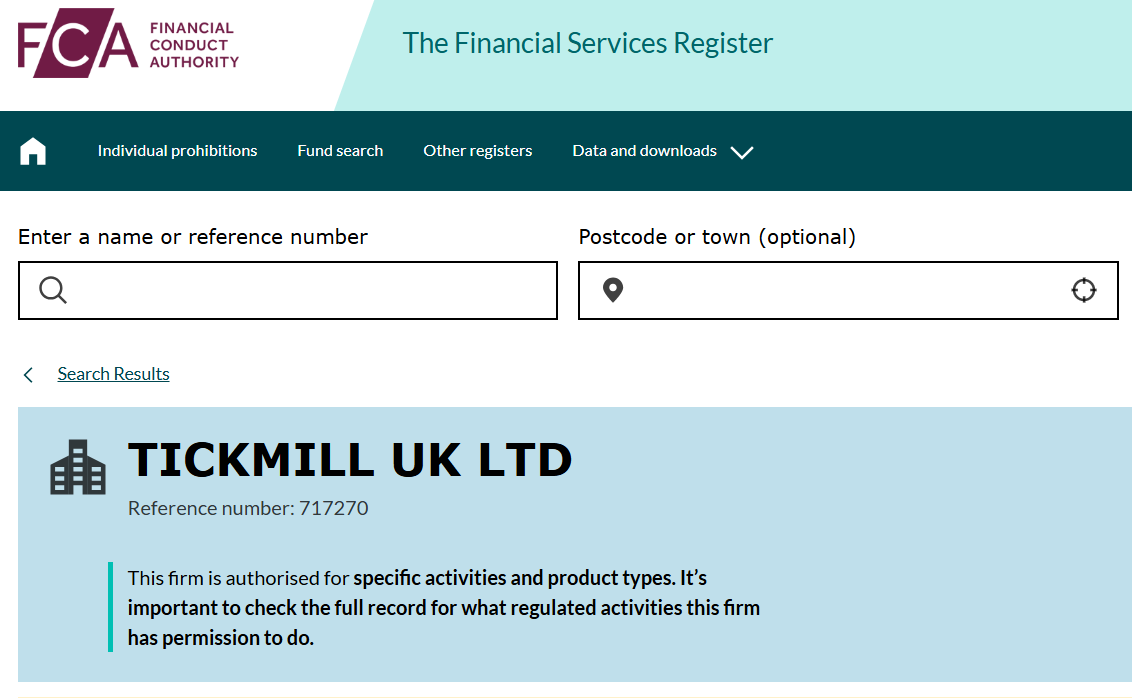

Tickmill Futures & Options traders in Kenya will have their accounts placed under the regulation of the Financial Conduct Authority (FCA) United Kingdom.

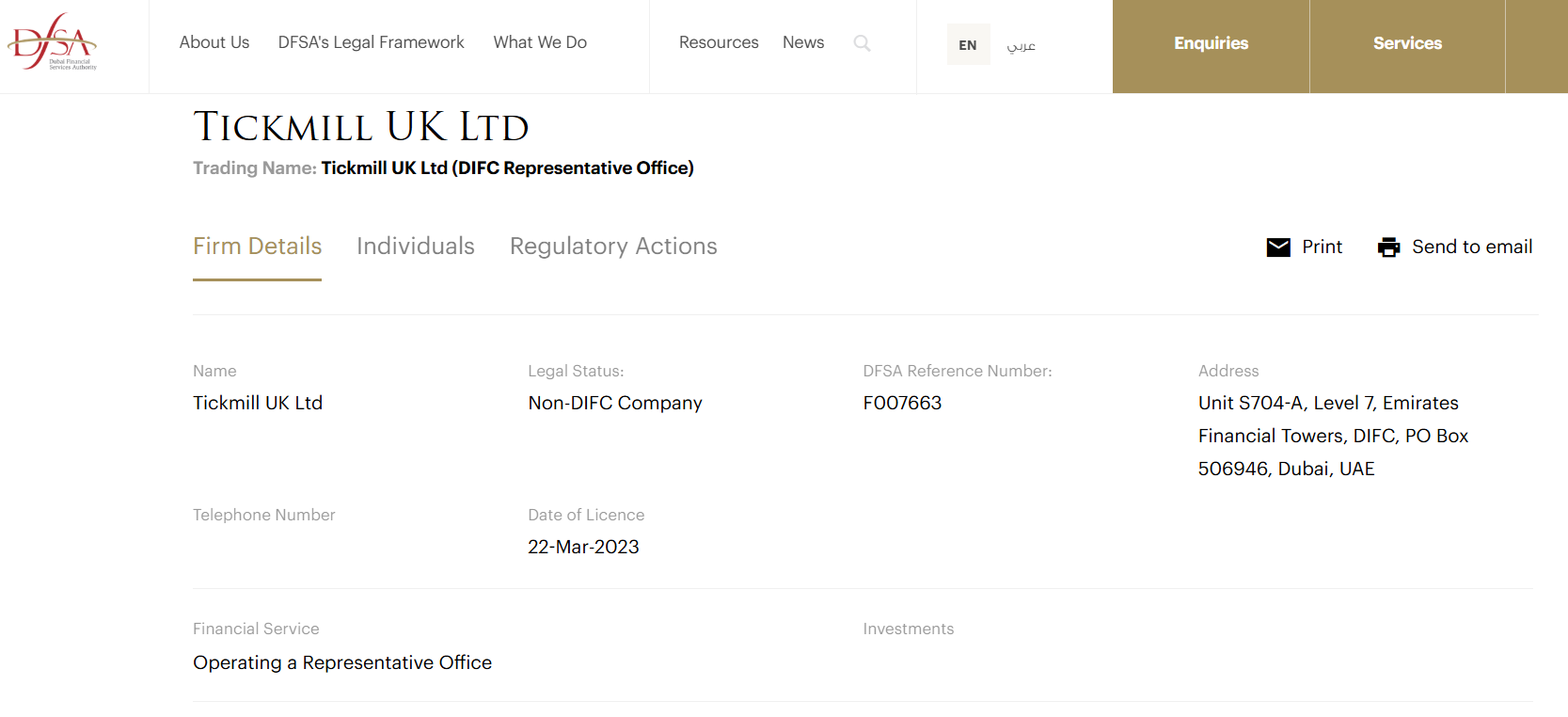

Tickmill UK LTD is also regulated in Dubai by the Dubai Financial Services Authority (DFSA).

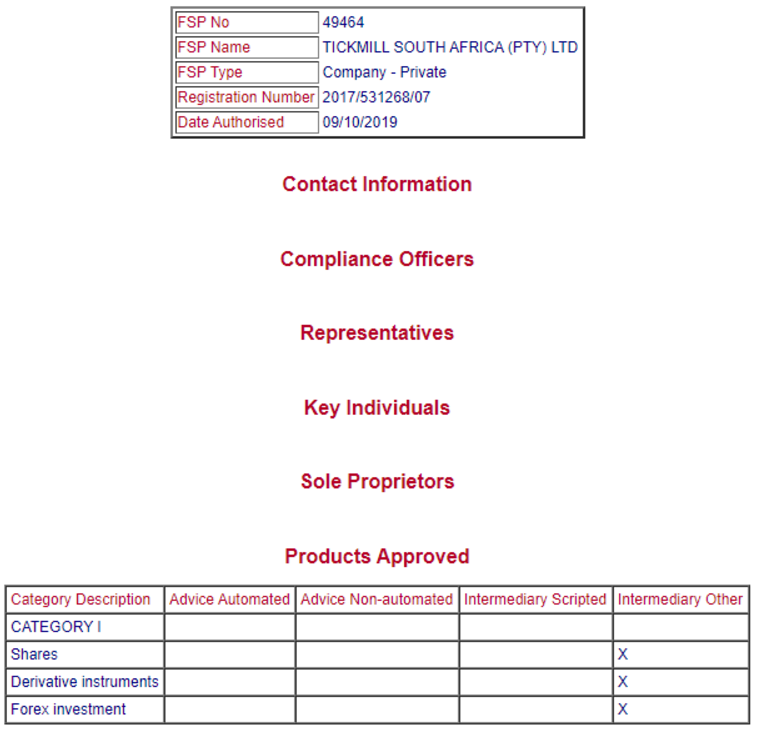

In South Africa, Tickmill is regulated by the Financial Sector Conduct Authority (FSCA) who issued them two licenses to act as a Financial Service Provider & Over-the-counter Derivative Provider.

Tickmill Regulation Summary

| 📍Country | ⚖️Regulator | #️⃣License No. | 📅Date License Issued |

| FSA | Seychelles | SD 008 | |

| FCA | UK | 801701 | 2016 |

| South Africa | FSCA | FSP 49464 | |

| Dubai | DFSA | F007663 | |

| CySEC | Cyprus | 278/15 | 2015 |

Deposit & Withdrawal - 8/10

Tickmill Minimum Deposit

The Tickmill minimum deposit is $100 for all their account types. You can make your deposit in Kenyan Shilling.

Payment Methods

1. MPESA

Tickmill accepts MPESA deposits in Kenyan Shilling currency.

2. Visa & MasterCard

Tickmill Kenya accepts withdrawals & deposits from Visa and Master Debit/Credit Cards issued by any Kenyan bank. The deposits/withdrawals are processed 24/7 including on weekends & they reflect instantly.

3. Cryptocurrency

Tickmill Kenya accepts withdrawals & deposits using Bitcoin, Ethereum, Tether & USDC.

The crypto deposits/withdrawals at Tickmill are processed 24/7 including on weekends & they reflect instantly.

4. Apple Pay & Google Pay

Tickmill Kenya accepts withdrawals & deposits using Apple Pay & Google Pay.

Apple Pay & Google Pay deposits/withdrawals at Tickmill are processed 24/7 including on weekends & they reflect instantly.

5. Skrill

Tickmill Kenya accepts withdrawals & deposits using Skrill.

Skrill deposits/withdrawals at Tickmill are processed 24/7 including on weekends & they reflect instantly.

6. Local Bank

Tickmill allows you transfer money from your local Kenyan bank account, into your Tickmill wallet.

Tickmill Minimum Withdrawal

The Tickmill minimum withdrawal is $25 for all withdrawal methods. From your client area, you can delete a withdrawal request that is awaiting approval.

Tickmill Withdrawal Time

Tickmill withdrawal time is not instant, instead it takes 24 hours for the funds to reach you.

Account Types - 6.5/10

1. The Classic Account

An entry-level account with a one dimensional pricing system where you only pay spreads when you trade.

This pricing structure can be understood by beginners as it is less ambiguous. However the Classic Account has higher spreads than other accounts in the Tickmill lineup.

2. MetaTrader Raw Account

This account is for those who want to access raw spread pricing on MetaTrader. This account charges low spread but in return, you must pay a flat commission on every trade.

3. TradingView Raw Account

This is another raw spread pricing account designed for those who want to trade on TradingView

Account Management - 4.5/5

Online Wallet

When you register & create a profile with Tickmill, an online wallet is created for you to warehouse your deposits.

Account Currency

Tickmill does not offer KES as an account currency. You are free to deposit in KES but Tickmill will convert your deposit into USD which is the default account currency.

The Tickmill wallet is not a trading account; when you want to trade you must perform an internal transfer from your wallet to your MT4/5 trading account.

Leverage

Tickmill leverage is 1:1000. From your client area, you can change the leverage on your Tickmill trading account as may times as you wish. There is no restriction on how many times you can change leverge at Tickmill.

Number of Tickmill Accounts You Can Open

Tickmill allows you open 3 MT4, 3 MT5 and 1 TradingView account type.

How Do I Open a Tickmill Account?

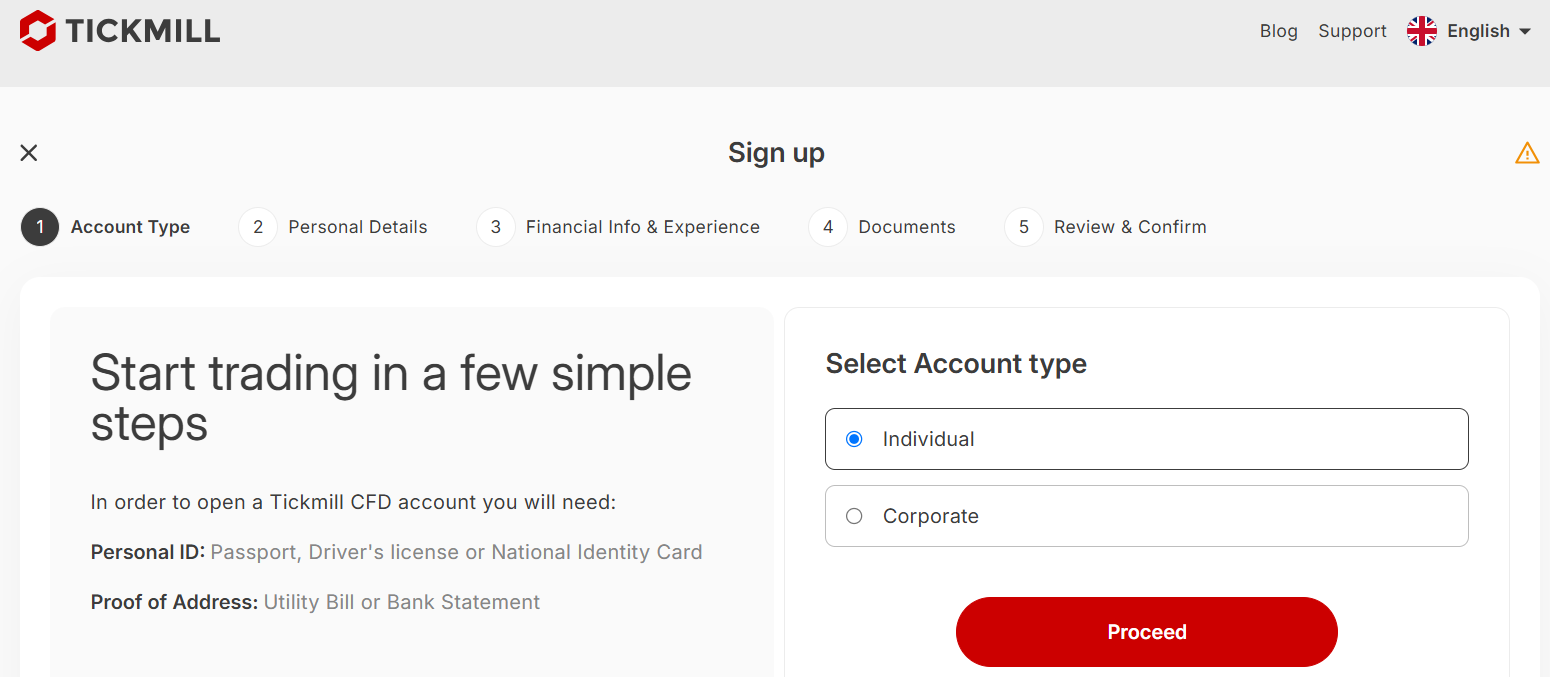

Step 1: Account Type

Go to the Tickmill website and click on Create Account, then click on signup.

Step 2a: Personal Details

Select the class of account you want to open; Tickmill allows you open Individual & Corporate Account Classes.

Proceed to enter your personal details such as name and date of birth as it appears on your government issued ID.

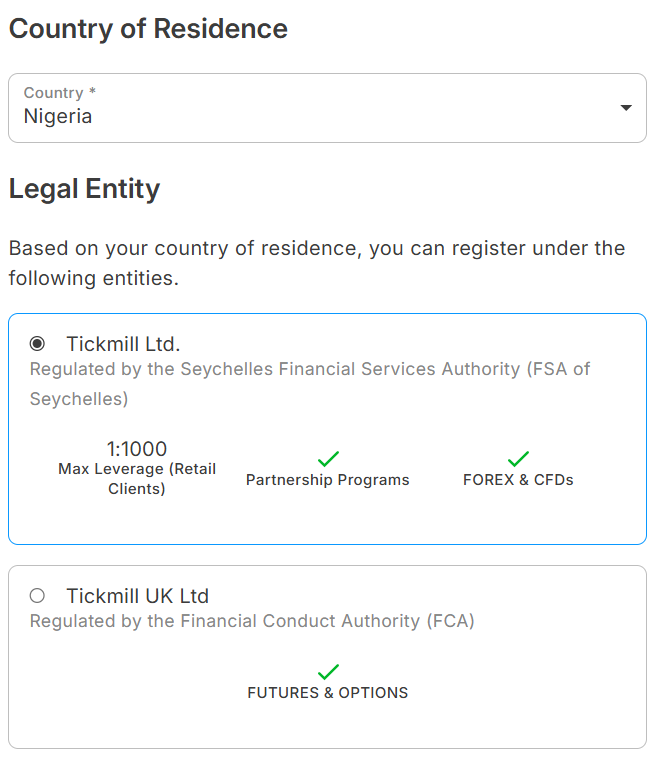

Step 2b

Select the legal entity/country your account will be registered under. If you intend to trade CFDs without owning the underlying asset, select Tickmill Seychelles as your legal entity.

With Tickmill Seychelles you can access leverage up to 1:1000 & the minimum deposit is N30,000.

If you intend to trade Futures & Options, select Tickmill UK as your legal entity.

With Tickmill UK as your legal entity you cannot access more than 1:30 leverage & you will require a higher minimum deposit to start trading.

Proceed to enter your phone number, email address & select your preferred language. You will need to verify your email via a link so ensure the email address is active.

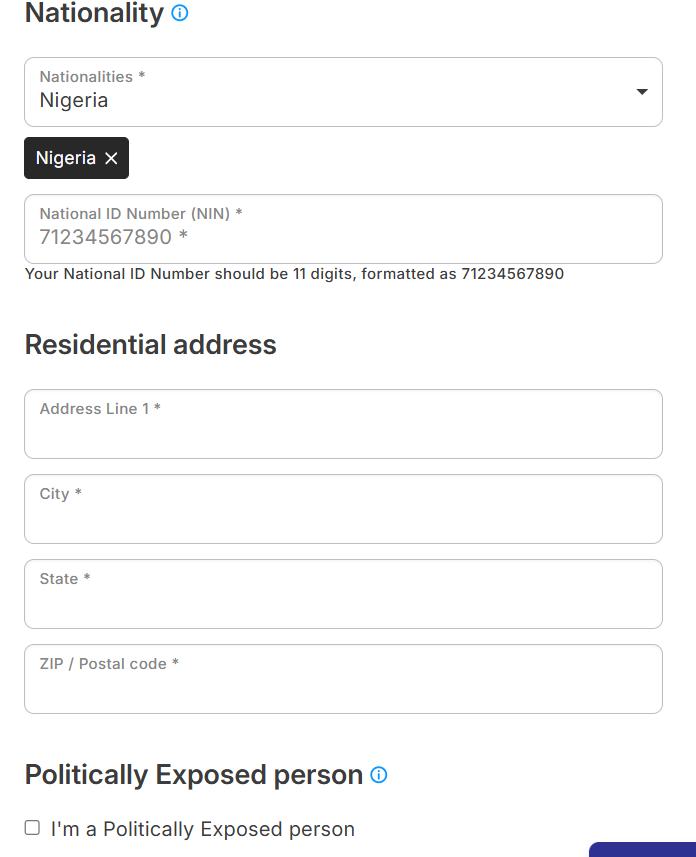

Check your email & click on the email verification link which will redirect you to a page to fill out your National Identity Number (NIN) & Residential Address. You will also be required to state if you are a Politically Exposed Person (PEP)

Be careful at this stage because the address you give to Tickmill must match the one on your utility bill & drivers license/passport.

Step 3: Financial Information & Trading Experience

Proceed to fill a questionnaire about your source of income, net worth, & past trading experience.

Step 4: Upload Your Means of Identification Docs

For Kenyans Tickmill will require a drivers license or international passport that contains your residential address as a means of ID.

As proof of residence, Tickmill Kenya will also require a utility bill showing your name and address.

Tickmill Fees -5/5

Before we start, take note that the spreads displayed on the Tickmill website are for the Raw Account only. Tickmill does not display the spread for their Classic Account.

Tickmill spreads are not high when you open their recommended account which is the Raw Spread Account.

The Raw Account has a spread starting from 0.0 pips & a commission of $3 per side per lot on Forex and Precious Metals including Gold and Silver.

When you will encounter high spreads is if you open the Tickmill Classic Account which has an all-inclusive spread starting from 1.6 pips & zero commission.

Tickmill does not have swap-free instruments, so overnight swaps are charged on your trading positions left open till the next day.

| Account Type | ✂️Avg. Spread | 💰Commission per side | 💱Currency Conversion Fee | 🌙Overnight Fees | 😴Inactivity Fee |

| Raw Account | From 0.0 pips | $3 per side | Yes | Yes | Yes |

| Classic Account | From 1.6 pips | $0 | Yes | Yes | Yes |

| Tickmill Trader Raw Account | From 0.0 pips | $3.5 per side | Yes | Yes | Yes |

Is Tickmill A Market Maker?

Yes, Tickmill acts as a Market Maker to forex & CFD trades but when you are trading Exchange Traded Derivatives like Stock Futures, Tickmill connects you directly to the source of the pricing.

Does Tickmill Charge Inactivity Fee?

No, Tickmill does not charge an inactivity fee on dormant accounts.

Tickmill Platforms - 3.5/5

1. Tickmill MT4

MT4 on Tickmill comes with additional help by way of the Advanced Trading Tool Kit which when downloaded and plugged into MT4 gives added functionality and improves its performance.

All Tickmill account types also work on MT4 but spread pricing on MT4 is for the Raw Account only (and not the Classic Account).

2. TickMill MT5

Tickmill MT5 can be downloaded from their website & can be upgraded using the Tickmill Advanced Tool Kit.

If you intend to trade stock CFDs, you can only do so on Tickmill MT5. Also note that spread pricing on Tickmill MT5 reflects only the Raw Account spread.

3. Tickmill Mobile App

Tickmill has a mobile app called Tickmill Trader.

However, the app only works with the Tickmill Trader Raw Account.

| 💻Trading Platform | ❓Availability |

| MT4 | Yes |

| MT5 | Yes |

| Proprietary Apps | Yes |

| cTrader | No |

| TradingView | No |

Tickmill Copy Trading -3.5/5

Tickmill offers copy trading and as a copier, you can connect your account to a Strategy Provider and copy their trades.

If you want to become a Strategy Provider on Tickmill, you need to open a trading account with $250 minimum balance, register & create a profile that others will see, then set your fee.

Strategy Providers on Tickmill can open multiple copy trading accounts then specify the one copiers will copy from.

Copy trading works on Tickmill MT4 & MT5 platforms but when trading stock CFDs, both copier & Strategy Provider need to be using MT5 accounts.

TickMill copy trading takes place in a social environment where you can interact with other traders hence it’s also called social trading.

Copy trading is not a guarantee of profits because SPs also make losses and their losses will reflect in the copiers account too.

Customer Support - 4.5/5

Tickmill customer support is 24/5 & unavailable during weekends.

Tickmill assigns Personal Account Managers to every account & this makes resolving issues faster.

Live chat is available and you get a response almost immediately.

Telephone support is available but is not toll-free.

Email response will take 24 hours but its faster to reach Tickmill through Live Chat.

Tickmill has education in both video and text format accessible from their website.

| 🎧 Live Chat Support | Yes |

| 📧 Email Support | Yes |

| 📞 Telephone Support | Yes |

| 📖 Help Center | Yes |

| 👨 Personal Account Manager | Yes |

| 👩🏫 Academy | Yes |

Final Verdict - 8.5/10

Tickmill is the Best Forex Broker in Kenya for Raw Spreads, so we recommend them to experienced traders.

We do no recommend Tickmill to beginners because of the absence of a naira account, average customer support, as well as their over-dependence on MetaTrader.